BTC Prospects and Evolution

Key Insights

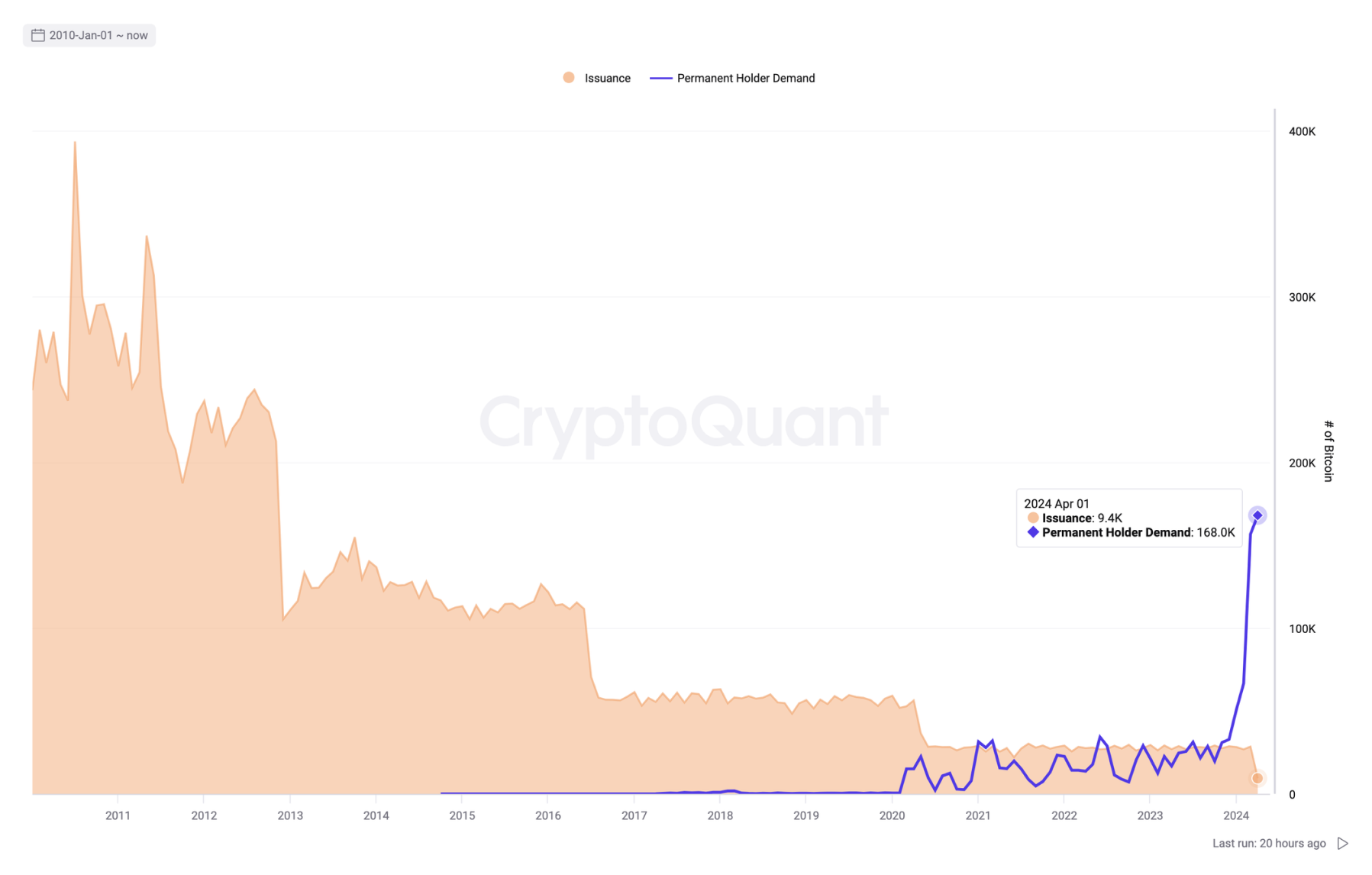

- Recent data suggests that demand for Bitcoin from long-term investors has exceeded the issue of new coins for the first time

- In light of the upcoming BTC halving institutional investors see Bitcoin as more and more stable asset

- Investors are beginning to recognize Bitcoin’s role as a reliable store of value over the long term

Bitcoin Evolution

There are developments in the world of cryptocurrencies that carry deep meanings beyond just numbers on a crypto chart. There are signals demonstrating a shift in the perception of Bitcoin as an investment asset and hinting at its potential prospects.

One of the key points that makes this period particularly important is the Bitcoin halving of 2024. Every four years the reward for mining Bitcoin is halved, reducing the supply of new coins. This process makes every dollar investment in Bitcoin more valuable.

What makes this point particularly significant is that it is attracting the attention of institutional investors. When major players begin to see Bitcoin as a stable and sought-after asset, it creates positive pressure on the price and encourages further growth.

Bitcoin Future Prospects

When we are talking about Bitcoin forecast, it’s important to note that investors now see Bitcoin as more than just future money. And while Bitcoin's price may fluctuate in the short term, fundamental changes, such as increased demand from long-term investors, provide a basis for confidence in Bitcoin future.

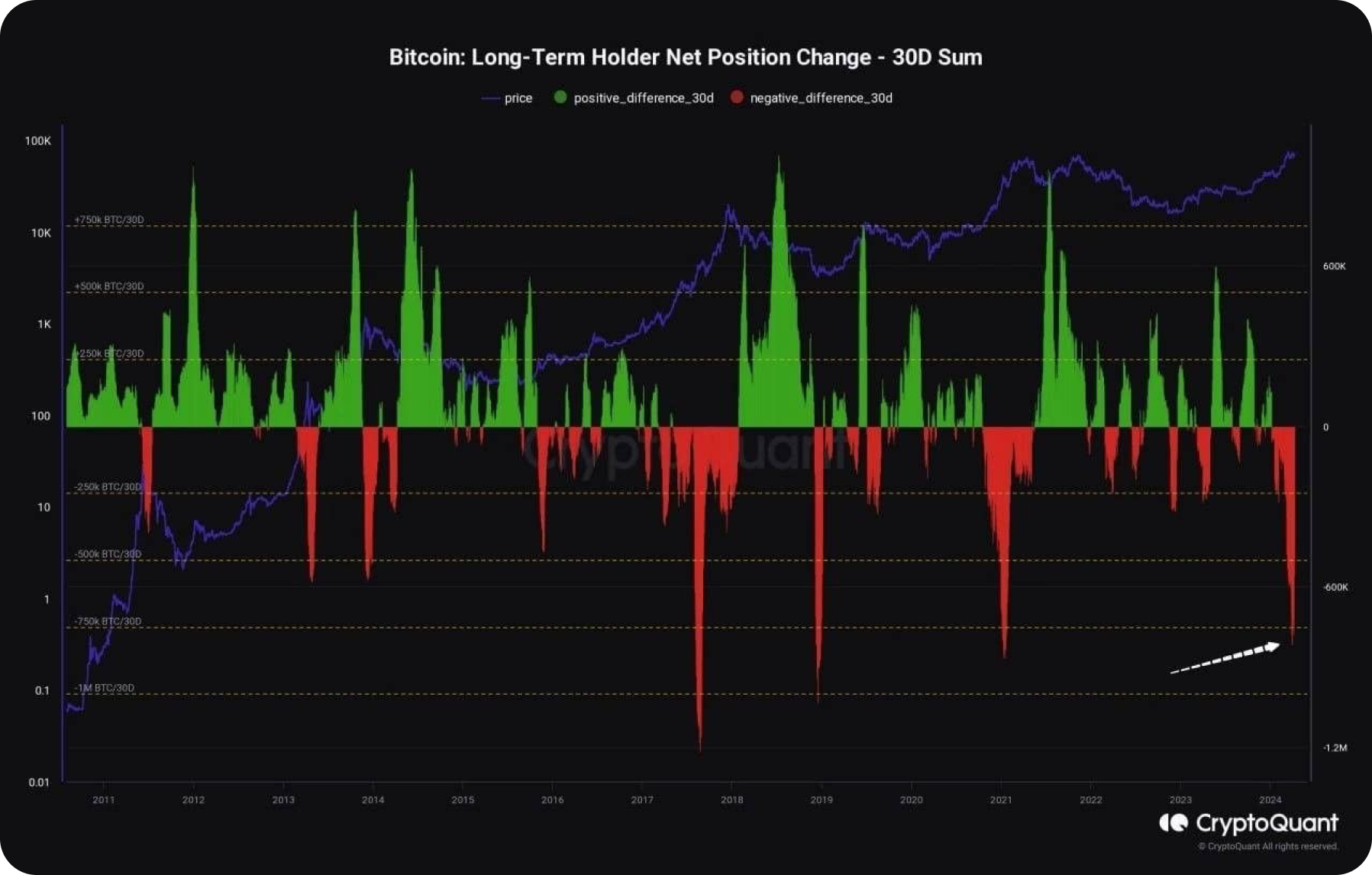

The world of cryptocurrency investing is always eventful, and recent data confirms this. For the fourth time in Bitcoin's history, we witnessed record profit taking by long-term holders. What does this mean and how could it affect the cryptocurrency market?

Long-term Bitcoin holders are those who hold their coins for an extended period of time, disregarding short-term price fluctuations. They often hold onto their investments in anticipation of future increases in the asset's value.

Profit taking means selling an asset in order to lock in the profit made. In this case, long-term holders have decided to sell some of their Bitcoin, probably because the BTC price has reached a certain level and they want to lock in their gains.

This record-breaking moment could have various impacts on the market. First, it could temporarily affect the price of Bitcoin because it increases the supply in the market. However, if demand remains strong, it could lead to a short-term recovery in the price after a correction.

Second, in terms of Bitcoin price prediction, it could also indicate that long-term investors are beginning to believe that the BTC price has reached its limit and they are deciding to partially exit their positions. This could lead to an expected decrease in volatility in the near future as the market may become more stable.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

The developments mentioned in this article demonstrate not only the evolution of Bitcoin as a financial asset, but also emphasize the importance of cryptocurrencies in the context of the global financial system.

Crypto assets, such as Bitcoin, can overcome temporary fluctuations and set new standards in investment strategy.

Such developments are stimulating the development of cryptocurrency infrastructure, as well as attracting the attention of regulators and lawmakers to the regulation of this new asset class.

This in turn contributes to a more transparent and sustainable environment for investing in cryptocurrencies, which may attract even more participants and investments in this area in the future.

Users can buy Bitcoin for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.