BTC Analysis October 2023

Key Insights

- The decision by the SEC not to appeal Grayscale's Bitcoin ETF conversion reflects growing interest in institutional investments and ETFs, potentially indicating increased legitimacy for Bitcoin in the traditional financial landscape.

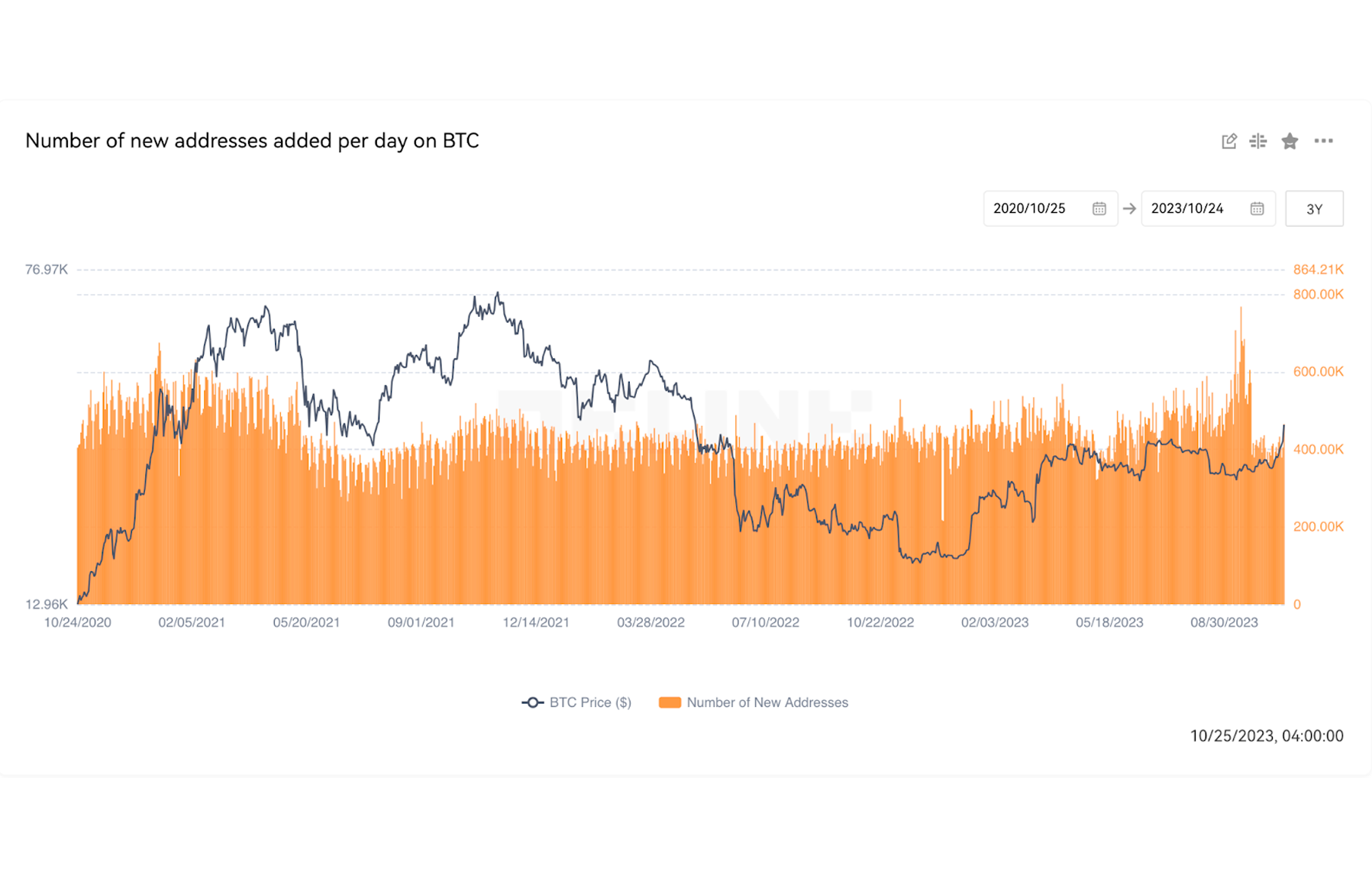

- The stable number of new Bitcoin addresses despite price increases suggests that market participants may be anticipating long-term changes rather than seeking short-term gains, possibly linked to institutional investment trends.

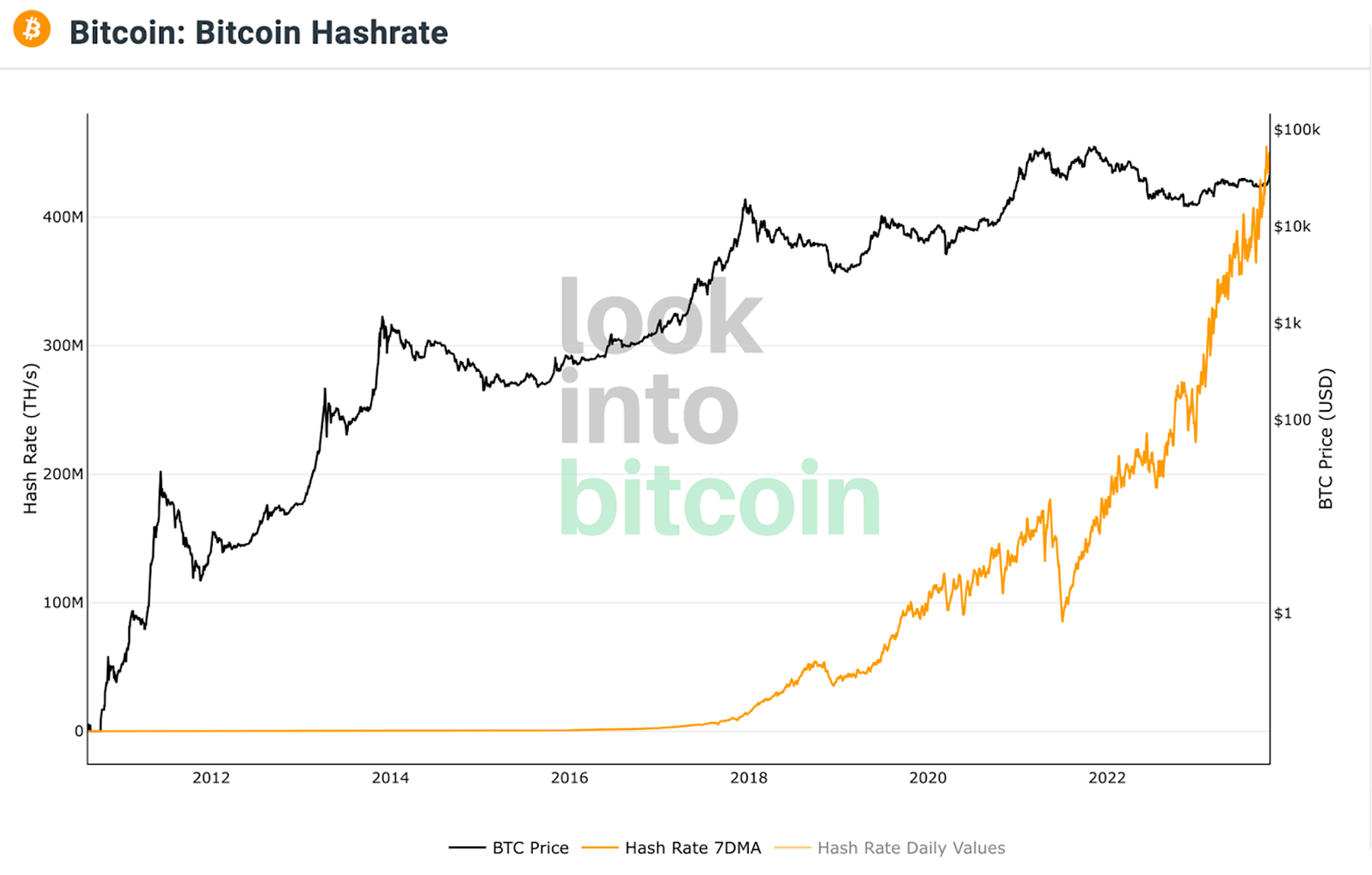

- The consistent growth in Bitcoin's hash rate is a positive sign for network security and long-term stability, highlighting the ongoing interest and activity among miners in the Bitcoin network.

This on-chain analysis takes into consideration the aftermath of the Grayscale court case.

To provide a comprehensive BTC analysis for October 2023 we researched the following on-chain data: number of new BTC addresses, BTC daily transaction activity, BTC exchange address balances, Bitcoin hash rate, and Bitcoin open interest.

Grayscale Case

In October 2021 the SEC rejected Grayscale company's application to list an exchange-traded fund (ETF) that would track BTC price movements. Grayscale aimed to convert its existing Bitcoin trust into an ETF, a proposal that the SEC denied.

Grayscale argued that the safety measures applied to Bitcoin futures ETFs, particularly the market oversight by the Chicago Mercantile Exchange (CME), should also be sufficient for their spot ETF.

They contended that both ETFs rely on the underlying price of Bitcoin and that CME's regulatory oversight would provide adequate investor protection.

This argument ultimately convinced the court, leading to a favorable ruling for Grayscale.

The Securities and Exchange Commission (SEC) has opted not to file an appeal, allowing Grayscale to convert its Bitcoin trust into an exchange-traded fund (ETF). The appeal deadline expired on October 13, and following the confirmation of no appeal, the price of BTC once again saw a significant increase.

However, despite this favorable development and the uptick in Bitcoin price, the number of new addresses on the network has remained at mid-September levels when BTC was in a sideways trend.

Number of New BTC Addresses

The lack of a notable increase in the number of new Bitcoin addresses may indicate several potential factors. It's possible that some investors are waiting for further crypto market changes before entering the cryptocurrency space.

This could also suggest that existing crypto market participants are more focused on reallocating their assets rather than creating new addresses.

In summary, the rise in Bitcoin price in response to the SEC's decision and the absence of a sharp increase in the number of new addresses might suggest that the crypto market is anticipating long-term changes linked to institutional investments and ETFs, rather than short-term fluctuations.

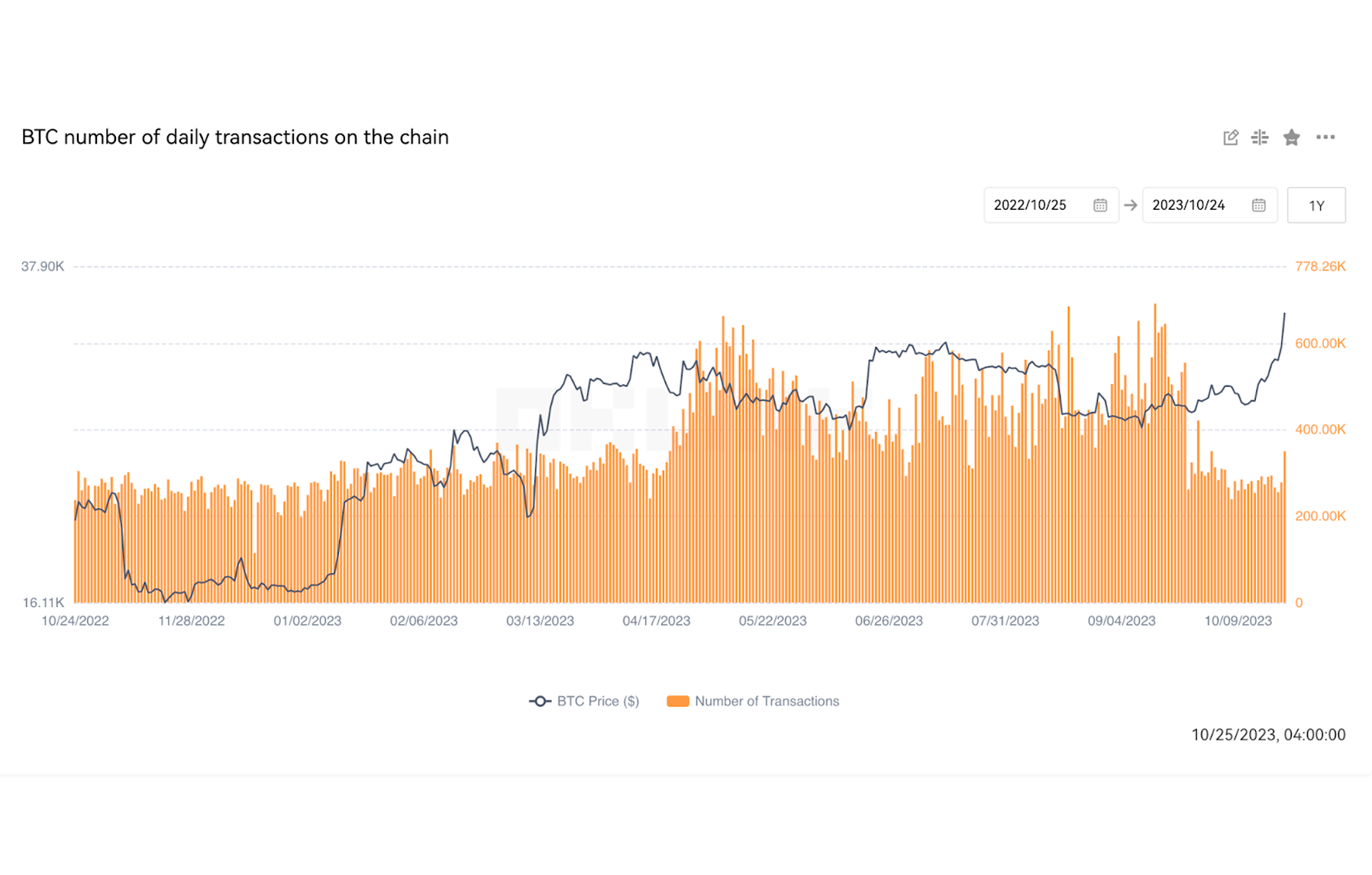

BTC Daily Transaction Activity

Despite the rising price of Bitcoin, there has been a decline in the number of daily transactions on the blockchain. This might imply that some long-term holders prefer to retain their Bitcoins, expecting further BTC price appreciation, rather than actively engaging in trading.

Additionally, the increased interest in BTC from major institutional investors and substantial transactions could be contributing to a reduction in the number of small transactions on the Bitcoin blockchain.

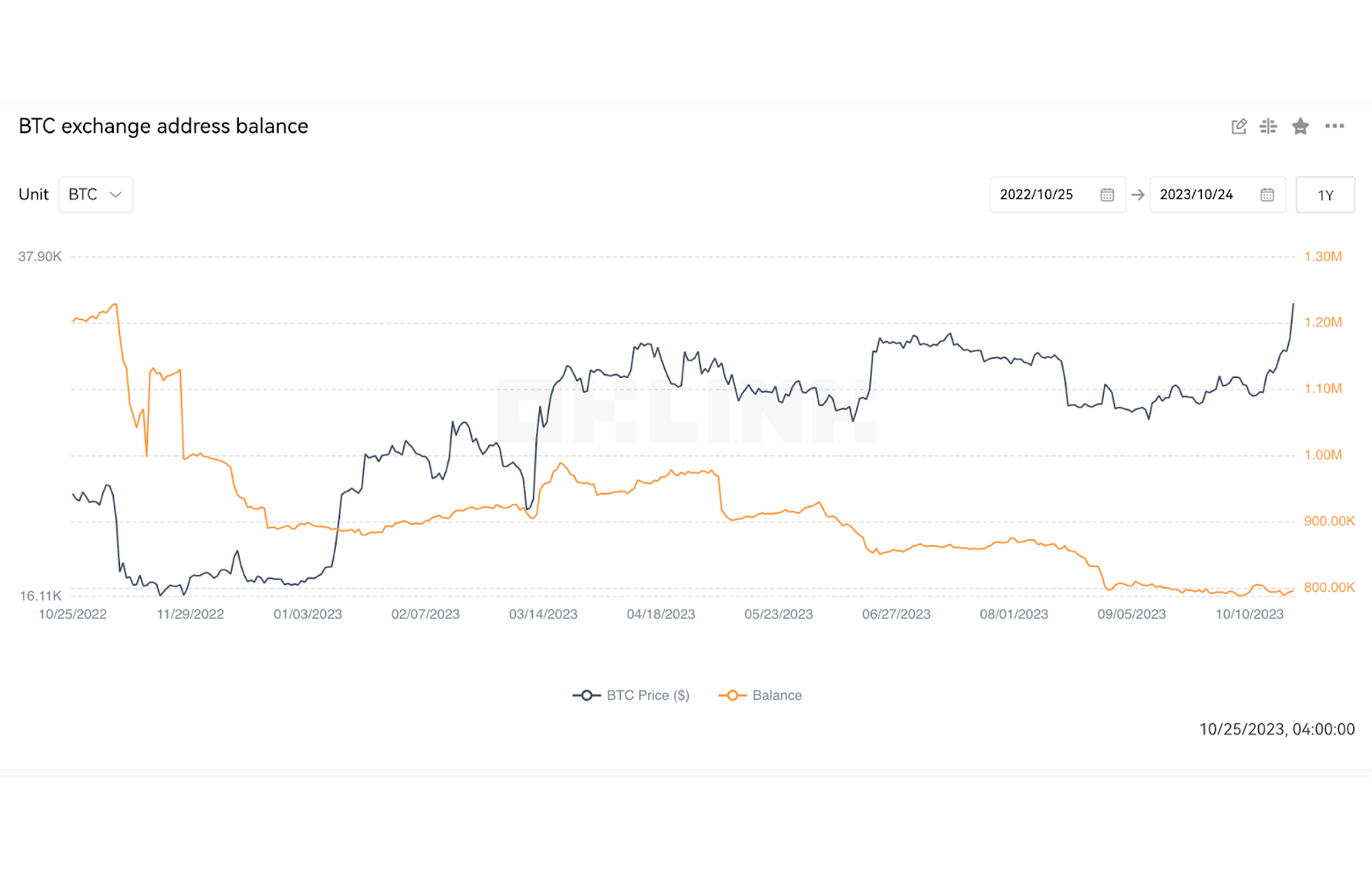

BTC Exchange Address Balances

The address balance of cryptocurrencies on exchanges has remained nearly unchanged for a month, even as the price of Bitcoin has risen.

This can be attributed to the popular HODLing strategy, where investors hold onto their Bitcoins with long-term objectives and hopes of future BTC price growth. Individuals following this strategy typically do not actively trade or transfer their assets from the exchange, resulting in relative stability in their balances.

Bitcoin Hash Rate

BTC hashrate continues to grow steadily and shows no signs of slowing down.

This suggests increasing miner activity and a growing interest in the Bitcoin network. Hashrate growth is often seen as a positive indicator for network security and long-term stability.

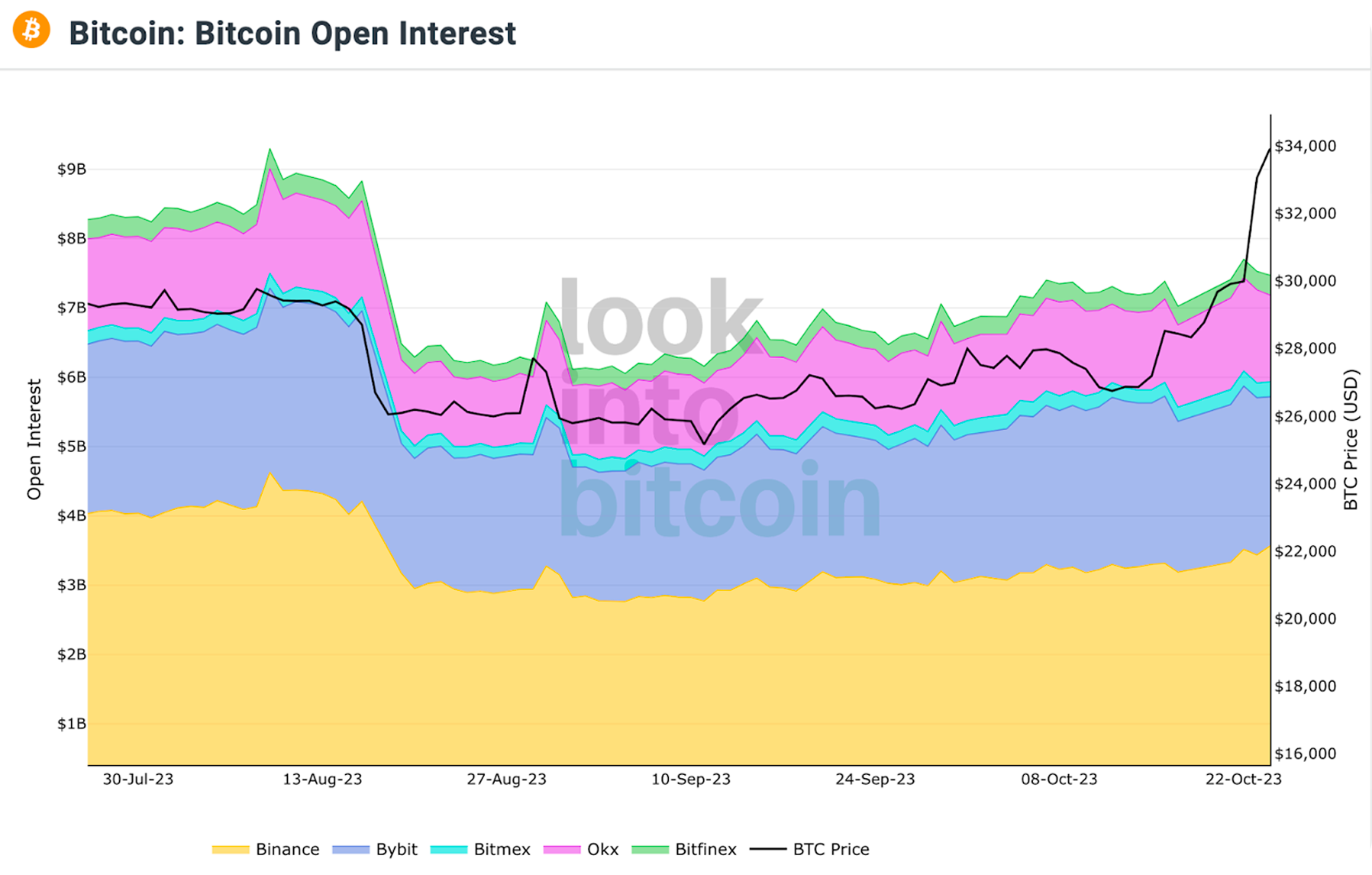

Bitcoin Open Interest

Despite the rapid increase in the price of BTC, there has been no corresponding increase in open interest in the BTC futures market. Open interest, in the context of futures, refers to the total number of active futures contracts on the exchange.

The lack of growth in open interest during a BTC price surge may indicate that many investors and traders have chosen not to enter into new futures positions in response to the rising prices.

Investors may be exercising caution due to concerns about a potential BTC price correction following a rapid increase and may prefer to monitor the situation without entering into new futures contracts.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

In conclusion, the analysis of several key BTC-related indicators paints a mixed picture. The SEC's decision regarding Grayscale and the subsequent BTC price increase reflects a growing interest in institutional investments and ETFs.

Despite the rise in BTC value, the number of new addresses on the network remains stable, suggesting an expectation of long-term changes.

The decrease in daily BTC transactions may indicate a preference among long-term holders to retain their assets.

Balances on cryptocurrency exchanges remain stable, in line with the HODLing strategy.

Meanwhile, Bitcoin hash rate growth indicates increasing miner activity and interest in the network.

The absence of Bitcoin open interest growth in the futures market may suggest investor caution in response to rapid price increases.

Overall, the chosen indicators point to the Bitcoin market anticipating longer-term changes associated with institutional investments, rather than short-term fluctuations.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.