Navi Lending Platform Review

Key Insights

- The NAVI crypto lending platform's architecture leverages parallel processing capabilities to deliver a frictionless capital management experience, distinguishing itself through multi-source price feeds and seamless orderbook integration.

- NAVI’s strengths are flexibility, reliability and integration with key components of the SUI ecosystem.

- Utilizing the Move programming language, NAVI establishes a robust foundation for executing complex financial agreements like collateralized loans.

NAVI crypto lending platform is a decentralized finance protocol designed to run on the Sui blockchain. NAVI positions itself as a universal liquidity platform that provides users with crypto lending, borrowing and asset managementfunctions.

The main objective of NAVI crypto lending protocol is to provide security, flexibility and efficiency in the use of capital in the Sui crypto ecosystem.

NAVI: Key Features

Work mechanics

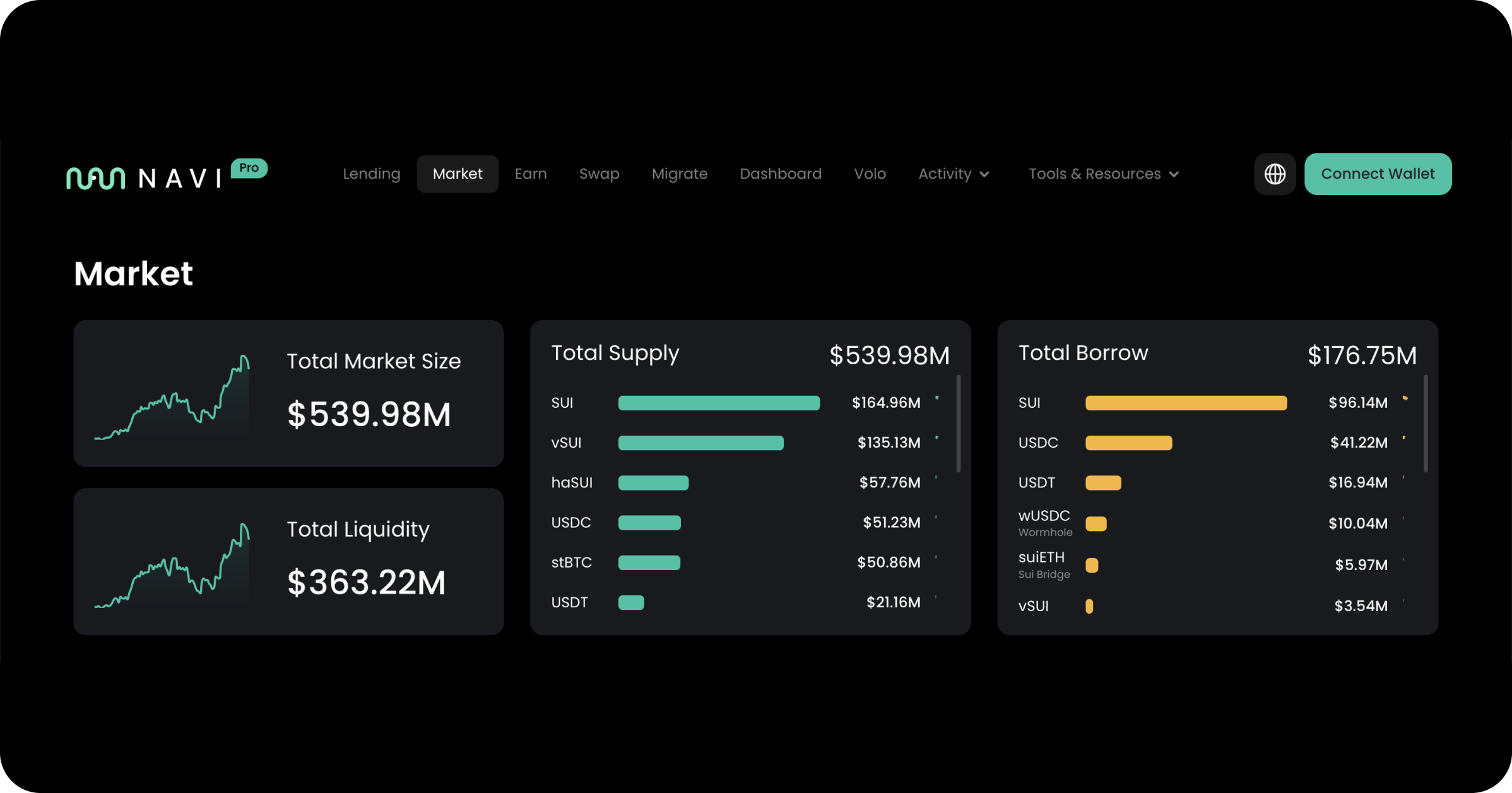

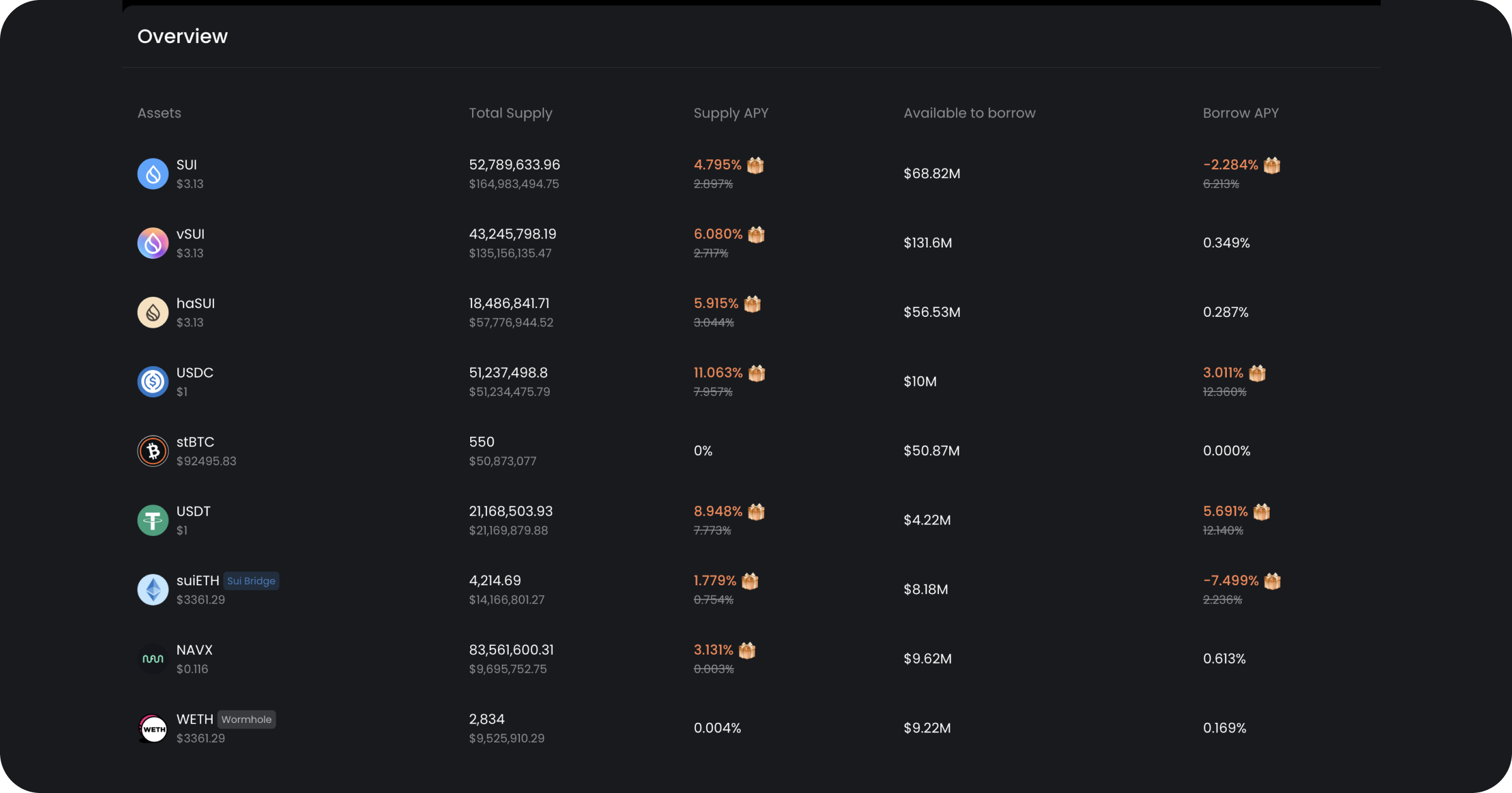

NAVI connects lenders providing assets to liquidity pools and borrowers using the assets as collateral for loans. The process includes depositing assets (SUI, USDT, USDC, wETH and others), using oracles to value collateral and calculate borrowing limits, and risk management through automated liquidations in case collateral value falls below limits.

Multi-oracle support

NAVI uses data from multiple sources including Supra and Pyth as well as centralized exchanges (e.g. Binance and Coinbase). This reduces the risks of price manipulation and increases the robustness of the protocol.

Integration with DeepBook

NAVI is embedded in the Sui Foundation's orderbook, ensuring high liquidity and minimising transaction slippage. DeepBook enables the protocol to efficiently manage liquidity and interact with other ecosystem participants.

NAVI: Key Innovations

Isolated liquidity pools

The NAVI protocol has introduced isolation mechanisms to minimize the risks of spreading losses from one pool to others. This is useful for lenders who want to mitigate potential default risks.

Liquidation model

If the value of collateral falls below a certain level, the borrower's assets are liquidated through an auction mechanism. Liquidators receive an incentive in the form of small discounts on assets, which helps to stabilise the system quickly.

Flexible collateral parameters

NAVI offers flexible LTV (Loan-to-Value) limits, depending on the type of asset. This allows borrowers to borrow at higher limits while maintaining a high level of security for lenders.

Governance via DAO

NAVI token (NAVX) holders can participate in voting to determine protocol parameters including interest rates, choice of supported assets and fees.

NAVI Architecture On Sui Blockchain

NAVI crypto lending platform is built on the Sui blockchain, which has been designed with a focus on high performance, scalability and low transaction costs. This is achieved through the following features:

Parallel transaction processing

Unlike traditional blockchains that process transactions sequentially, Sui adopts a parallel processing model. This means that multiple independent transactions (e.g., transfers between different users) can be executed simultaneously. This architecture eliminates bottlenecks as network load grows, ensuring stable performance even during periods of peak demand.

Object-based data architecture

In Sui, each asset is represented as an object with a unique identifier. This simplifies asset management and enables complex smart contracts, such as credit pools, to be implemented with minimal resources.

Transaction fees

Thanks to the efficient operation of the network, transaction fees remain low, making Sui an ideal choice for high-frequency transactions typical of crypto lending and borrowing at DeFi. This is especially important for NAVI, where transaction efficiency directly impacts the user experience.

Move Programming Language

Move is a programming language designed to work with digital assets and smart contracts. In NAVI, it provides a robust implementation of protocols, minimising the risks of bugs and vulnerabilities.

Resource management

Move is built on the concept of strict resource control. Every asset transaction is strictly audited, eliminating unauthorized transfers or losses. This is particularly important in the DeFi context, where asset security is paramount.

Error resilience

Move prevents common errors in smart contracts, such as overflowing numbers or incorrect data deletion. These features make NAVI more reliable for users.

Modularity and extensibility

Move allows for flexible and scalable modules that can be reused. This facilitates the rapid addition of new features to NAVI without the need for a complete code rewrite.

NAVi Compatibility With Protocols In The Sui Ecosystem

NAVI actively integrates with key members of the Sui ecosystem, which increases its functionality and user appeal:

Cetus Protocol and Turbos Finance

These decentralised exchanges provide NAVI with additional opportunities to interact with liquidity. For example, users can use leveraged assets from NAVI to trade on these platforms, creating additional use cases.

DeepBook

Integration with Sui Foundation's decentralized orderbook DeepBook provides high liquidity for NAVI transactions. This allows users to easily convert assets, borrow or lend funds without delays or significant price slippage.

Ecosystem Expansion

Thanks to Sui standards, NAVI easily integrates with new projects emerging in the ecosystem. This ensures that the protocol remains relevant as the network grows.

Benefits of NAVI Crypto Lending Platform

Security

The use of the Move language minimises the risk of vulnerabilities.

Flexibility

Highly customisable to the needs of borrowers and lenders through isolated pools and adjustable parameters.

Efficiency

Integration with DeepBook and the use of multi-oracle make transactions fast and accurate.

Asset diversification

Support for a variety of tokens including SUI, USDT, USDC, wETH.

NAVI Tokenomics: NAVX

The NAVX token is a key element of the NAVI crypto lending ecosystem, providing protocol management, incentivising participants and supporting the economic model.

NAVX fulfils both utilitarian and governance functions, making the protocol not only a lending tool but also a participant in the wider DeFi ecosystem.

NAVX Token Functions

Protocol governance

NAVX token holders can participate in key decisions through a Decentralized Autonomous Organization (DAO). Voting allows for determining crypto lending and borrowing rates, liquidation limits and collateral levels, adding new assets and strategies for lending pools.

Member incentives

NAVX is used to reward user activity including rewards for liquidity providers and borrowers, and bonuses for voting and staking participation.

Financial Instrument

The NAVX token can be used for staking, allowing participants to receive a portion of the platform's revenue. This creates an additional level of motivation for long-term participation in the ecosystem.

Economic model

The NAVX token plays a role in the distribution of platform revenue. Fees charged for crypto lending, borrowing and liquidations are partially shared between NAVX holders, DAO participants and protocol reserves.

The NAVI token plays an important role not only within the protocol, but also within the Sui ecosystem:

Liquidity

NAVX is traded on decentralised exchanges in the Sui ecosystem, such as Cetus Protocol and Turbos Finance. This allows users to freely exchange NAVI for other assets.

Yield strategies

The NAVX token can be used as part of revenue farming strategies by providing it to other platforms' liquidity pools.

NAVI Token Mechanics

Emission model

The number of NAVX tokens is limited in advance to avoid inflation. New tokens are distributed through rewards for providing liquidity or participating in management.

Deflationary mechanisms

The protocol can use part of the fees to redeem and burn NAVX tokens, reducing their overall supply and maintaining value in the market.

Participatory staking

NAVX token holders can lock them into the platform to generate revenue from NAVX's operating profits, including transaction fees.

NAVI: Risks and Challenges

Dependence on the Sui ecosystem

The success of NAVI is closely linked to the development and popularity of the Sui blockchain. If the ecosystem does not achieve significant scale, this could limit NAVI's growth potential.

Competition

There are dozens of protocols with similar functionality such as Aave, Compound and others. NAVI needs to offer unique benefits to attract users.

Market risks

Volatility in collateral asset prices remains a key risk factor for liquidations and protocol stability.

Users can get any cryptocurrency for fiat or crypto on SimpleSwap.

Summary

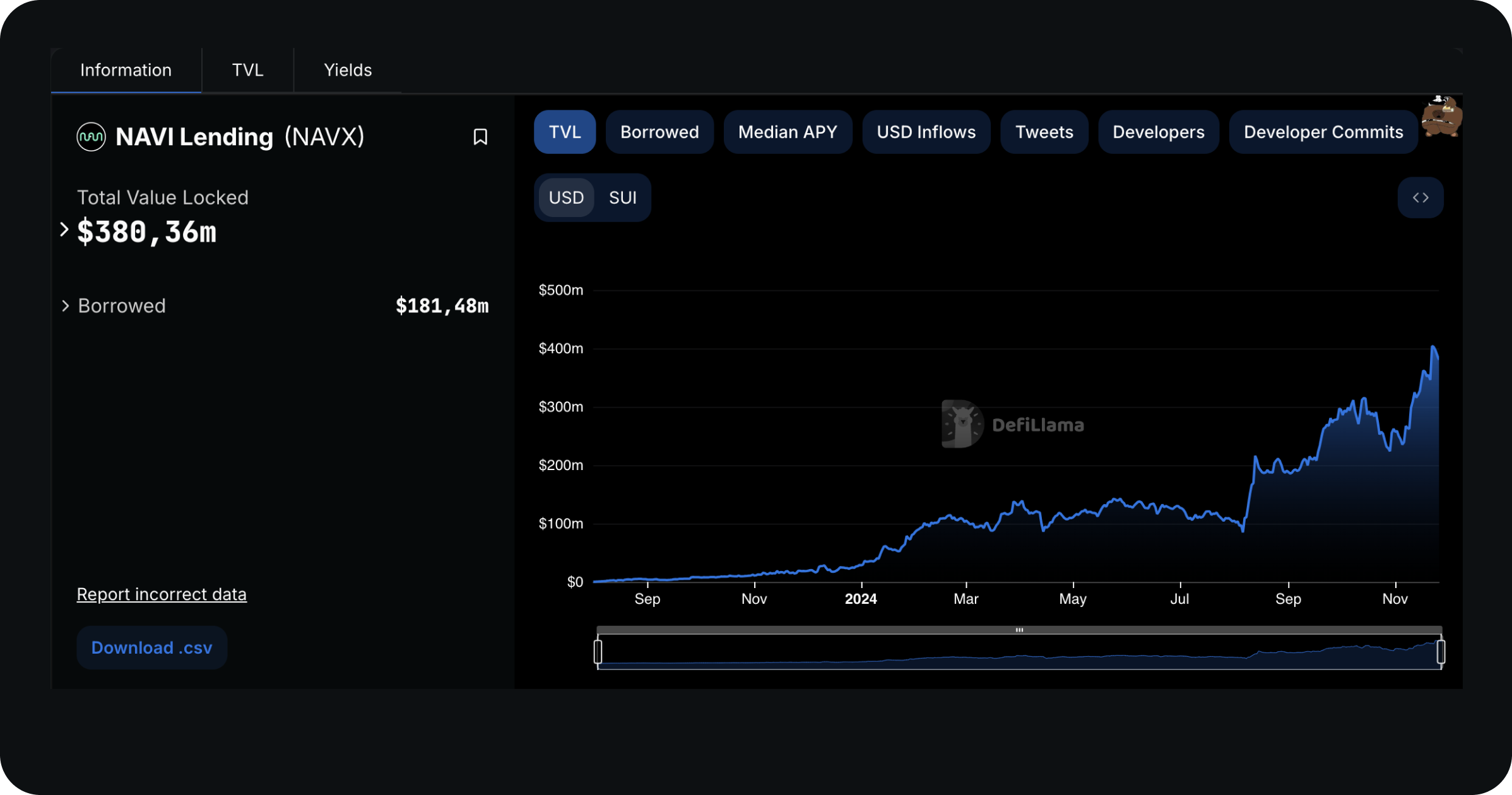

NAVI represents a progressive DeFi protocol uniquely positioned within the Sui blockchain ecosystem to enhance liquidity, reliability, and transaction efficiency.

Through its advanced integration with DeepBook, comprehensive utilization of data from multiple oracles, and the secure and versatile Move programming framework, NAVI is well-equipped to provide a superior platform for crypto lending, borrowing, and asset management.

As it focuses on these strengths, NAVI is poised to compete effectively against established protocols, provided that the Sui crypto ecosystem continues to grow and gain traction within the broader cryptocurrency market.

However, the NAVI protocol must navigate inherent risks associated with market dynamics and potential ecosystem limitations to sustain its growth trajectory and user adoption.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.