LTC Technical Analysis

Key Insights

- After an accumulation phase, LTC experienced a bullish trend. The POC shifted up from $53.76 to $88.10, signalling sustained interest.

- Despite the 113% gains, investors continue accumulating LTC in anticipation of further appreciation.

- LTC may continue accumulating near $88.10 volume level before breaking the next resistance level.

As of writing, LTC ranks 10th on CoinMarketCap with a market cap of $7,683,001,696.

LTC Daily Timeframe

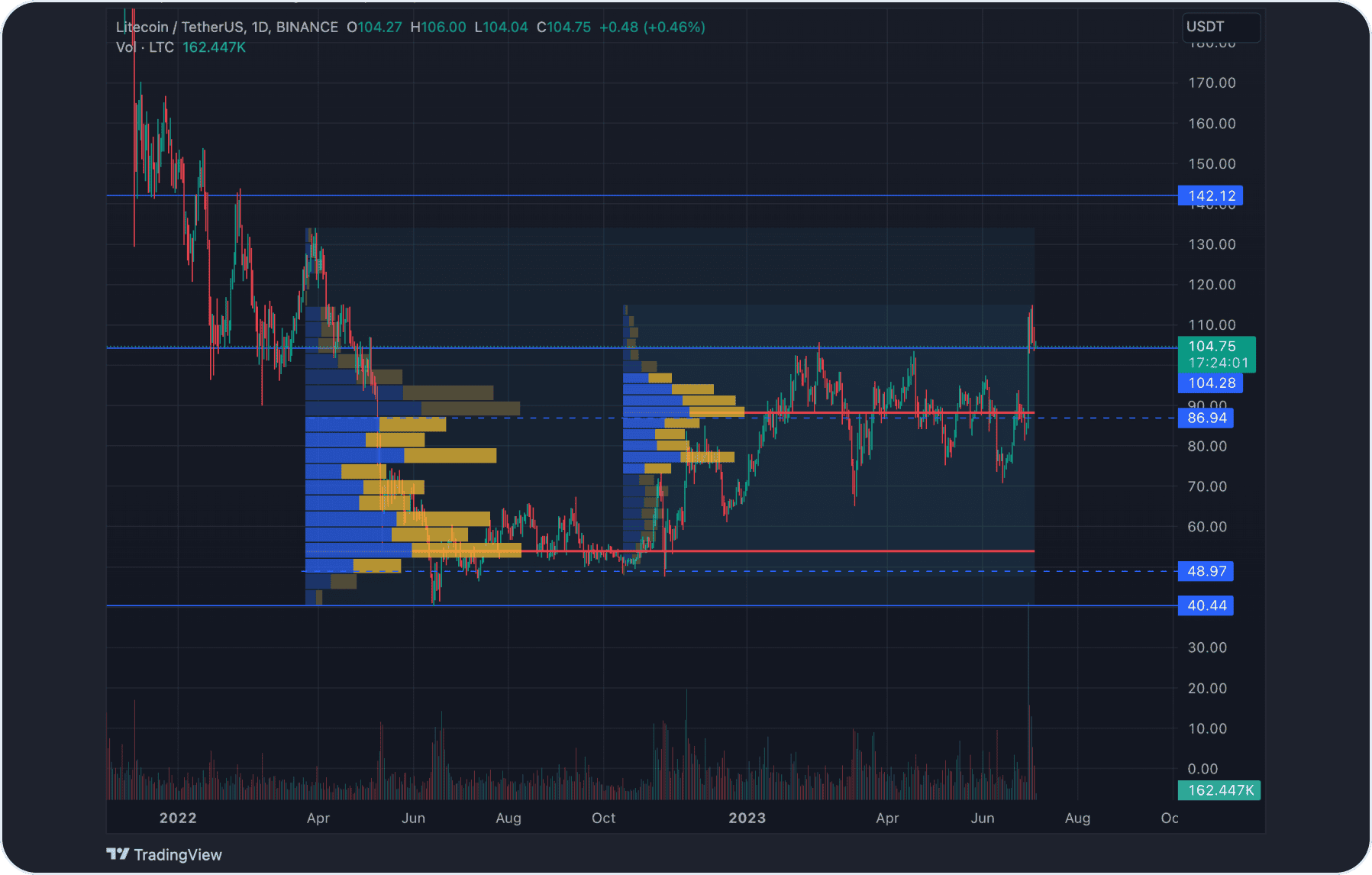

Here’s the daily timeframe of the LTC price chart.

Since the beginning of 2023, this digital asset has demonstrated a stable growth, although it went through several significant downward corrections. The maximum price dip reached over 40%, but the cryptocurrency quickly recovered from it.

After a prolonged accumulation phase lasting for 160 days, the asset showed an upward trend, rising from a price of $49 to $115; that's why the coin is a part of a market uncertainty portfolio. The increase amounted to an impressive 113%. It is also worth noting the change in the volume point of control (POC) level from $53.76 to $88.10, indicating sustained market interest in this asset.

LTC Price Prediction

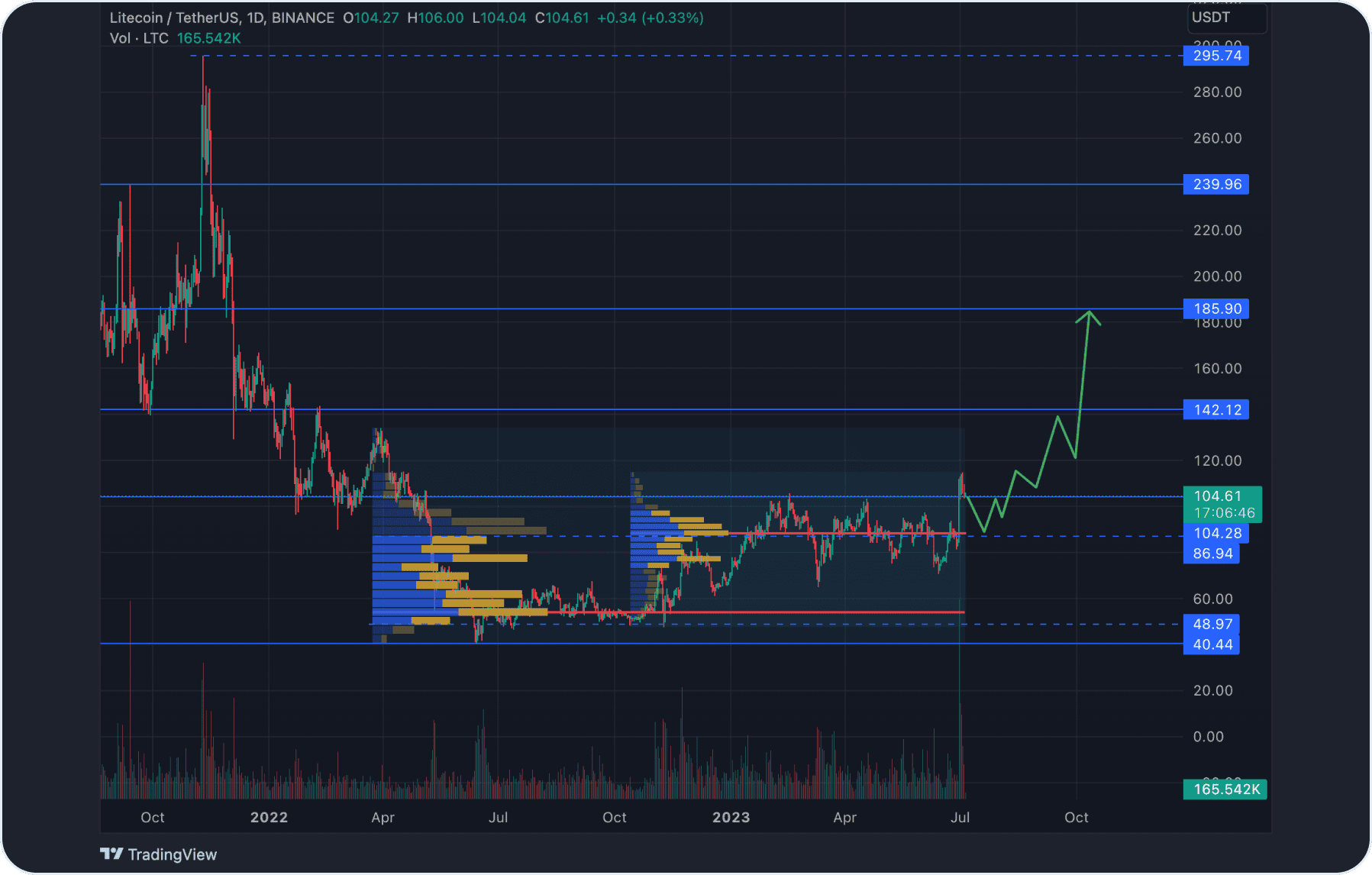

Despite the 113% growth since the beginning of the year, investors continue to accumulate long-term positions in hopes of further price appreciation.

It is important to mention that LTC's popularity was also fuelled by a lawsuit filed by the SEC against several crypto assets.

The future situation may involve the continuation of the accumulation phase near the POC volume level at $88.10, with a possible upward movement and breaking the $104.64 mark. The following price targets would then be $142 and $185. However, it is important to consider the possibility of prolonged asset corrections and take them into account when trading.

It is also worth considering the possibility of a return to the previous volume level at $53.76 (or even lower) to gather liquidity that has accumulated below that level. Such a movement could be triggered by potential increased regulatory pressure from the SEC.

Our skilled SimpleSwap analyst offers a trading scenario with LTC on TradingView.

Users can get LTC for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.