Risk Hedging Strategy Using Stablecoins and DeFi

Key Insights

- By using stablecoins, futures contracts, and DeFi platforms, you can protect your capital and minimize losses in crypto market volatility.

- Hedging allows you to smooth out sharp market fluctuations and protect your investment portfolio.

- A step-by-step crypto strategy of how to implement hedging in cryptocurrency investments

Investing in cryptocurrencies offers great opportunities, but also involves high risks. The crypto market is known for its high volatility as asset values can fluctuate by tens of percent in a matter of days.

Therefore, developing a hedging strategy is an important step to protect your capital and minimize losses.

Thus, hedging is an important tool for risk management in cryptocurrency investments.

What Is Hedging

Hedging is a risk management strategy used to reduce potential losses by investing in assets that move differently from core investments.

Essentially, it involves purchasing one asset to offset the risk of loss from another.

One common form of hedging is diversification, where investors spread their investments across various market sectors to mitigate the risk of poor performance from any single investment.

This approach acknowledges the uncertainty of predicting which investments will perform best.

Hedging is crucial in finance as it minimizes the impact of unpredictable price fluctuations. By providing an offset position in a related asset or security, it helps investors manage their portfolio's risk and safeguard against potential market losses.

Hedging strategy is widely employed by crypto market participants to protect their assets from adverse market movements.

The Necessity Of Hedging

Below are several advantages of hedging that come from its implementing.

- Reducing Volatility

Cryptocurrencies often experience drastic price fluctuations. This makes investing in them risky, as the value can change by 10-20% or more in a short period of time. Hedging helps minimize the impact of these fluctuations on your capital.

- Capital Protection

The purpose of hedging is to preserve your capital. Even when the value of cryptocurrencies drops, a well-designed hedging strategy can mitigate losses and protect your crypto portfolio from significant losses.

- Financial Stability

When the crypto market is volatile, hedging provides financial security, allowing investors to make more informed and confident investment decisions. You'll be sure that your capital is protected, allowing you to focus on your long-term goals.

- Increased Returns

Some hedging tools, such as DeFi platforms, can not only protect your capital but also generate additional income. This can increase the overall return on your crypto portfolio.

- Risk Diversification

Hedging helps spread risk. Instead of relying solely on the rising value of cryptocurrencies, you can use various tools to spread risk and increase the stability of your crypto portfolio.

How to Hedge Cryptocurrency Risks

Here you can familiarise yourselves with three types of hedging aimed at risk management.

Hedging Using Stablecoins

Stablecoins such as USDT, USDC or DAI are pegged to the value of fiat currencies such as the US dollar. This helps reduce the impact of crypto market volatility on your portfolio.

Asset allocation: Keep a portion of your portfolio in stablecoins (e.g. 30-40%). This reduces the risk of loss due to fluctuations in the cryptocurrency markets.

If the value of the cryptocurrencies in your crypto portfolio increases, move some of your profits into stablecoins. This helps lock in profits and protect against potential price drops.

Hedging Using Futures Contracts and Options

This type of hedging implies using futures contracts and options, that are financial instruments that allow you to buy or sell cryptocurrencies in the future at a predetermined price.

If you expect prices to fall, sell cryptocurrency futures contracts. If the price falls, losses in the spot market will be offset by gains from the futures.

Hedging While Waiting Out Price Drops

During periods of falling prices in the crypto market, you can use stablecoins to take temporary shelter and generate additional income through DeFi platforms.

Invest your stablecoins in DeFi platforms to generate income. You can place them on lending platforms (Compound, Aave) or participate in liquidity pools (Uniswap, Sushiswap) to earn interest and additional rewards.

Check the terms on DeFi platforms regularly to optimize returns and choose the best rates for your capital.

Application of Hedging Strategy In Cryptocurrency Investments

Suppose you have invested in a cryptocurrency as follows:

Bitcoin: $50,000

Etherium: $30,000

Total: $80,000

After a significant rise in cryptocurrency prices, you have noticed signs of a possible reversal of the uptrend. To protect your capital and minimize risks, you decide to apply a hedging strategy.

Below this crypto strategy is outlined in a step-by-step guide.

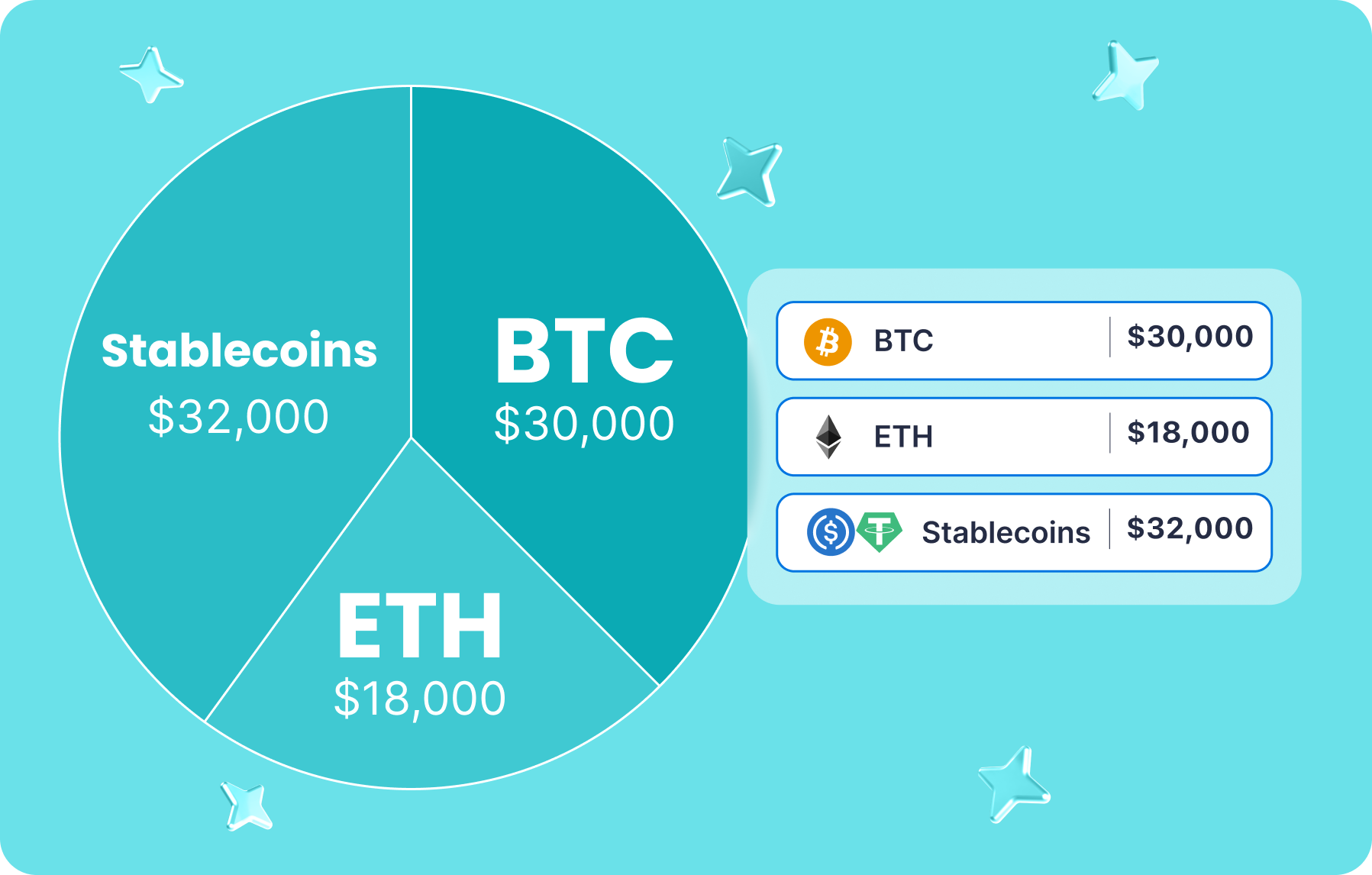

Crypto Strategy Step 1: Asset Allocation

Transfer to stablecoins: You decide to transfer 40% of your entire portfolio into stablecoins to reduce your exposure to volatility. In this case, that would be 40% of $80,000 = $32,000.

Sell some BTC and ETH and transfer $32,000 into stablecoins (e.g. USDT or USDC).

Your crypto portfolio now looks like this:

BTC: $30,000

ETH: $18,000

Stablecoins: $32,000

Total: $80,000

When there will be signs of the end of the decline and signals of an uptrend, you can buy BTC and ETH again.

Crypto Strategy Step 2: Hedging with Futures Contracts

Here hedging implies that if you anticipate a possible drop, you decide to sell futures contracts on BTC and ETH.

For example:

Sell BTC futures current price of $70,000 when the price reaches the value benchmark close the position.

Sell ETH futures at the current price of $4,000 when the price reaches the value benchmark to close the position.

This way, if the price of BTC falls below $70,000, you will make a profit on the futures contract, which will offset the losses from the decline in the price of BTC. The same goes for ETH.

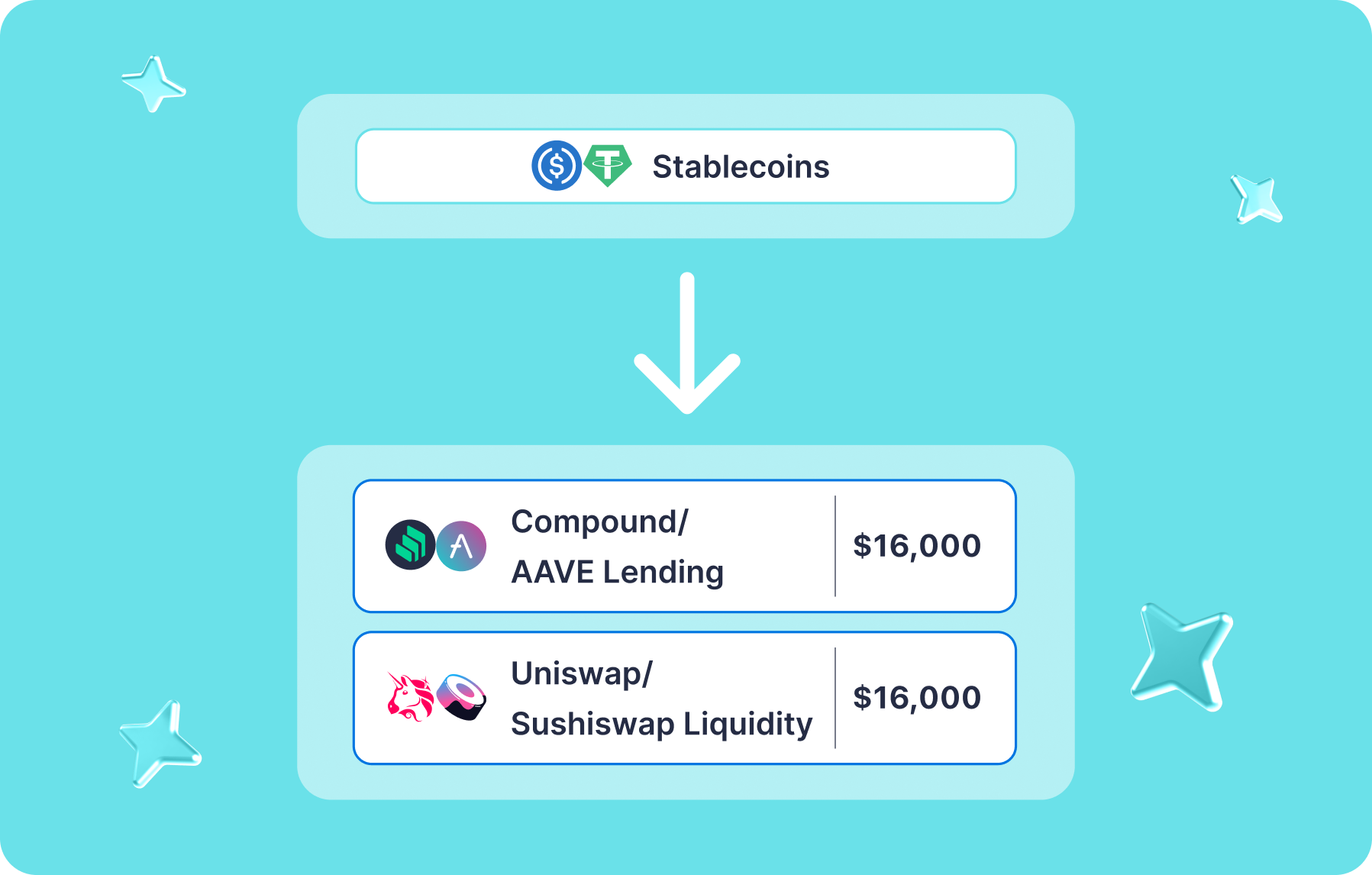

Crypto Strategy Step 3: Using DeFi platforms

Transfer your stablecoins ($32,000) to a DeFi platform to generate income.

For example:

Place $16,000 in lending on the Compound or Aave platform to earn interest.

Continuing to hedge, invest the remaining $16,000 in a liquidity pool on the Uniswap or Sushiswap platform to generate trading fee income.

Optimize returns: Regularly check the terms on DeFi platforms and adjust your fund allocation to maximize returns.

Bottom Line Crypto Strategy

Crypto portfolio:

BTC: $30,000

ETH: $18,000

Stablecoins: $32,000 (some on DeFi platforms for income)

Futures contracts: Open sell positions (hedging against the fall)

If BTC and ETH fall in value, losses will be partially offset by gains from futures contracts.

If the crypto market remains stable or continues to rise, the income from DeFi platforms will increase the total return of your portfolio.

Monitoring and Adjustment

Regularly check the status of futures contracts and DeFi platforms.

If necessary, adjust asset allocation and hedging based on market conditions and your investment objectives.

Users can get BTC, ETH, and any other cryptocurrency for fiat or crypto on SimpleSwap.

Summary

Investing in cryptocurrencies presents significant opportunities but also entails high risks due to extreme market volatility. Implementing a hedging strategy is crucial for protecting capital and minimizing potential losses.

Hedging involves diversifying investments across various assets, using stablecoins, futures contracts, and DeFi platforms to offset risks from core investments.

By reducing volatility, protecting capital, ensuring financial stability, and potentially increasing returns, hedging allows investors to manage risks effectively and make more informed decisions.

Regular monitoring and adjustments ensure that the hedging strategy remains effective in changing market conditions, ultimately safeguarding the investor's crypto portfolio.

In this article, we used a hedging strategy involving asset allocation to stablecoins, selling futures contracts, and investing in DeFi platforms.

This crypto strategy reduces risk, protects capital, and maximizes potential returns, which is especially important when there are signals of a possible market trend reversal.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.