Grand Crypto Portfolio

Key Insights

- Inclusion of USDC, USDT, and DAI, as well as 2 biggest cryptos allows portfolio stabilization during volatility.

- Targeting leading smart contract platforms like Cardano, Solana, and Polkadot provides infrastructure for participating in the growing dApps ecosystem.

- Capping DeFi exposure at 15% balances yield opportunities with risk management.

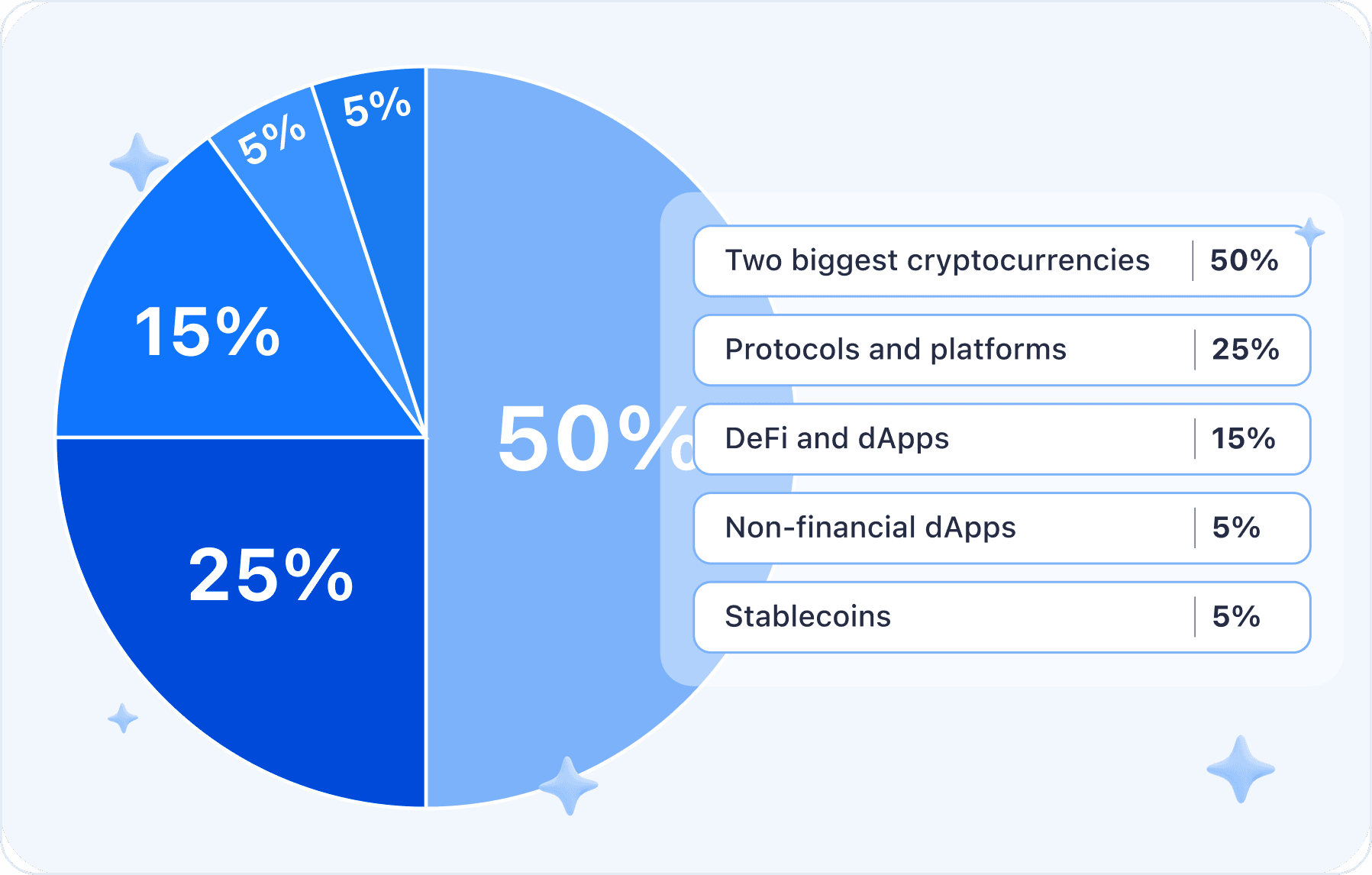

This diversified portfolio highlights a range of cryptos and dApps across different sectors, aiming to strike a balancebetween stability and growth potential. Aiming at portfolio diversification, this one will include the most prominent cryptocurrencies, crypto protocols and platforms, DeFi projects, non-financial dApps, and stablecoins.

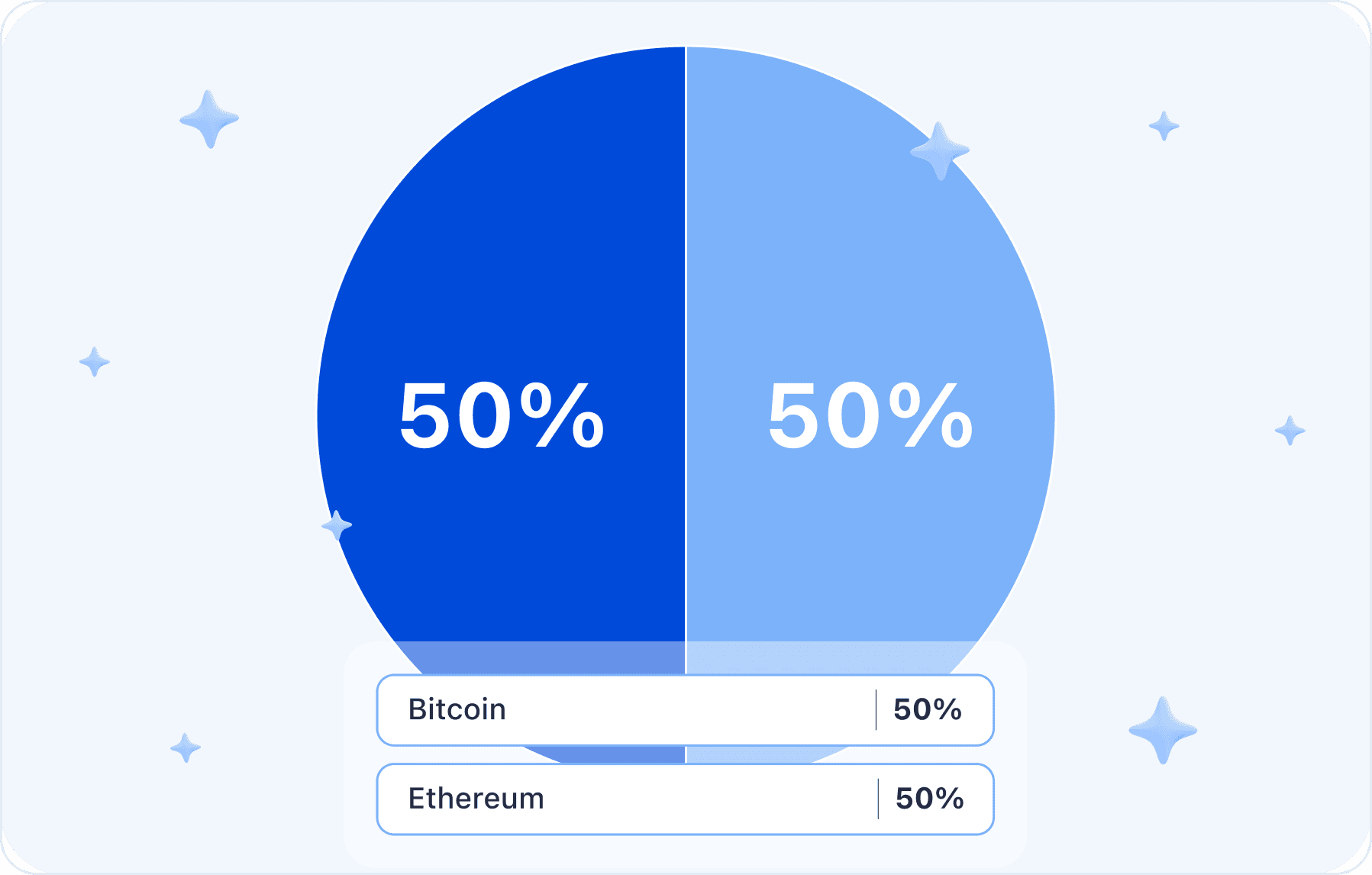

Biggest Cryptocurrencies (50%)

The strategy of asset allocation between Bitcoin and Ethereum allows for a diversified portfolio, participation in the growth of the crypto market, and the opportunity for investors to profit from the dApps sector based on the Ethereum blockchain.

- Bitcoin (BTC) - 30%

Bitcoin is the first and most prominent cryptocurrency. It is a global standard of digital value and a symbol of resilience in the investment world. Bitcoin provides stability and reliability to investors. As the first decentralized digital currency, Bitcoin provides a reliable store of value and liquidity benchmark.

Bitcoin’s long history and proven security make it a reliable investment. The trading volume of BTC shows that many market participants are interested in it. For those unfamiliar with cryptocurrency, it may be advisable to add Bitcoin to a diversified portfolio.

- Ethereum (ETH) - 20%

Ethereum is a platform for creating smart contracts and dApps that can be used to diversify portfolio. The transition to Proof of Stake (PoS) in Ethereum 2.0 is expected to enhance efficiency and scalability, which could facilitate the growth of the DeFi ecosystem.

This cryptocurrency is also included in the portfolios of a diverse range of investors, with the objective of achieving stable, albeit not explosive, growth.

Ethereum plays a pivotal role in the DeFi and innovative tech scene.

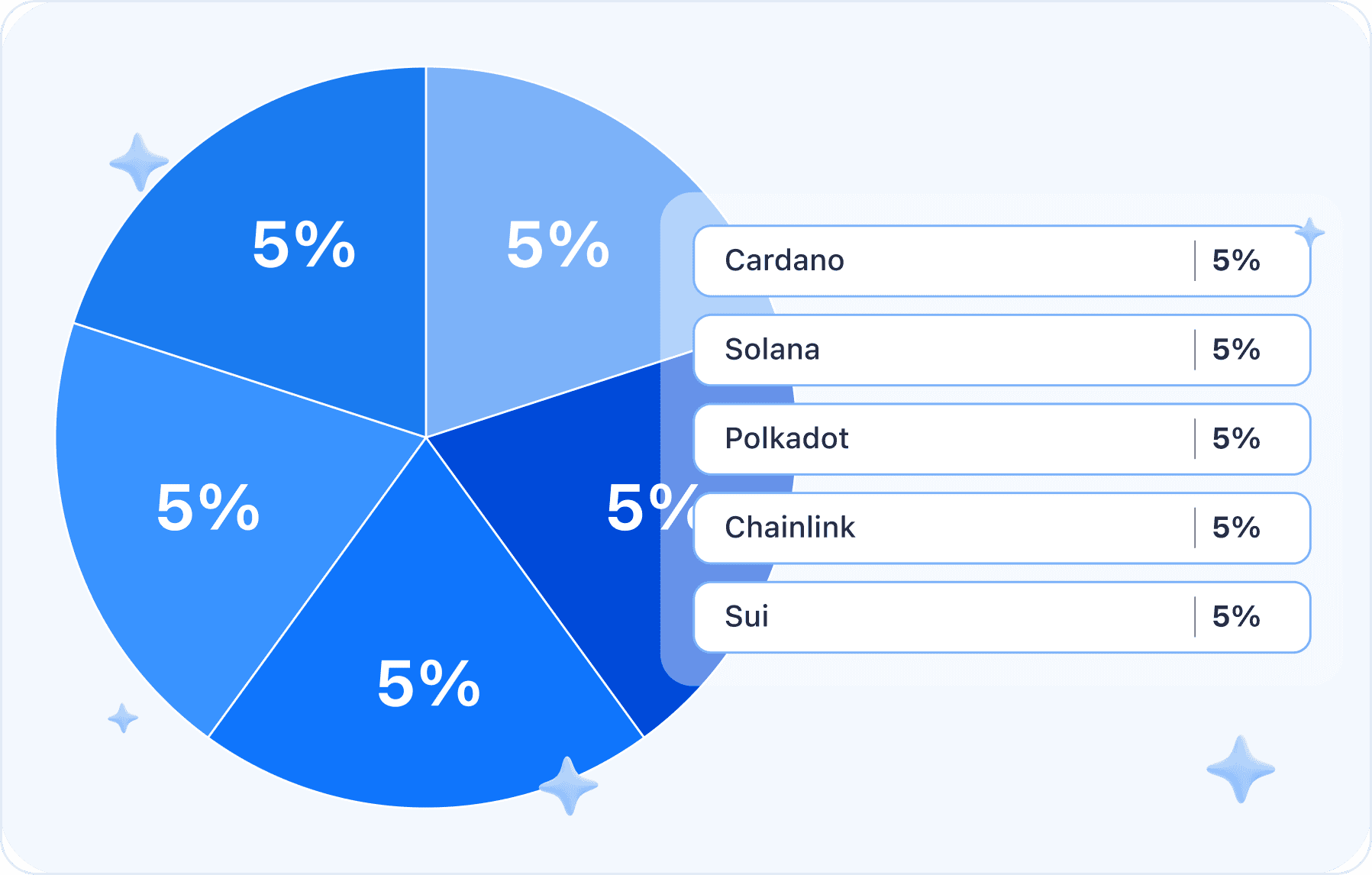

Crypto Protocols & Platforms (25%)

These protocols and cryptocurrencies display higher volatility, risk, and returns than more traditional assets. Following is an asset allocation using them.

- Cardano (ADA) - 5%

The ADA can be used to send and receive value on the Cardano network, as well as to pay for transaction fees and network operations. ADA holders have the opportunity to participate in the governance of the Cardano network by voting on proposals and updates.

ADA holders may also choose to stake their coins to help secure the network and earn rewards in the process. The maximum supply of ADA is fixed at 45 billion tokens, with a current circulating supply of approximately 35 billion.

- Solana (SOL) - 5%

Solana is a high-performance blockchain that provides rapid and scalable solutions for dApps and financial products.

SOL cryptocurrency is fast and has low transaction costs, which could open up new use cases for blockchain and accelerate the growth of innovative DeFi products.

- Polkadot (DOT) - 5%

Polkadot provides infrastructure for creating interoperable decentralized applications.

Polkadot is a blockchain that provides the necessary infrastructure for the creation and management of parallel blockchains and for facilitating their interaction.

Polkadot is a protocol that is specifically designed to connect blockchains, thereby enabling the transfer of value and data across previously incompatible networks such as Bitcoin and Ethereum.

The DOT token is utilized for staking and governance.

- Chainlink (LINK) - 5%

Chainlink is an oracle service, which provides data from external sources to smart contracts, enabling them to fulfil their functions.

It facilitates connectivity between blockchains and external data. Chainlink has the potential to become an indispensable component of the DeFi ecosystem, given the need for trusted information.

Chainlink plays a vital role in facilitating cross-chain data exchange between blockchains and decentralized applications.

- Sui (Sui) - 5%

Sui is a blockchain that offers tools for creating and deploying dApps. It emphasizes usability and scalability.

Sui is a level one blockchain created using the Move programming language. Sui offers a solution for creating smart contracts that provides high network bandwidth combined with low fees.

The Sui project is currently ranked in the top 50 by market capitalization and has significant growth potential.

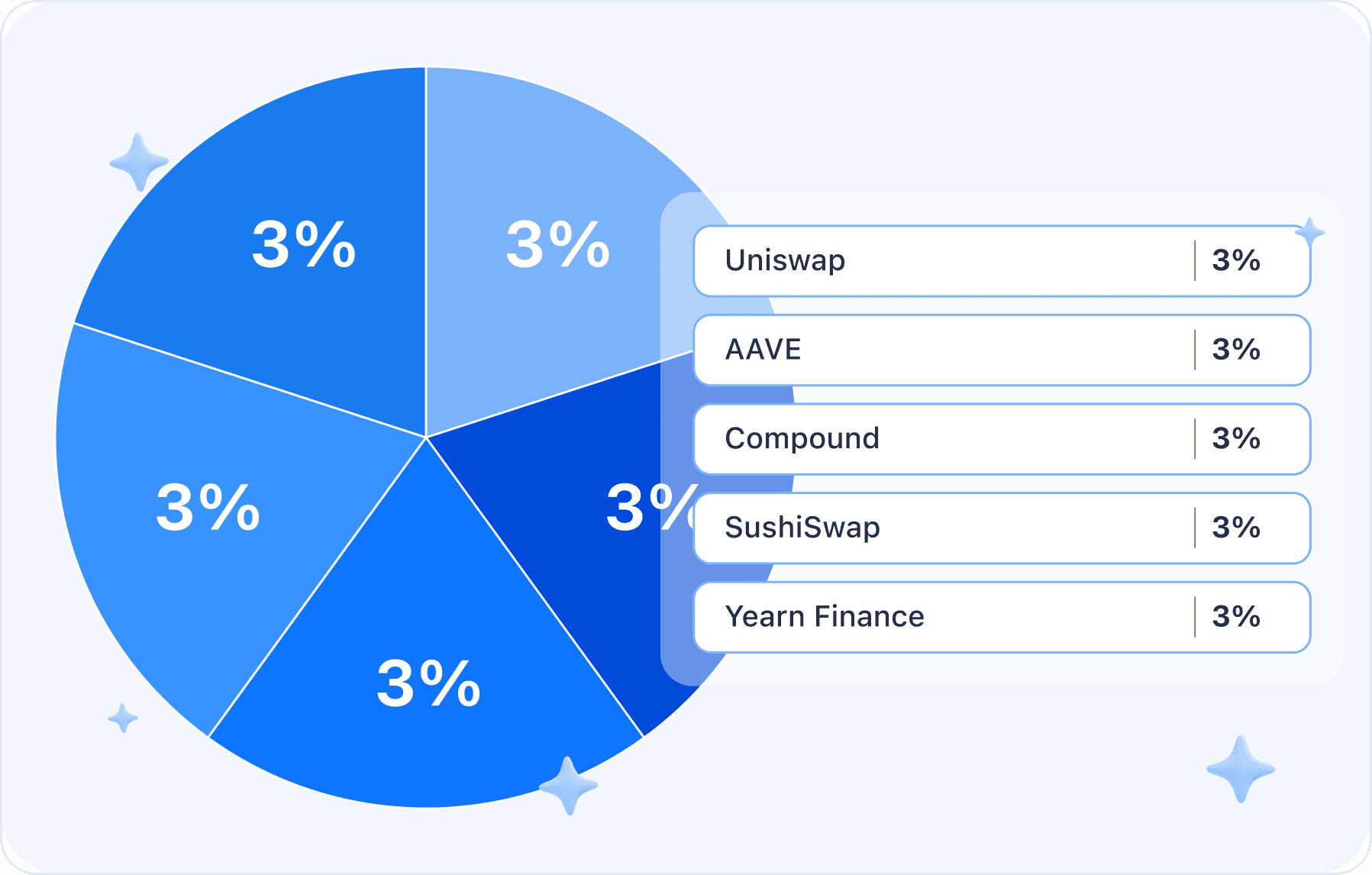

DeFi Projects (15%)

A DeFi coin is a type of cryptocurrency that's used to participate in the DeFi economy. In particular, a DeFi coin is a type of cryptocurrency that's used in decentralized exchanges, liquidity pools, income farming, lending, asset management, digital wallets, and NFT.

Given the many different DeFi services that are currently available, there are also many different DeFi coins and tokens.

- Uniswap (UNI) - 3%

Uniswap is a decentralized exchange that streamlines the provision of liquidity. Uniswap v2 enables users to exchange any ERC-20 tokens with one another. The growing demand for decentralized trading platforms makes UNI an invaluable asset for those seeking to participate in this sector's growth.

The Uniswap exchange is a decentralized platform that utilizes automated liquidity pools in lieu of order books to facilitate direct token swapping.

The UNI token is a crucial component of the Uniswap ecosystem, facilitating trustless swapping and bootstrapping liquidity for long-tail ERC-20 tokens. Additionally, users can participate in the governance of the network and receive rewards with the UNI coin.

- Aave (AAVE) - 3%

Aave is an Ethereum-based protocol for decentralized lending and borrowing. As DeFi continues to evolve, AAVE will remain at the forefront of innovation by offering new financial options to users.

AAVE is the leading DeFi lending protocol in terms of total volume. AAVE provides users with the ability to borrow and lend cryptocurrencies through the use of smart contracts technology, eliminating the need for third parties.

- Compound (COMP) - 3%

Compound is a prominent DeFi lending protocol that enables users to borrow against cryptocurrencies and earn interest on their crypto assets by adding them to lending pools.

The incorporation of the project into the diversified portfolio provides exposure to the DeFi lending sector, which is one of the most prominent areas of decentralized finance development.

- SushiSwap (SUSHI) - 3%

SushiSwap is an Ethereum-based decentralized exchange that was created with the goal of making it easy for users to exchange tokens, provide liquidity, and earn SUSHI tokens.

One of the best features of SushiSwap is the SUSHI token farming mechanism. This mechanism allows users to earn SUSHI tokens, which encourages participation and ensures a constant supply of liquidity on the platform.

- Yearn Finance (YFI) - 3%

Yearn Finance is a platform for automated asset management in DeFi. It provides tools for optimizing yield across various protocols and exchanges.

Yearn Finance is a set of protocols operating on the Ethereum blockchain that enables users to maximize their passive income from crypto assets they own through the use of lending and trading services.

Yearn Finance provides its services independently, eliminating the necessity for a financial intermediary such as a bank or custodian.

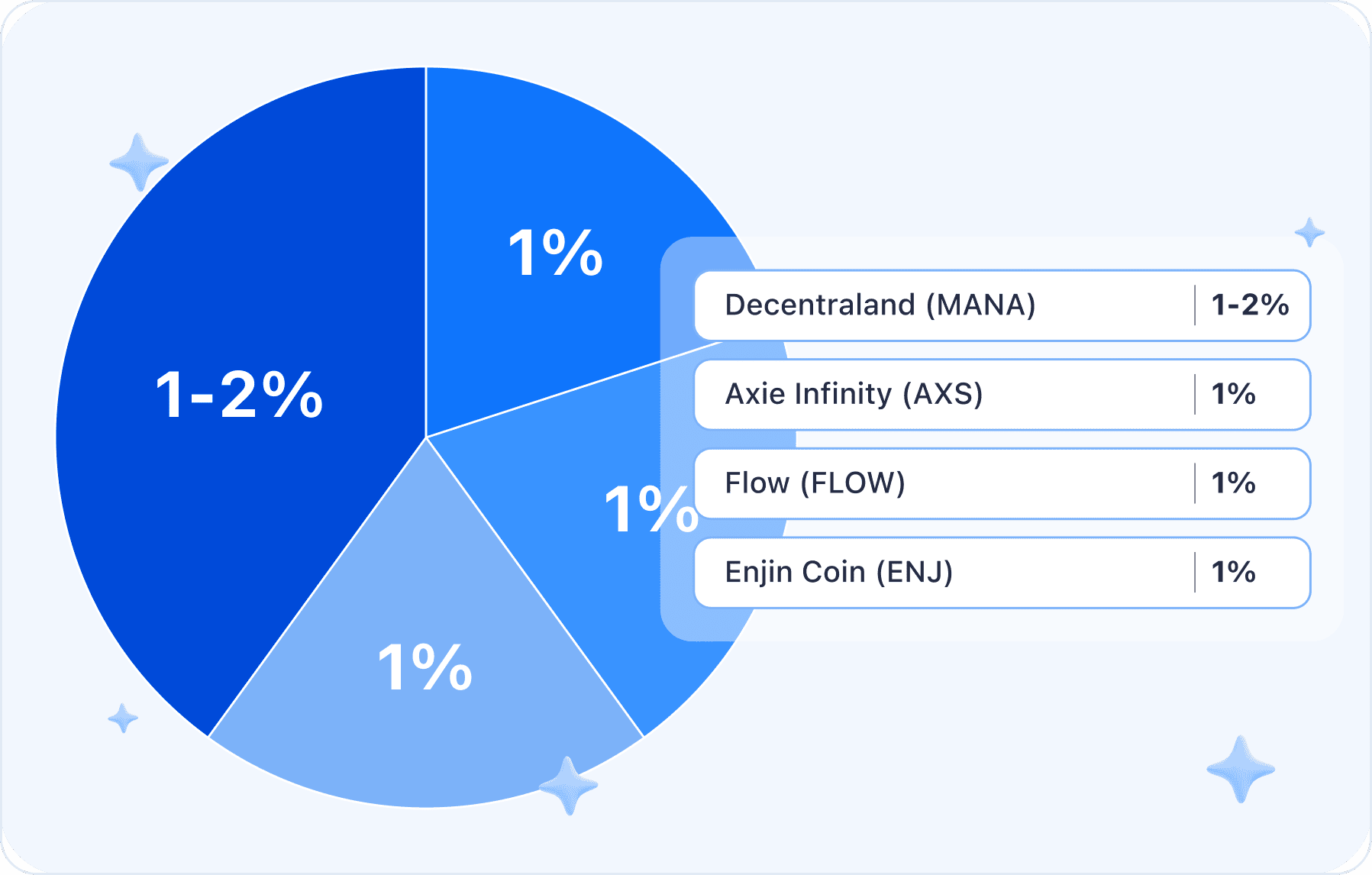

Non-Financial dApps (5%)

- Decentraland (MANA) - 2%

Decentraland is a blockchain-based virtual world where users can create and sell virtual assets and real estate.

Decentraland is an innovative virtual reality platform that offers users the chance to create their own content and interact with other participants.

The MANA token is a cryptocurrency designed for use within the Decentraland ecosystem.

- Axie Infinity (AXS) - 1%

Axie Infinity is a gaming platform that allows users to play, collect, and trade virtual creatures known as Axies.

The Axie Infinity game is a pioneering example of a play-to-earn game. Its objective is to introduce blockchain technology to a mass audience in a format that is both accessible and enjoyable.

The game has attracted significant attention due to its rapid uptake and far-reaching appeal.

- Flow (FLOW) - 1%

Flow is a blockchain platform designed for creating and launching dApps and games.

The FLOW cryptocurrency is the native token of the Flow blockchain. Flow operates on a proof-of-stake (PoS) consensus mechanism, similar to the Ethereum blockchain.

This blockchain aims to underpin a more extensive deployment of Web3 and the metaverse, accessible to everyone. To achieve this vision of an open Web3 and metaverse, Flow supports a variety of dApps, DeFi platforms, NFTs, PFP projects, and more.

- Enjin Coin (ENJ) - 1%

Enjin Coin is a token associated with a platform for creating and managing digital assets in games and virtual worlds.

Enjin Coin is a cryptocurrency built on the Ethereum blockchain and serves as the native token for the Enjin Network. The Enjin Network provides tools that allow game developers to tokenize digital assets, such as NFTs, which hold real-world value backed by Enjin Coin.

Users can obtain and store these unique assets on Enjin’s platform for use in games. Additionally, companies looking to develop blockchain products can leverage Enjin's comprehensive suite of tools.

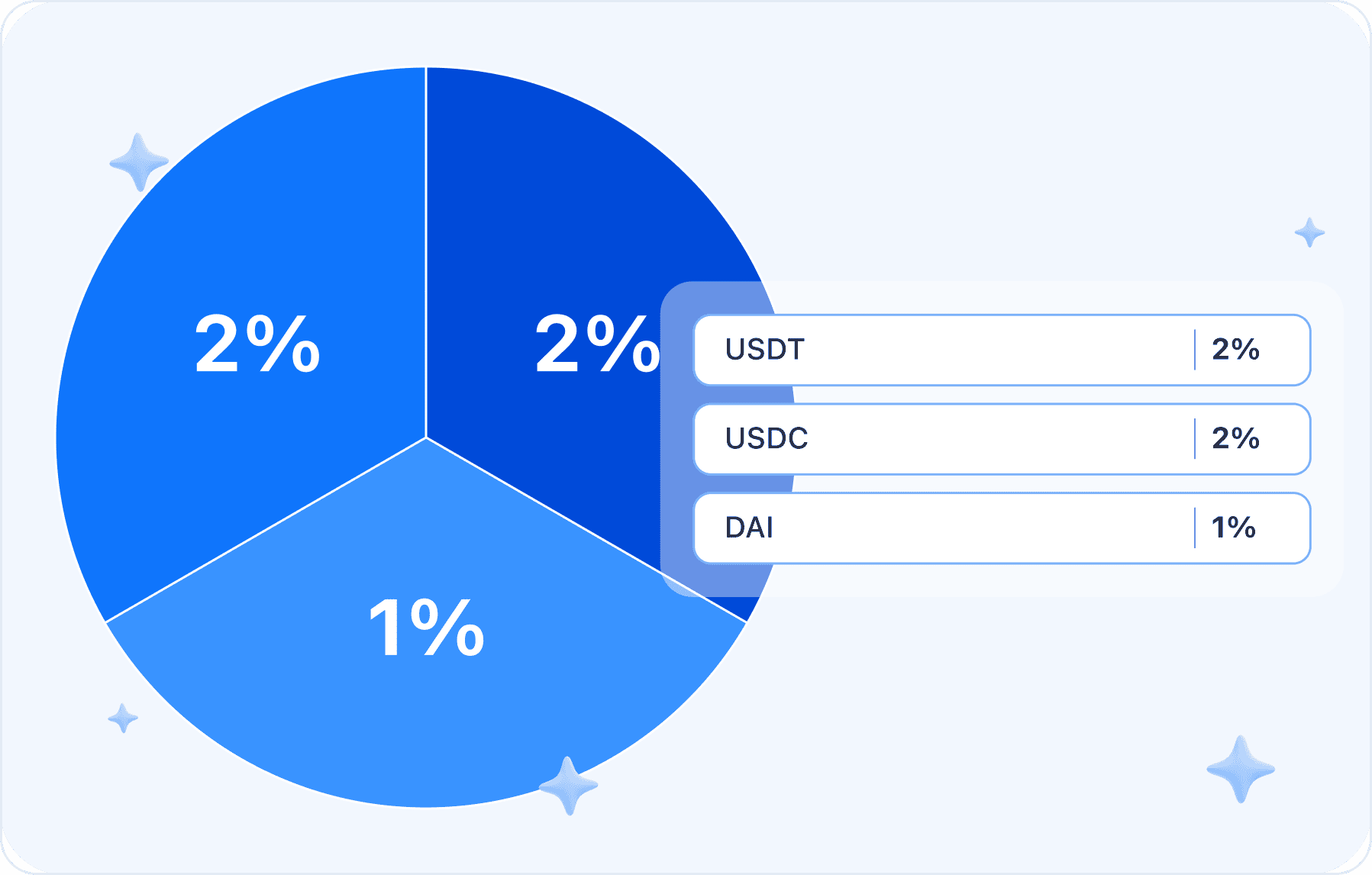

Stablecoins (5%)

A stablecoin is a type of cryptocurrency that is backed by reserve assets, such as the U.S. dollar or gold, to provide price stability. This backing provides a degree of stability in the face of market fluctuations.

- USD Coin (USDC) - 2%

USD Coin is a stablecoin pegged to the US dollar, offering investors a stable and liquid addition to a diversified portfolio. USDC is fully backed by the US dollar at a 1:1 ratio. It is a tokenized US dollar, with the value of one USDC coin being as close to the value of one US dollar as possible.

USDC has a diverse range of applications in the DeFi sector and can be readily converted into other assets.

- Tether (USDT) - 2%

Tether is a stablecoin pegged to the US dollar. It is widely used in cryptocurrency trading and exchanges.

Tether (USDT) is the third largest cryptocurrency in terms of market capitalization (after Bitcoin and Ethereum, respectively), and is the largest stablecoin.

- DAI - 1%

DAI is a stablecoin that utilizes a collateralization mechanism to maintain price stability. It operates on the Ethereum blockchain.

The price of DAI is linked to the US dollar rate. As a stablecoin, this crypto asset offers a reliable means of storing funds and making interuser payments. The stability of DAI is guaranteed not only by its peg to the dollar, but also by its use of collateralized debt positions (CDPs) and smart contracts technology.

DAI offers stability in the face of market volatility. It is a cryptocurrency that automatically adjusts to changing market conditions to maintain a stable value against major world currencies.

Users can get any of the portfolio coins on SimpleSwap or via the widget below this article.

Summary

The expected profitability of this crypto portfolio depends on the market dynamics of each crypto individually.

We have included a diversified and vast number of crypto entities: two of the most popular cryptocurrencies, crypto platforms, DeFi projects, non-financial dApps, and stablecoins.

Risk management, portfolio diversification, and asset allocation among different crypto categories help mitigate risks and increases the likelihood of overall portfolio profitability.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.