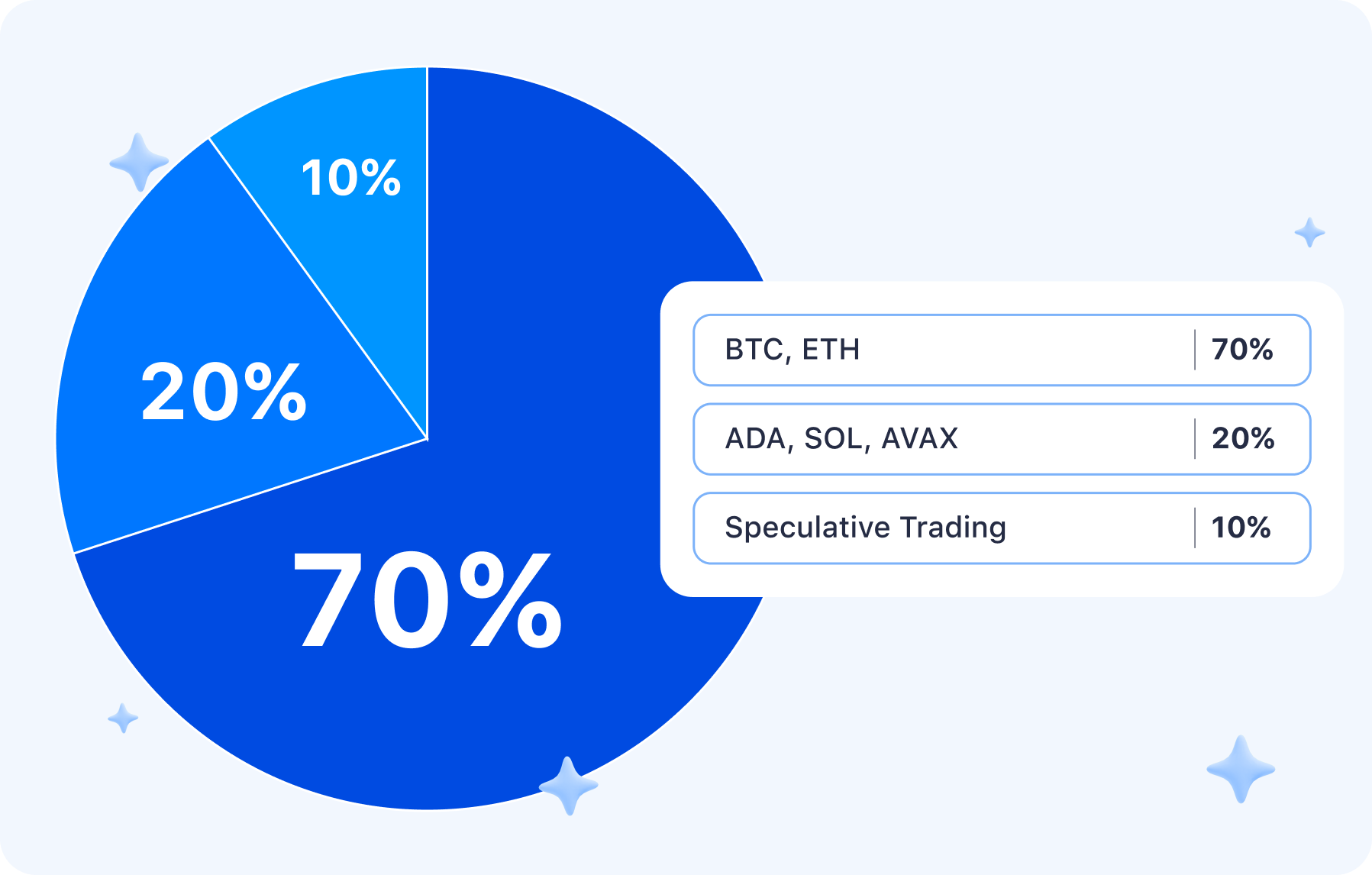

Crypto Portfolio Scenarios & Portfolio Management

Key Insights

- This strategy diversifies across BTC, ETH, ADA, SOL, and AVAX, assigning percentages based on stability, growth potential, and innovation of each coin.

- Clear actions for growth, downturns, and stagnant markets are outlined for each crypto "pilot," focusing on stability, fundamental analysis, and speculative trades, adapting to market movements.

- Below are 3 actionable strategies, integrating technical analysis and enabling informed portfolio management decisions.

Three market scenarios are listed below for five coins and crypto platforms (Bitcoin, Ethereum, Cardano, Avalanche, and Solana) and speculative trading as an additional strategy. This will help users make informed decisions as to their investment portfolio management.

Please note that portfolio diversification in % (see the portfolio widget after the text of the article) is shown without the 10% dedicated to speculative deals.

In this article, we are using the term Pilots to address parts of the portfolio, with First Pilot being the core part of it.

Crypto Platforms & Protocols

- Bitcoin (BTC)

Bitcoin is the first cryptocurrency. It operates using peer-to-peer technology without the need for central authority or banks.

The Bitcoin network collectively manages transactions and the issuance of BTC. To this day, Bitcoin remains the most popular go-to cryptocurrency which makes it the most stable in the overall market’s volatility.

- Ethereum (ETH)

Ethereum is a project and technology that facilitates digital currency ETH, global payments, and decentralised applications. The Ethereum community has created a thriving digital economy and innovative methods for online creators to earn income.

- Cardano (ADA)

Cardano is a blockchain platform that prioritizes security and scalability, with a focus on simplicity in developing dApps.

- Solana (SOL)

Solana is a blockchain platform that offers high performance, scalability, and low fees. It supports various decentralized applications and provides fast transactions.

- Avalanche (AVAX)

Avalanche is a scalable blockchain platform that allows to create low code applications.

- Speculative trades: high-risk trading that might allow for high reward.

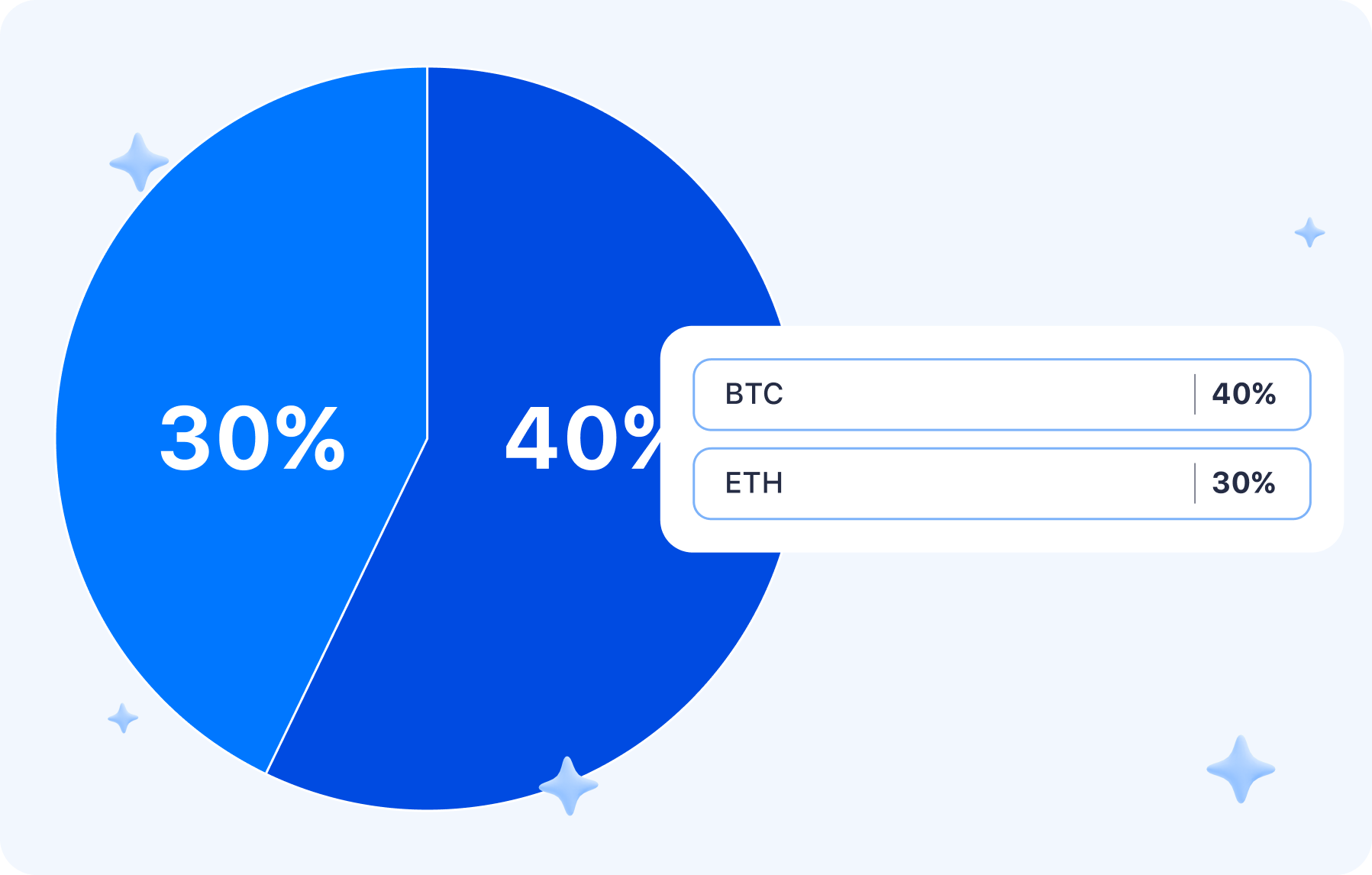

Main Pilot of Crypto Portfolio (70%)

- Bitcoin (BTC): 40%

Stability: Bitcoin is a highly stable cryptocurrency, widely recognized and actively used as a store of value.

Long-term potential: BTC crypto is supported by growing interest from institutional investors and is a pioneer in the use of blockchain technology.

- Ethereum (ETH): 30%

Stability: Ethereum is also a stable cryptocurrency with widespread use in blockchain applications.

Long-term potential: ETH crypto is supported by growing interest from institutional investors and plays an important role in the blockchain ecosystems' growth.

Ethereum allows developers to create dApps, providing users with more freedom and privacy. Despite facing similar risks to other blockchain platforms, Ethereum's financial stability is considered high due to its significant market cap and successful fundraising history.

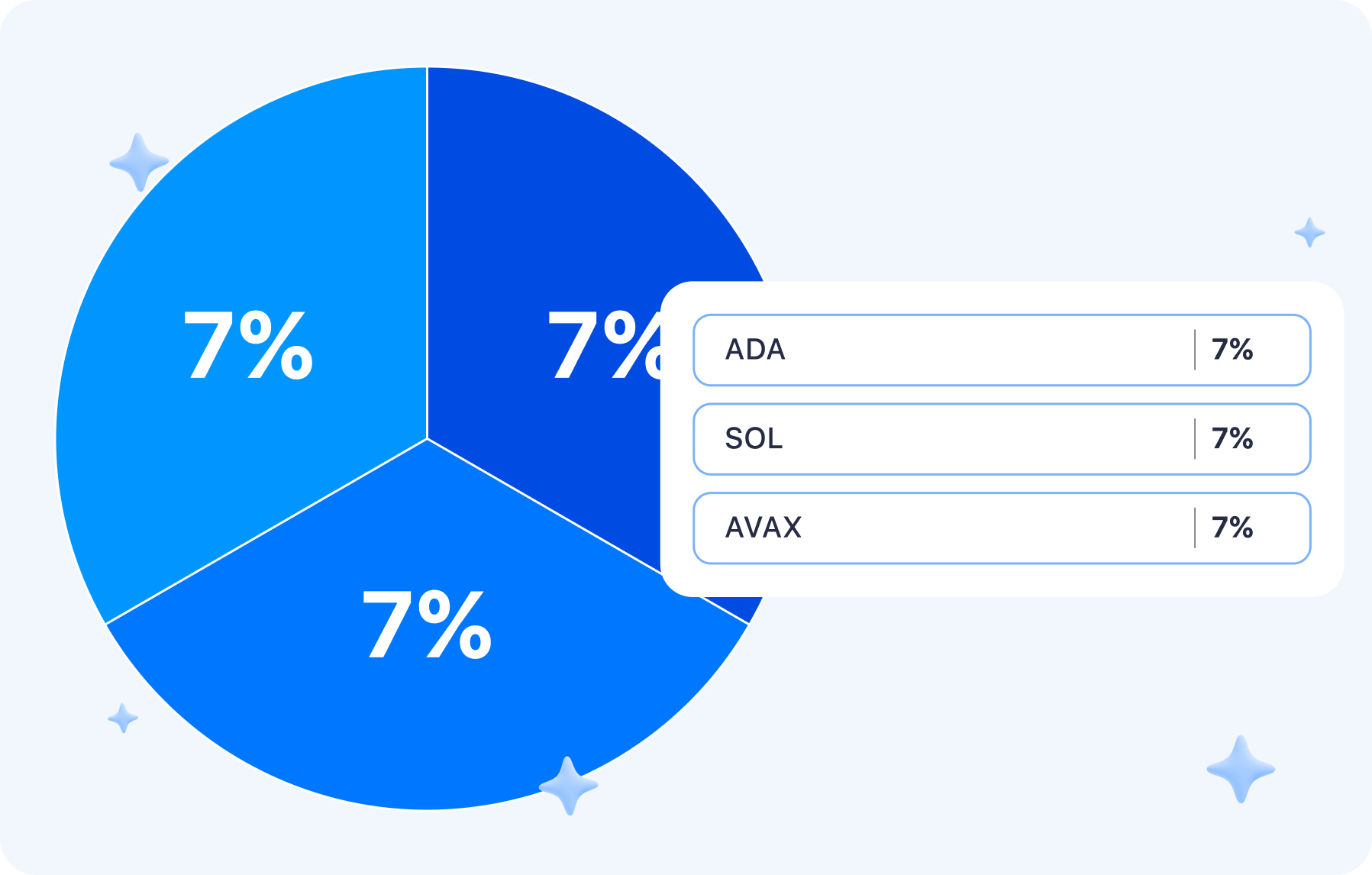

Second Pilot of Crypto Portfolio (20%)

- ADA (Cardano): 7%

Innovation: Cardano offers innovative solutions in blockchain scalability and resilience, which could lead to increased interest and price.

Growth Potential: ADA provides positive outlook for long-term growth.

ADA Cardano offers substantially fast processing of transactions. It is a peer-reviewed network. The ADA crypto team collaborates closely with academics to produce peer-reviewed research that informs blockchain development.

- SOL (Solana): 7%

Performance and low fees: Solana crypto provides high performance and low fees, which can attract users and investors.

Institutional Investor Support: Solana has an active community and support from institutional investors increase growth potential.

Solana's combination of Proof of History (PoH), Proof of Stake (PoS), Tower Byzantine Fault Tolerance (BFT), and turbocharged replication ensures high throughput and low fees, making it an excellent choice for high-performance dApps.

The Solana Software Development Kit (SDK) enables developers to create efficient smart contracts and diverse applications on the network. Solana provides a versatile ecosystem that caters to various blockchain needs.

- AVAX (Avalanche): 6%

Multi-consensus platform: Avalanche provides a multi-consensus platform, which fosters an active ecosystem in the DeFi and NFT space.

Development in DeFi: Avalanche has positive prospects for development in decentralized finance.

The AVAX blockchain provides efficient and versatile solutions for various applications through its innovative consensus methods and adaptable structure.

AVAX crypto operates on a unique economic model that involves staking and token burning. Avalanche's proactive approach to risk and consistent development efforts make it highly competitive in the market.

Third Pilot of Crypto Portfolio (10%)

- Speculative trades: 10%

Technical Analysis: Utilizing technical analysis to identify short-term opportunities and determine entry and exit points.

Speculative: High market volatility creates opportunities to capitalize on short-term price fluctuations.

This portfolio seeks to strike a balance between stable assets with long-term potential and more innovative assets, and provides room for speculative trades using technical analysis.

Market Growth Scenario

- Main Pilot (BTC, ETH)

Action: You can hold current positions in Bitcoin (BTC) and Ethereum (ETH).

Reasoning: BTC and ETH traditionally respond to overall market growth, and their stability is an advantage during periods of positive trends.

- Second Pilot (ADA, SOL, AVAX)

Action: Evaluate the performance of ADA, SOL, and AVAX crypto. You may want to consider partial selling to lock in profits and rebalancing the portfolio in favor of more stable assets if warranted by current market conditions.

Reasoning: Partial profit taking can provide additional liquidity and reduce risk. Rebalancing the portfolio toward stable assets can help preserve capital.

- Third Pilot (Speculative Trades)

Action: Evaluate the market for promising new opportunities for short-term trades. You can consider executing the necessary trades according to the identified opportunities.

Reasoning: During periods of market growth, promising new assets may become available. Speculative trades may provide additional short-term profit opportunities.

In the market growth scenario, the main focus is on holding stable assets such as BTC and ETH, which tend to respond to positive trends.

The second pilot, involving ADA, SOL and AVAX, is supported by a strategy of taking some profits and rebalancing in favor of more conservative assets.

The third pilot, related to speculative trades, provides flexibility to speculate and take advantage of short-term opportunities that may arise during periods of market volatility.

Market Downside Scenario

- Main Pilot (BTC, ETH)

Action: You can consider additional purchases of Bitcoin (BTC) and Ethereum (ETH) for cost averaging.

Reasoning: During periods of market decline, cost averaging can reduce the cost of acquiring assets, which in the long run can lead to an improved investment outcome.

- Second Pilot (ADA, SOL, AVAX)

Action: It might make sense to valuate the fundamental characteristics of each project if they remain intact and consider increasing portfolio exposure to those assets that still have potential.

Reasoning: During periods of market decline, the fundamental characteristics of projects may become more important. Increasing share in assets with potential may be strategically justified.

- Third Pilot (Speculative Deals)

Action: Evaluate current market corrections. Now you can decide whether to adapt a speculation-based trading strategy to mitigate potential losses. Consider limiting risk and possibly reducing exposure to high-risk assets.

Reasoning: In a falling market, it is important to minimize potential losses. Adapting a speculative strategy may include more conservative approaches to risk and reducing exposure to high-risk assets.

In a down market scenario, the focus is on strategies to manage risk and optimize the portfolio. Cost averaging in the main pilot may be useful in the long term.

A second pilot focused on fundamental performance can be supported by a strategy of increasing exposure to assets with retained potential. Speculative trades, in turn, may require limiting risk and adapting the strategy to changes in the market to mitigate potential losses.

Market Stagnation Scenario

- Core Pilot (BTC, ETH)

Action: You may want to maintain current portfolio holdings of Bitcoin (BTC) and Ethereum (ETH).

Reasoning: Stable cryptocurrencies such as BTC and ETH can be more resilient during periods of market stagnation. Maintaining a current balance can help preserve capital and preparedness for a possible market recovery.

- Second Pilot (ADA, SOL, AVAX)

Action: Regularly assess the fundamental characteristics of projects. If there are no significant changes, it may make sense to maintain the current balance of assets in the portfolio.

Reasoning: During periods of stagnation, the fundamental characteristics of projects become key. Maintaining a stable balance may be a prudent decision based on the long-term outlook for the assets.

- Third Pilot (Speculative Trades)

Action: In a stagnant market, try actively monitoring technical analysis. Decide whether short-term trades remain possible based on technical data. The SimpleSwap financial analyst provides their ideas on TradingView; feel free to review them.

Reasoning: During periods of market stagnation, technical analysis can be a key tool for identifying short-term opportunities. Speculative trades can provide opportunities for profit when the market is properly analyzed.

Summary

In a stagnant market scenario, the strategy is based on stability and fundamental characteristics.

The main pilot maintains current shares to maintain stability, the second pilot evaluates fundamental characteristics to maintain balance, and the third pilot, related to speculative trades, emphasizes technical analysis to identify short opportunities in the absence of overall market growth.

This portfolio provides comprehensive intel on several coins' and platforms' behavior in three possible market scenarios, thus helping the enthusiasts follow informed strategies.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.