DJIA, DAX, and BTC Indexes Correlation November

Key Insights

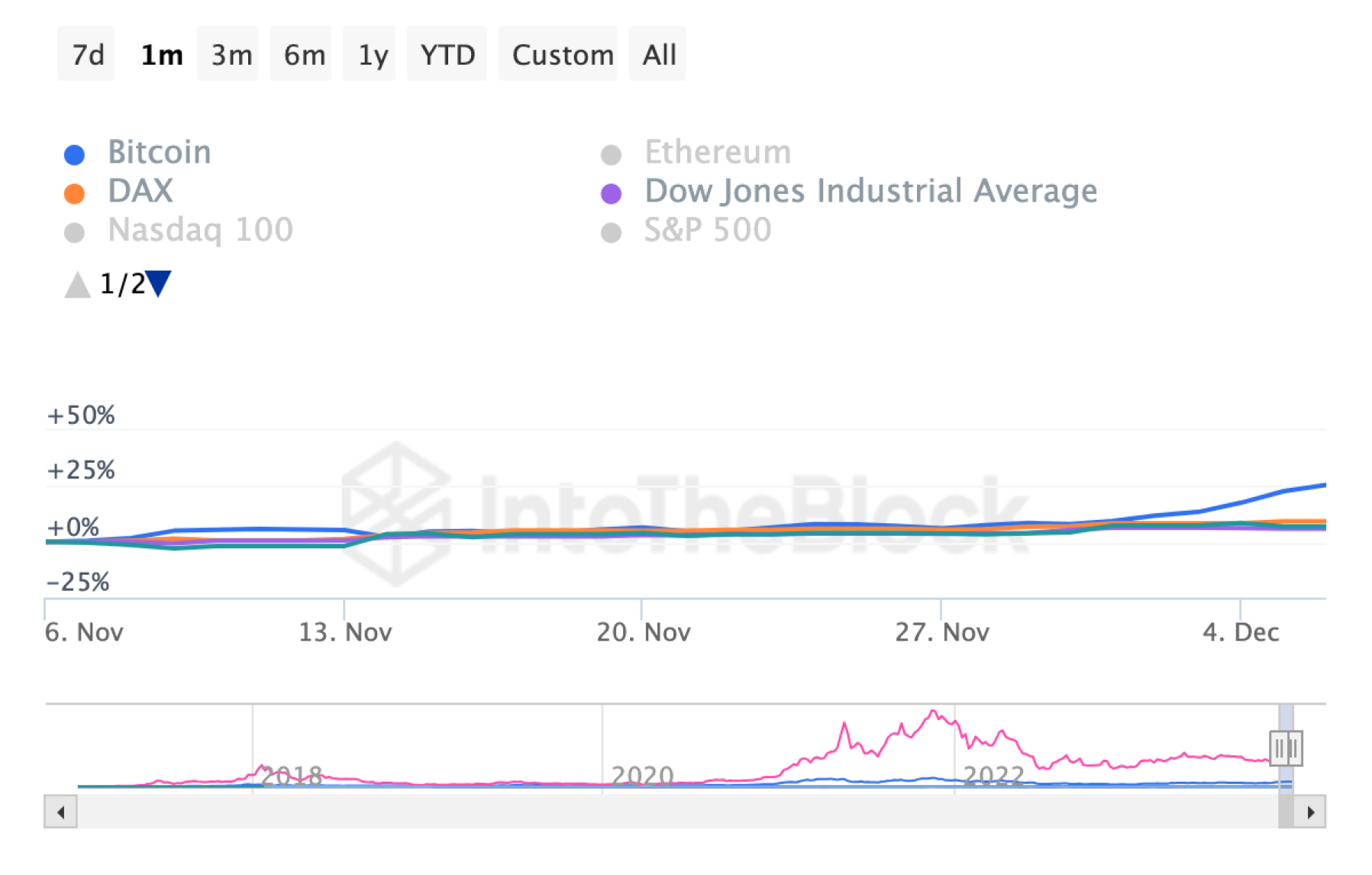

- November 2023 sees a moderate market optimism, with rising stock sentiment influencing Bitcoin prices due to a pronounced correlation with major indexes like the DAX and DJIA.

- Analysts anticipate a 90% likelihood of SEC approval for crypto ETFs in early 2024, potentially drawing traditional investors into the crypto space and bolstering positive market movements.

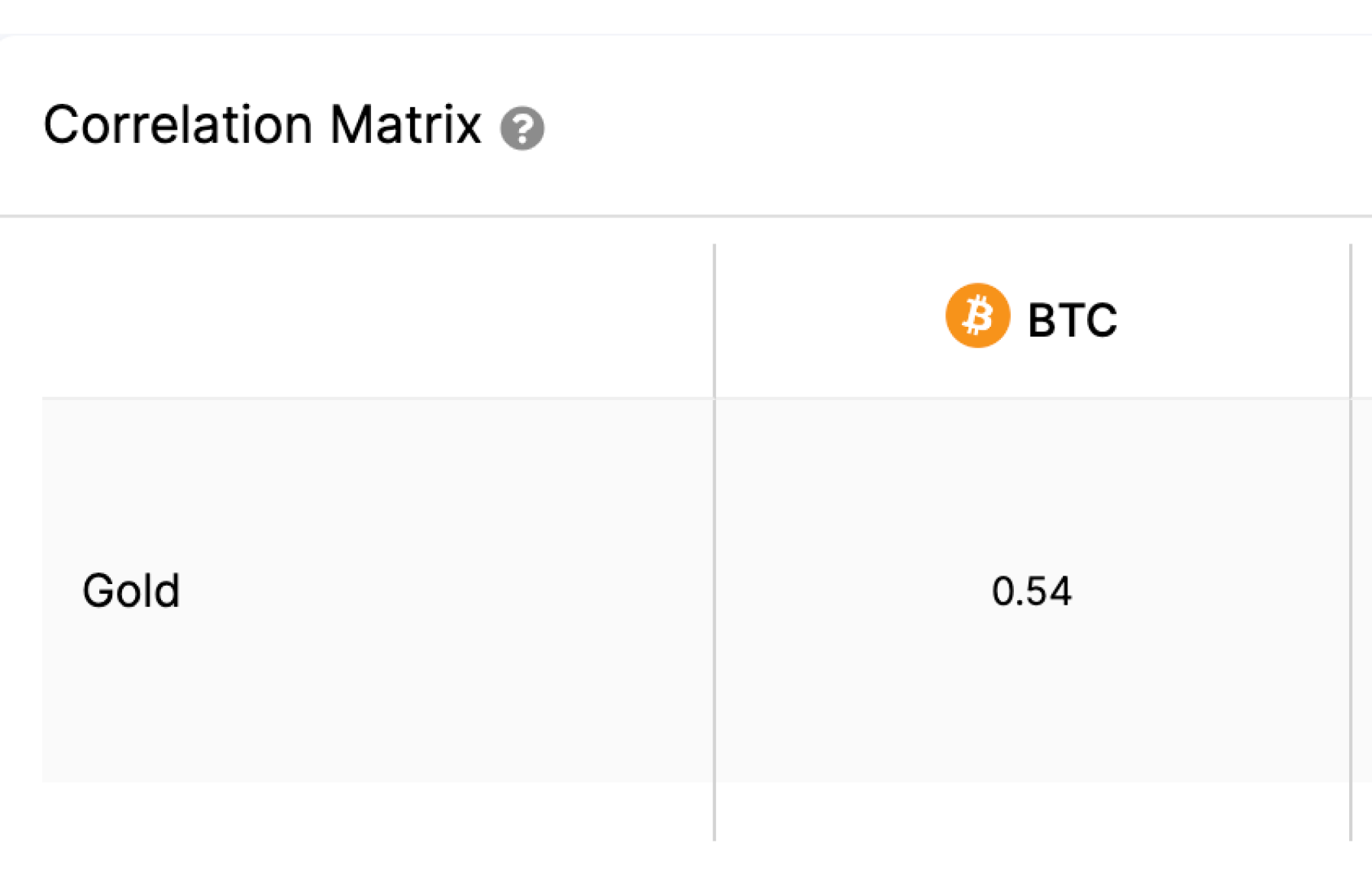

- The noteworthy correlation between BTC and gold, at 0.54, offers diversification opportunities and positions BTC as a digital safe haven, appealing to investors seeking resilient portfolios.

November 2023: Moderate Optimism

At the end of November, there's a moderate optimism on global stock exchanges, and this uplift in sentiment isn't without impact on crypto prices, particularly Bitcoin.

This period is characterized by a pronounced correlation between Bitcoin price movements and major stock indices like the DAX index and the Dow Jones Industrial Average (DJIA), which piques investors' interest.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (DJIA) is one of the oldest and most widely followed stock market indices worldwide. It represents a selection of 30 significant companies across various industries.

Changes in the Dow Jones index are closely monitored as an indicator of the economy's health and can influence investor sentiment and market trends. Crypto investors can’t but follow current Dow Jones Industrial Average, too, as it reflects the world stock markets conditions.

Below are several factors explaining the current correlation between the DAX index, the Dow Jones Industrial Average index, and the BTC index.

- Market sentiment recovery stimulates investor interest in risky assets. Favorable conditions in stock markets create a conducive atmosphere for crypto price growth, including Bitcoin.

- Growing interest in cryptocurrencies from major financial institutions contributes to aligning price movements between Bitcoin and traditional assets. This phenomenon reflects the increasing role of cryptocurrencies in the broader financial landscape.

- Positive economic events and trade agreements serve as additional factors bolstering investor confidence. These factors influence both asset categories and strengthen their correlation.

Expert Forecasts: Crypto ETF

Analysts from Bloomberg Intelligence express confidence that the SEC is likely to approve crypto ETFs in early January 2024 with a 90% probability.

This event may further support positive movements in the crypto market.

BTC can be purchased for crypto or fiat on SimpleSwap.

What is an ETF

An Exchange-Traded Fund (ETF) is a type of investment fund that trades on stock exchanges, similar to stocks. It holds a collection of assets like stocks, bonds, or commodities and allows investors to buy shares representing partial ownership of the fund's holdings. The ETF definition does not exclude the crypto market.

A Bitcoin ETF is a financial product that allows investors to gain exposure to Bitcoin without needing to directly buy or hold the crypto.

This cryptocurrency ETF tracks the price of Bitcoin, enabling investors to trade shares of the ETF on traditional stock exchanges like they would with any other stock. This would probably attract more traditional players in the crypto market, as they are more uses to the ETF concept rather than crypto investing.

BTC and Gold Indexes Correlation

Another intriguing aspect is the positive correlation between Bitcoin and gold, expressed by a coefficient of 0.54. This phenomenon draws investors' attention and provides new opportunities for portfolio diversification.

Investors aiming for effective diversification pay attention to the correlation between Bitcoin and gold. Both assets can serve as tools to mitigate risks and create a resilient investment portfolio.

The positive correlation with gold underscores Bitcoin as a digital safe haven. This makes crypto more attractive to investors accustomed to traditional assets and contributes to expanding the interested investor pool.

The positive correlation may signal trends in financial markets and increased trust in risky assets, creating a favorable environment for investments.

Users can buy BTC and other cryptocurrencies for fiat or crypto on SimpleSwap.

Summary

In conclusion, November 2023 witnessed moderate optimism in world stock markets, impacting the rise in crypto prices. The positive impact is attributed to the overall market sentiment recovery, growing interest in cryptocurrencies from major financial institutions, and favorable economic events.

These factors highlight the prospects for crypto market development. Analyst forecasts predict the likely approval of the Bitcoin ETF (and possibly any other cryptocurrency ETF) by the Securities and Exchange Commission (SEC) in early 2024, which is likely to strengthen positive market movements.

Additionally, the positive correlation between Bitcoin and gold provides investors with new opportunities for effective portfolio diversification, making crypto more appealing for investments.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.