BTC On-Chain Analysis August 2024

Key Insights

- The overall number of Bitcoin transactions increases due to panic selling and strategic buying by experienced investors.

- The growth in the large and very large transactions' categories may indicate institutional investors and large holders taking advantage of the current BTC price decline to accumulate positions.

- When the price of Bitcoin drops sharply, it attracts the attention of not only active market participants, but also the general public.

On-chain analysis is the examination of blockchain data, including transactions, trades, wallet address holdings, and more.

The term on-chain data refers to transactions that have been validated and permanently recorded on a blockchain ledger.

The validation and recording process is conducted by miners in proof-of-work (PoW) blockchains and stakers in proof-of-stake (PoS) blockchains. On-chain data is accessible to all parties, regardless of location.

On-chain analysis as a rule relies on a variety of metrics, including active addresses, transaction volume, supply distribution, and total value locked, price action of an asset, and more.

The current BTC analysis for August, 2024 below is based on the following indicators: number of BTC transactions, Bitcoin transaction count by size, daily active Bitcoin addresses, Bitcoin balance by holdings in USD, and search trends.

Look out for updates as we post new BTC on-chain analysis every one-two months.

Number of BTC Transactions

The on-chain data metric Number of Transactions shows that the average number of BTC transactions on the Bitcoin network has increased to 579.32 thousand transactions. Against the backdrop of the fall in the value of Bitcoin, this increase may indicate a number of key processes in the crypto market.

First of all, a decrease in the price of Bitcoin is often accompanied by the liquidation of a large number of marginal and futures positions. When the price of Bitcoin falls sharply, traders using leverage are faced with a forced sale of their assets to cover losses, which further increases pressure on the price.

Secondly, many Bitcoin holders, succumbing to panic, begin to sell their assets en masse, fearing further losses. This leads to a significant increase in the number of BTC transactions on the network, as many transfers to exchanges for sale occur.

However, experienced crypto market participants often view such periods as an opportunity for accumulation. They use BTC price declines to increase their positions, considering current levels attractive for long-term investments.

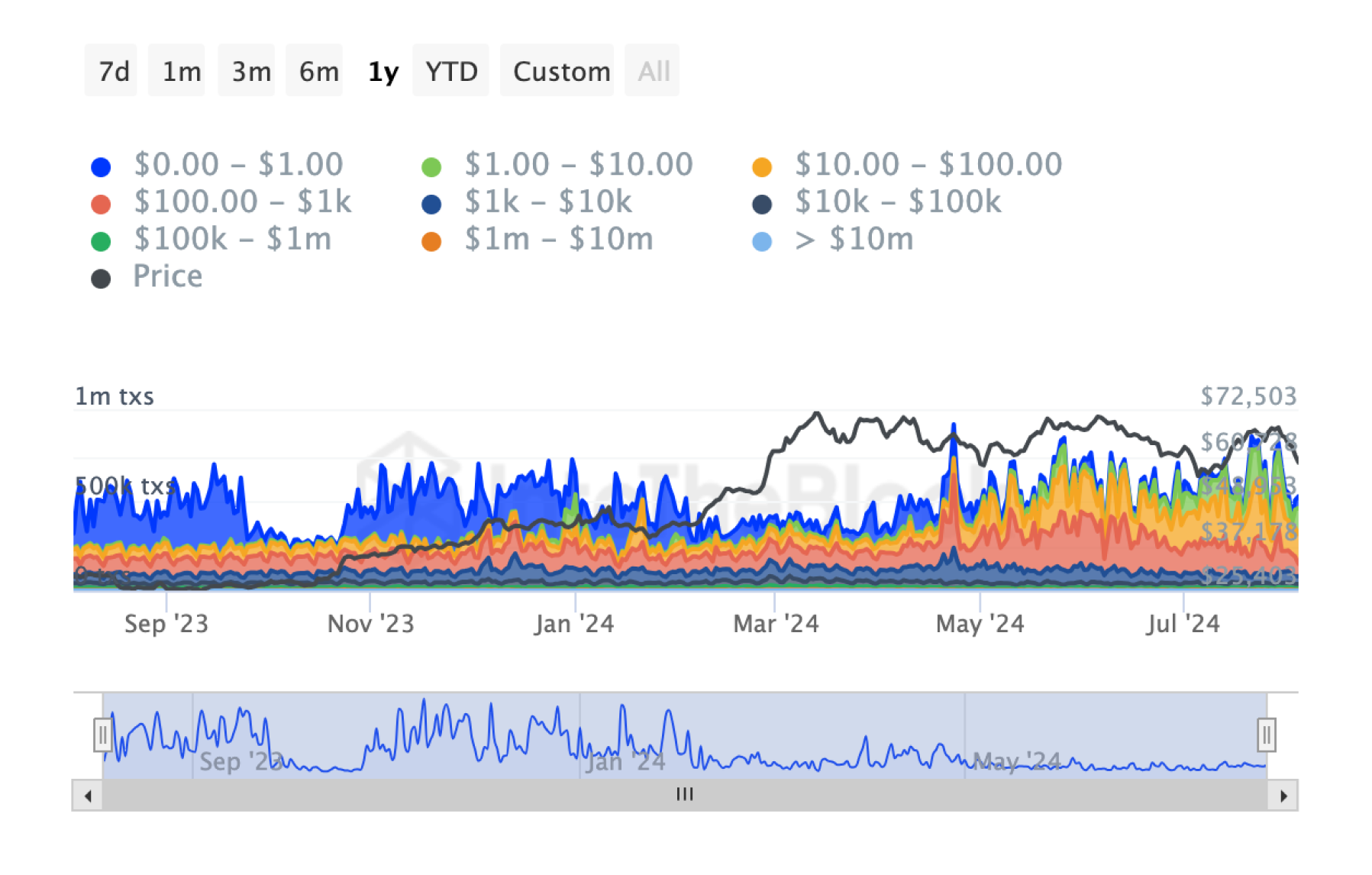

BTC Transaction Count by Size

The on-chain Transaction Count by Size metric shows how transaction activity of different sizes has changed given current crypto market conditions

Here's how to interpret these changes:

- Average BTC Transactions ($10.00 - $100.00 and $100.00 - $1k)

-22.89% and -66.76%, respectively.

A decrease in these ranges may indicate a decrease in retail purchases and medium-sized transfers. This could be due to users being cautious and reducing activity in the face of crypto market volatility, or a decrease in consumer activity in Bitcoin.

- Larger BTC Transactions ($1k - $10k and $10k - $100k)

-2.13% and -6.78%, respectively.

A slight decrease in transaction counts in these ranges may indicate that medium and large investors are holding their positions, perhaps waiting for further Bitcoin-related news and developments in the crypto market.

- Large and Very Large BTC Transactions ($100k - $1m, $1m - $10m, and > $10m)

+8.13%, +19.21%, and +34.84% respectively.

This on-chain data may indicate a redistribution of significant amounts of funds between large wallets or exchanges, as well as strategic purchases at low price levels.

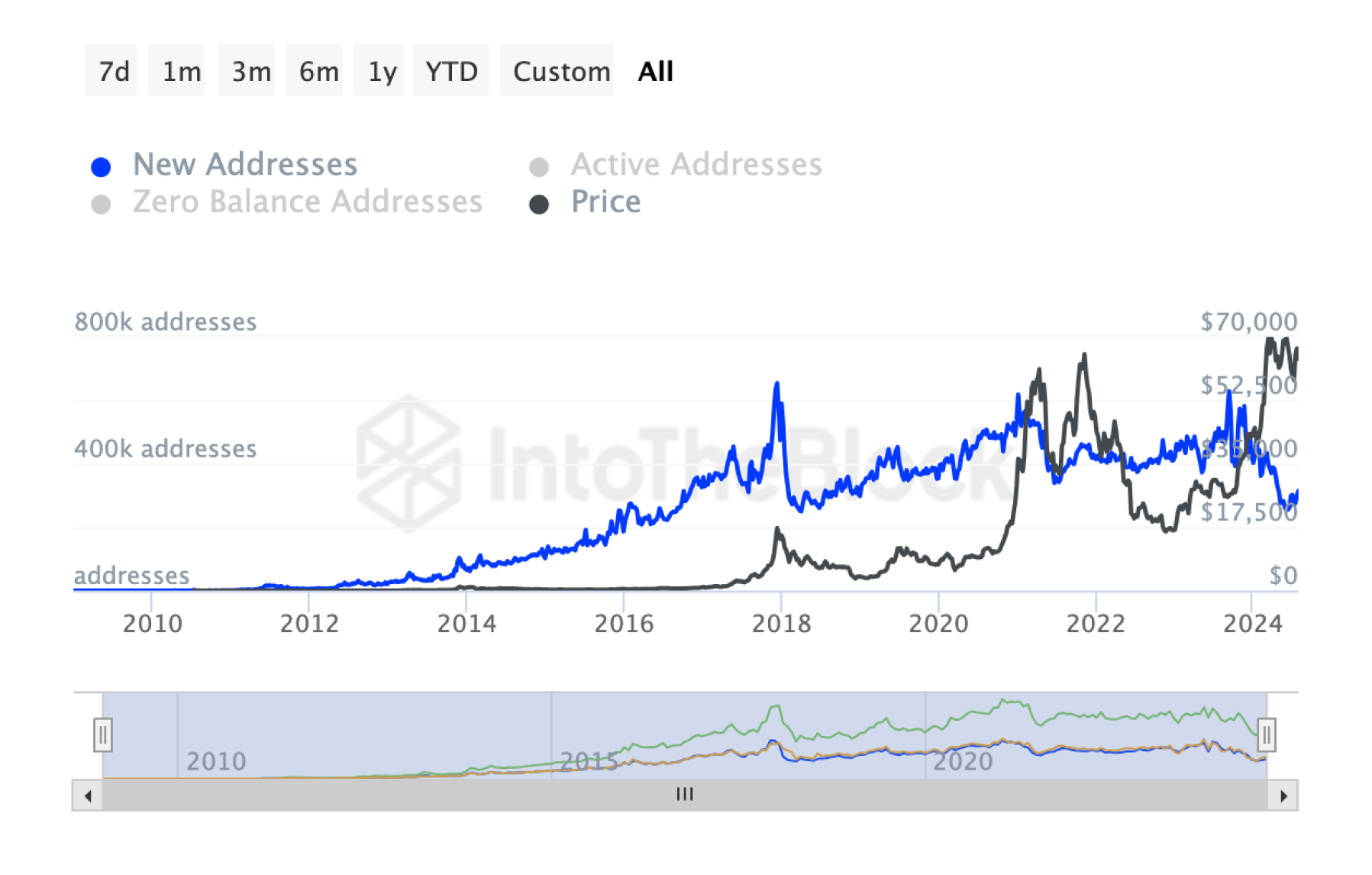

Daily Active Bitcoin Addresses

The Daily Active Addresses on-chain data metric measures the number of unique addresses participating in transactions on the Bitcoin network over the course of a day. The +15.34% increase in this metric after a decline from 980,000 to 614,000 may indicate several important changes in the behavior of crypto market participants.

Return of activity after a decline

After a significant drop in the number of active addresses from 980,000 to 614,000, there is a revival of activity, which may indicate a return of interest in the Bitcoin network. This increase may be due to both addition of new participants and the activation of existing users.

The increase in the number of active BTC addresses may be due to users reacting to a strong change in the price of Bitcoin. When the price drops significantly, many users may activate their wallets to sell or move funds, which increases the number of active addresses.

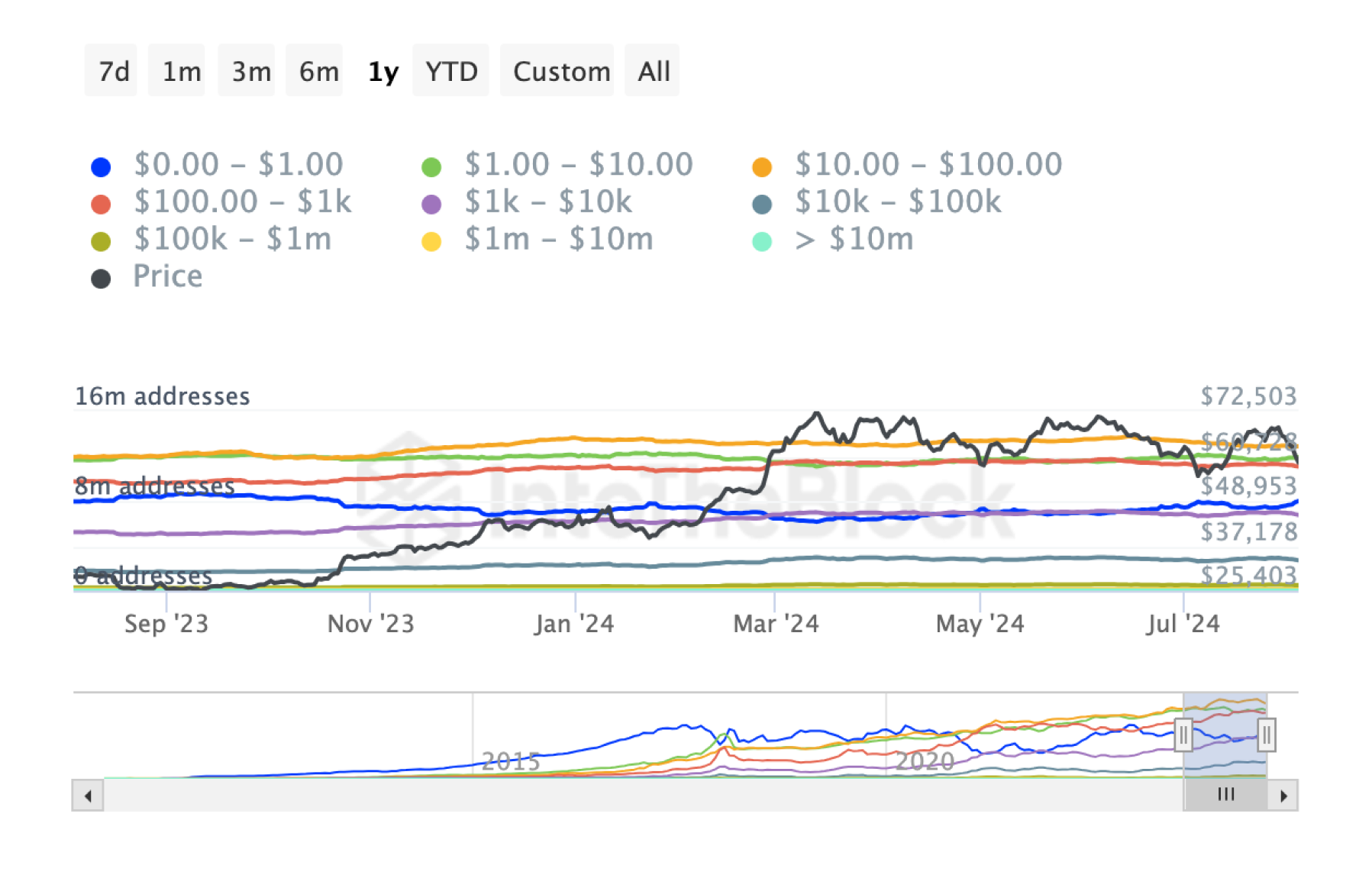

BTC Balance By Holdings in USD

This on-chain data metric shows that there is an increase in every category (every range).

- Changes in Balances ($100.00 - $1k and $1k - $10k)

+0.18% and +1.54%

The small increases in these categories indicate that average holders are increasing their positions, possibly using the current low BTC price to gradually accumulate. This could be due to long-term purchases or shifting funds from other assets.

- Changes in Balances ($10k - $100k and $100k - $1m)

+3.06% and +2.92%

The significant increases in these categories indicate that large holders are actively accumulating positions. These investors likely see the current situation as an opportunity to increase their participation in the crypto market by acquiring Bitcoin at depressed price levels.

- Changes in Balances ($1m - $10m and > $10m)

+3.49% and +3.45%

Increases in balances in these ranges are a strong signal that large institutional investors, or so-called whales, are taking advantage of current crypto market conditions to significantly increase their positions. This may indicate long-term confidence in a market recovery.

BTC On-Chain Analysis: Search Trends

The sharp rise in the Search Trends metric amidst a significant decline in the price of Bitcoin may indicate several key processes and market sentiments, all outlined below the chart.

- Increased Interest and Concern

A sharp increase in search queries may reflect the concern of people who are looking for information about the reasons for the drop in Bitcoin price, possible consequences, and forecasts for the future.

- Panic Among Retail Investors

During such periods, there is often an increase in search queries from retail investors trying to figure out what to do with Bitcoin and possibly considering selling their positions. This may indicate an increase in panic among less experienced crypto market participants.

- Speculation and Expectations

The increase in interest may also be due to people looking for speculative opportunities as the Bitcoin price falls, anticipating a possible rebound or further decline.

Users can get BTC or any other cryptocurrency for fiat or crypto on SimpleSwap.

Summary

From a long-term investment perspective, current crypto market conditions may present opportunities to enter the Bitcoin asset at low price levels, especially for sophisticated investors.

Large institutional players and long-term holders appear to be actively accumulating positions, which may indicate that they believe in the future recovery of Bitcoin and its growth potential.

However, investors should be mindful of the high volatility and possible risks associated with short-term BTC price fluctuations. Retail investors giving in to panic could increase volatility.

Overall, the current situation in the Bitcoin market shows signs of both panic and confidence on the part of major players, making it an interesting opportunity for long-term investment.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.