Amnis Finance: Liquid Staking on Aptos

Key Insights

- Amnis Finance utilizes a dual token system with amAPT and stAPT tokens, with the amAPT token maintaining a 1:1 value with APT, ensuring liquidity, while the stAPT token automatically compounds staking rewards.

- The Amnis Finance crypto platform functions as a bridge between staking and DeFi activities, as users' staked assets (in the form of stAPT) can be deployed across multiple Aptos ecosystem protocols like Aries Markets and Meso Finance, creating opportunities for compound yields.

- The Amnis Finance crypto service provides flexible withdrawal options, where participants can choose between immediate liquidity with a small fee or fee-free withdrawals after a 14-day waiting period, accommodating different user preferences and timeframes.

What Is Amnis Finance Crypto Platform

Amnis Finance is a pioneering liquid staking protocol on the Aptos blockchain that provides users with a convenient and secure way to maximize the yield of their APT tokens while maintaining the liquidity of these assets.

Amnis Finance is an important component of the Aptos ecosystem, providing users with the ability to not only stake their APTs, but also utilize them as a liquid asset through a dedicated amAPT token.

Amnis Finance crypto platform currently offers users an annualized yield of 9.24% in amAPT coins. This allows staking participants to not only keep their assets liquid through amAPT and stAPT tokens, but also generate a steady income, making the platform attractive to long-term APT holders.

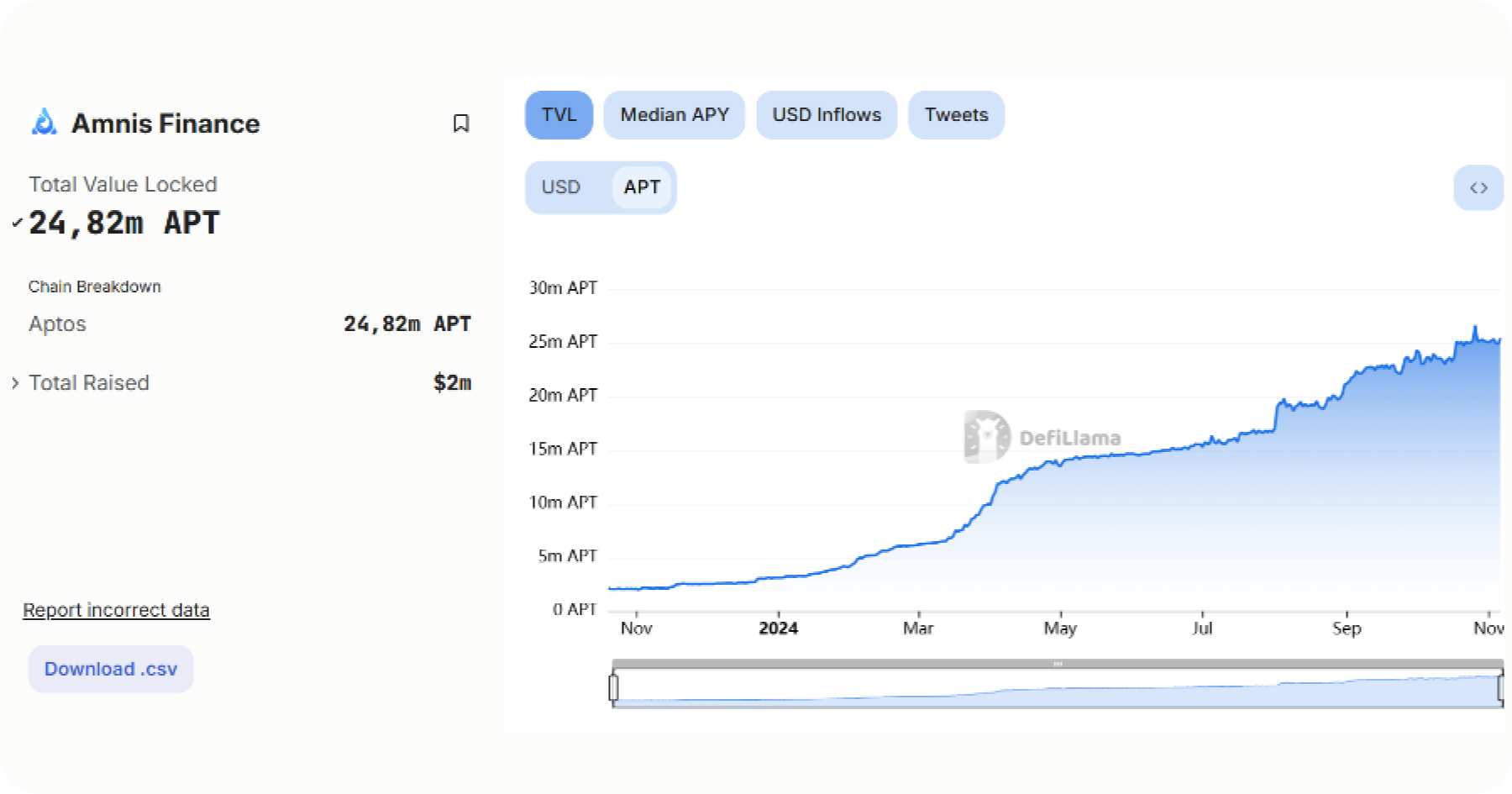

As TVL in Amnis Finance grows, user trust and interest is increasing, which also points to the development of theentire Aptos ecosystem. (We recently published a review about Aptos, which you can read here).

Amnis Finance has already accumulated almost 25 million APTs, which serve as a reserve for the liquid staking token amAPT.

What is amAPT

The amAPT token is a stablecoin linked to APT, Aptos coin, where 1 amAPT is always equal to 1 APT. Every time a user sends APT to Amnis Finance, an equivalent amount of amAPT is issued. This token preserves the liquidity of the assets, allowing holders to earn staking income without having to lock in their APTs.

Additionally, users can exchange amAPT for the Staked Aptos Coin (stAPT) token.

StAPT allows staking income to be earned automatically (autocompounding), similar to other tokens such as aUSDC from Aave and cUSDC from Compound.

As rewards from Aptos validators accumulate, the number of amAPTs in the vault increases, causing the value of each stAPT to increase. Thus, owning a stAPT entitles users to an increasing share of the amAPT vault.

Staking on Amnis Finance Crypto Platfrom

To take advantage of the liquid staking opportunities on Amnis Finance, follow these simple steps:

Wallet preparation and connection

If you don't already have a wallet that supports Aptos, create one. Amnis Finance is compatible with Okx Wallet, Martian Wallet, Pontem, Petra and more. The Aptos blockchain also allows you to use your familiar Google account, simplifying the connection process.

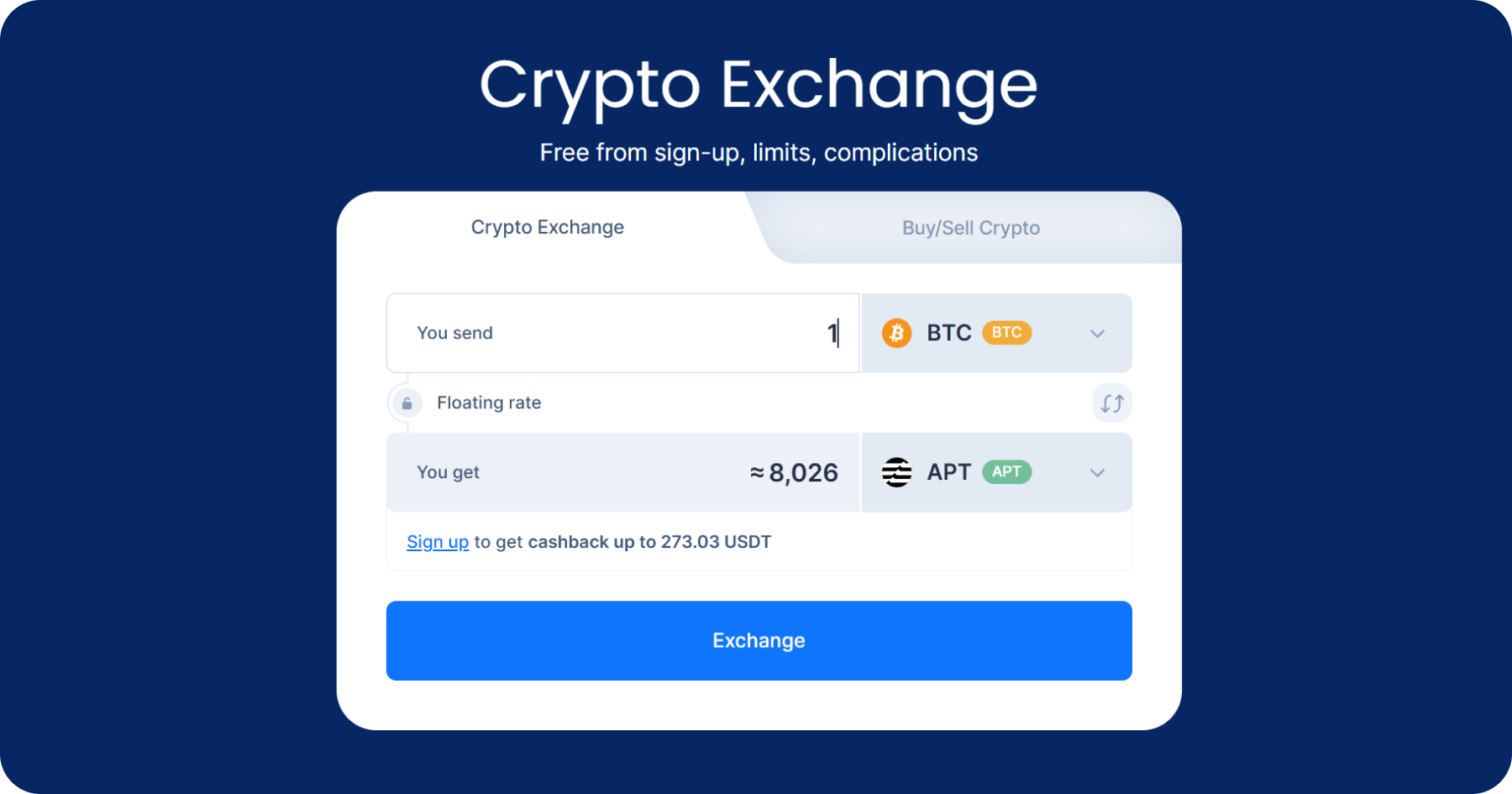

Fill your wallet with APT coins

Refill your wallet with APT coins using the SimpleSwap cross-chain exchange.

Log in to the Amnis Finance website and select a staking option

Go to the Amnis Finance website and click on Stake Now. This will take you to the home page where you can start the process.

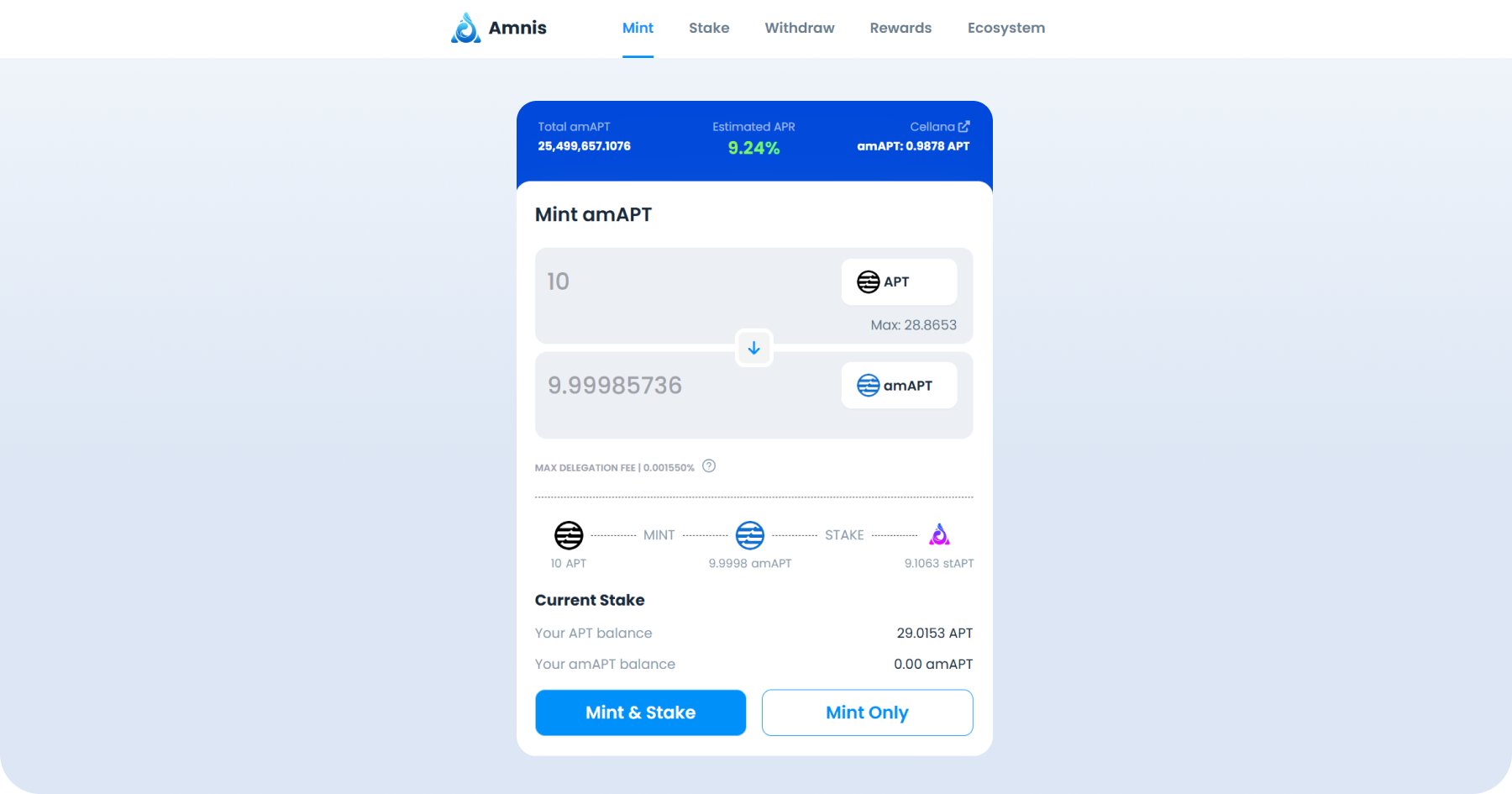

Exchange APT for amAPT

From the home page, select Mint. Here you can exchange your APT tokens to amAPT for staking. Enter the amount of APT you want to send for staking, click Mint & Stake and confirm the transaction in your wallet.

Convert amAPT to stAPT

After a successful transaction, a Staked Aptos Coin will appear in your wallet that automatically accumulates staking rewards.

You can exchange amAPT for stAPT and back to utilize the accumulated rewards at any time.

Receive stAPT tokens

Once you have staked your APTs on Amnis Finance crypto platform, you receive stAPT tokens that can be used in other projects in the Aptos ecosystem.

This way, your assets not only remain staked on Amnis Finance, but can also generate additional income, for example on Aries Markets or Meso Finance. This allows you to earn from both staking and deposit at the same time.

This approach effectively increases the return on your assets by maximizing the power of the Aptos ecosystem.

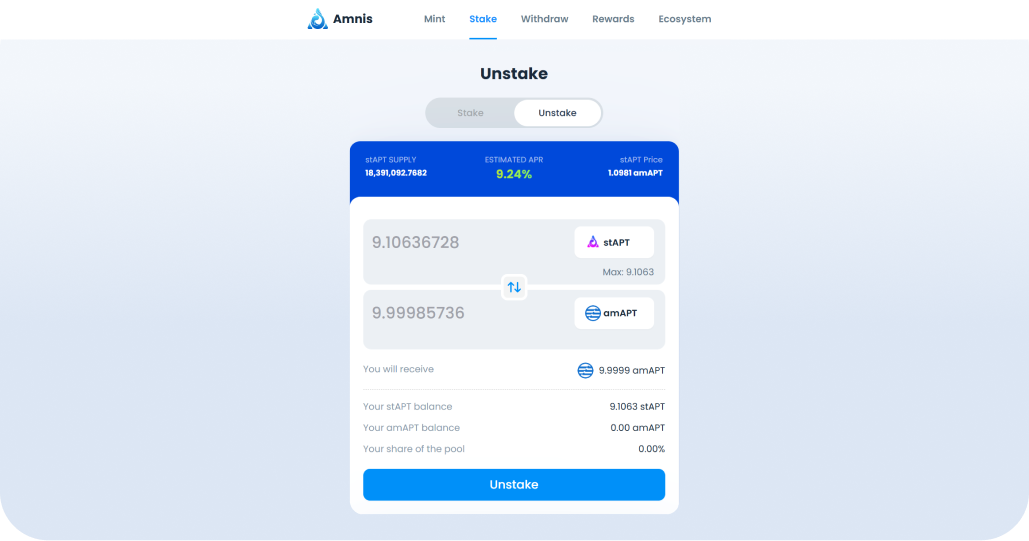

Exit staking

To return your assets from staking, select Stake from the menu, click Unstake and specify the amount you want to withdraw. The amAPT tokens will be returned to your wallet.

Convert amAPT back to APT

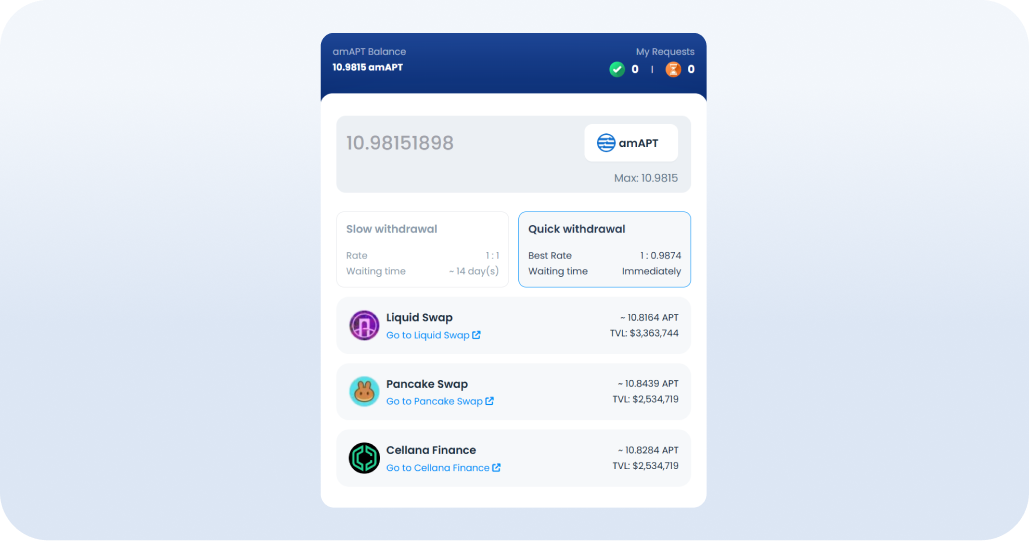

Go to the Withdrawal section, where you will be offered two options:

Withdraw APT immediately (Quick Withdrawal), but with a small fee.

Wait 14 days for withdrawal to avoid the fee.

Summary

Amnis Finance crypto platform is an interesting solution for liquid staking on the Aptos blockchain, giving users the ability to generate stable returns while maintaining access to their assets.

With the amAPT and stAPT tokens, users can participate in staking without limiting their ability to work with other projects in the ecosystem.

This kind of flexibility makes Amnis Finance particularly attractive to long-term investors looking to maximize the return on their assets.

The ability to utilize the stAPT token in other Aptos DeFi protocols, such as Aries Markets and Meso Finance, allows users to not only earn money from staking, but also increase their income through additional ecosystem tools.

With the growing interest in the Aptos ecosystem, Amnis Finance looks promising for those who want to generate income from liquid staking in the long term by capitalizing on new DeFi opportunities.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.