Bitcoin Mining: 2024-2027 Outlook

Key Insights

- Bitcoin mining is a difficult and complex process, but one that might provide a steady income

- With Bitcoin halving on the horizon the miners might face some losses, although previous data suggests a future rise in income

- An overview of Bitcoin mining development since Bitcoin's launch in 2009

What Is Bitcoin Mining

BTC mining is the process of creating new blocks and verifying transactions in the Bitcoin cryptocurrency network. The essence of mining is the use of computing power to solve complex mathematical problems, which allows new blocks to be added to the chain known as the blockchain. Each new block contains a set of recent transactions, as well as a special code or hash called a Proof of Work that validates the computation.

The role of mining Bitcoin in the network is extremely important. First, miners ensure the security and integrity of the network. By solving mathematical problems, they validate transactions and protect the network from fraud and double spending. Second, mining is a mechanism for distributing new BTC coins. For each block generated, the miner is rewarded with a certain amount of BTC, which incentivizes their participation in the network.

In addition, mining supports the decentralized nature of the Bitcoin network. Because the mining process is distributed among many participants around the world, there is no centralized control over the network. This makes Bitcoin resistant to government intervention.

Thus, Bitcoin crypto mining plays a key role in the security, decentralization, and efficient functioning of the cryptocurrency network. Without the involvement of miners, not only could not new transactions be added to the blockchain, but also the entire Bitcoin system would not function reliably.

Bitcoin can be bought for fiat or crypto on SimpleSwap.

Bitcoin Mining Market

The Bitcoin mining market is a dynamic and ever-changing sector of the cryptocurrency industry. The interplay of multiple factors, including technological innovation, economic conditions, regulation, and changes in cryptocurrency exchange rates, influence the dynamics of the mining market. Below is an overview of the key aspects of this market and its current dynamics:

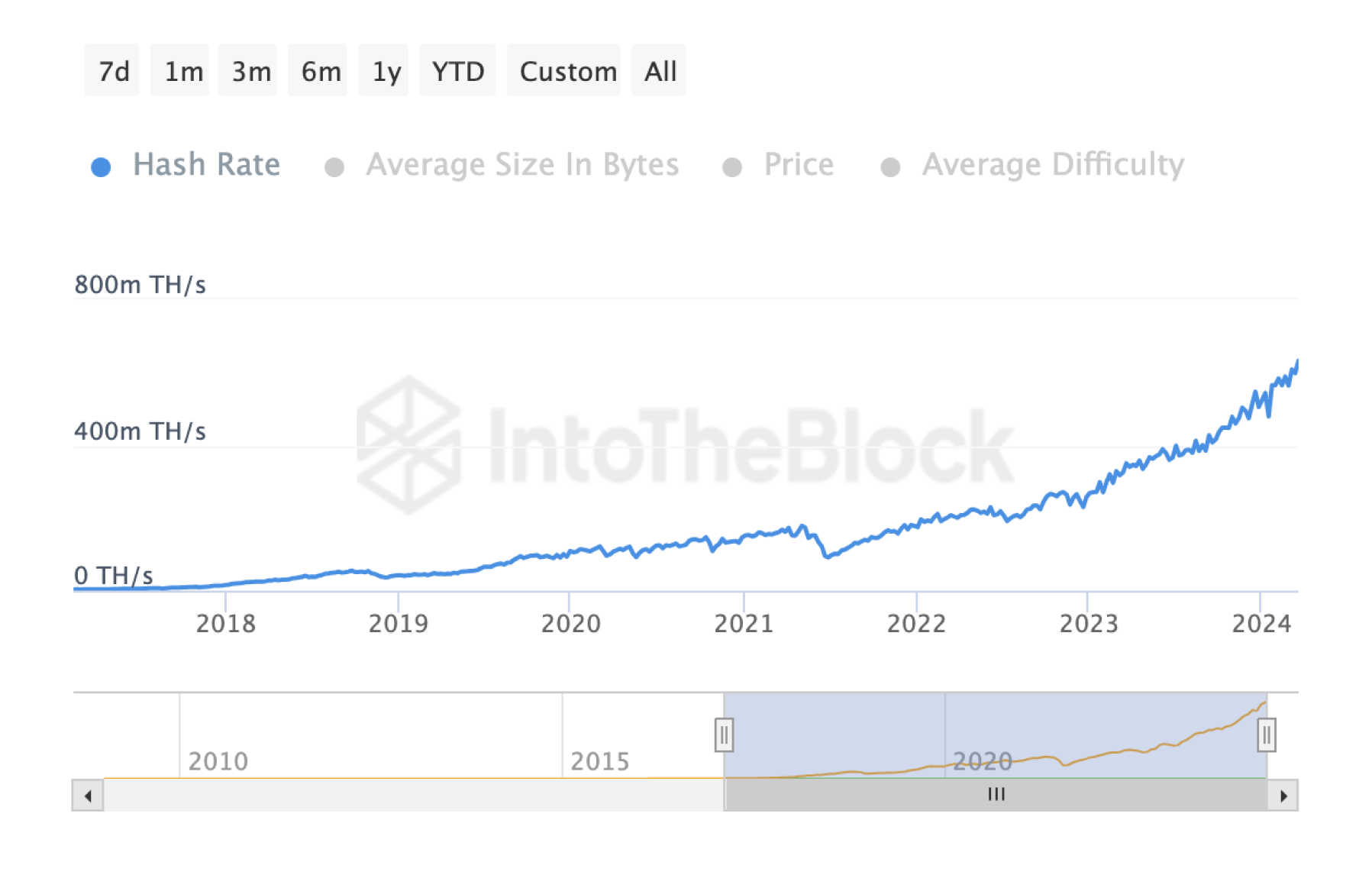

- Computing Power and Mining Complexity

The growing interest in cryptocurrencies, including Bitcoin, is leading to an increase in the computing power of the network and, consequently, an increase in the complexity of mining. This requires miners to constantly upgrade and modernize their equipment to stay competitive.

- Economic profitability

The efficiency of mining is directly related to the current price of cryptocurrencies and the cost of energy. When the price of cryptocurrencies is low or energy costs are high, mining may become less profitable, which may lead to miners leaving the market.

- Technological innovation

The development of specialized mining devices, such as ASIC miners, is driving improvements in the efficiency and productivity of mining. This may change the balance of power in the market and affect the profitability of mining for various participants.

- Geographic Distribution

Mining is active in various regions of the world, and the preference for certain locations may depend on the cost of electricity, tax incentives, infrastructure, and other factors. For example, certain countries with affordable energy sources, such as hydroelectric power plants, may attract miners with their low electricity costs.

- Regulation and legislation

Regulation of cryptocurrencies and mining in various countries has a significant impact on the activities of miners. Positive regulation can contribute to the growth of the industry, while negative measures can restrict market access and worsen the environment for mining.

The overall dynamics of the Bitcoin mining market are subject to constant changes in response to the aforementioned factors as well as other variables, making it an interesting subject to analyze and forecast in the cryptocurrency industry.

Key Milestones in Mining Development

Since Bitcoin's launch in 2009, mining has gone through several key stages of development, reflecting changes in technology, economics, and perceptions of cryptocurrencies:

- CPU-mining period

In Bitcoin's early years, mining was done on regular computer processors. This was the period when members of the network could mine Bitcoins using the computing resources of their home computers.

- GPU mining era

As the complexity of mining increased and the number of participants grew, the process of mining on CPUs became less efficient. At this point, miners started using graphics processing units (GPUs), which were more efficient at solving cryptographic problems.

- The emergence of ASIC miners

A breakthrough in the world of mining was the creation of specialized mining devices known as ASICs (Application-Specific Integrated Circuit). These devices were specifically designed for Bitcoin mining tasks and were much more efficient than CPUs and GPUs.

- Institutional Mining

With the growing interest in cryptocurrencies and increased investment in the sector, institutional mining emerged. Large companies and investors began to invest heavily in mining farms and infrastructure, increasing competition and professionalism in the field.

- Energy Efficiency Era

In recent years, there has been increased interest in developing more energy efficient mining methods, especially in light of discussions about the environmental impact of mining. New approaches are emerging, such as the use of renewable energy sources and the development of eco-friendly mining devices.

These stages reflect the evolution of Bitcoin mining from a relatively accessible hobby to an industrialized and highly competitive field. Together, they form the history and development of mining, reflecting the depth and complexity of the cryptocurrency industry.

Bitcoin Mining Outlook 2024-2027

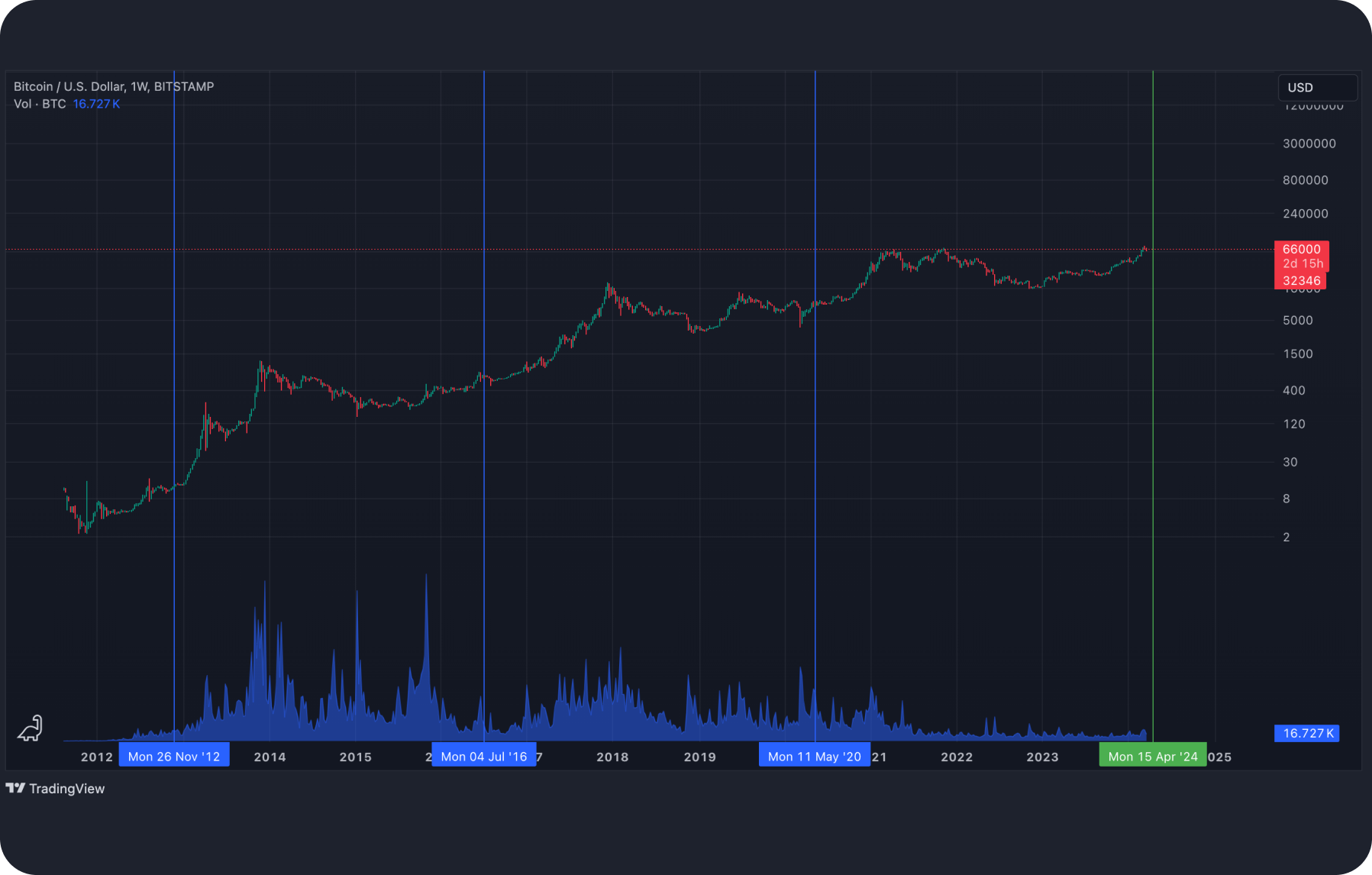

The halving of Bitcoin is coming soon. This event is expected by the entire crypto community in the world. How will it affect miners? Simply put, before the halving, they received 6.25 BTC per block, and after it - only 3.125 BTC. The reward per mined block is halved. If we look at this in terms of the simple laws of economics, if supply decreases and demand remains high, we should expect the cost of supply to increase. Sounds logical, right?

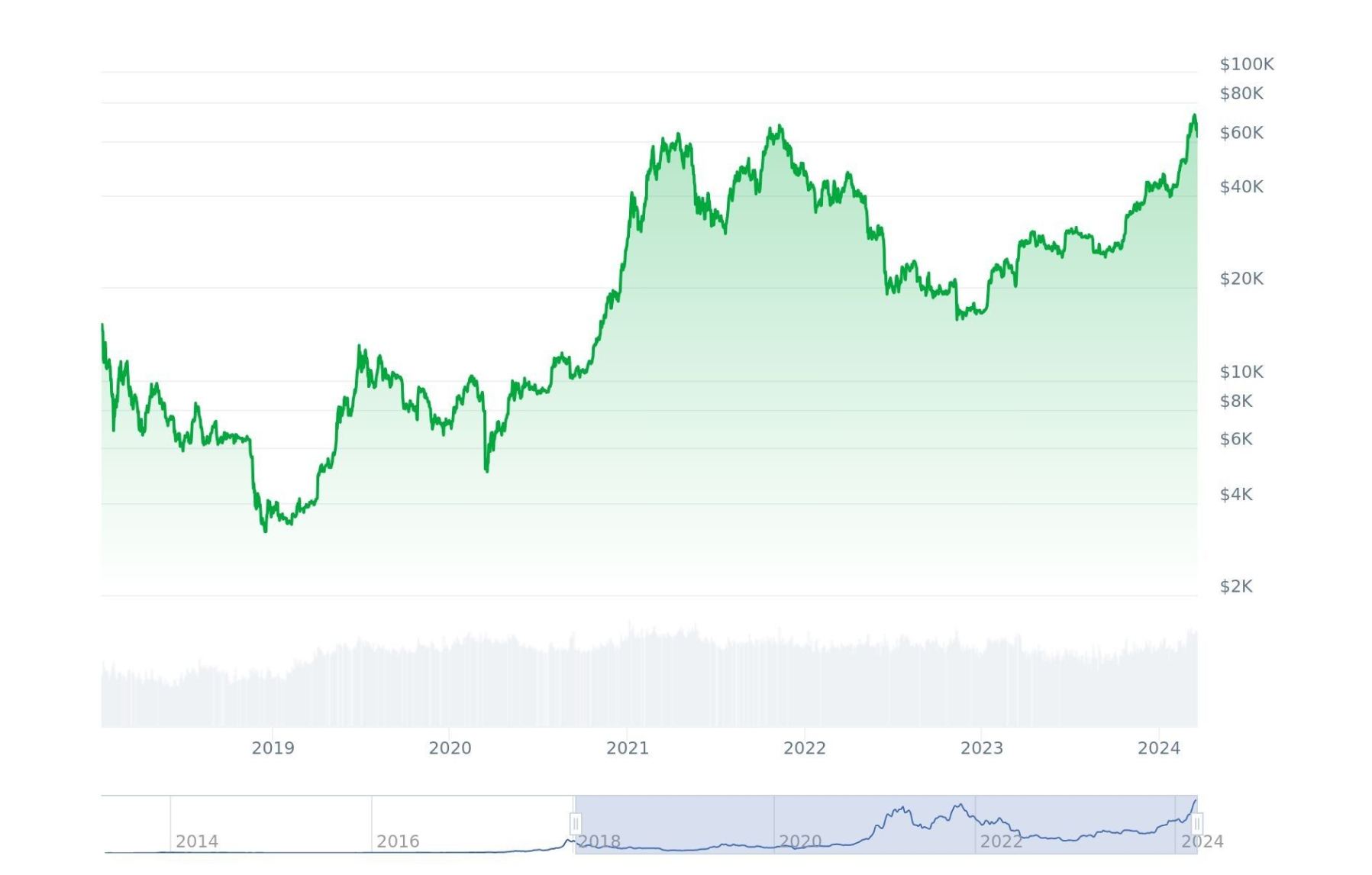

However, take a look at the chart: after each halving, Bitcoin has risen significantly. This is understandable, and it shows our risk of decreasing earnings. But, since we are not aiming for instant profits, we are working ahead. Bitcoin is predicted to be worth over $120,000 within three years, according to experts and the crypto community. Based on this, our risks are compensated by the high value of BTC in the future.

Cryptocurrency mining is a highly sought-after business that promises a steady income, but it is far from being easy. To get started, you need Bitcoin mining software and powerful computers and a deep understanding of blockchain technology.

Mining equipment falls into two main categories:

- ASIC (application-specific integrated circuit)

These are specialized computers designed exclusively for cryptocurrency mining. They are highly efficient, but they are also more expensive.

- GPU (graphic processing unit)

These are less powerful than ASICs, but more affordable. They are mainly used for mining at home. In addition, graphics cards can also be used for other purposes such as gaming and design.

Profit from mining depends on three main factors: the current cryptocurrency exchange rate, electricity costs and the efficiency of the equipment. The best way to get started is to buy new equipment, but this can be expensive. Another option is to buy used equipment. It is important to evaluate its condition and efficiency.

You should realize that the overall hash rate of the network and the complexity of cryptocurrency mining can fluctuate greatly, which directly affects the profitability of mining. Therefore, it is important to be aware of the changes and adapt your strategies.

The data obtained from the table provides important information about the expected income from cryptocurrency mining when using certain mining hardware. In this case, purchasing a $4000 ASIC with 180Th power specifications and 3.5 kW power consumption implies a monthly income of $373, given the electricity costs of $0.07 per kWh and the current BTC exchange rate of $68000.

Additionally, taking into account the equipment purchase and maintenance costs, the cost of production per Bitcoin mined is estimated at $21811. This is an important indicator for investors and miners to assess the feasibility of investing in mining.

For example, in order to mine one Bitcoin per month under current conditions, it is required to use as many as 124 ASICs with a capacity of 180Th. Such data allows analyzing the efficiency and profitability of mining equipment, which helps in making informed investment decisions.

It is important to keep in mind that after halving, the network complexity is expected to increase and, as a result, the reward for mining is expected to decrease.

However, it is also worth considering that the cost of BTC mining will keep the profitability of the equipment even during periods when the market trend goes in an unfavorable direction. This is due to the fact that the profitability of mining depends not only on the current cryptocurrency exchange rate, but also on the efficiency of the mining hardware and the cost of electricity.

Cryptocurrency Mining Alternatives

- Ease of mining

Many alternative coins are easier to mine due to their low complexity and lack of need for special mining hardware like ASICs.

- ASIC Resistant

For example, Monero is designed to be ASIC resistant, making it possible to mine on regular computers or GPUs.

- More generous rewards

Some altcoins offer higher rewards per block, increasing the potential profitability of mining.

- Different consensus mechanisms

Alternative coins can use a variety of consensus mechanisms other than Bitcoin's Proof of Work (PoW), which can reduce power consumption and competition.

- Faster block processing

Some alternative coins have shorter block times, which helps increase mining revenue.

Let's take a look at a few alternative coins for mining:

- RavenCoin (RVN)

Main focus: decentralized mining.

Algorithm: Proof-of-Work.

Current price: $0.021.

Reward per block: 2,500 RVN.

- LiteCoin (LTC)

Benefits: GPU mining, low transaction fees.

Algorithm: Scrypt.

Current price: $83.54.

Reward per block: 6.25 LTC.

- Ethereum Classic (ETC):

Benefits: support for DApps and Smart Contracts.

Algorithm: EtcHash (modification of Ethash).

Block time: about 13 seconds.

Reward per block: 2.56 ETC.

These alternative coins provide miners with opportunities for diversification and possible higher returns depending on specific circumstances.

Summary

To conclude this article on the outlook for mining from 2024 to 2027, there are a few key points to note. First, the upcoming Bitcoin halving is generating interest and expectations in the cryptocurrency community. It comes with a halving of miners' remuneration, which could affect their income. However, historical data shows that after the halving, the BTC price often rises significantly, which compensates for the potential losses of miners.

Second, for successful mining, it is important to consider not only current market conditions, but also long-term trends. It is predicted that the price of Bitcoin will continue to rise over the next three years, reaching over $120,000. This creates prospects for miners, even as the reward per block decreases.

The third aspect to consider is the variability of network complexity and factors that affect the profitability of mining, such as power costs and equipment efficiency. However, despite these factors, cryptocurrency mining remains a promising and potentially lucrative business in the near future.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.