Yield Farming: Uniswap v3 Stablecoin Farming

Key Insights

- Uniswap V3 allows creating liquidity pools with flexible pricing logic.

- By adding liquidity in stablecoin pairs like USDC/USDT, investors can minimize risks from price fluctuations.

- To earn fees, add funds to the pool and set the price range based on commission. Deposited assets will collect transaction fees.

Let’s dive in crypto yield farming with a liquidity pool on Uniswap V3.

Liquidity pool is an option for crypto investors that offers a share of commission when two tokens are exchanged in it with minimised risk. Below you can find out how it’s done via Uniswap V3.

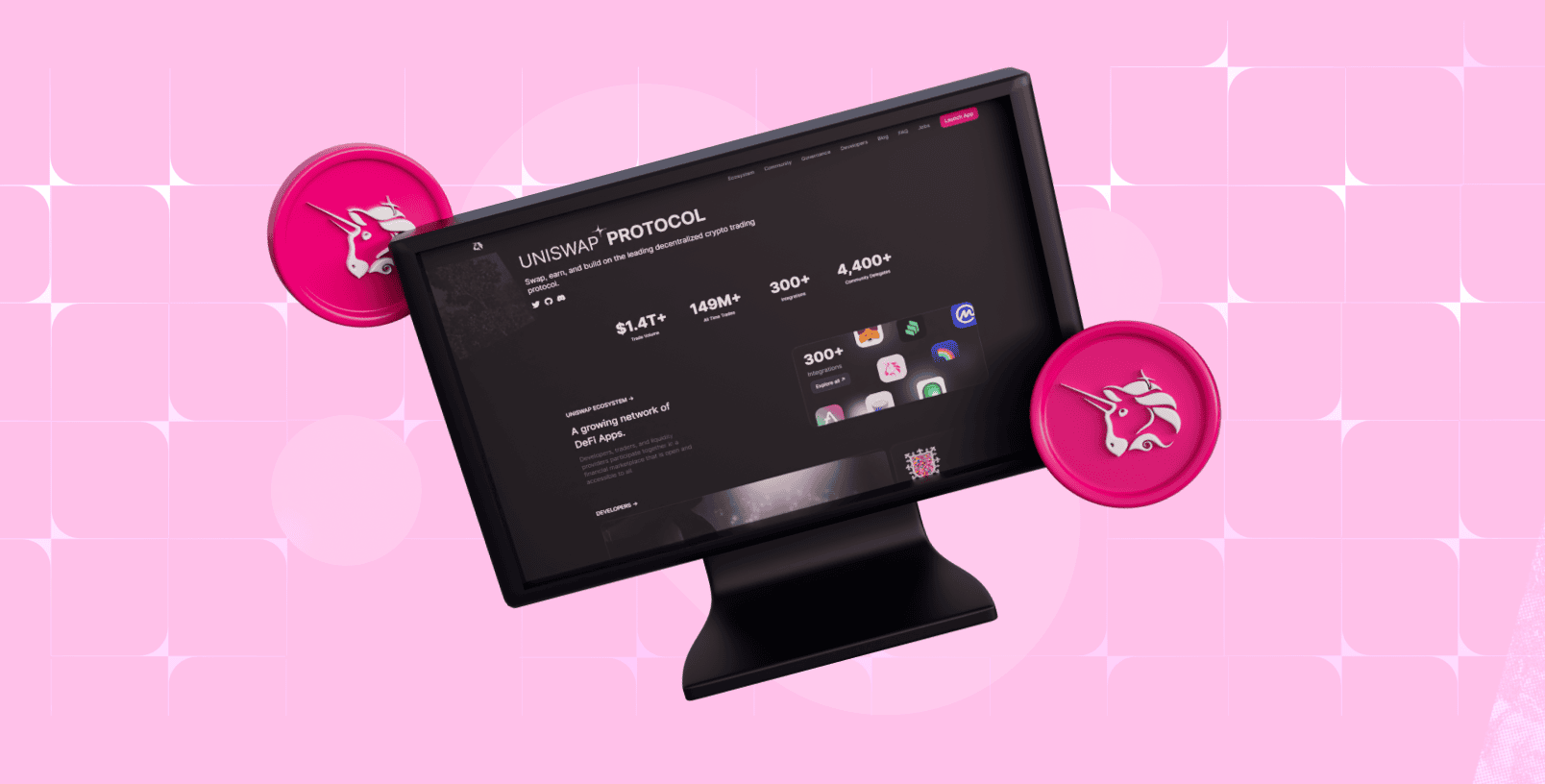

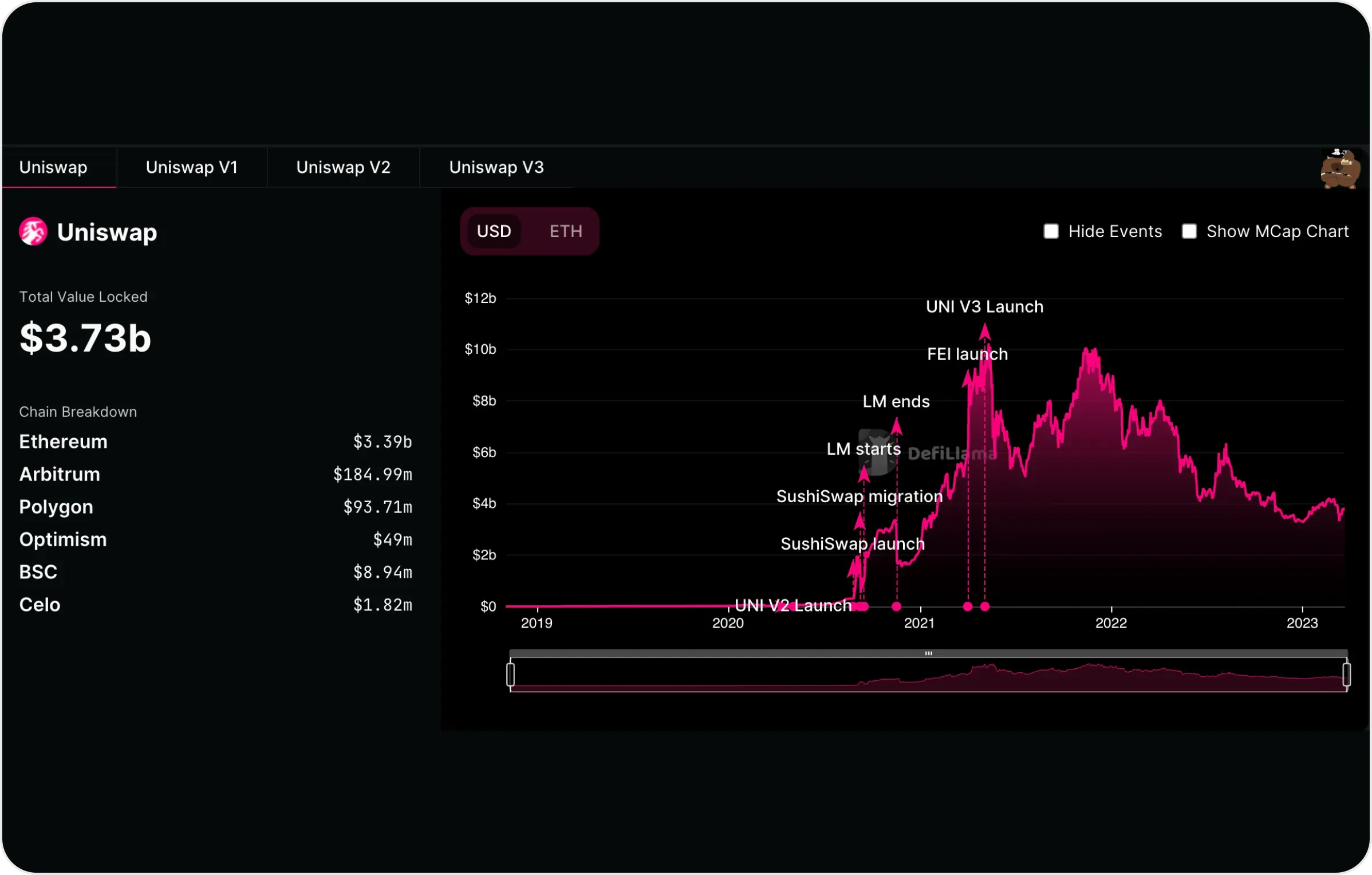

What Is Uniswap

Uniswap is a decentralized crypto exchange based on the Ethereum blockchain technology. Uniswap V3 is its third version. The main difference between Uniswap V3 and Uniswap V2 and other previous versions is the ability to create pools with more flexible pricing logic. This allows us to improve the efficiency of using liquidity and reduce losses on the exchange of crypto.

Every time there is an exchange between two tokens in the pool, you get a share of the commission for that transaction. The size of your share depends on how many coins you have deposited into the pool compared to the total liquidity in the pool.

Since USDC and USDT are stablecoins, they are not subject to significant price fluctuations, which makes them a solid choice for investors who want to minimize risk.

What Is Yield Farming

Yield farming is an investment strategy that involves providing liquidity and staking, lending, or borrowing cryptocurrency assets on a DeFi platform to earn a higher return. It is important to note that yield farming as crypto farming is a high-risk strategy. Payment may be received in additional cryptocurrency.

How to Add Liquidity to the Pool

Following is a Uniswap instruction of adding liquidity to the pool.

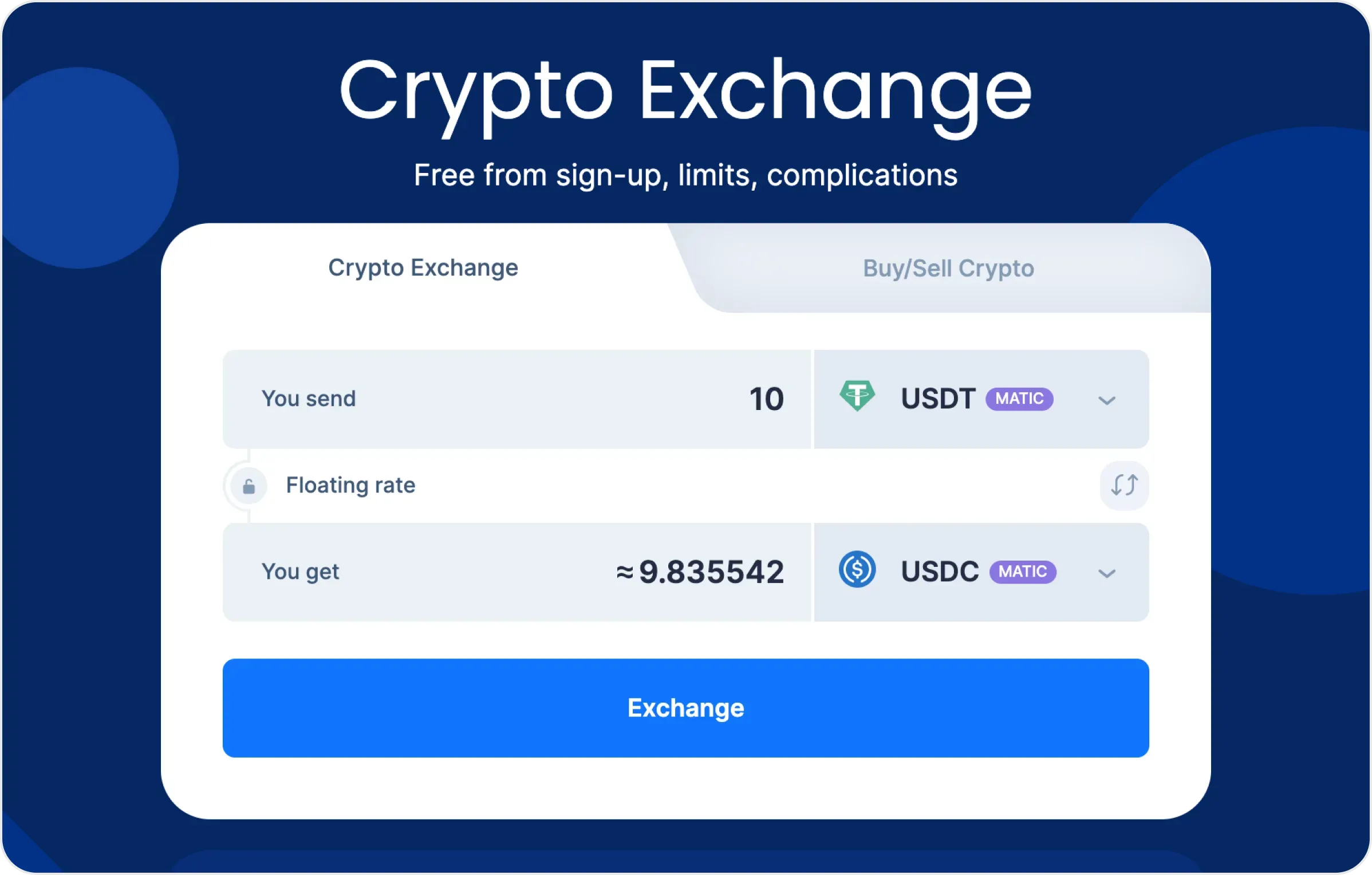

- Top up your Ethereum wallet with SimpleSwap

Before you can add liquidity to the Uniswap USDC/USDT pool, you need to have an Ethereum or Polygon wallet that supports these tokens. Top this wallet up with USDC and USDT.

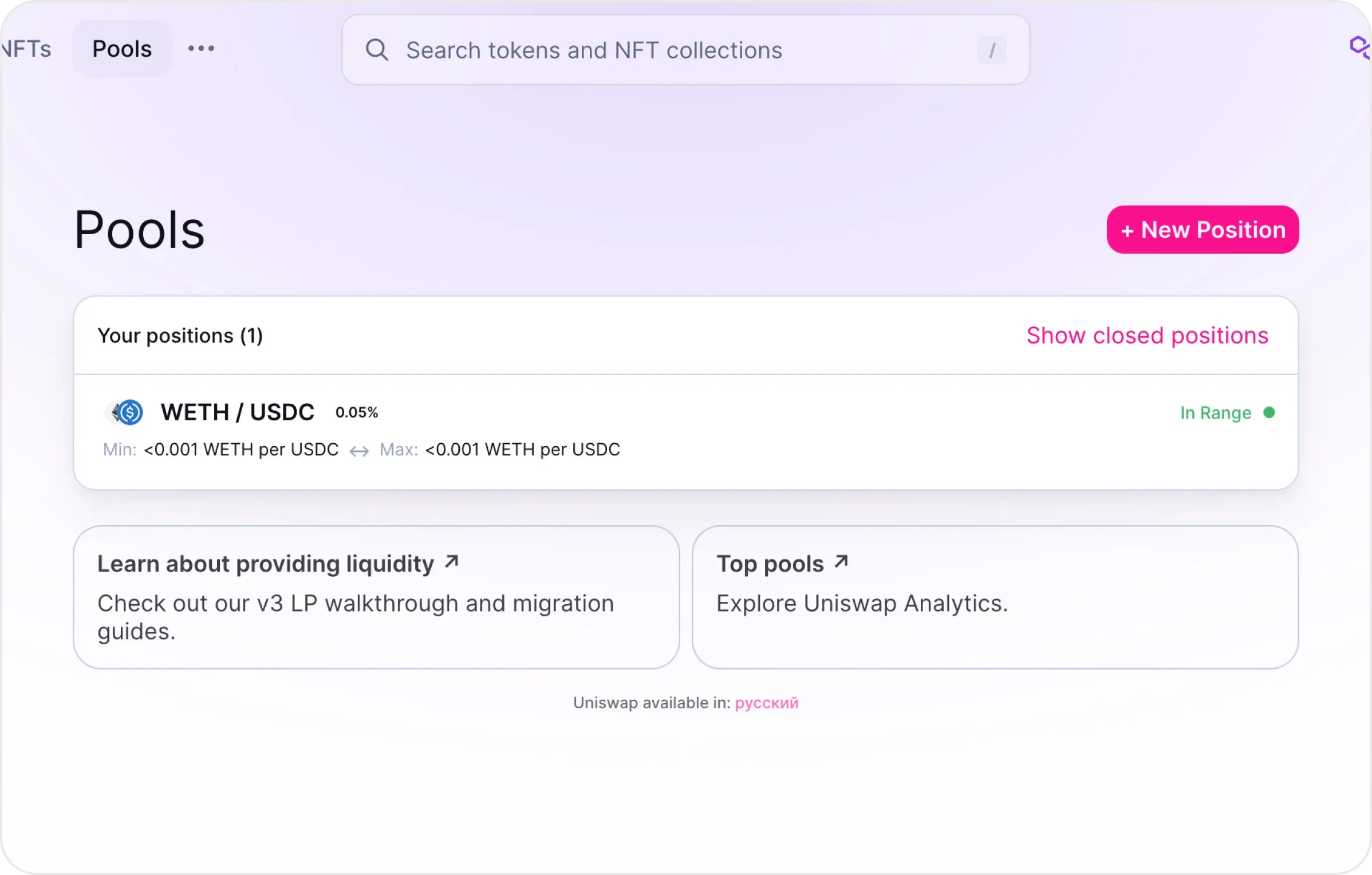

- Go to Pools on Uniswap v3

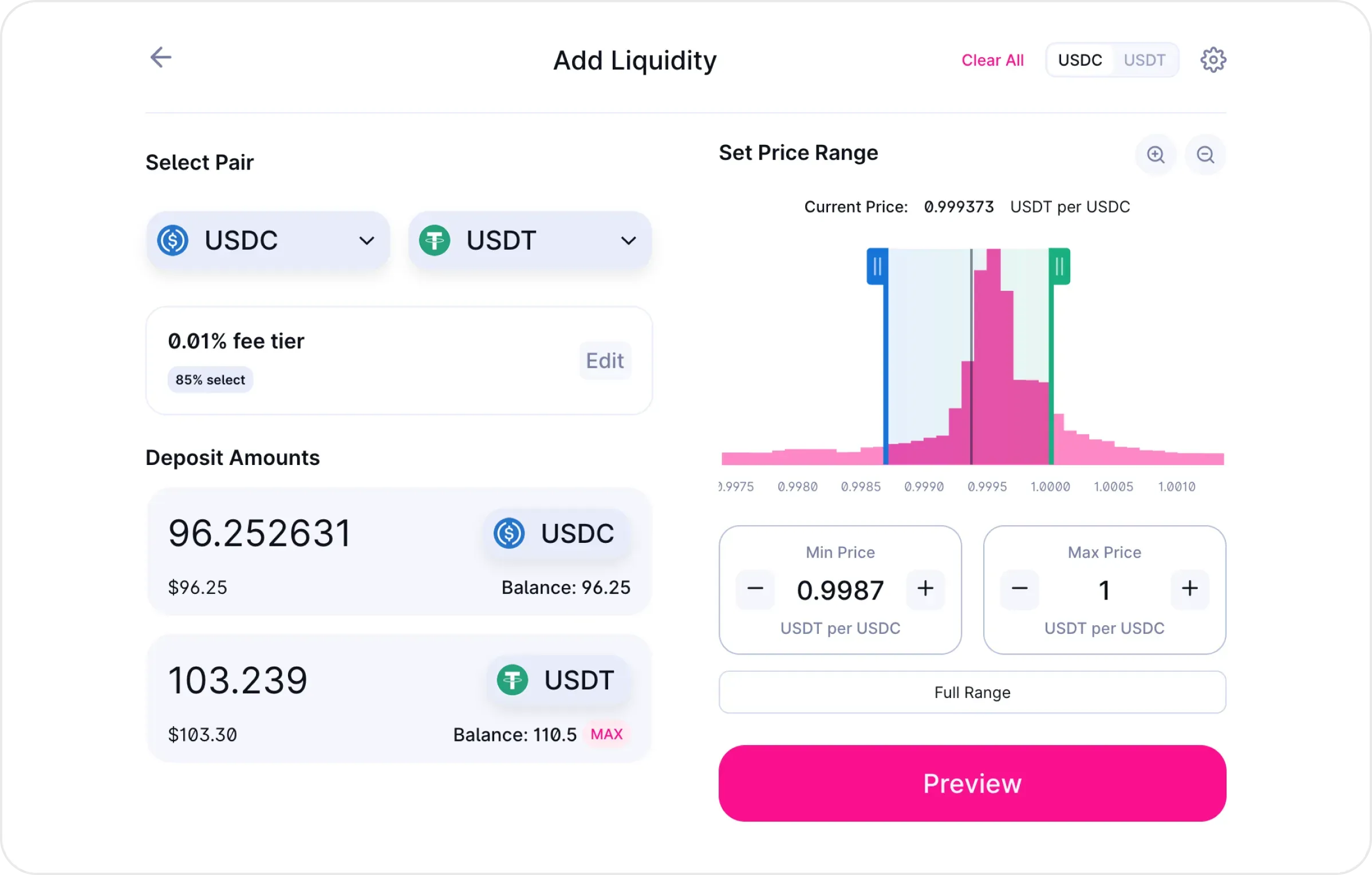

Connect to your wallet. Press +New Position and choose USDC and USDT on Polygon.

- Go to Set Price Range

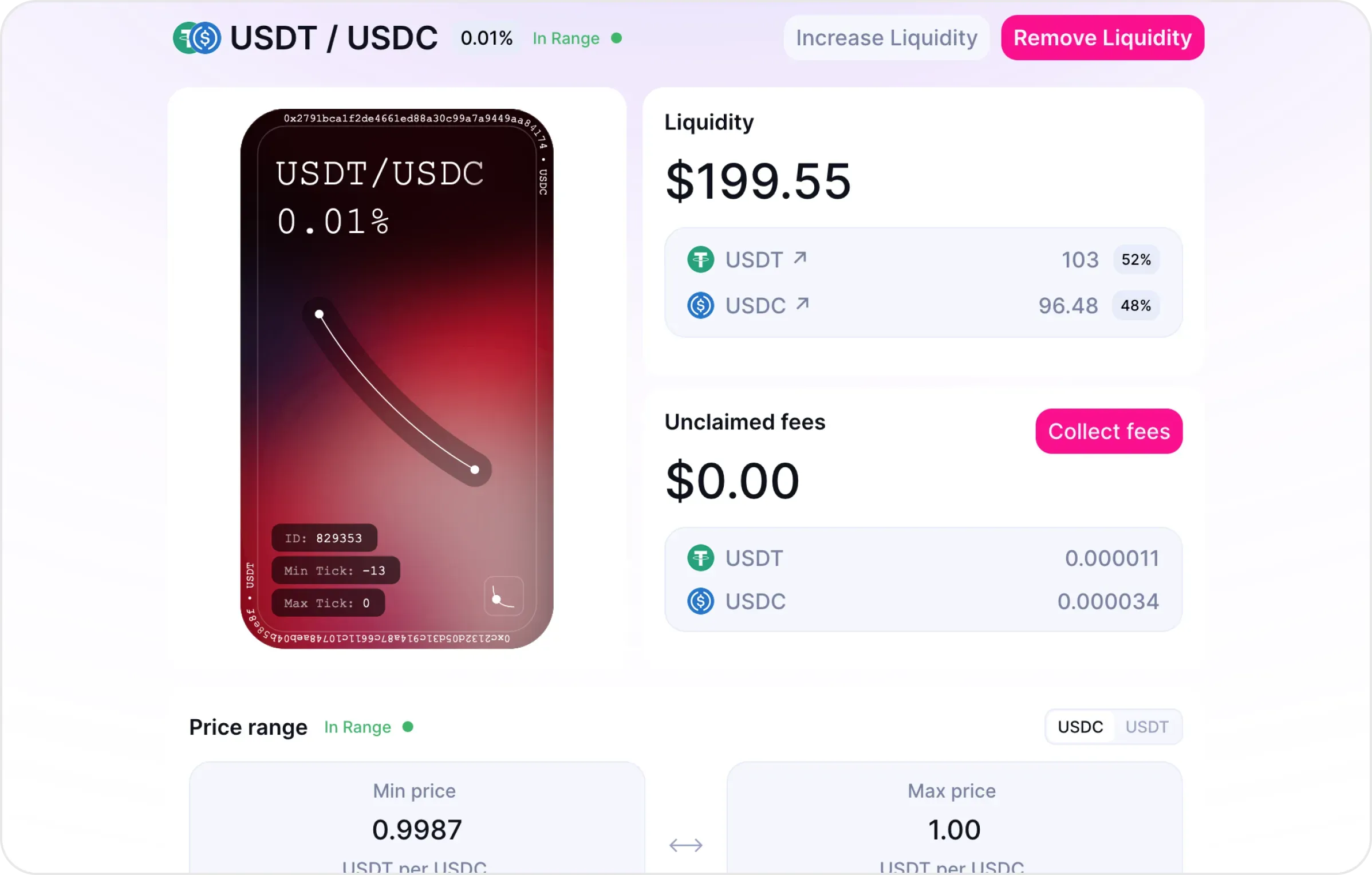

Choose the type of pool by commission and the price range you want to use for your pool. In our case, this will be0.01%, since 85% of the liquidity is in the pool with this commission. Choose the volatility range.

- Press Add to create a pool

Enter the amount of liquidity you want to add to the pool in the appropriate field in the Deposit Amounts section. Approve the selected assets and click Preview. Make sure the pool is created correctly and click Add.

- Enjoy your commissions

We’re all set. Your stablecoin pool has been created and is already earning commissions.

Thus, with this stablecoin pair, you can have passive income from crypto transaction fees.

Summary

Uniswap V3, a third version of Uniswap decentralized cryoto exchange, makes it possible to create liquidity pools with flexible pricing logic. Adding liquidity pools via USDT and USDC minimises risks of price fluctuation. A detailed instruction of how to add liquidity pools is provided.

Users can get all coins mentioned in this article on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.