BTC Analysis April 2023

Key Insights

- There was a notable decrease in the number of addresses on the Bitcoin blockchain. The BTC price also decreased by 17%.

- The growth in the number of wallets with balances up to 10 BTC indicates an increase in the number of small and medium investors, while the number of wallets with balance over 10 BTC is slowing down, which indicates that large holders are cautious.

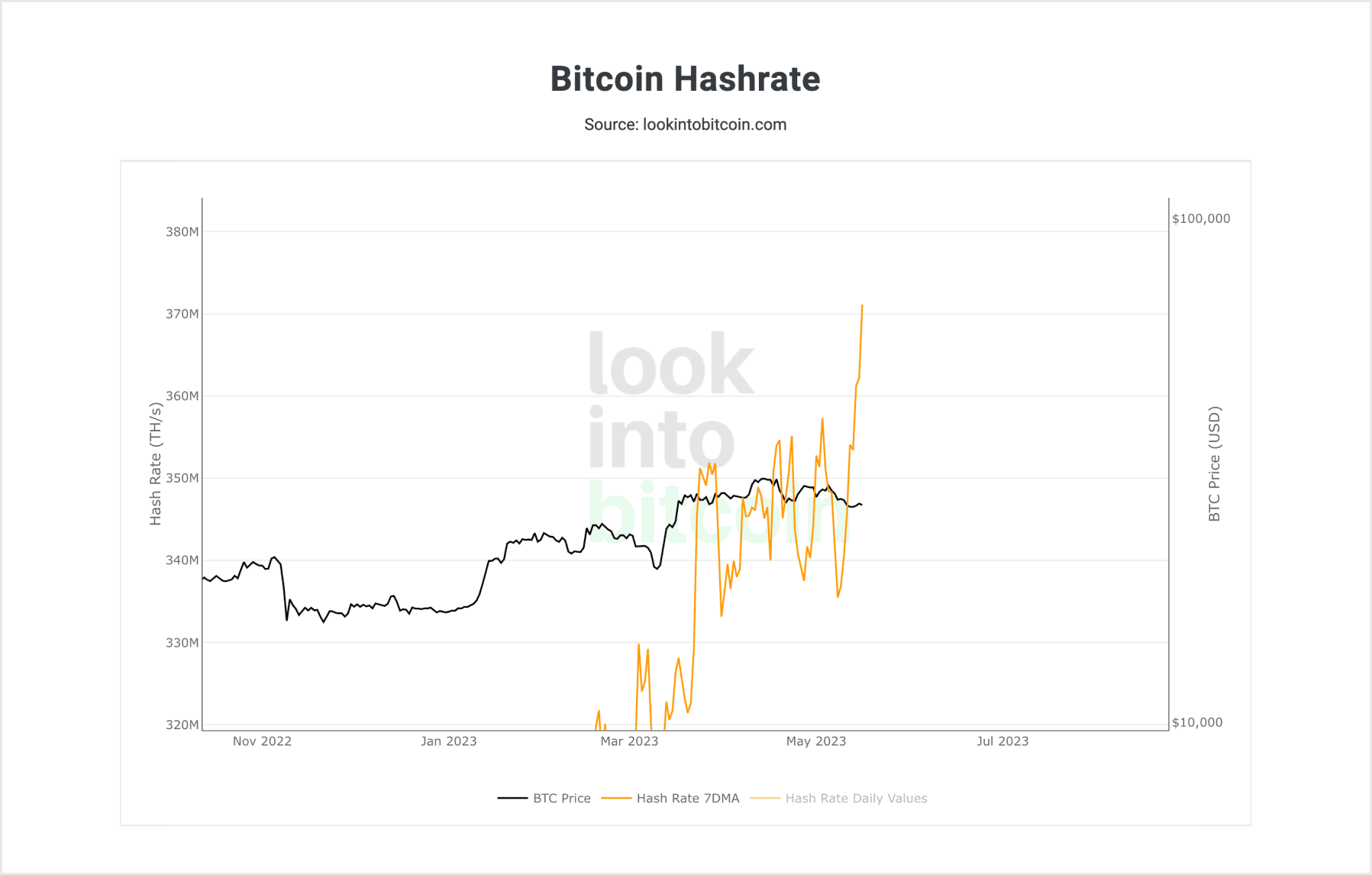

- The growth in hashrate indicates that miners are maintaining their interest and participation in the Bitcoin network. This is a positive signal for the network and confirms Bitcoin's potential.

On-Chain Analytics Explained

On-chain analysis entails the examination of blockchain data encompassing transactions, trades, and wallet address holdings. This analysis provides real-time insights into the activities of crypto market participants within respective blockchains.

The term on-chain data pertains to transactions that have been validated and permanently recorded on a blockchain ledger.

On-chain data is the one that has been validated and recorded on a blockchain ledger. This validation and recording process is carried out by miners in Proof-of-Work (PoW) blockchains and stakers in Proof-of-Stake (PoS) blockchains. Access to on-chain data is open to anyone, anywhere, as it is publicly recorded on blockchain ledgers.

On-chain analysis relies on various metrics, including active addresses, transaction volume, supply distribution, and total value locked, in conjunction with the price action of an asset.

This BTC analysis below is based on the following indicators: Total transfer volume, number of active addresses, and hashrate.

Look out for more BTC on-chain analyses as we post new one every one-two months.

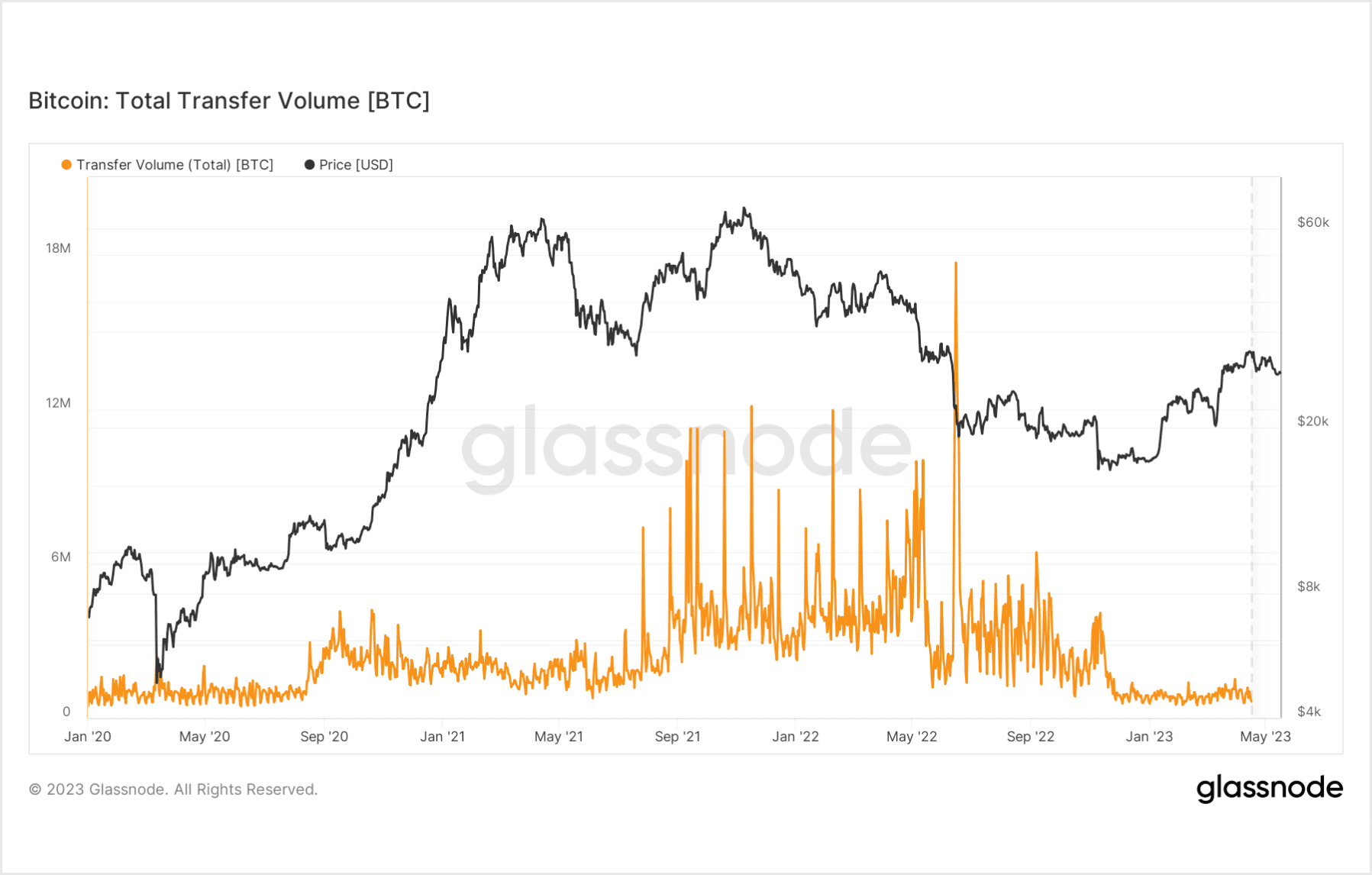

Total BTC Transfer Volume

Despite a significant decrease in the overall transfer volume and an ongoing period of sideways movement (flat) in the metric, the BTC price has increased by 100% since January.

The graphs here and below are taken from Glassnode.

The price of Bitcoin is not always directly correlated with the transfer volume: Although the overall transfer volume can be an important factor influencing the price of Bitcoin in the long term, other factors can also have a significant impact on price dynamics.

In this case, despite the decrease in transfer volume and a period of stagnation, the price of Bitcoin still increased, indicating the influence of other factors such as investor demand or overall crypto market trends.

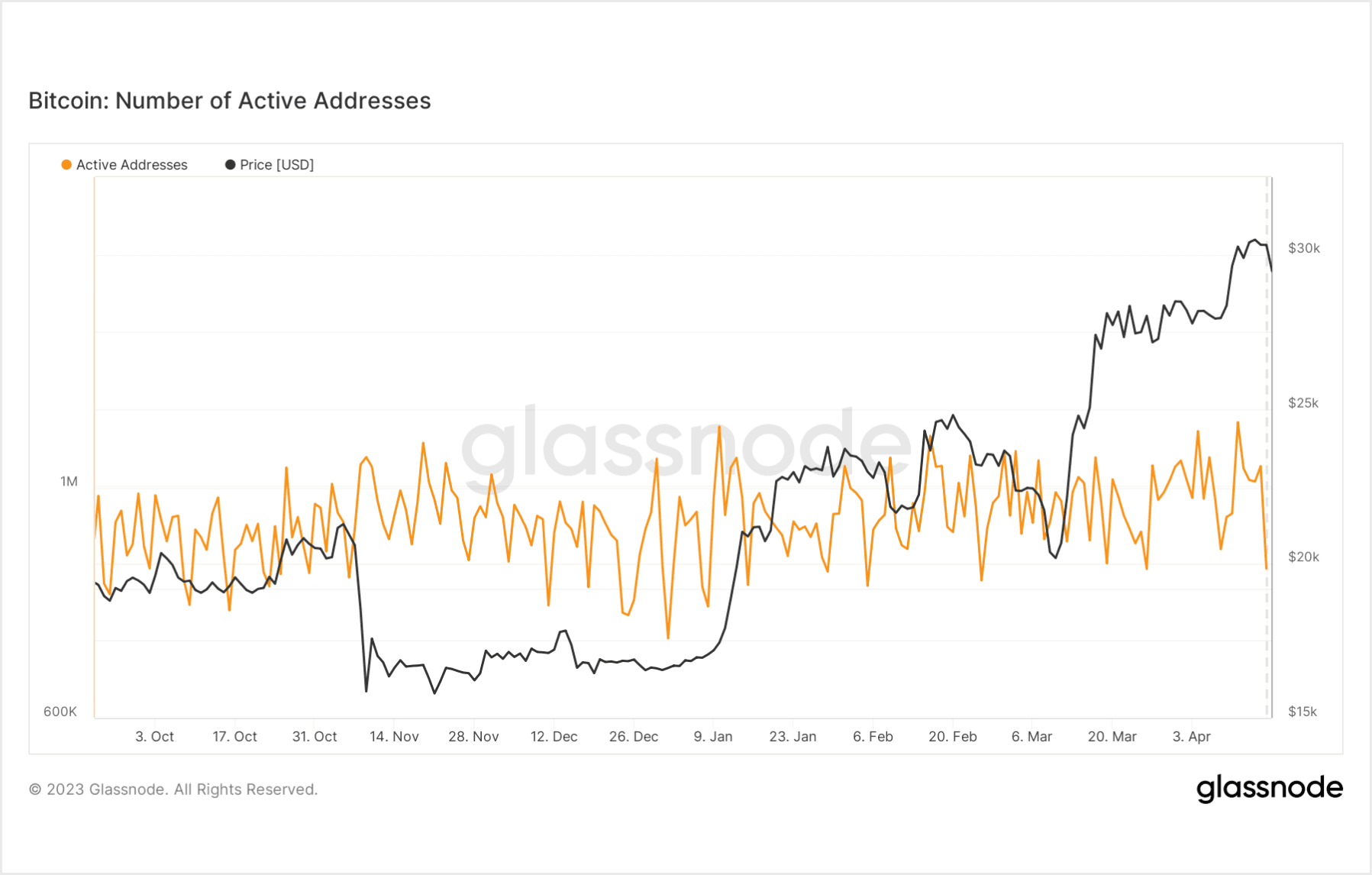

Number of Active Bitcoin Addresses

The on-chain data shows that there has been a noticeable reduction in the number of addresses on the Bitcoin blockchain, decreasing from 1,158,000 to 837,000. At the same time, the price of Bitcoin also decreased by 17%.

Correction after growth: The 17% price decrease in Bitcoin following the reduction in the number of addresses could be a result of a correction after a previous period of growth.

The price of Bitcoin tends to exhibit cyclicality, and periods of growth can be accompanied by correction periods when the price decreases. This may be related to investors taking profits or the crypto market attempting to establish a more sustainable price level. It's worth checking various indicators to make sure one's entering or exiting their positions right on time.

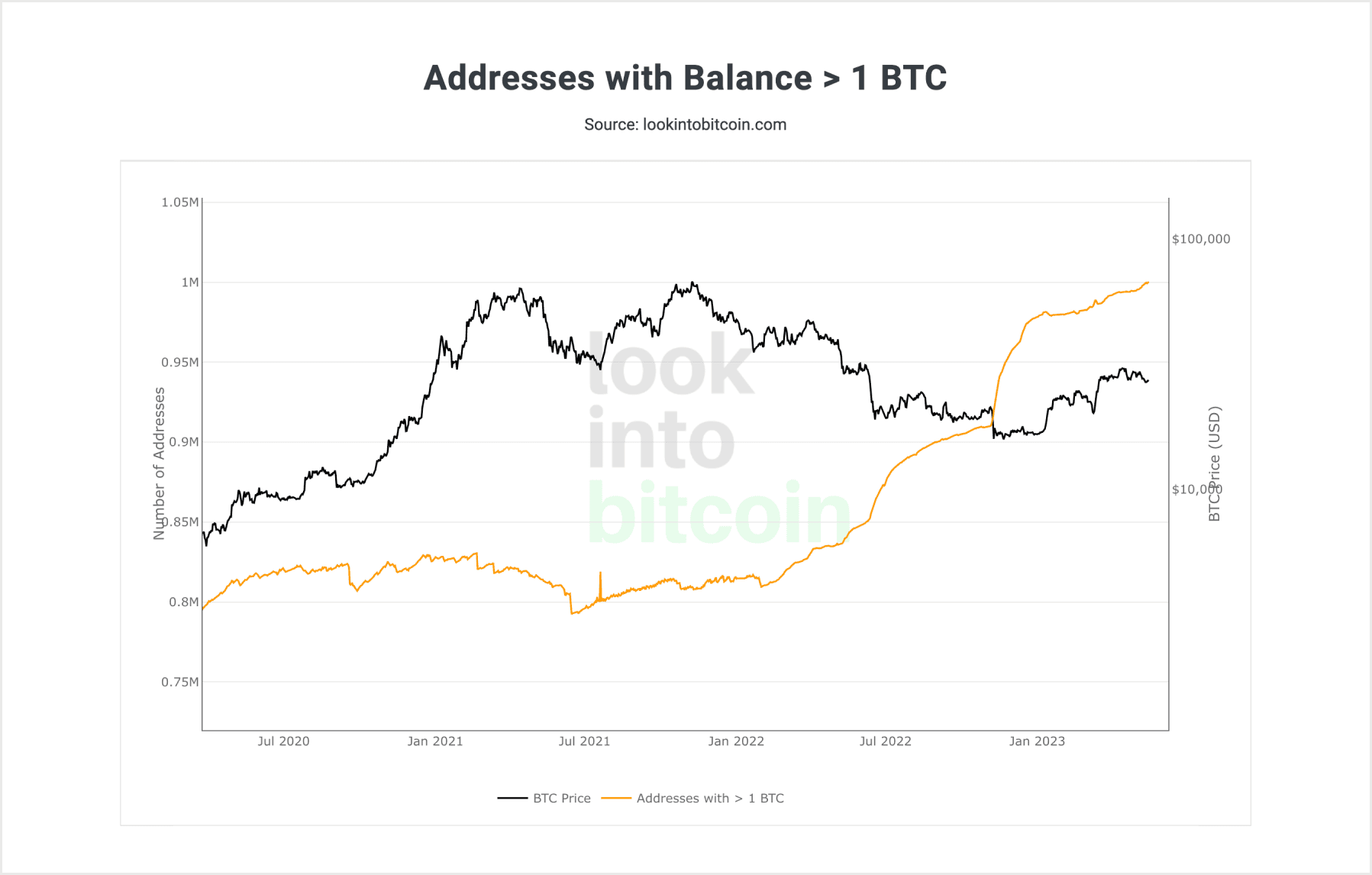

Bitcoin: Addresses with Balance > 1 BTC

The number of wallets with a balance up to 1 BTC and a balance between 1 BTC and 10 BTC continues to grow steadily.

This may indicate an increase in the number of small and medium-sized investors who are acquiring and increasing their positions in Bitcoin. Such behaviour could be attributed to heightened interest in cryptocurrencies and growing informed investment.

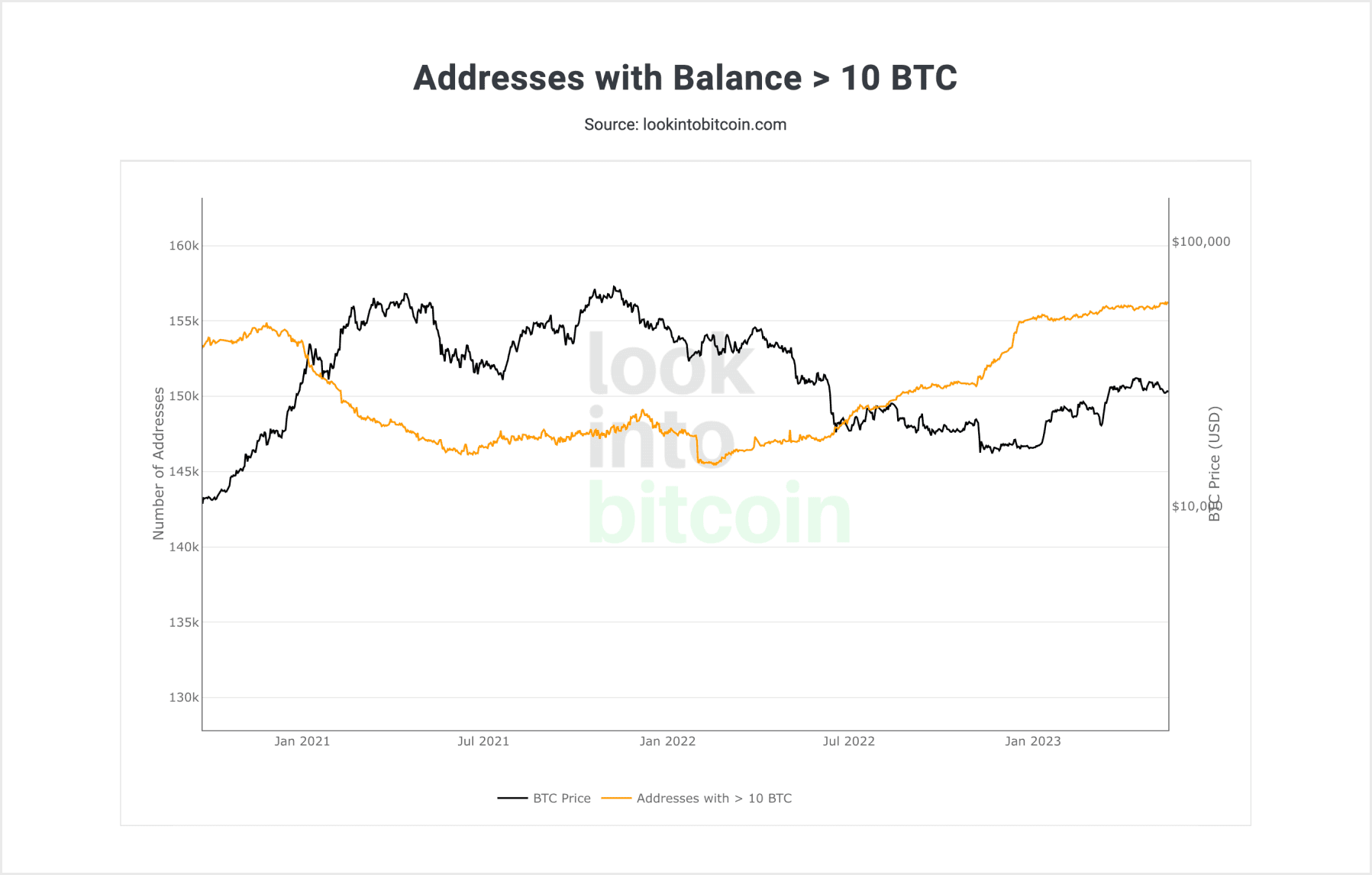

Bitcoin: Addresses with Balance > 10 BTC

However, it is worth noting that the growth in the number of wallets with a balance exceeding 10 BTC has slowed downafter the initial price increase of Bitcoin since the beginning of the year.

This may indicate caution among large Bitcoin holders who may prefer to maintain their positions or engage in smaller trading operations. This reaction could be linked to expectations of further crypto market dynamics and a desire to minimise risks.

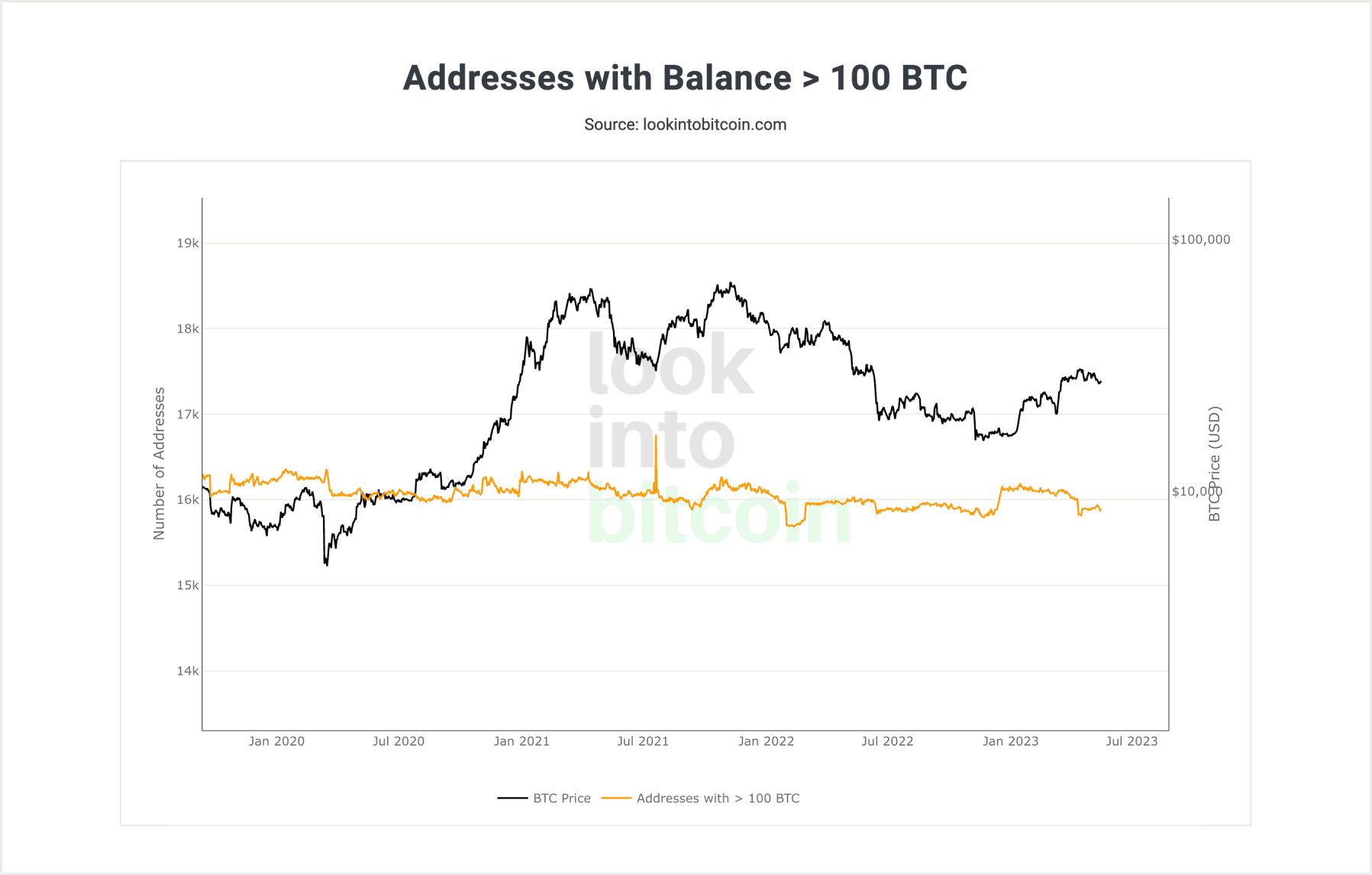

Bitcoin: Addresses with Balance > 100 BTC

The number of wallets with a balance of more than 100 BTC is slowly declining after the initial wave of Bitcoin's 65% growth.

This BTC analysis may indicate partial profit-taking by major holders who may decide to reduce their positions after a significant increase of BTC price. Such a decline could be associated with the desire to realise profits or reallocate funds to other assets.

Analysing these three categories of wallets indicates different trends among Bitcoin holders. The growth in wallets with smaller balances may reflect increased interest from new and small investors, while caution and partial profit realisation can be observed among major holders.

Bitcoin Hashrate

The growth in hashrate signifies that miners continue to allocate computational resources to the Bitcoin network to mine new blocks and receive rewards for their work.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

This Bitcoin analysis has shed light on the following.

The rise in Bitcoin price is not always directly correlated with the transfer volume.

Other factors, such as investor demand and overall crypto market trends, can significantly influence BTC price dynamics.

The decrease in the number of addresses on the Bitcoin blockchain and the accompanying decline in Bitcoin price may be a result of a correction following a growth period.

Bitcoin price tends to exhibit cyclicality, and correction periods can occur after periods of growth.

The increase in the number of wallets with smaller balances (up to 1 BTC and between 1 BTC and 10 BTC) indicates a heightened interest from small and medium-sized investors in Bitcoin.

This suggests a growth in informed investing and a general interest in crypto.

Major Bitcoin holders may exercise caution and partially liquidate their positions after significant price increases. They may seek to minimise risks and reallocate their funds into other assets.

The growth in hashrate indicates a continued interest and participation of miners in the Bitcoin network.

This can be a positive signal for the BTC network and confirm miners' belief in the potential of Bitcoin.

In conclusion, analysing these factors allows us to understand the complex and multifaceted nature of the influence on Bitcoin price. Various factors, including investor demand, holder behaviour, and miner activity, contribute to the price dynamics of Bitcoin.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.