BTC Analysis March 2023

Key Insights

- On-chain analysis shows that the rise in BTC price over the past 6 months has not significantly increased the number of active addresses.

- Despite the price growth, the number of new BTC addresses and transactions has not increased at the same rate, indicating that current market players are increasing their positions without attracting new participants.

- The stability of BTC balances on exchanges suggests a positive outlook for BTC based on long-term investment belief and potential, despite fluctuations in short-term metrics.

On-chain analysis entails the examination of blockchain data encompassing transactions, trades, and wallet address holdings. On-chain data is the one that has been validated and recorded on a blockchain ledger.

For investors and traders on-chain data unveils crucial information about who holds or trades specific cryptocurrencies, how sophisticated investors are managing their portfolios, and the reactions of token holders to market events.

Utilizing on-chain analysis involves extrapolating trends and assessing crypto market sentiment.

On-chain analysis relies on various metrics. In this BTC analysis we look into the number of active and new addresses, number of Bitcoin transactions, balances on exchanges, and mean hash rate.

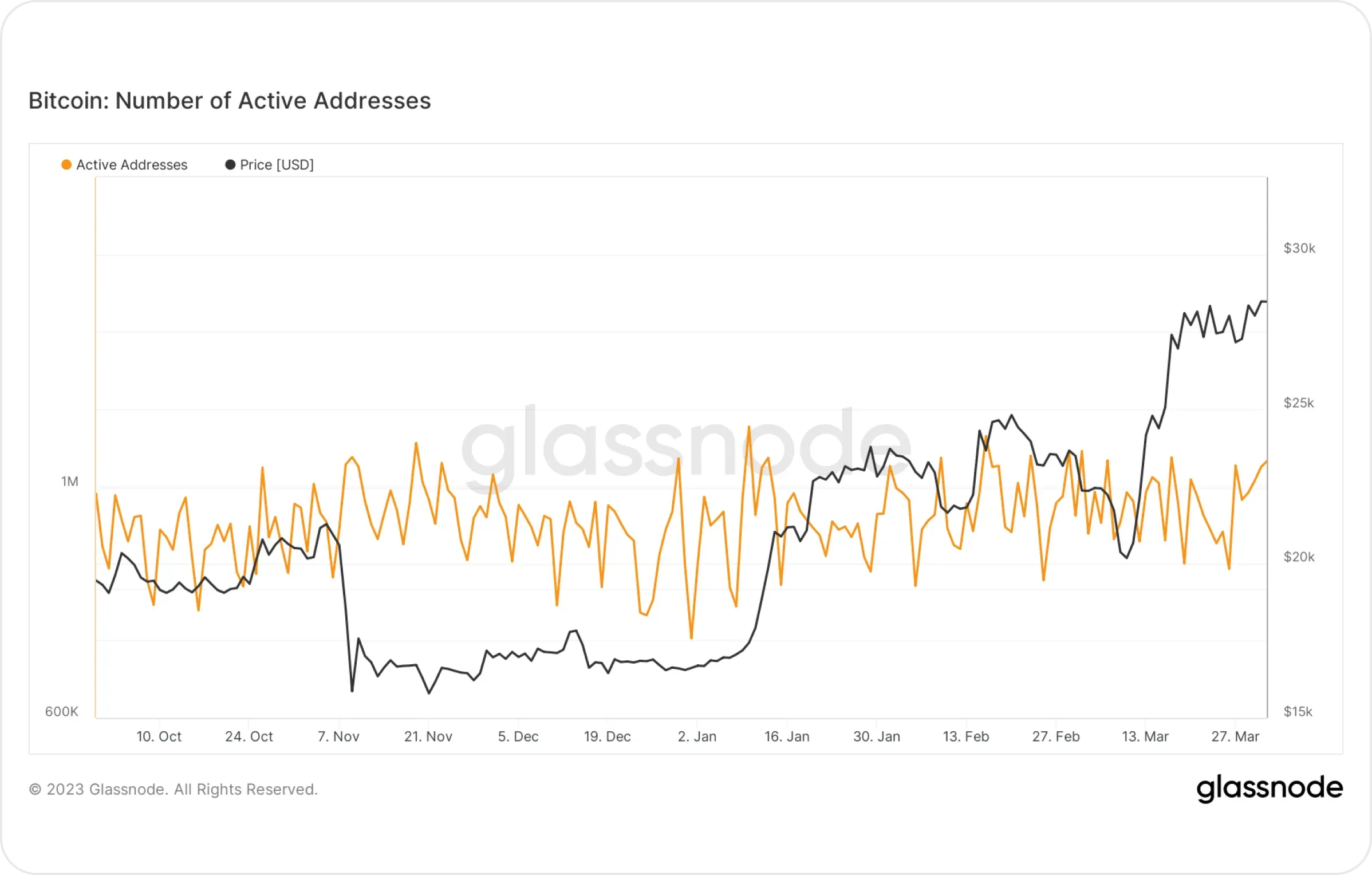

Number of Active Bitcoin Addresses

Over the past 6 months, the rise in the value of BTC has not led to significant changes in the number of active addresses, which at the time of writing is in the range of 700k to 1,150,000.

The graphs here and below are taken from Glassnode.

Most likely, the rise in the Bitcoin price is mainly driven by speculative factors. The lack of a significant increase in the number of active addresses under such conditions may mean that at this point, most investors prefer to hold their funds in BTC for the long term, rather than actively trade.

The BTC pump amid problems with banks in the US may be due to the fact that some investors have decided to use crypto as a hedge against potential economic risks associated with the banking system. However, such pumps may be temporary. After the situation with the banking system improves, the demand for Bitcoin may decrease.

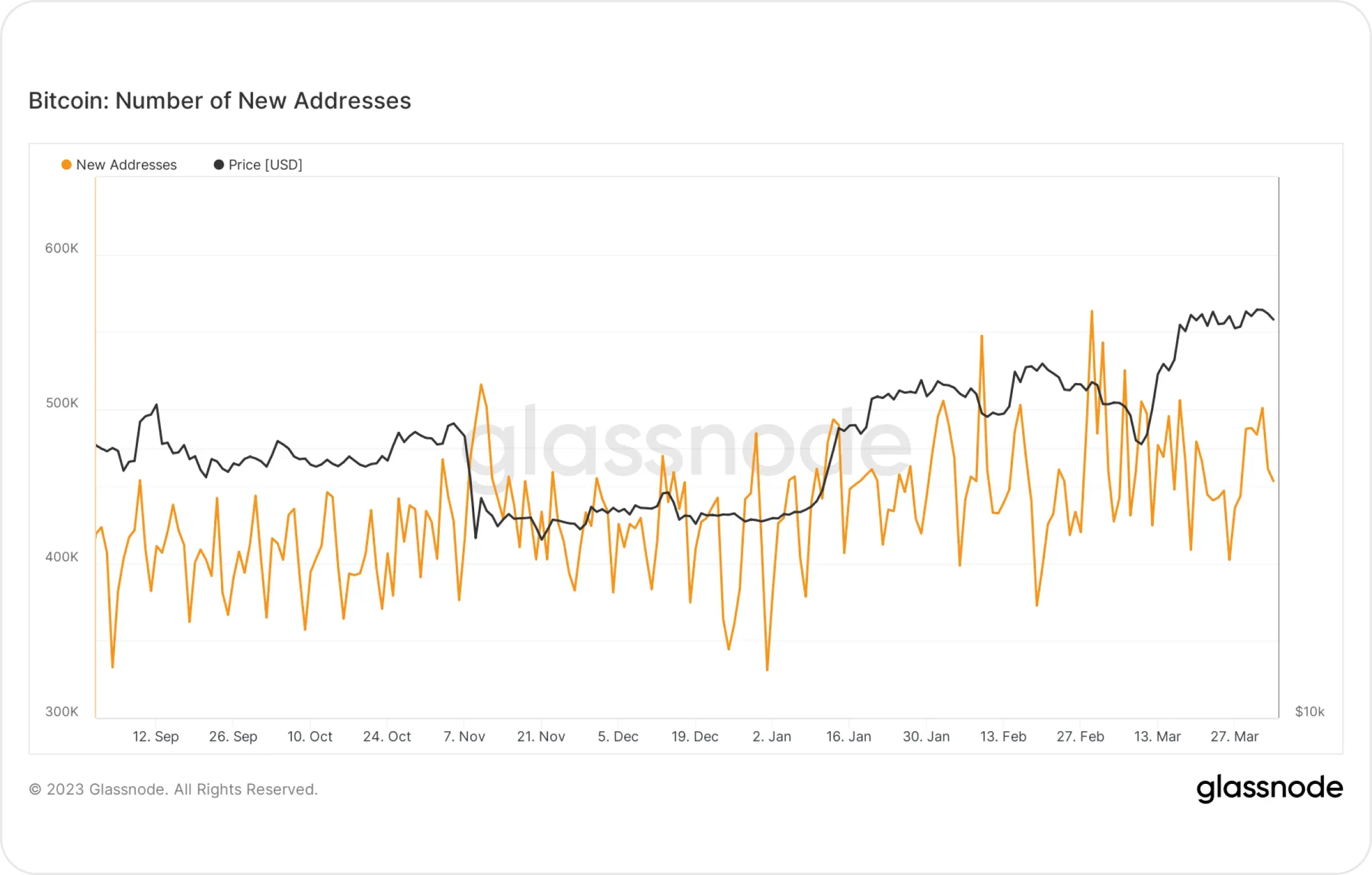

Number of New Bitcoin Addresses

From January to March, the number of new BTC addresses gradually increased. In March, we observed a gradual decrease in the number of new addresses, despite the fact that the BTC price continuously grew.

This may mean that current crypto market players increase their positions in BTC without attracting new participants. Perhaps the coin holders are confident about the further growth of Bitcoin price and would like to maintain their position in the market. Ascending trends are to be checked with multiple indicators.

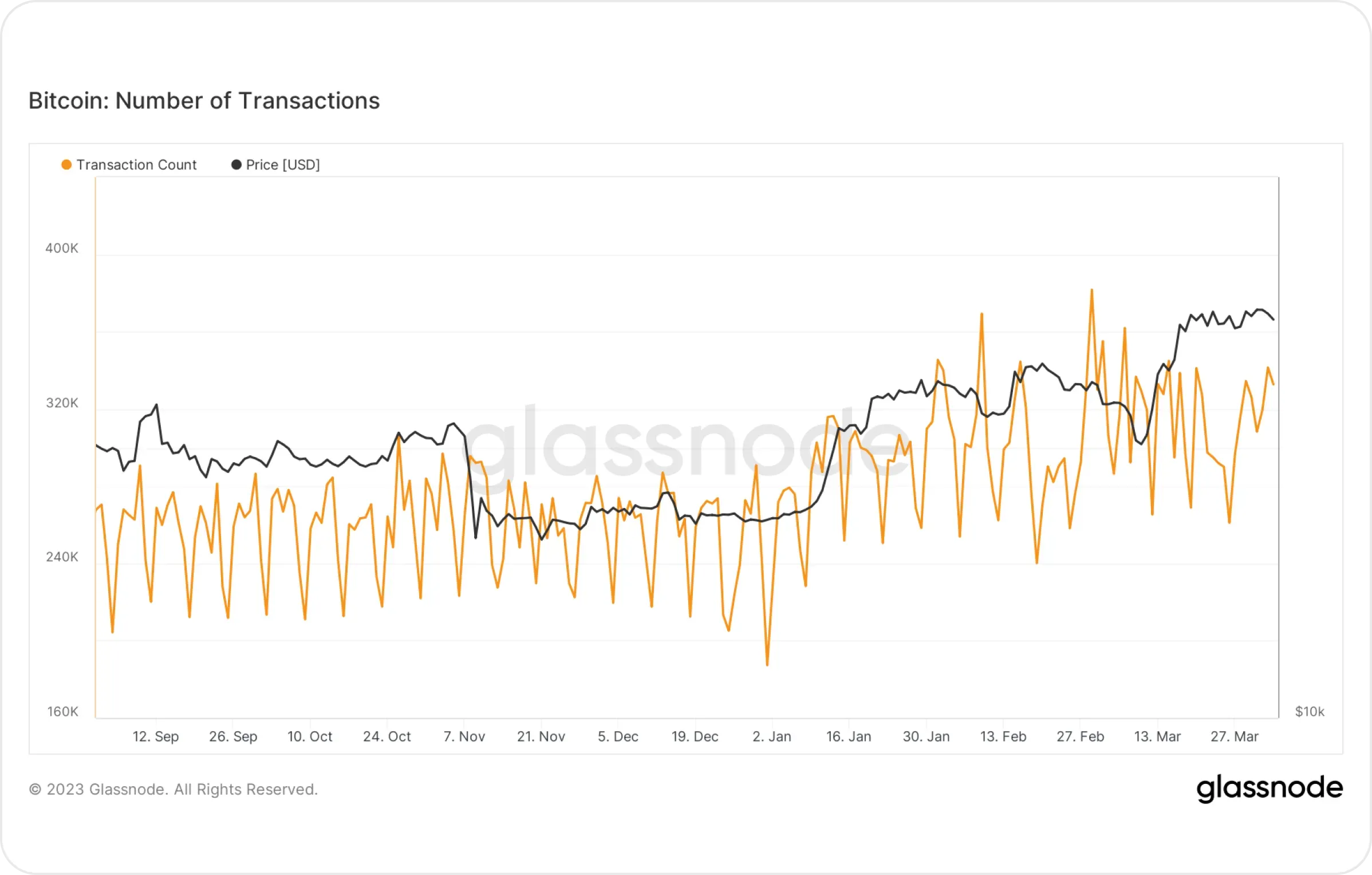

Number of BTC Transactions

From January to March, the increase in the BTC price was accompanied by an increase in the number of transactions. In March, despite the continued rise in prices, the number of transactions decreased.

A decrease in the number of transactions while the Bitcoin price continues to rise may indicate an increase in the volume of large transactions. A lower number of regular transactions usually indicates a reduction in the use of BTC as a means of payment and an increase in the speculative component of the market.

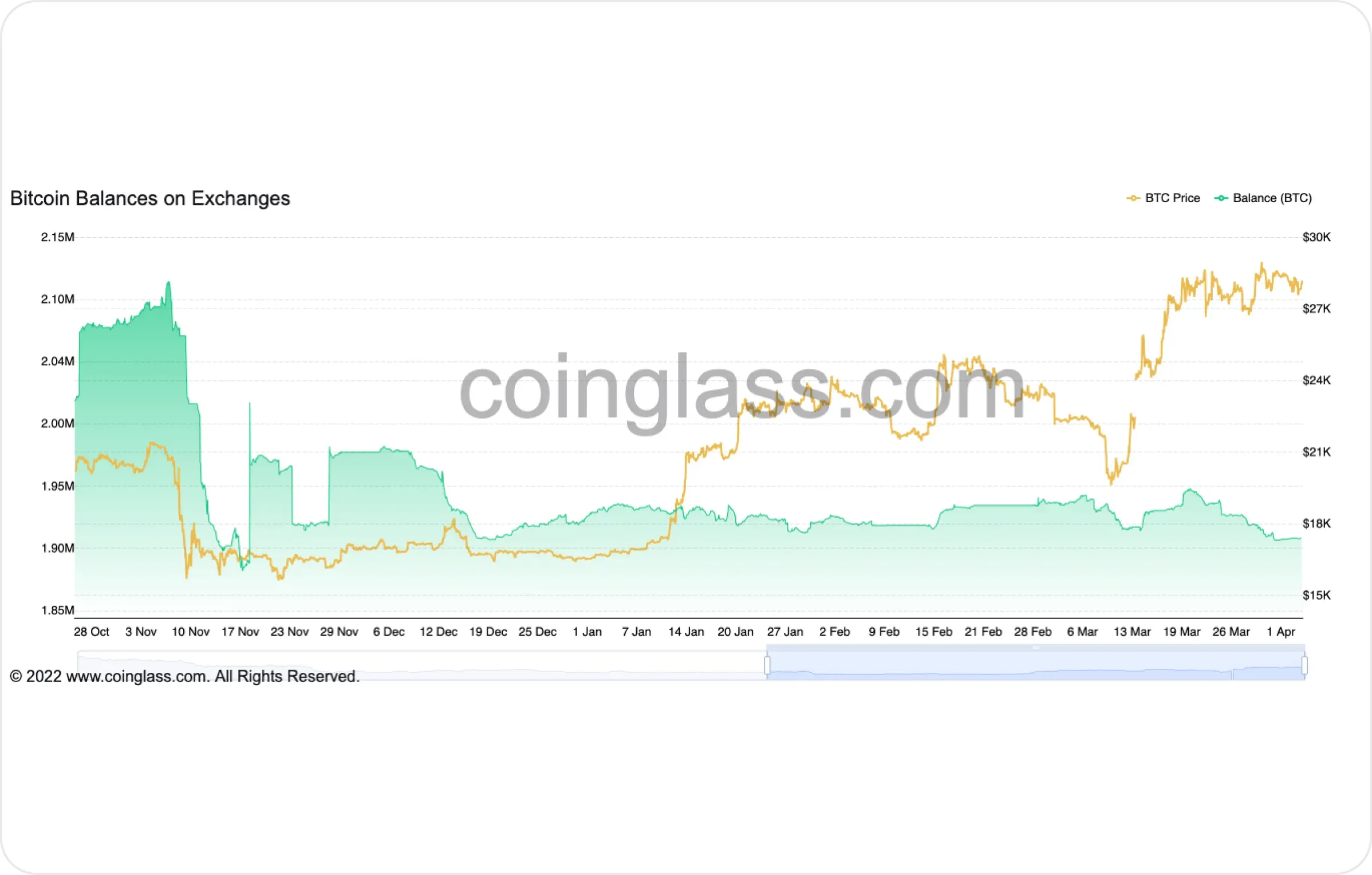

Bitcoin Balances on Exchanges

Since the beginning of January, the BTC balance on the exchanges has remained virtually unchanged, while the BTC price has continued to grow. During price corrections on the stock exchanges, there was a decrease in balances. In March, the balances on the exchanges gradually decreased, but the price of BTC would only grow.

Presumably, investors stop selling their coins on the exchange and prefer to hold BTC in the long term, perhaps, again, expecting further growth in the price of BTC.

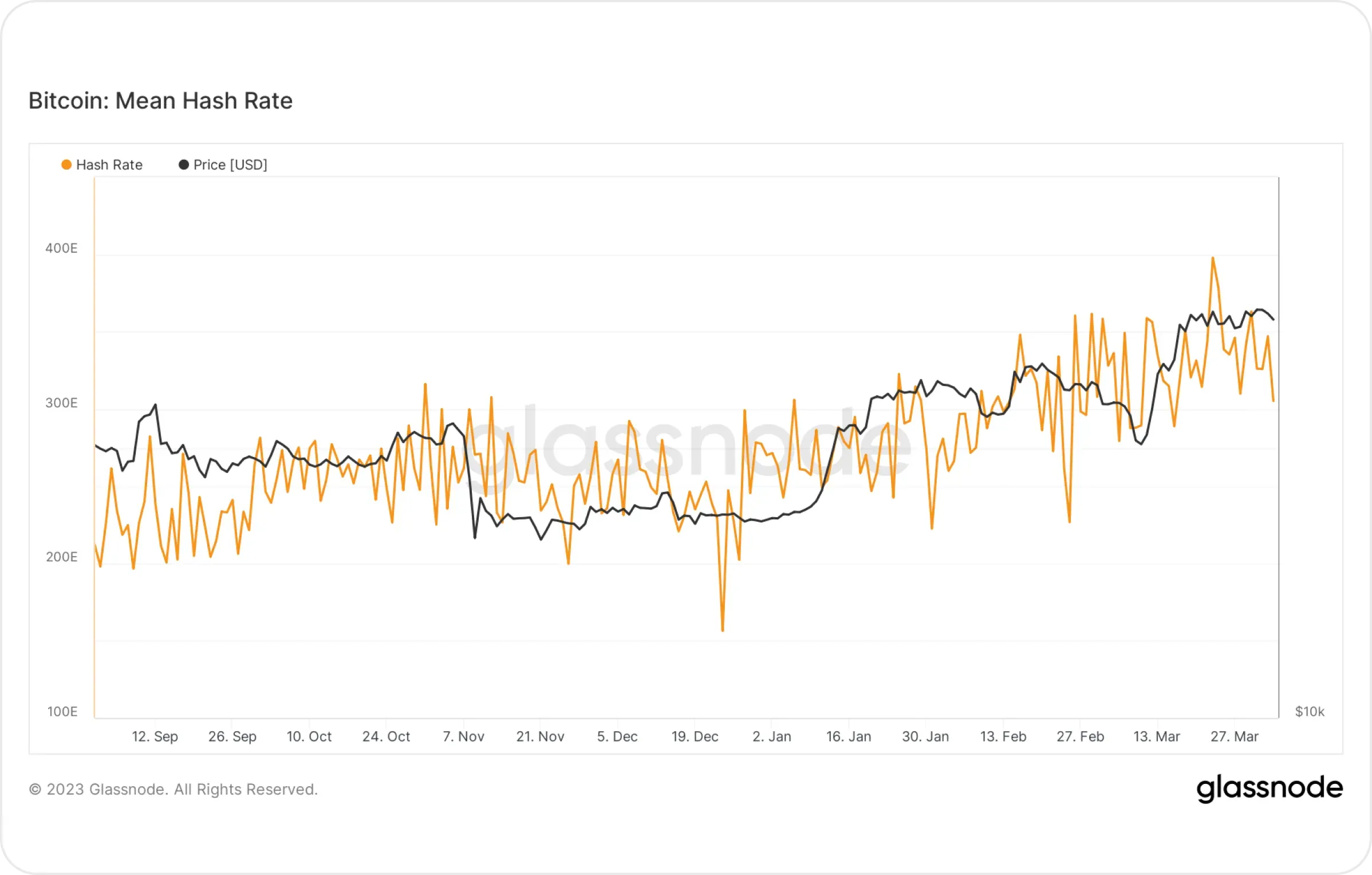

BTC Mean Hash Rate

The growth of the hash rate since the beginning of the year indicates that minerscontinue to invest money and resources in Bitcoin mining. This most likely indicates an increased interest in cryptocurrency and faith in its long-term potential.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

The overall conclusion based on metrics over the past 6 months suggests that BTC continues to rise in price. The outlook for BTC based on metrics looks positive.

However, some metrics, such as the number of new addresses and the number of transactions, do not grow as quickly.

The growth in hash rate and the continued investment in mining indicate that crypto market participants believe in the long-term potential of cryptocurrency in general.

In addition, the stability of BTC balance on the exchanges may indicate that investors and traders aim at long-term holding of crypto, rather than short-term speculation.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.