2024’s Fastest-Growing DeFi Trend: The Dominance of Derivatives DEXs

Key Insights

- Huperliquid emerged as the leader in derivatives DEXs trading volumes in 2024, leveraging its innovative blockchain and perpetual futures platform.

- Derivatives DEXs have seen a 100% growth in TVL throughout the year, reaching $3.6B in September 2024, with Jupiter leading in TVL.

- Platforms like Huperliquid and dYdX have developed their own blockchains, designed specifically to optimize decentralized trading experiences, marking a significant trend in the DeFi space.

Derivatives decentralized exchanges (DEXs) have become an essential part of the DeFi sector and one of the most popular DeFi trends in 2024.

The growing popularity of decentralized derivatives exchange is driven by an increasing number of users who prefer decentralized platforms for trading without needing to trust a third party (such as an exchange) or rely on custodial asset storage.

As more decentralized platforms for derivatives trading emerge, traders have greater opportunities to incorporate them into their strategies.

Improvements in UX and functionality allow DEXs to offer a trading experience comparable to leading centralized exchanges (CEXs) while maintaining decentralization and anonymity for market participants.

Perpetual Futures: Leading Derivatives DEX

The most popular derivatives DEXs are platforms for trading perpetual futures. These exchanges allow users to trade perpetual futures on major crypto assets with leverage (borrowed funds).

The available trading pairs and maximum leverage vary across platforms. Typically, the maximum leverage (up to 100x) is provided for the most liquid assets like BTC, ETH, and SOL.

Trading takes place on-chain using DEX smart contracts and the user’s wallet, where they store their assets. For ease of use, some exchanges offer a "one-click trading" option, where users can create a separate trading wallet without needing to manually confirm each transaction.

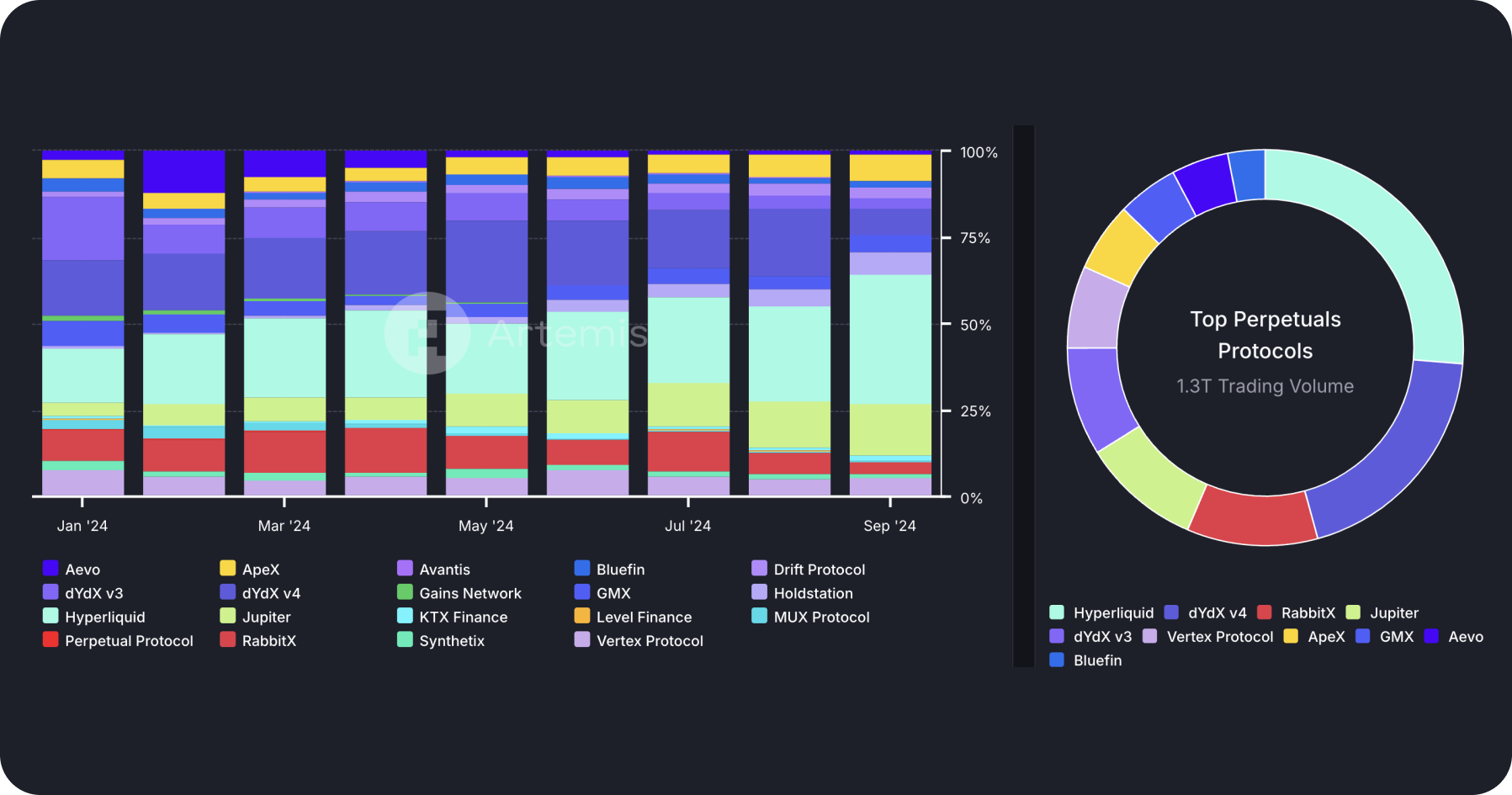

Changing Leadership in the DEXs Market

Since the beginning of the year, there has been a leadership shift in trading volume within the derivatives DEX sector. A new DEX, Huperliquid, launched in fall 2023, has become the leader in trading volumes.

The previous market leader, dYdX, was overtaken and fell to third place by September, giving up second place to Jupiter exchange. Overall, the total trading volume on derivatives DEXs has shown slight growth throughout 2024.

In January, the trading volume was $113B, increasing to $128B by August. Market leaders dominate trading volumes: in August, Huperliquid accounted for 27.5% of total volume ($35.2B), dYdX v4 captured 19% ($24.5B), and Jupiterheld 13% ($16.9B).

By September, Huperliquid's share had grown to 37.4%, establishing it as the undisputed leader in the derivatives DEX market.

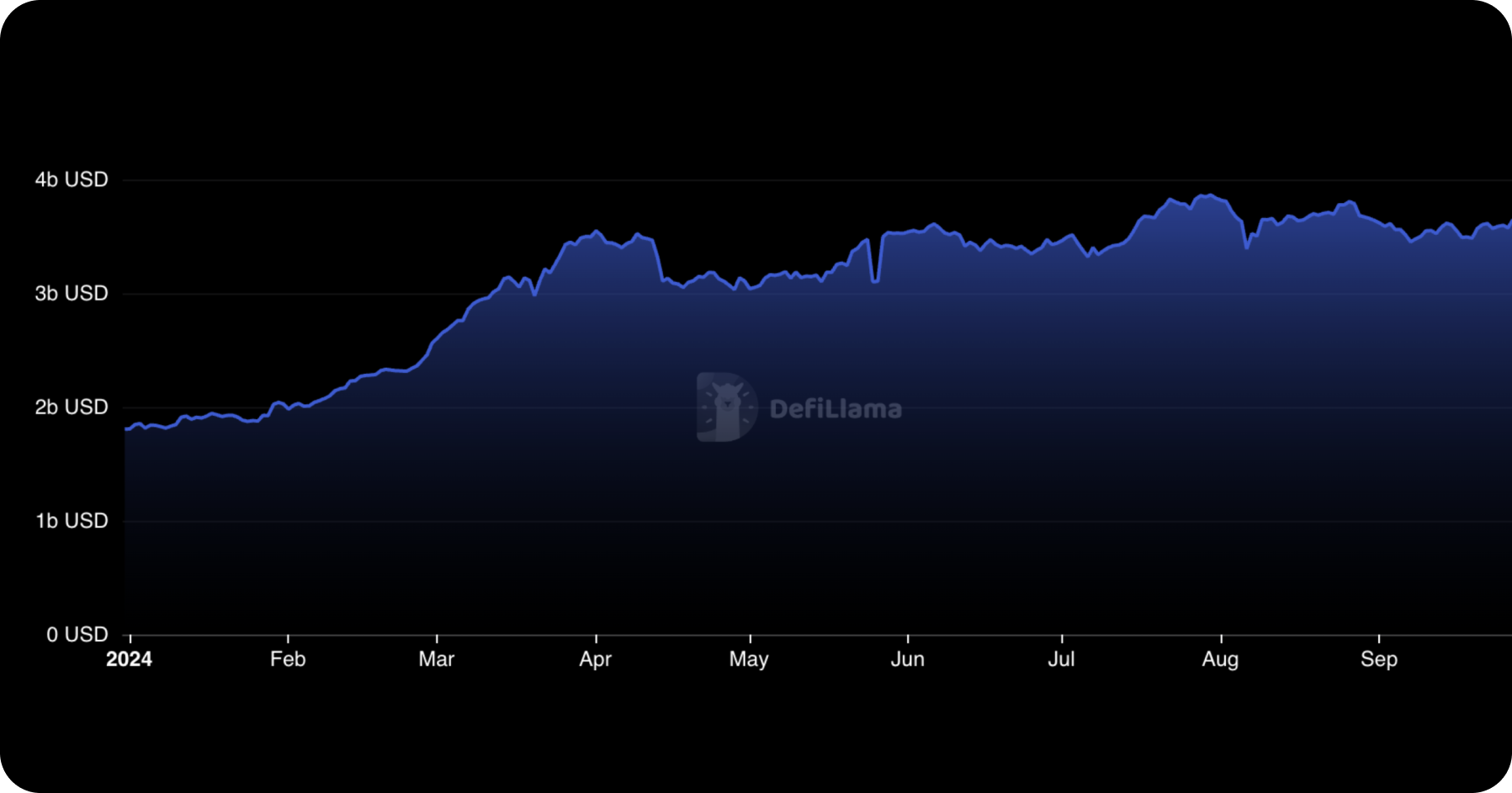

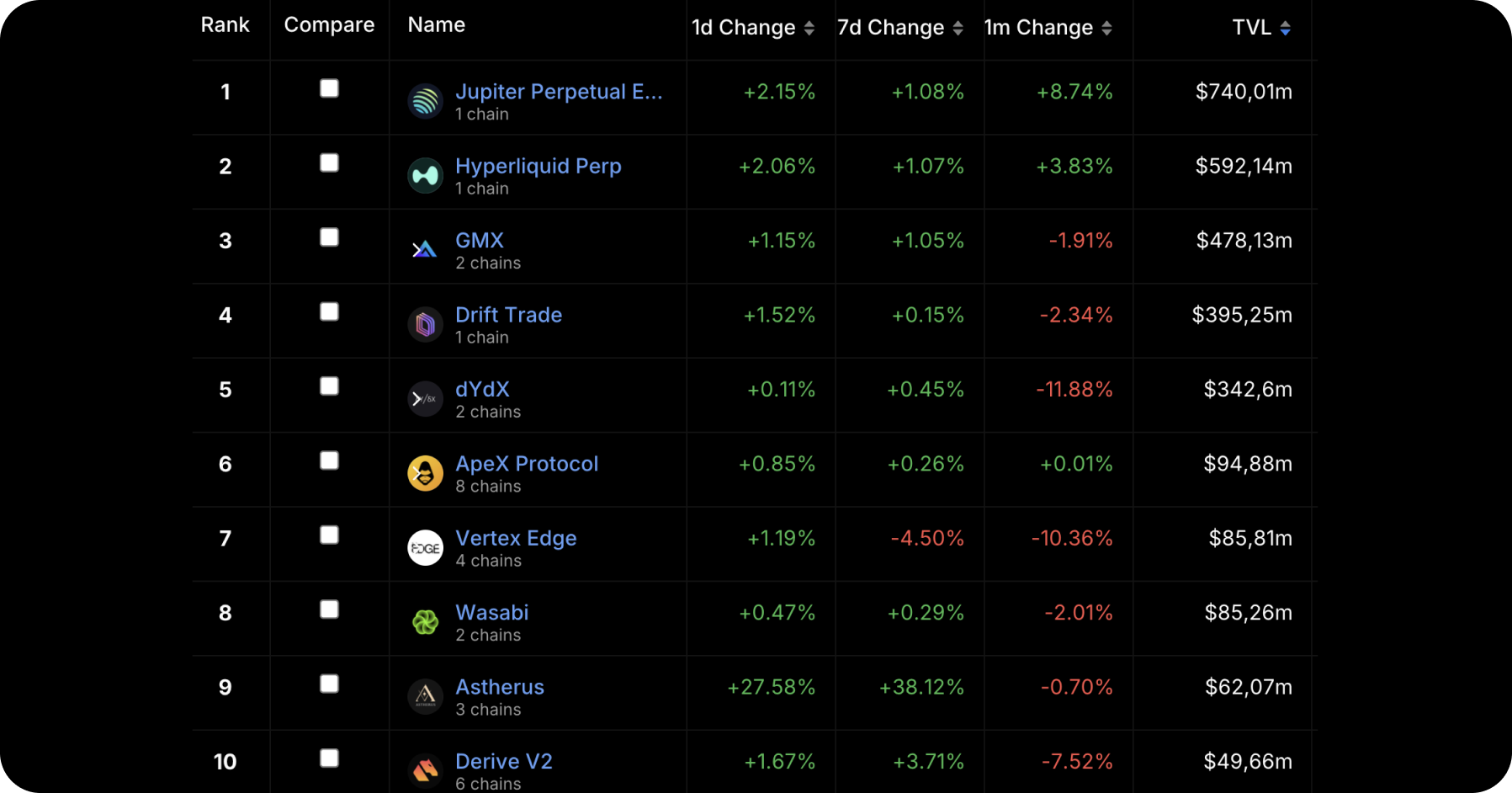

Another indicator of the rising popularity of derivatives DEXs is TVL (Total Value Locked) in protocols. Since the beginning of the year, TVL in derivatives DEXs has grown by 100%—from $1.8B in January to $3.6B in September.

Jupiter (JUP) leads in terms of TVL among derivatives DEXs, followed by Huperliquid, GMX (GMX), Drift (DRIFT), and dYdX (DYDX).

Key Features of the Leading Derivatives DEXs

Huperliquid

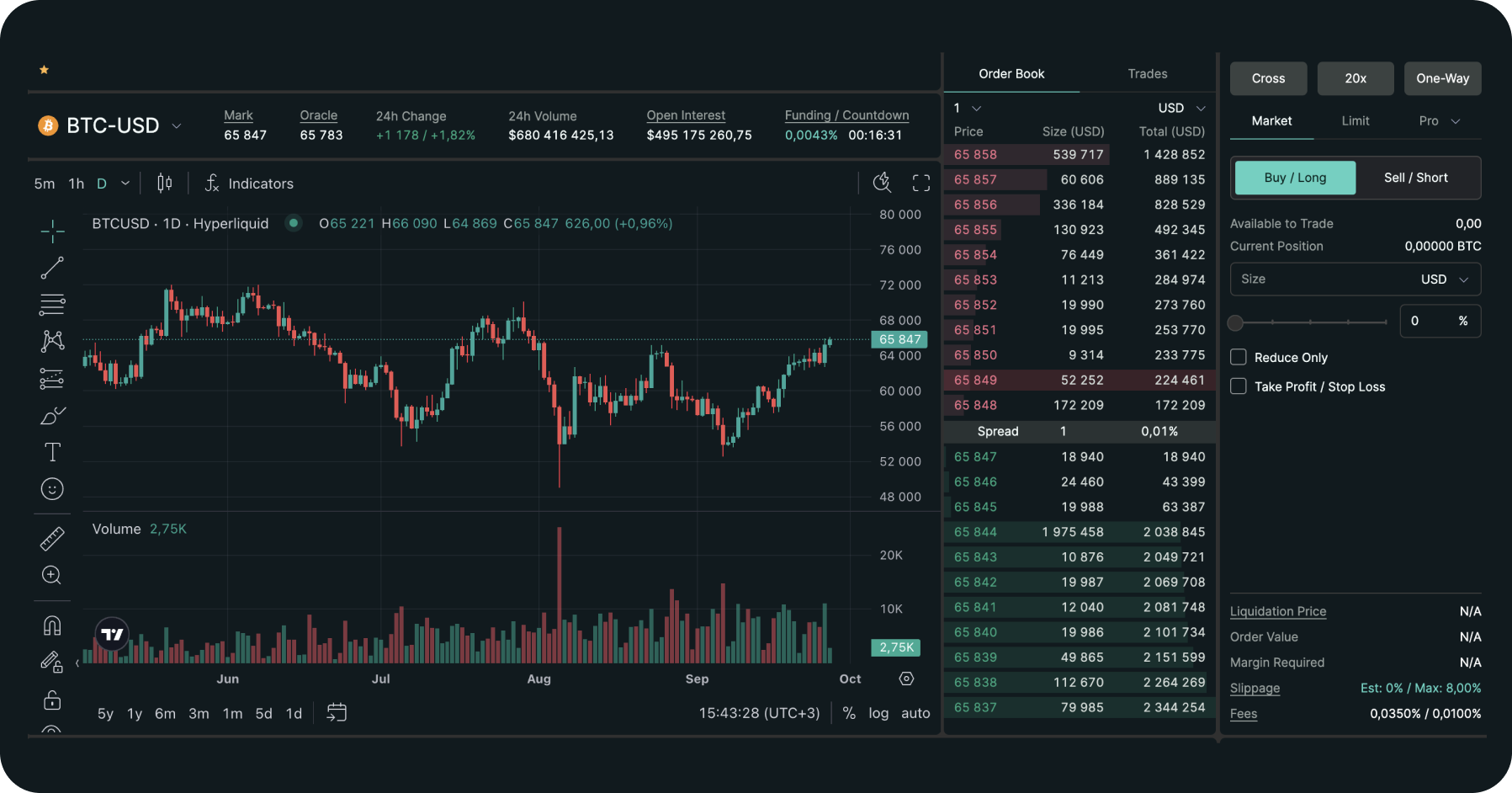

Huperliquid is developing a platform for decentralized derivatives and spot trading. A key feature of Huperliquid is its own L1 blockchain, designed to support permissionless on-chain trading.

The Huperliquid L1 uses the HyperBFT consensus algorithm, which offers block latency of less than 1 second and supports the execution of up to 100,000 orders per second.

The platform's main product is a decentralized exchange for perpetual futures, based on an on-chain order book. Users can trade futures with up to 50x leverage (for BTC and ETH).

In addition to perpetual trading, Huperliquid offers pre-market token trading before official listings.

Huperliquid's innovations in the realm of decentralized derivatives exchanges include two groundbreaking features: HIP-1 and HIP-2.

- HIP-1

HIP-1 is a standard for fungible tokens with a limited supply. This standard allows the creation of on-chain order books between pairs of tokens using the HIP-1 standard.

HIP-1 has now become the new token standard for spot market trading on Huperliquid, which plays a critical role in the decentralized derivatives exchange ecosystem. The first token launched on Huperliquid's spot market was the meme coin Hypurr (PURR).

- HIP-2 (Huperliquidity)

Since HIP-1 is a new token standard, a new liquidity bootstrapping model was needed, particularly for tokens in the early stages of price discovery. The Huperliquidity model is inspired by Uniswap but interacts with Huperliquid’s on-chain order book. HIP-2 represents a fully decentralized liquidity provision strategy, making it a key component in the growing DEXs landscape.

Unlike traditional automated order book strategies, there are no operators here. The logic of the strategy is secured by the same consensus mechanism that governs the order book itself. Huperliquidity ensures a price spread of 0.3%every 3 seconds, making it a valuable tool for decentralized derivatives exchanges.

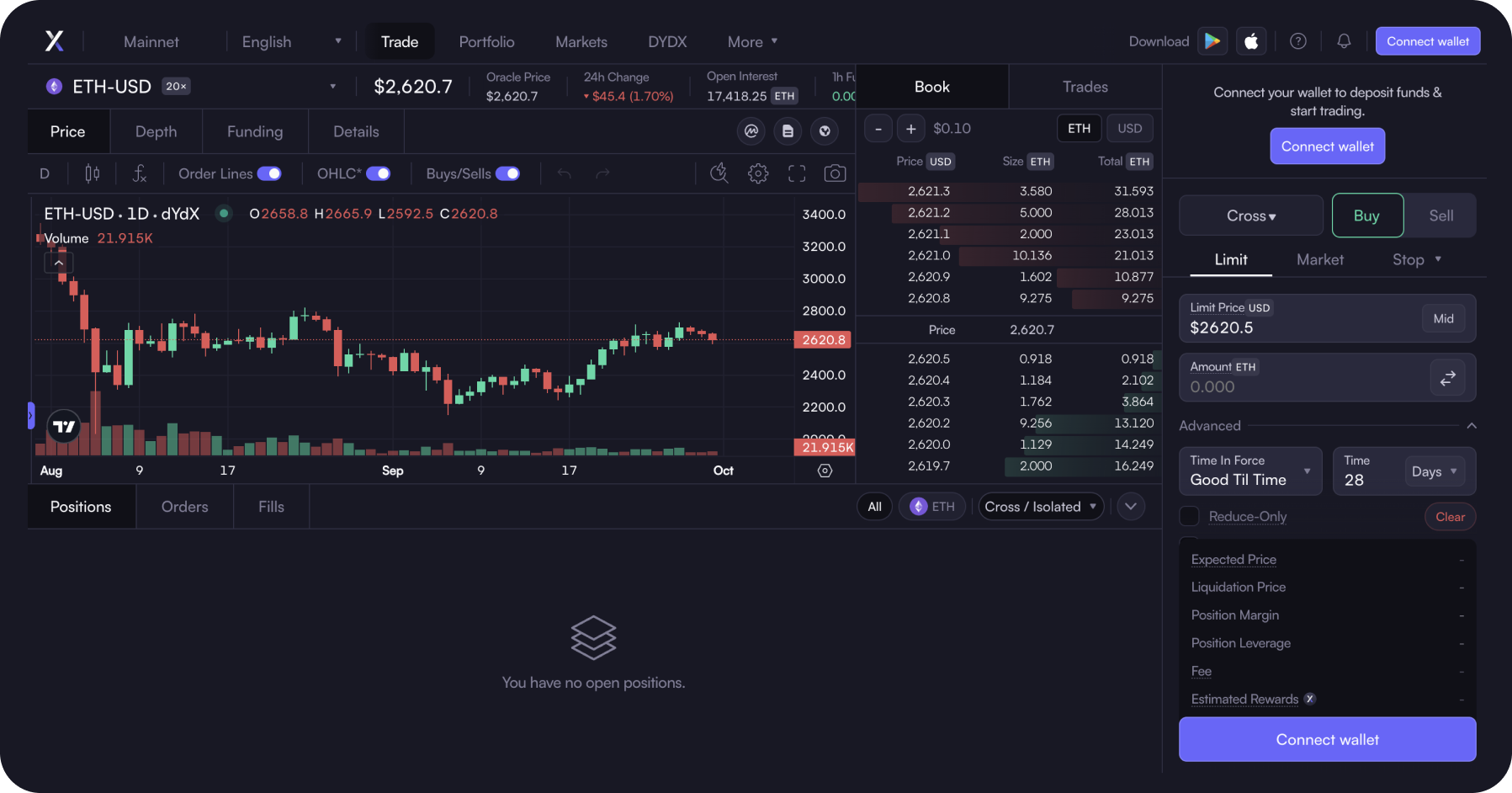

dYdX (DYDX)

dYdX is a decentralized exchange for perpetual futures trading, supporting 140 crypto assets with up to 20x leverage. Initially launched on Ethereum, dYdX later migrated to an L2 solution by StarkWare to reduce transaction fees and increase throughput.

In October 2023, dYdX launched version 4 (dYdX v4), operating on its own blockchain, dYdX Chain, built using Cosmos SDK with the Tendermint proof-of-stake consensus. The migration allowed dYdX to decentralize its order book and increase throughput to 2,000 TPS (transactions per second).

In addition to the desktop version, dYdX also offers a mobile app, available on both iOS and Android.

The platform’s native token, DYDX, is used for staking and governance within the protocol of this decentralized derivatives exchange. Through staking, users can delegate their DYDX tokens to validators on the dYdX Chain, enhancing the network’s security.

Staking rewards are generated from trading fees (in USDC) earned by the protocol, as well as transaction fees (in USDC or DYDX).

DYDX token holders can also participate in governance by voting on improvement proposals (DIPs), a common practice in DEXs. When a proposal reaches the necessary quorum, it becomes part of the platform’s roadmap.

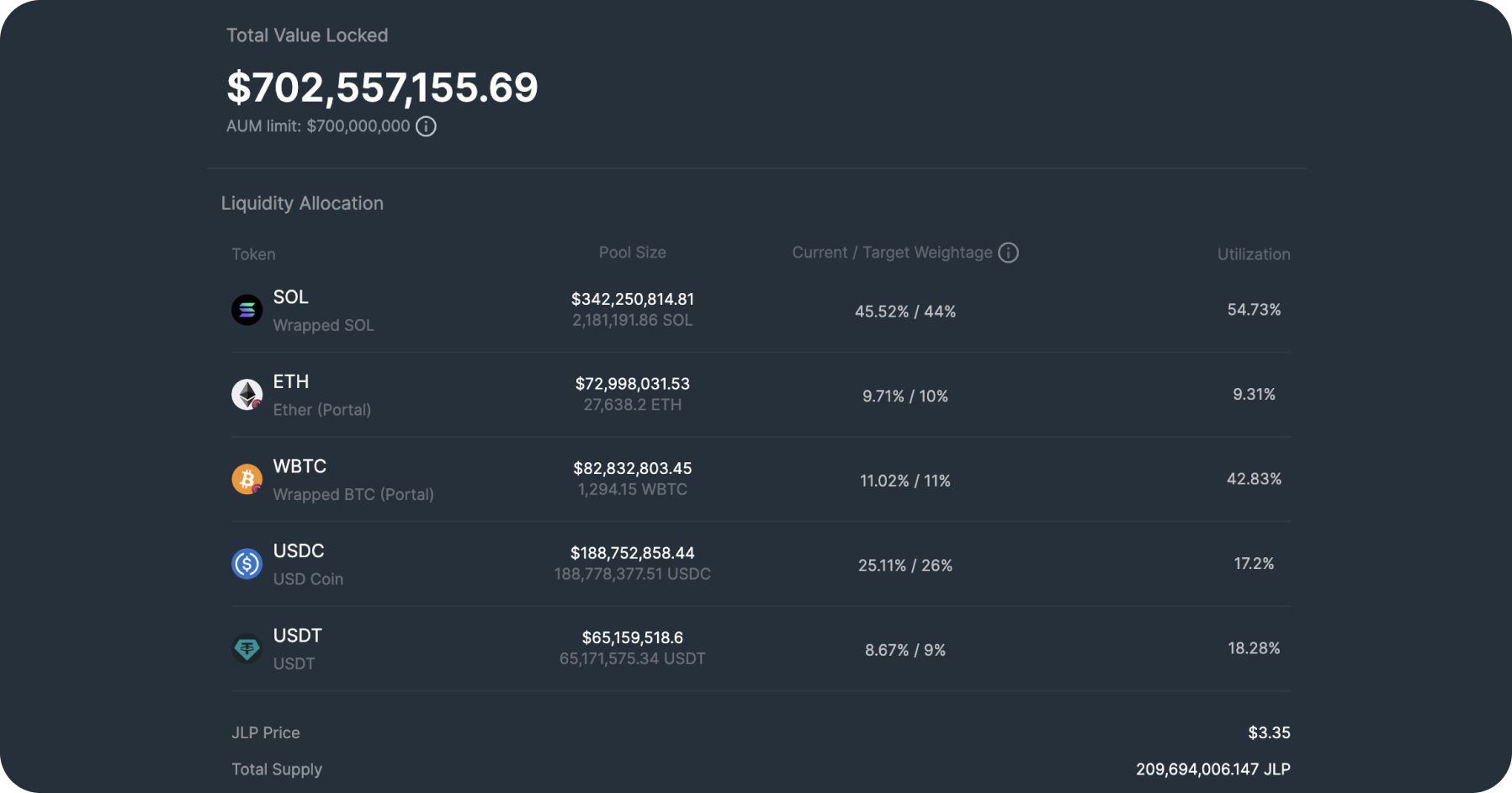

Jupiter (JUP)

Jupiter is the largest DEX aggregator and decentralized derivatives exchange on the Solana blockchain, offering perpetual futures trading on three major assets—SOL, BTC, and ETH—with up to 100x leverage.

Despite the limited asset selection, Jupiter has become one of the top derivatives DEXs by trading volume in 2024, offering nearly zero slippage, no impact on asset prices, and deep liquidity via LP pools.

The Jupiter Liquidity Provider (JLP) pool acts as a counterparty to traders when executing trades on this decentralized derivatives exchange. When opening leveraged positions, traders borrow funds from the JLP pool. In return, the pool earns trading fees (75% of which are collected) and distributes them among liquidity providers.

To become a liquidity provider on Jupiter, one can purchase JLP tokens, which represent your share in the pool (composed of USDC, USDT, SOL, wBTC, and ETH). You can buy and sell JLP tokens, which are SPL tokens, like any other token using Jupiter pools. The current APY for the JLP pool is 30.87%.

Sources of yield include:

- Token index: SOL, ETH, wBTC, USDC, USDT

- PnL (Profit and Loss) from traders

- 75% of protocol fees

The primary token of Jupiter, JUP, serves as the protocol’s governance token for the decentralized derivatives exchange. Token holders can participate in decision-making regarding platform development, updates, and other aspects. Participation occurs through voting on proposals submitted via a dedicated governance portal.

Users can get all the mentioned coins on SimpleSwap.

Summary

Derivatives DEXs are one of the fastest-growing sectors in DeFi, attracting traders with decentralized trading experiences and non-custodial asset management.

The most popular derivatives DEXs offer perpetual futures trading on various crypto assets with leverage and decentralized order books.

Notably, 2 out of 3 of the top derivatives DEXs by trading volume operate on custom blockchains tailored to their functionality.

The rise of custom chains, focusing on specific aspects like trading and liquidity provision, is one of the defining trends of 2024.

As DEXs continues to gain traction, this sector of DeFi is poised for significant growth, with more traders likely to favor decentralized protocols over centralized exchanges. This is a space to watch closely in the coming years.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.