Crypto Accumulation Strategy

Key Insights

- Regular small investments in selected crypto assets builds capital over time without requiring large upfront capital.

- Purchasing during the bear phase of the crypto market allows buying into projects at discount levels to maximize returns in an eventual recovery.

- Sticking to a consistent crypto strategy for an extended timeframe smooths short-term volatility of gains.

Here we take a detailed look into asset accumulation and the eponymous phase, as well as related crypto accumulation strategies.

The asset accumulation works for both traditional market and crypto market. If an investor wants to diversify the means of capitalization, they can turn to adding crypto accumulation strategies to their pool of market tools.

What Is Accumulation Phase

In the realm of cryptocurrency, market behavior follows cyclical patterns, with each market cycle comprising four distinct phases. The first of these market cycles is the accumulation phase, succeeded by the markup, distribution, and markdown phases.

For investors and individuals saving, for instance, for retirement, there exists a distinct two-phase journey in wealth management. Initially, there's the market cycle of accumulation focused on diligently building up investment value through regular savings.

Following this market cycle is the distribution phase, where the accumulated funds are accessed and utilized to sustain one's livelihood.

During the accumulation phase, which commences once the bulk of sellers exit the crypto market, volatility tends to be prevalent. However, as this phase of accumulation of assets unfolds, prices typically stabilize, akin to the stock market's accumulation phase.

What Is Asset Accumulation

As an investor, various crypto strategies can be adopted, including a focused crypto accumulation approach that capitalizes on the accumulation phase. Such an approach offers several benefits, including capital growth, diversification, and risk management.

However, accumulating crypto assets requires meticulous planning, disciplined execution, and a steadfast long-term perspective.

Particularly in today's crypto market environment, accumulation of assets in cryptocurrency holds significant importance for those seeking to leverage the market's growth potential.

Asset accumulation in the cryptocurrency space demands patience, diligence, and a forward-looking outlook.

By conducting thorough research, diversifying investments, adhering to a consistent investment regimen, and prioritizing security and risk management, investors can position themselves advantageously to capitalize on the potential growth of the crypto market.

What Is Crypto Accumulation Strategy

Crypto accumulation strategies are all about buying crypto assets regularly, regardless of the price.

This method lets crypto market investors build their portfolios steadily over time and avoid risky trading behaviors. Plus, this approach lets investors capitalize on big price jumps in crypto assets.

If clear goals are set, there's a need to analyze the crypto market, diversify the portfolio, and get involved in staking and yield farming. Thus, there will be a better chance of accumulating more crypto and reaping the benefits of the market's long-term growth potential.

The crypto market is very volatile, with big price swings from one day to the next. If investors want to build up the assets, it’s important to keep an eye on the long term.

Dollar cost averaging is a very fitting strategy. It involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This approach can help to avoid the effects of price volatility and build up the crypto assets steadily over time.

Accumulation Crypto Strategy Implementation

Here is an accumulation plan as a crypto strategy for building capital and creation of a financial cushion:

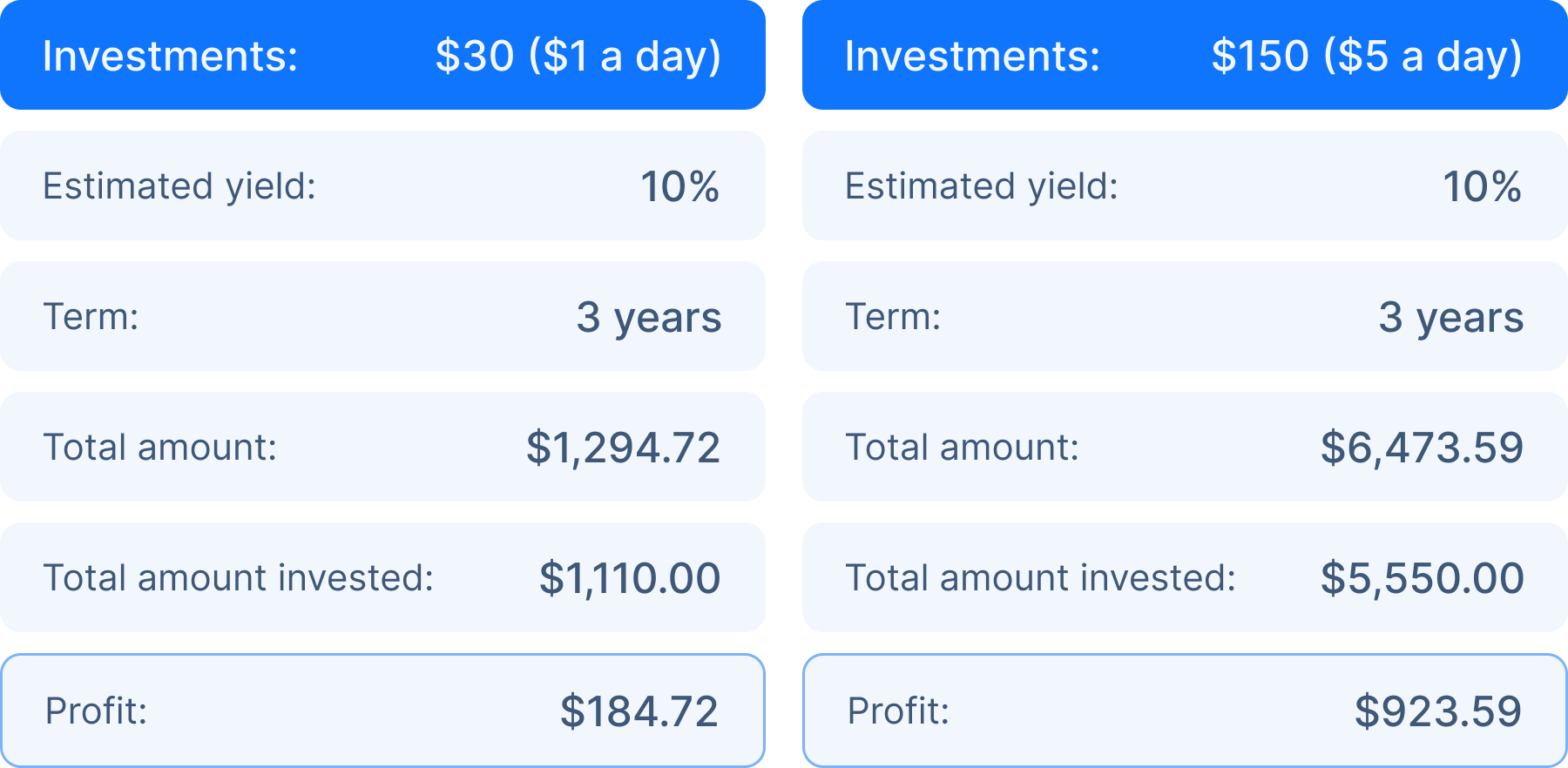

This crypto strategy assumes daily savings of $1. Savings allow to collect $30 per month and up for cryptocurrencies and tokens.

According to the strategy, coins are manually selected for purchase on a monthly basis. The choice is based on the prospects of strong growth due to fundamental indicators and crypto market recovery after a prolonged bear market stage.

Thee implementation period for this crypto strategy is at least 1 year and the minimum investment per month is $30.

Although a minimum profit is presumed, big crypto projects are known to grow.

This asset accumulation strategy is the easiest and cheapest way to generate passive income on crypto with a minimum estimated yield of 10%, no matter how much the market is entered with.

Users can purchase cryptocurrencies to implement this strategy on SimpleSwap.

Summary

This article outlines the importance and process of the accumulation phase in both traditional and cryptocurrency markets. In the context of wealth management, the accumulation phase involves diligently saving and building investment value.

In the crypto market, the accumulation phase is the first of four market cycles, characterized by volatility that eventually stabilizes as prices begin to rise.

Investors can adopt various crypto strategies to accumulate assets. This involves regular, disciplined purchases regardless of market price, aiming for capital growth, diversification, and risk management.

Successful asset accumulation in crypto demands thorough research, diversification, consistent investment, and a long-term perspective.

A key strategy for accumulating crypto assets is dollar cost averaging, which mitigates volatility by investing a fixed amount at regular intervals. This method helps build a steady portfolio and capitalize on market growth over time.

The article also presents a practical accumulation strategy, suggesting daily savings of $1 to accumulate $30 per month for cryptocurrency investments. This plan involves manually selecting promising coins based on fundamental indicators and aims for a minimum investment period of one year, with an expected minimum yield of 10%, providing an accessible way to generate passive income in the crypto market.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.