BTC On-Chain Analysis January 2024

Key Insights

- In January, 2024, we saw a decrease in Bitcoin price growth and it’s number of transactions, notably the large transactions (> $10m)

- With transaction volume and number of transactions decreasing, number of BTC addresses is stable, while balance of holders sees increase in number of of the share of large holders.

- Investing in Bitcoin and holding it in a portfolio is currently assessed as a promising decision, especially given the long-term trends and optimistic market forecasts.

On-chain analysis entails the examination of blockchain data encompassing transactions, trades, and wallet address holdings. This analysis provides real-time insights into the activities of crypto market participants within respective blockchains.

The term on-chain data pertains to transactions that have been validated and permanently recorded on a blockchain ledger.

Our focus in this Bitcoin on-chain analysis is number of transactions, BTC transaction volume, BTC total addresses, and BTC balance by holdings, and we’re using Bitcoin Rainbow Chart as another indicator.

Number of BTC Transactions

According to the on-chain analysis during January, there was a gradual decrease in the number of transactions in the Bitcoin network. It decreased from a maximum of 731.35 thousand to a minimum of 340.19 thousand.

This reduction in the number of BTC transactions coincided with a slowdown in price growth and a 20% correction in the BTC exchange rate.

Bitcoin's 20% price correction may have an impact on transaction activity. Crypto market participants can wait for price stabilization and assess the situation before making new transactions.

BTC Transaction Volume in USD by Size

Analysing the on-chain data shows that there has been a significant decrease in large transactions. BTC volume > $10m decreased by more than 30%.

This movement in BTC transaction volumes may indicate a decrease in activity of large players. In addition, this reduction may indicate a reallocation of capital or a preference for smaller transactions at the moment.

Total BTC Addresses

During January, the number of Bitcoin addresses remained at approximately the same level. The minimum value was 51.42 million and the maximum was 51.93 million.

This may indicate the stability of interest in Bitcoin among network participants and the absence of major shifts or changes in their behavior. This may be due to the market's optimistic forecasts regarding the price of BTC.

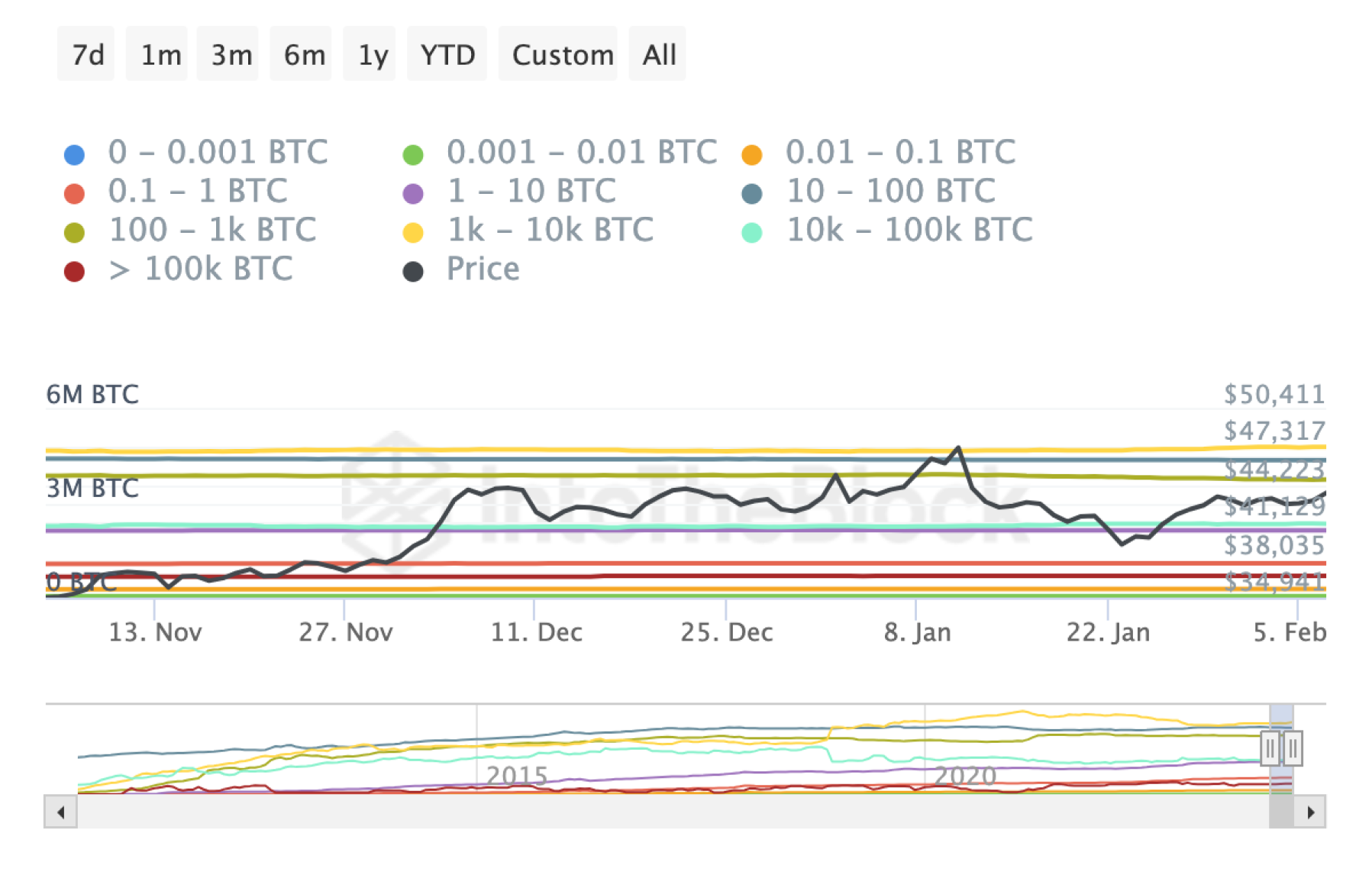

BTC Balance by Holdings

As per on-chain analysis, we see that there is stability of balances of BTC holders, manifested in the following changes.

- Increased interest of small holders (0 - 0.001 BTC): -0.84%

- Increase in interest of small holders (1 - 10 BTC): -0.10%

- Increase in the share of large holders (10k - 100k BTC): +3.69%

- Increase in the share of the largest holders (> 100k BTC): +0%

This on-chain data indicates that small holders partially decreased their Bitcoin holdings, while large holders increased their holdings and the largest holders kept their balances unchanged.

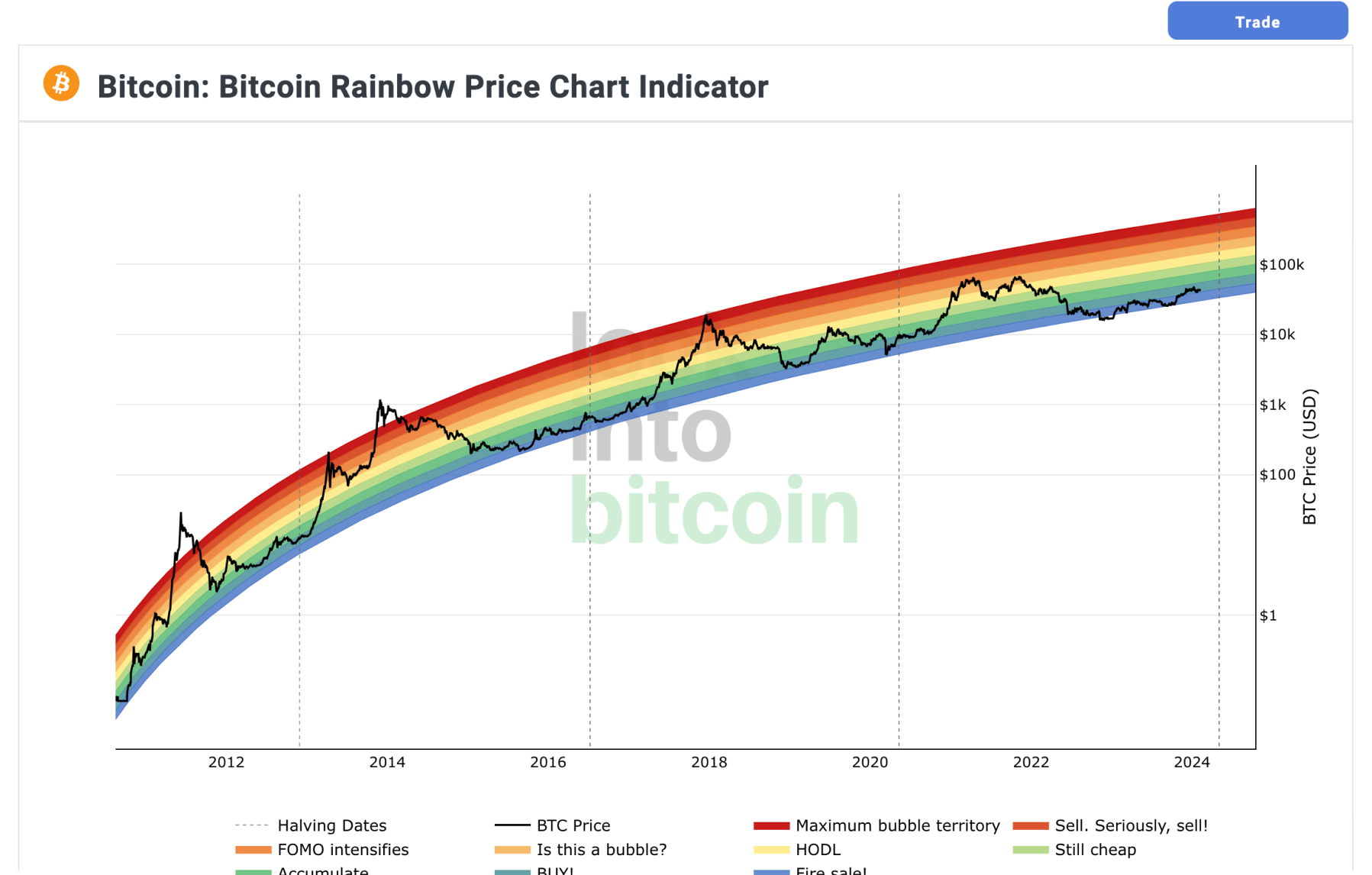

Bitcoin Rainbow Chart Indicator

The Bitcoin Rainbow Price Chart indicator analyzes Bitcoin price dynamics based on different time periods and price levels represented as rainbow colors.

According to Bitcoin Rainbow Chart indicator, the current price of BTC continues to be in a favorable zone for buying and further holding the asset. This means that at the moment, investing in Bitcoin and holding it in a portfolio is seen as a promising solution with a high potential for value growth.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

In light of the on-chain data presented, Bitcoin investment outlook and holding looks reasonable and even promising.

The decline in the number of transactions on the Bitcoin network could be the result of a 20% price correction. However, it could also indicate a wait for the BTC price to stabilize before new transactions, which could be a positive factor for holding BTC.

A decrease in large transaction volume by more than 30% could be an indicator of a temporary decrease in activity by large players. However, a preference for smaller transactions could help decentralize and spread BTC ownership.

A stable number of Bitcoin addresses indicates a continued interest of network participants in the asset, which may be related to the market's optimistic outlook on the price of BTC.

On-chain data lets us see an increase in the share of large holders, along with the continued stability of the largest holders' balances, indicates confidence in the retention of BTC among large investors. At the same time, small changes in the share of small holders may be the result of temporary factors.

The analysis of BTC price dynamics via Bitcoin Rainbow Chart indicator shows a favorable zone for buying and holding the asset, which confirms the potential growth of its value in the future.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.