Level Functionality Overview

Key Insights

- Level introduces a unique approach by allowing stablecoins, like lvlUSD, to provide economic security to decentralized networks.

- Level combines the stability of stablecoins with restaking mechanisms, enabling users to protect blockchain systems while earning returns on their assets.

- While Level presents an opportunity for stablecoin holders to earn passive income through staking and restaking, the project is still in its infancy and should be approached with caution.

What Is Level

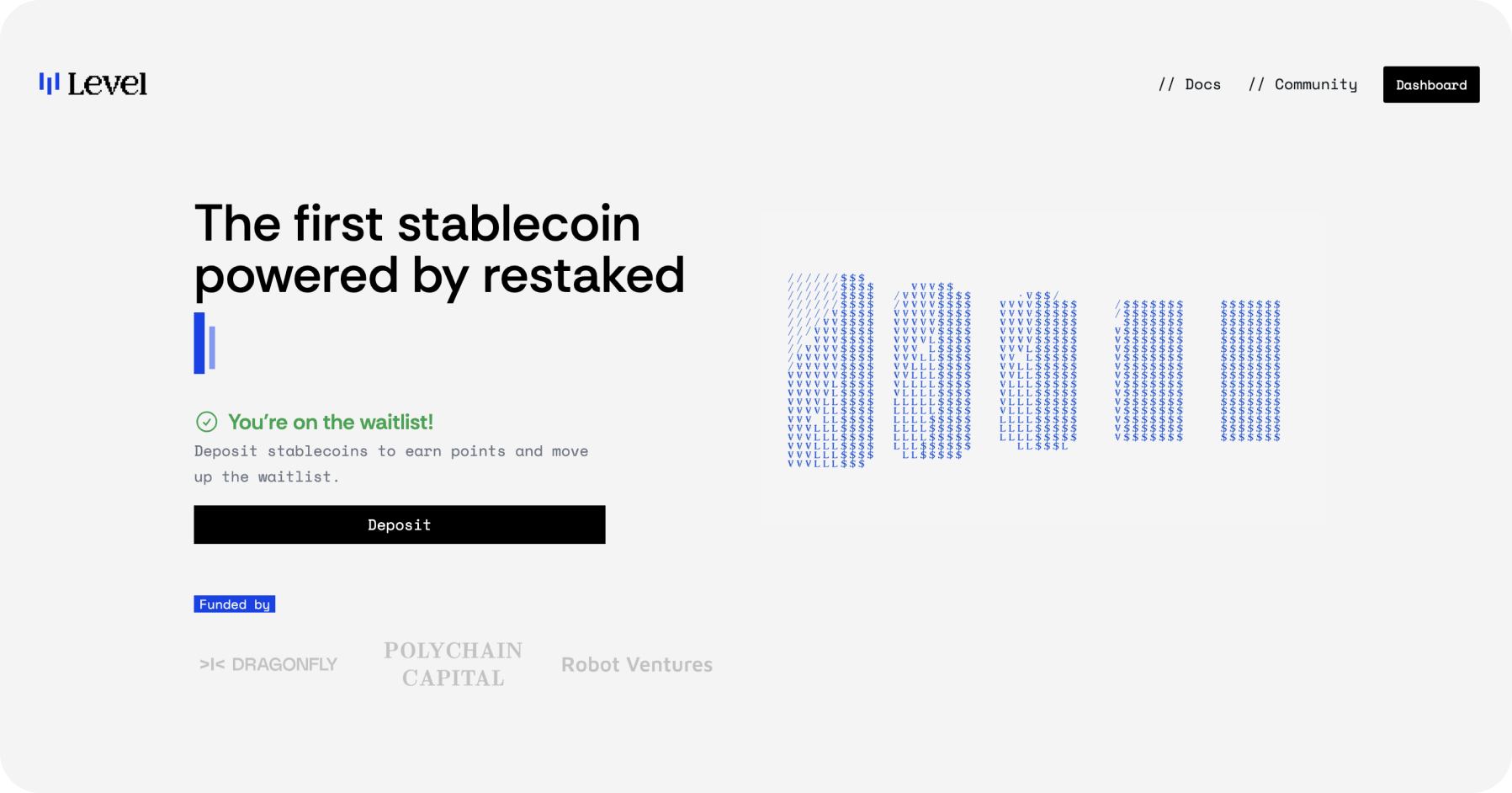

Level is a decentralized protocol that introduces a new concept of stablecoin, opening up the possibility of using stablecoins in providing crypto economic security to blockchains and blockchain services.

Level aims to combine two important functions of cryptocurrencies:

Permissionless access to the U.S. dollar

The ability to protect decentralized networks from fraudulent attacks

Level is developing a solution that will enable the use of stablecoins in providing Shared Security through restaking mechanisms.

Level aims to introduce a groundbreaking stablecoin protocol, backed by tokens that are restaked. This mechanism works by allowing users to stake dollar-backed tokens, like USDC or USDT, on restaking platforms such as EigenLayer, generating yield from their use in securing other blockchain networks.

When users mint the stablecoin through Level, the platform manages the restaking process automatically.

Level is also introducing its own stablecoin lvlUSD - liquid restaked dollar: a yield bearing, cross-chain tokenpegged to the US dollar and backed 1:1 by other stablecoins used in restaking (e.g. USDT or USDC).

lvlUSD offers an opportunity for users who do not want to take the risk of holding BTC or ETH to participate in a liquid restaking and get additional returns on their stablecoins.

In August 2024 Level closed a $3.6M investment round with participation from Polychain Capital, DragonFly Capital, Robor Ventures and angel investors.

Protocols like EigenLayer, Symbiotic, and Karak have committed to supporting tokens that provide economic security, including dollar-denominated ones.

To better understand the Level functionality let’s refresh the knowledge of staking and restaking.

Staking In the Blockchain Industry

Staking is a key concept underpinning the security of blockchains and protocols based on the Proof-of-Stake consensus algorithm and its variations.

Staking refers to locking a user's assets into a special contract for a certain period of time (e.g., while the validator is active). Staked assets act as an economic guarantee of good faith behavior of validators and in case of fraudulent actions can be confiscated in the process of staking.

The most popular asset for staking is the L1 coin of the Ethereum blockchain, ETH. About 30% of the supply of ETH is in staking and provide security to Ethereum.

Staking volatile assets such as ETH has its drawbacks. The value of staked assets is constantly changing due to market movements and stakers can take losses if the price of the staked asset falls.

The Concept of Restaking

Restaking allows the use of staked ETH to secure multiple networks or protocols that for some reason cannot be validated through the Ethereum Virtual Machine.

Restaking enables the “reuse” of ETH to provide pooled security for such protocols, reducing economic costs, increasing returns from staking, and increasing trust in the services of these protocols.

Learn more here about the concept of restaking and the EigenLayer protocol that introduced this concept.

Benefits of Level

Level combines a $162B stablecoin segment with 24.1M monthly active users with the ability to participate in crypto economic security through restaking.

Level allows users to get great returns on stablecoins compared to the risk-free interest rate offered by some projects.

Features of getting profitability from using stablecoins in Level:

Generating yield from all protocols that utilize your stablecoins as an economic security guarantee (via restaking)

Non-custodiality. You don't need to trust your assets to a custodian to get yields

Minimum trust. You only need to trust the stablecoin issuer (e.g. Tether) and the Level Protocol to get returns

Level Architecture

There are 3 main components to the Level USD architecture:

Smart contracts for the issuance of stablecoin

Base Yield

Restaking

Stablecoin Issuance

lvlUSD is backed by a basket of stablecoins such as USDT and USDC. Users can mint and redeem lvlUSD by interacting with a special contract.

Minting requires a collateral deposit in the form of stablecoins and confirmation to send them to a backup address. After sending, the user receives the amount of lvlUSD corresponding to their deposit.

LvlUSD is an overcollateralized stablecoin, meaning that the size of the collateral must always be larger than the size of the lvlUSD issued.

At withdrawal, there is a cooldown period to check the necessary volume of collateral to redeem lvlUSD. If withdrawal is successful, lvlUSD is burned and the collateral is returned to the user's address.

Restaking

The collateral used to mint lvlUSD is sent to restaking protocols such as EigenLayer, Karak, Symbiotic.

Assets are allocated to the vaults of these protocols and can then be used by AVS (actively validated service) protocols to ensure their economic security.

At withdrawal of funds from the restaking protocols there is a period of assets blocking, usually 7-10 days.

Base Yield

One of the key features of Level is the ability to generate additional yield from staked assets.

In addition to the yield from the use of stablecoins in restricted restaking protocols, Level also allows to generate “base yield” from the use of collateral in lending protocols.

Level allocates assets to the lending protocols, the proceeds are used to mint new lvlUSD that become available for branding by lvlUSD stakers.

Level Points Program

Level currently has an active level points (Level XP) program for active community members.

Level XP farming is a way to support the protocol and get a chance to be rewarded in the future by dropping a protocol token, but it does not guarantee any rewards or profitability.

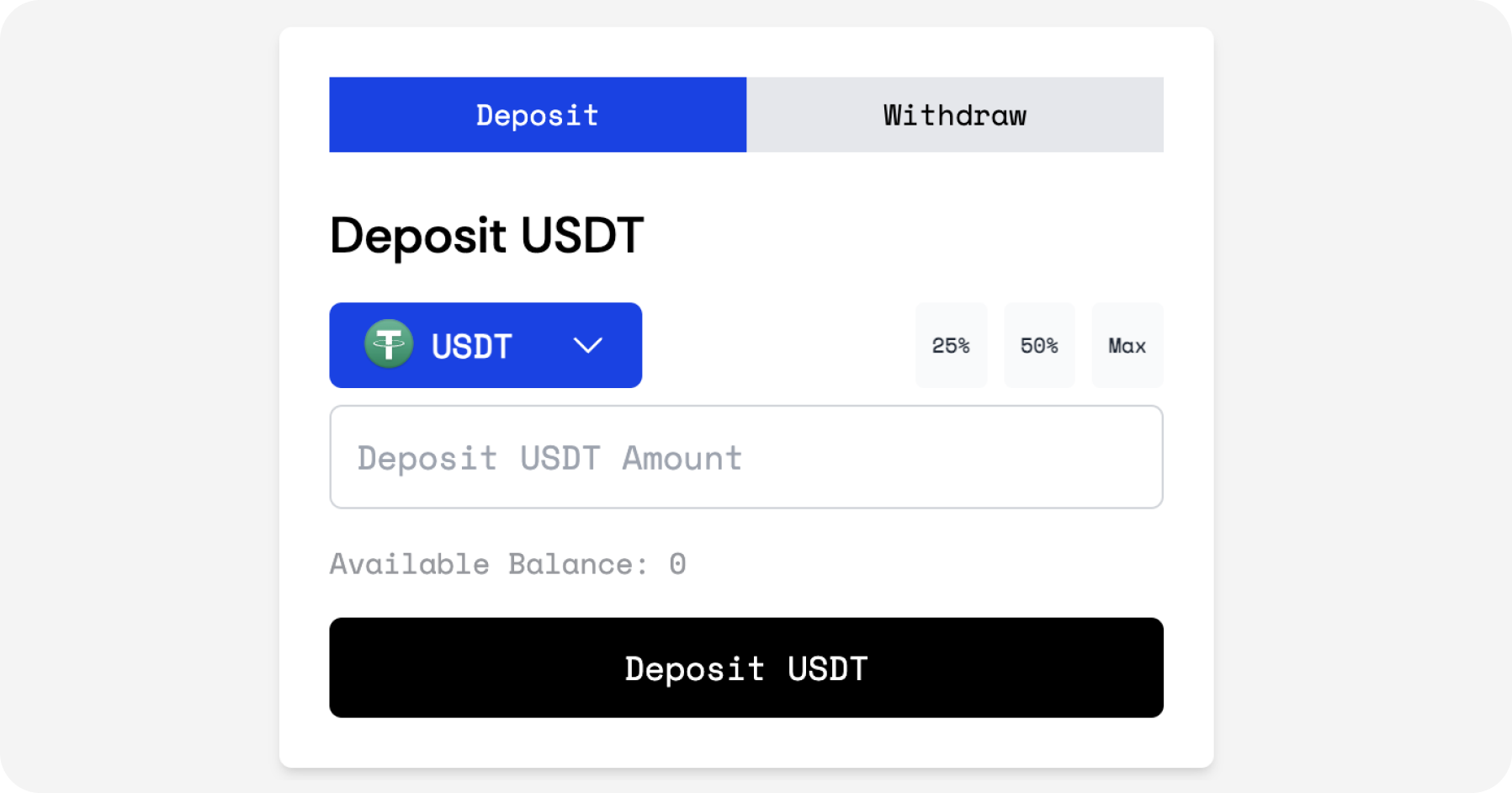

The easiest way to get involved in farming points is to make a stablecoin deposit on Level. Currently, there are several assets available for deposit: USDT, USDC, FRAX deUSD, USDO++, and others.

After making a deposit, you will start accumulating points (Level XP) and moving up on the leaderboard. You have full control over your assets and can withdraw them at any time.

How to Make a Deposit on Level

If you have decided to participate in Level points farming, follow these simple steps:

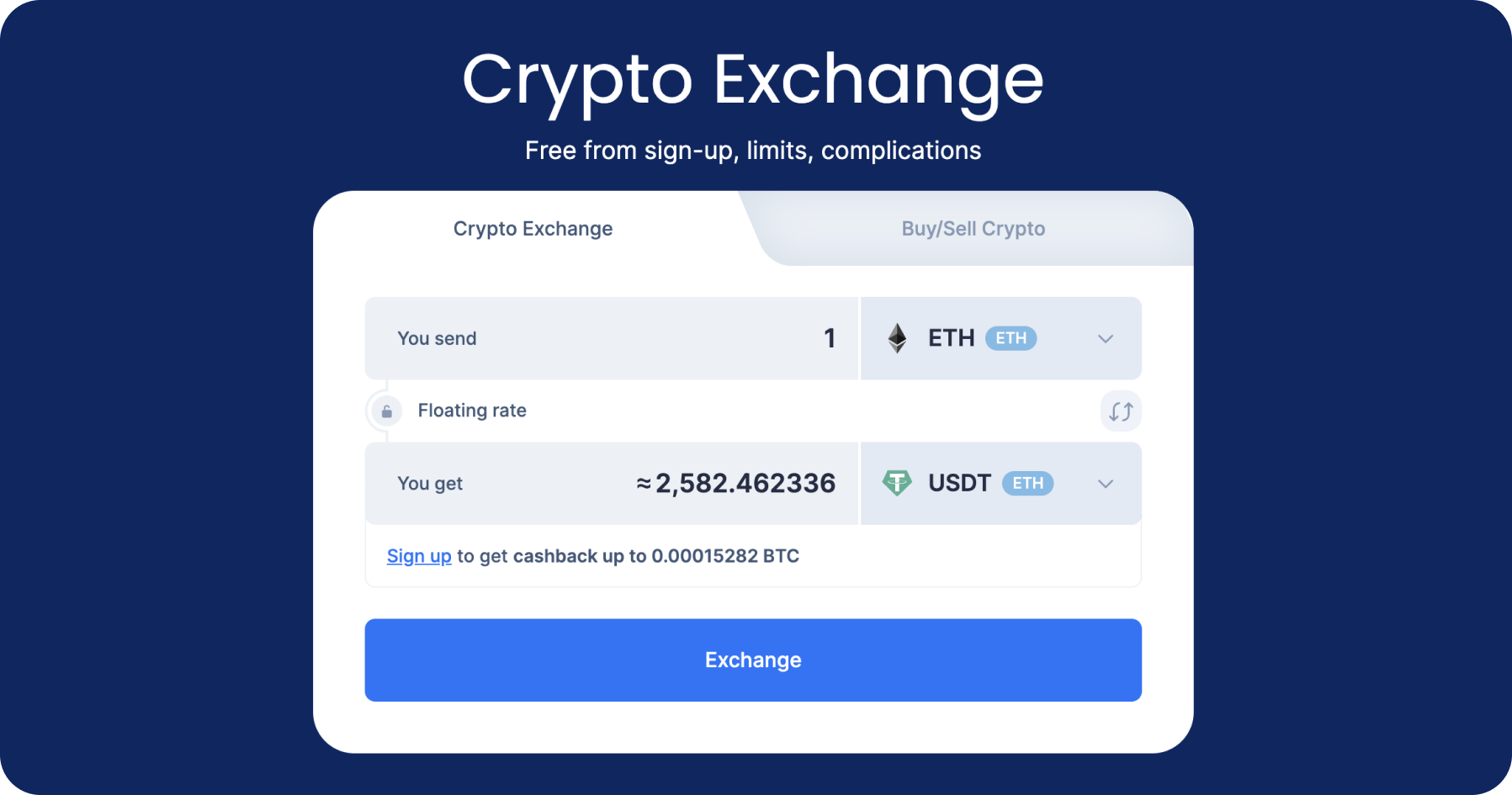

Purchase the desired stablecoin for deposit.

For example, exchange ETH for USDT or USDC on the Ethereum blockchain via SimpleSwap

Go to the official Level website.

To register you will need an invitation code. You can find it in the Discord of the project or use our invitation link.

Go to the Dashboard tab and click on the Deposit button.

You will be taken to the deposit/withdrawal window, where you can select the stablecoin and the number of assets you want to send to Level. After that, confirm your deposit through your wallet.

After completing your deposit, you will start accumulating points (Level XP) in proportion to the size of your deposit. You can track your accumulated XP in the Dashboard tab.

You will be able to withdraw your assets from Level at any time with your accumulated XP intact. Level also offers stablecoin deposit boosts from protocol partners:

Usual: 3x Usual Pills + Level XP

Elixir: 5x Elixir Potions + Level XP

Karak: 3x Karak Points + Level XP

Summary

Level presents an interesting concept that combines several important areas of the crypto industry, in particular the stablecoin segment, one of the largest in the industry, and a new narrative of shared security through asset restaking.

The introduction of the lvlUSD stablecoin will allow a large number of users of popular stablecoins such as USDT and USDC to get additional returns on their assets without holding volatile tokens such as ETH or BTC.

The potential of using stablecoins to provide crypto economic security for blockchains and other protocols carries significant benefits for all participants, validators, stakers and AVSs.

However, Level is still in the early stages of development and has not realized all of its stated functionality.

You should be cautious about such projects, but Level definitely deserves to be on your watchlist in the near future.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.