Maximizing ETH Holdings Return Strategy

Key Insights

- Many centralized exchanges provide ETH staking service for its users.

- While staking on CEX is the easiest way to increase earnings from your ETH holdings, it is also associated with the highest risk.

- Liquid staking is a popular strategy for Ethereum holders that want to maximize earnings and keep their ETH liquid.

What Is Ethereum

To properly present this crypto strategy, let’s look into what is Ethereum.

Ethereum (ETH) is the leading L1 blockchain and smart contract platform for running decentralized applications and protocols. ETH is a native token of Ethereum and ranks second by market capitalization among all cryptocurrencies.

ETH is used for paying transaction fees in Ethereum network and a wide range of Ethereum-based L2 chains. After Ethereum migration to Proof-of-Stake consensys mechanism ETH is also used to secure and validate the work of blockchain via staking process.

ETH is one of the most popular crypto assets globally and is actively utilized in various investment strategies. Recent news about the approval of ETH spot ETFs in the US has increased its value as an investment tool and has the potential to propel its price to new highs.

While holding ETH is a popular strategy among crypto investors, there are several ways to use your ETH to substantially increase your earnings compared to simply holding it in a wallet.

These strategies differ by risk-reward ratio, so investors should choose a crypto strategy that aligns with their risk management approach.

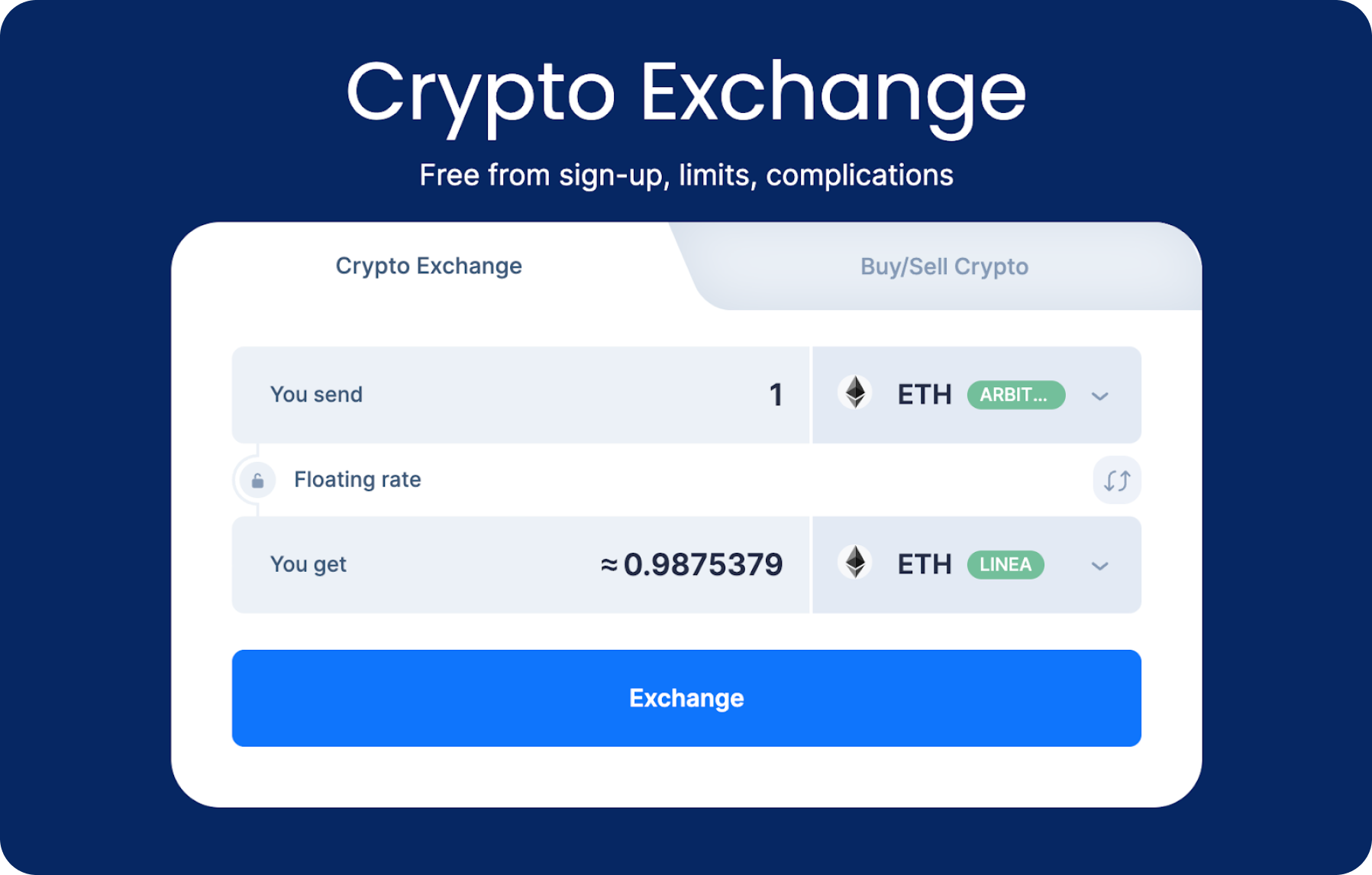

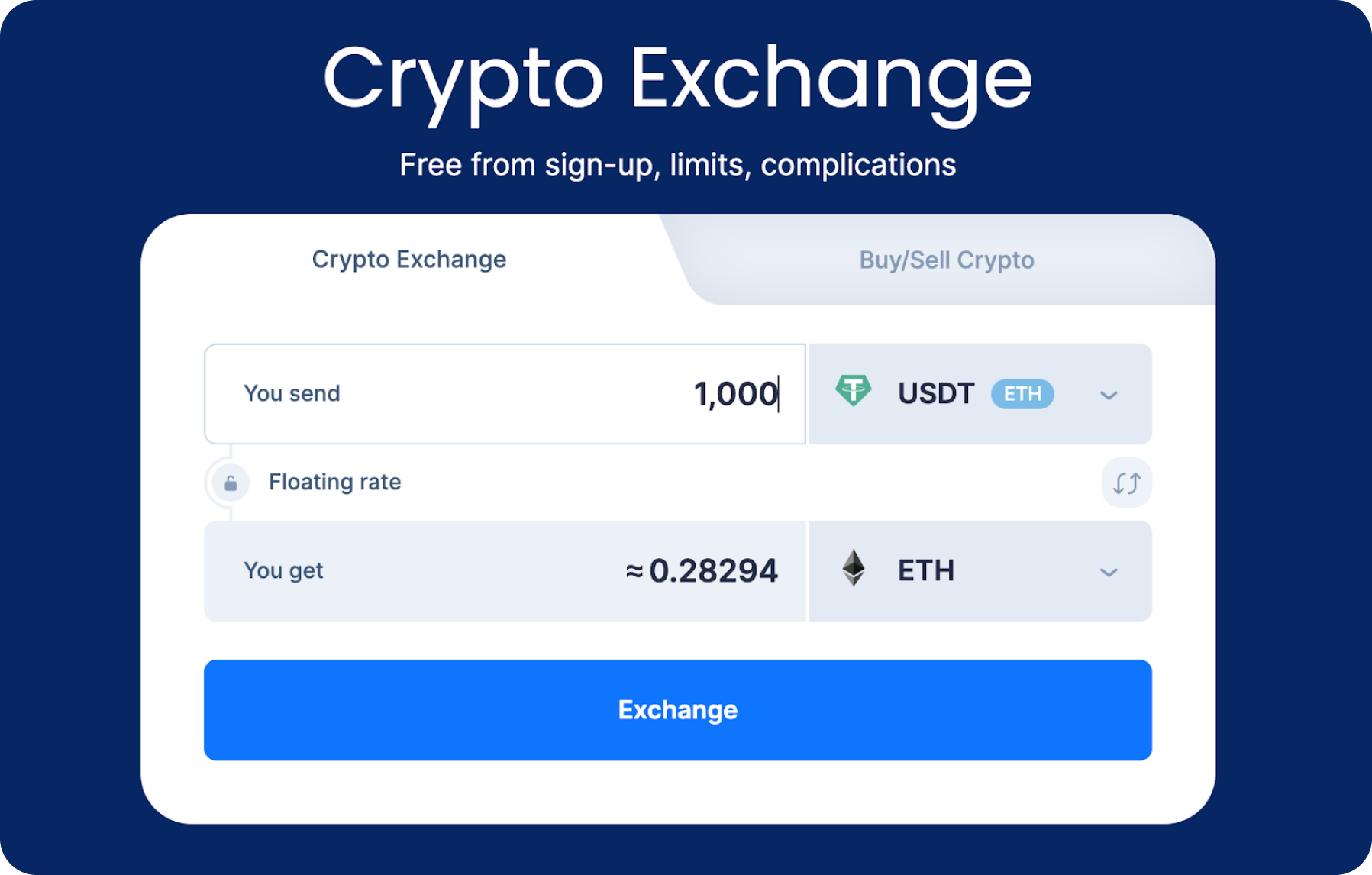

Before we start, note that you can easily buy or exchange ETH using SimpleSwap service featuring instant exchanges with minimum fees and a variety of assets to swap. For example, you can buy ETH for USDT within a SimpleSwap user-friendly interface.

Ethereum Staking

Staking is the most straightforward strategy for ETH holders. It is a process of depositing your ETH and becoming a validator of the network. Each crypto strategy is defined below.

Solo ETH Staking

To become a solo Ethereum staker you need 32 ETH to stake. After staking ETH your validator node is activated and you will be responsible for storing data, processing transactions, and adding new blocks to the blockchain.

To become an ETH solo validator you also need specialized hardware - a computer that will operate online 24/7. Validator node can be deployed on your personal computer, however for more efficiency validators prefer to use special hardware.

Instructions for deploying and activating nodes can be found on Ethereum website. Also, Ethereum has developed dApp Node - free and open-source software that gives users app-like experience in managing nodes without the need for technical skills and work with code.

In exchange for your validator work you will receive rewards in ETH. Current validator APR is 3.3%. ETH rewards will be periodically deposited to your withdrawal address.

Solo ETH staking is the gold standard for staking that ensures the maximum level of security for your ETH as you do not need to trust any intermediaries and custodians.

The drawback of solo Ethereum staking is high financial requirements for running node plus illiquidity of your ETH. Once staked, your funds will be locked and you will not be able to use your staked ETH in dApps, sell or send it. To withdraw your assets you should initiate a withdrawal process that takes a variable amount of time.

ETH Staking as a Service

This staking option also requires 32 ETH to be staked to activate your validator role, but you can delegate node operations to third-party providers.

To put it simply, in this crypto strategy you do not need to deal with technical complexities of deploying and running node using your hardware and delegate this work to a service provider that will run a node on your behalf.

Service providers charge a fee for their work that reduces your potential earnings.

SaaS is a good option if you have enough ETH and want to join Ethereum as a validator but do not want to deal with technical issues of running node on your computer.

However, this type of ETH staking is more risky compared to solo Ethereum staking as you should trust third parties and accept risks of dishonest behavior of node operators, attacks and regulation issues they may face.

The list of SaaS providers is available on Ethereum website and includes well-known names such as Kiln, P2P.org, stakefish, Consensys Staking, RockX Staking, Firment, and others.

ETH Staking on Centralized Exchanges

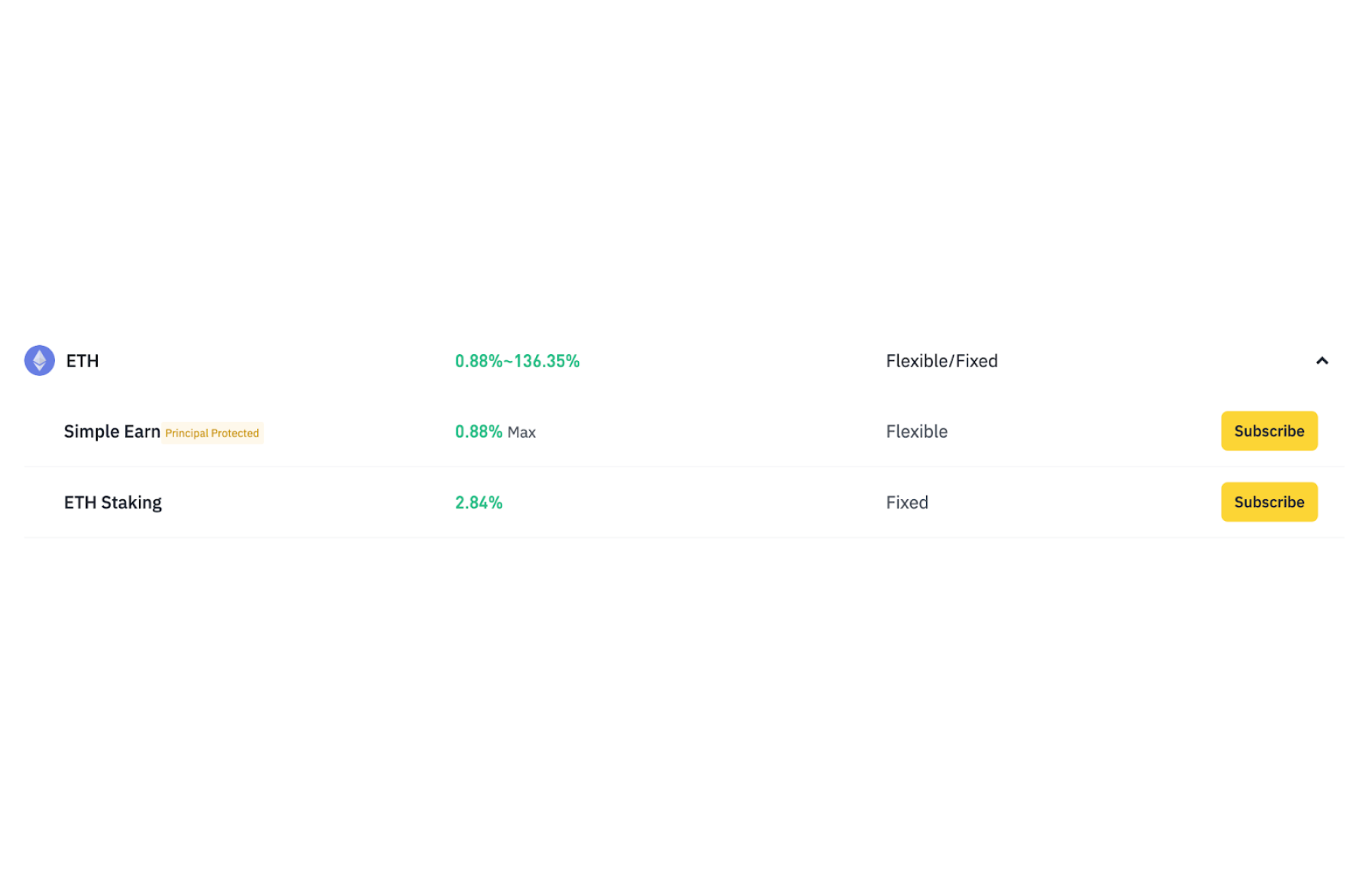

You can transfer ETH from your wallet to the CEX account and deposit it into a staking pool. You will earn yield on your staked assets with minimum efforts from your side. For example, Binance suggests 0.88% - 2.84% estimated APR on your ETH.

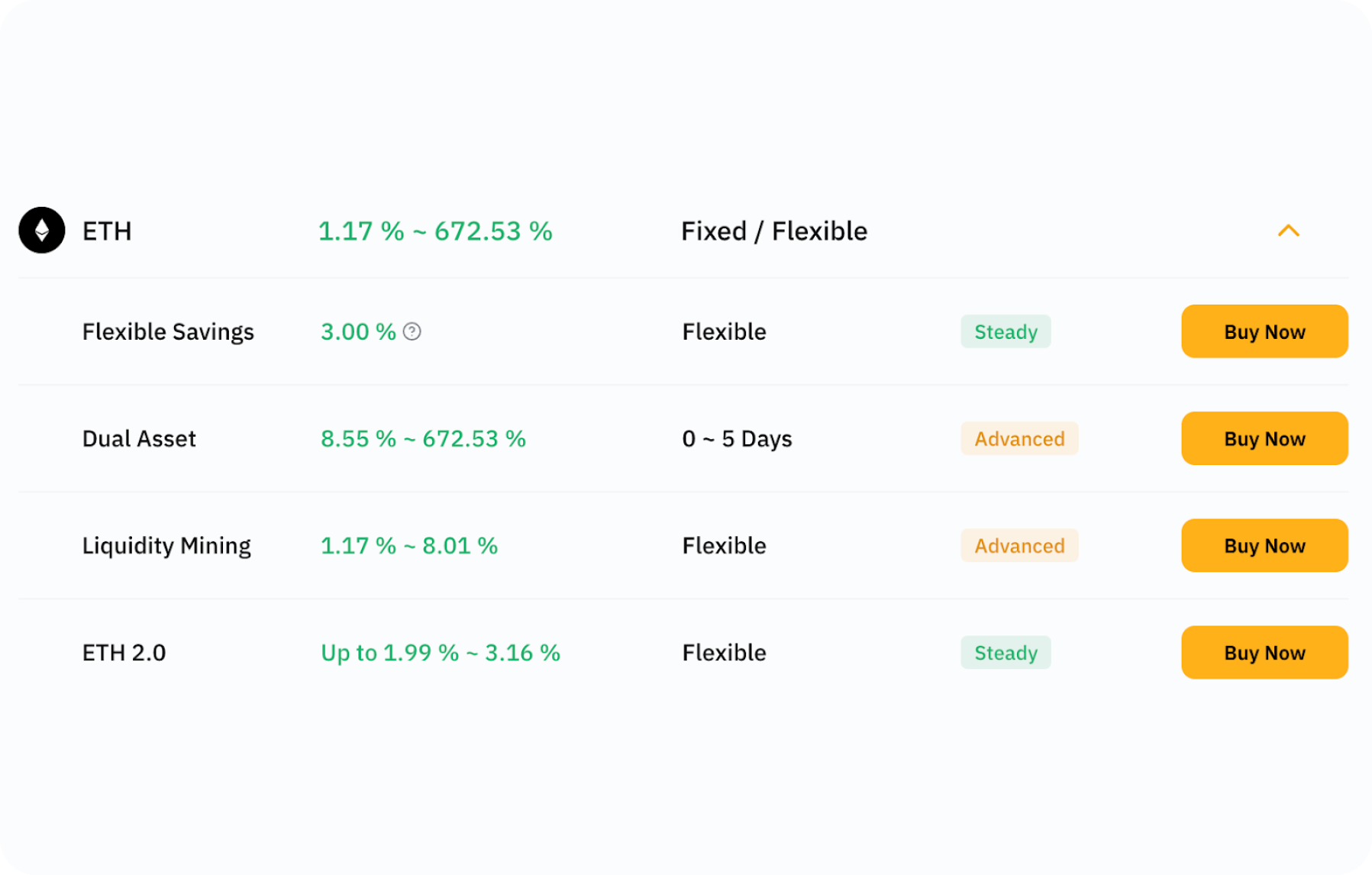

Bybit provides 1.99% - 3.16% APR on ETH 2.0 staking with advanced options, for example liquidity mining with APR up to 8.01%.

While ETH staking on CEX, you do not own your assets and CEX acts as a custodian of your funds. It can block your account at any time and freeze your assets.

There is also a risk of CEX facing problems with liquidity due to unpredicted market movements or exchange fraudulent activities. In this case it can stop withdrawals and you will not be able to access your funds.

Moreover, CEX concentrate a large amount of ETH to run large numbers of nodes that reduces network decentralization making Ethereum blockchain more vulnerable to attacks.

Liquid Staking

Liquid staking provides you with the option to participate in the staking process without the need to own 32 ETH. You can enter liquid staking with any ETH amount you are going to stake.

Another advantage of liquid staking is the liquidity of ETH.

You will receive a liquid staking token (LST) in exchange for your deposited ETH and can use LST in other DeFi activities increasing your capital efficiency and earnings. The popular solution for liquid staking is Lido Finance.

Lido has its LST - stETH, a rebasing utility token representing your staked ETH in Lido. Owning stETH you will earn 3% APR plus additional income from utilizing LST in other protocols.

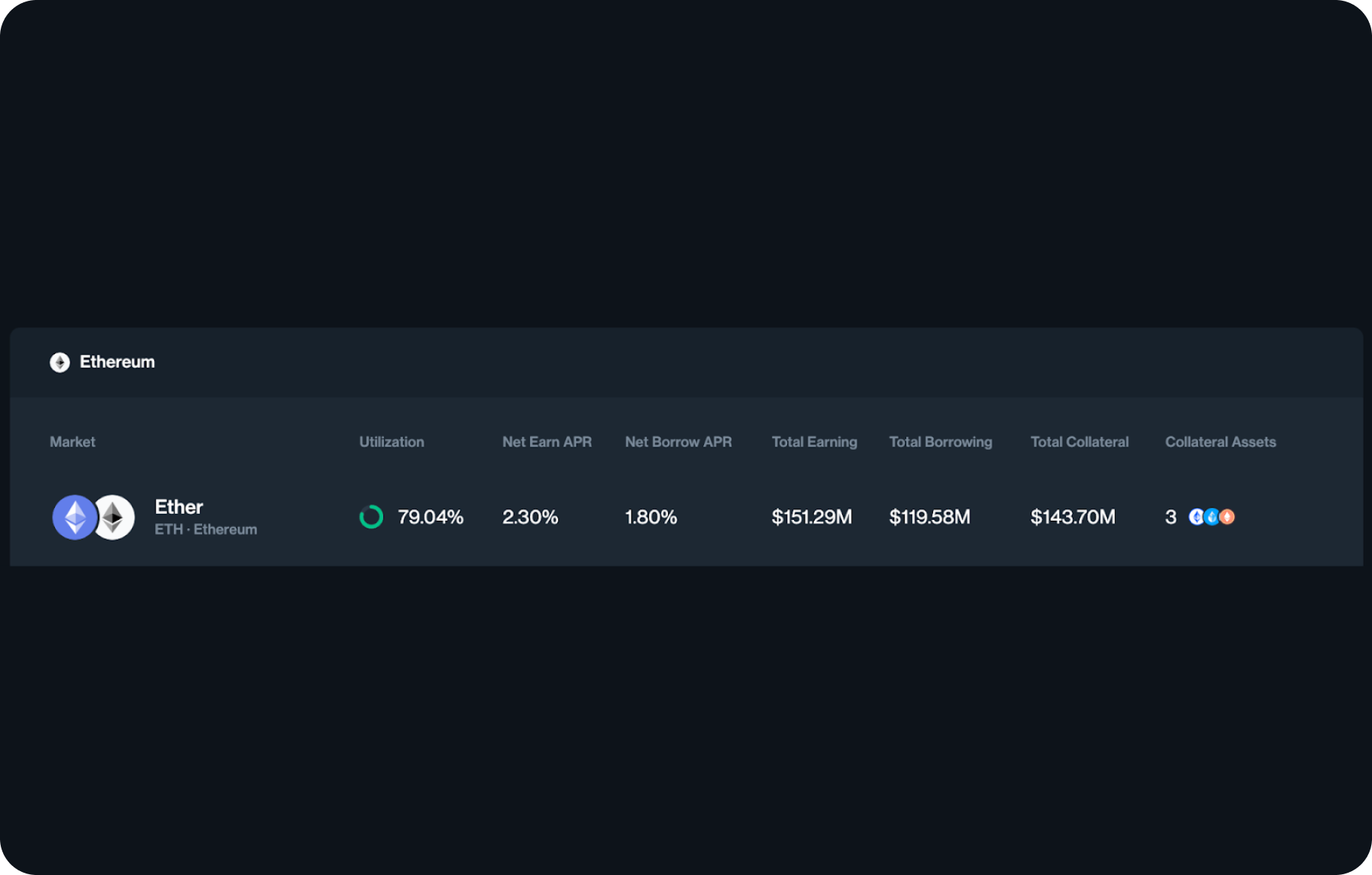

For example, you can supply stETH into Compound vaults and earn an additional 2.3% APR. Thus, your income from ETH will be 3% APR from liquid staking + 2.3% APR from Compound.

Liquid Restaking

Liquid restaking expands the concept of liquid staking enabling the reuse of ETH on the consensus level.

You can opt for liquid restaking to earn additional rewards and enhance crypto economic security of Ethereum blockchain. You can delegate your ETH into popular liquid restaking protocols, such as EtherFi, Renzo, Kelp, and others.

Moreover, leveraging liquid restaking solutions you will be able to earn additional rewards together with staking and restaking APR on your ETH. One possible crypto strategy to maximize your earnings using liquid restaking is described below.

- Go to EtherFi website, choose Linea network and supply desired amount of ETH to EtherFi. You will get weETH- liquid restaking token issued by EtherFi and representing your staked ETH in the protocol.

You can easily get ETH on Linea using SimpleSwap cross-chain exchanges in a couple of clicks. You only need to choose the network and asset you want to exchange for ETH. For example you can exchange ETH (Arbirtum) for ETH (Linea) with minimum commission.

- Visit Mitosis protocol website and deposit weETH into Mitosis. You will receive miweETH - LRT token from Mitosis.

By completing this simple steps you will multiply rewards from your ETH and get:

- Staking APR (near 3%) plus restaking APR on your ETH

- EigenLayer points to be eligible for future $EIGEN token distributions

- 2x points from EtherFi to be eligible for future $ETHFI token distributions

- MITO points from Mitosis that later will be converted into Mitosis governance token

- Staking ETH on the Linea network you will also collect L-XPL points from Linea within its “The Surge” program.

Users can get ETH and any other coin for fiat or crypto on SimpleSwap.

Summary

Your ETH holdings can be utilized to earn APR from Ethereum staking and restaking processes plus farming loyaltypoints from 3 projects that further will reward point holders with tokens.

Several strategies were provided in this article, with each crypto strategy shown in detail.

Note that liquid staking and restaking is the strategy with highest earnings potential but also with the highest risk ratio. By participating in these activities you need to trust several protocols and lock your ETH without the ability to immediately sell it.

The main risks of using such strategy include LST and LRT tokens depending on the principal asset (ETH), smart contracts hacks, and fraudulent activities of projects. Always access all risks and do your own research before engaging in any activities.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.