Market Overview: December 2024

This blog post will cover:

- Bitcoin Market Dynamics in December

- Top Gainers and Losers in December

- Bitcoin Dominance

- Trading Activity and Volumes

- Market Sentiment in December

- Has the Meme Coin Trend Ended?

- Fed Rate Cut

- Hype of the Month – Hyperliquid

- Conclusion

December has proven to be a challenging month for the cryptocurrency market. Historical data reveals that over the past 11 years, Bitcoin ended the month in the red six times and in the green five times. This year, December exhibits a neutral trend for Bitcoin, while altcoins face notable pressure. By the end of the month, Bitcoin is trading at a level close to its opening price.

One of the key events of December was the U.S. Federal Reserve's interest rate decision announced on December 18. This triggered a short-term market correction, cooling activity; however, its long-term impact may be limited.

In this report, we will delve into the main trends of December, the performance of Bitcoin and altcoins, changes in BTC dominance, trading activity dynamics, trading volumes, and other critical aspects shaping the final month of 2024.

Historical BTC Performance. Source: CoinGlass

Bitcoin Market Dynamics in December

Following an impressive November, during which Bitcoin surged by 37%, the asset required a technical pause, evident in the early days of December. However, by mid-month, Bitcoin resumed its upward momentum, reaching a new all-time high (ATH). The ATH of $108,353 was achieved on December 17, just a day before the U.S. Federal Reserve meeting.

Starting the month at $96,400, Bitcoin gained over 12% by December 17, reaffirming its position as the flagship of the crypto market.

However, the situation shifted dramatically after Federal Reserve Chairman Jerome Powell’s address on December 18. Bitcoin experienced a sharp decline, pulling the entire cryptocurrency market down with it. Within days, the asset’s price plummeted to $92,300, losing nearly 15% of its recent peak value. This underscored Bitcoin's volatility and speculative nature, reminding investors to exercise caution.

Bitcoin 30-Day Chart. Source: Cryptorank

Top Gainers and Losers in December

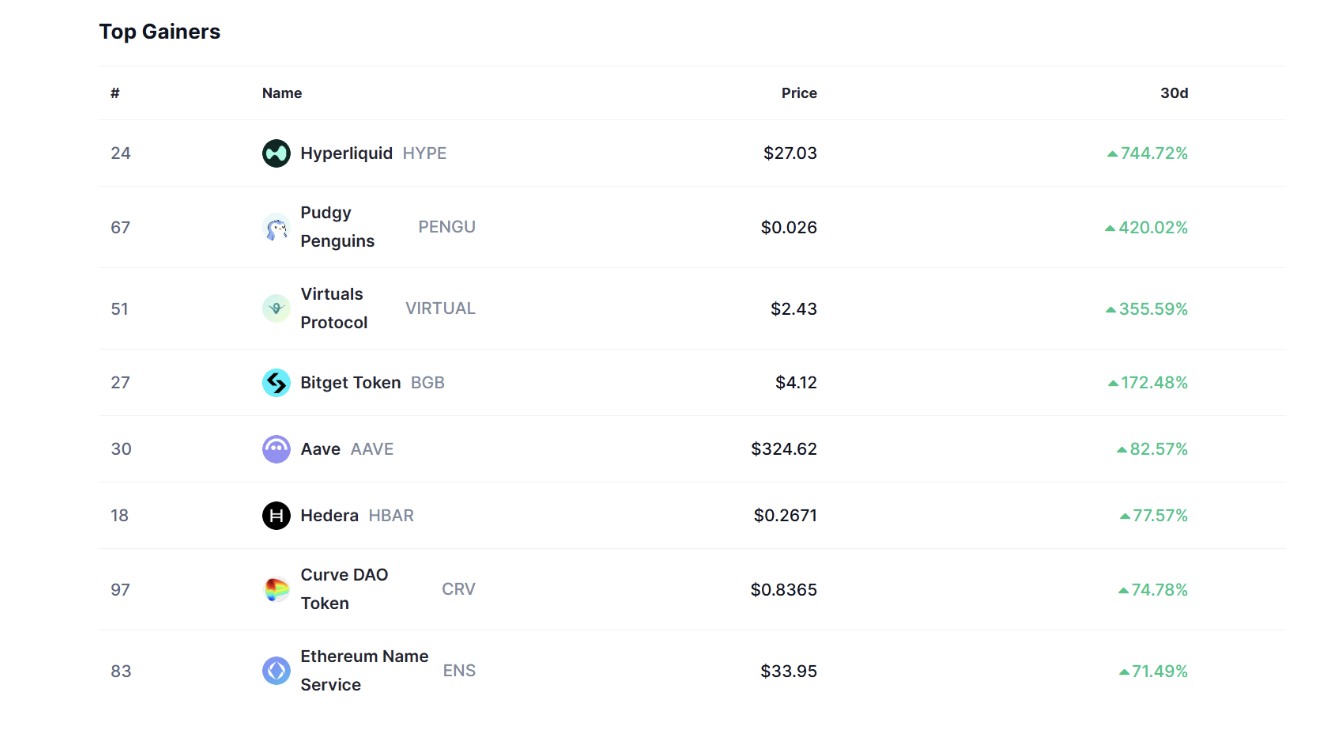

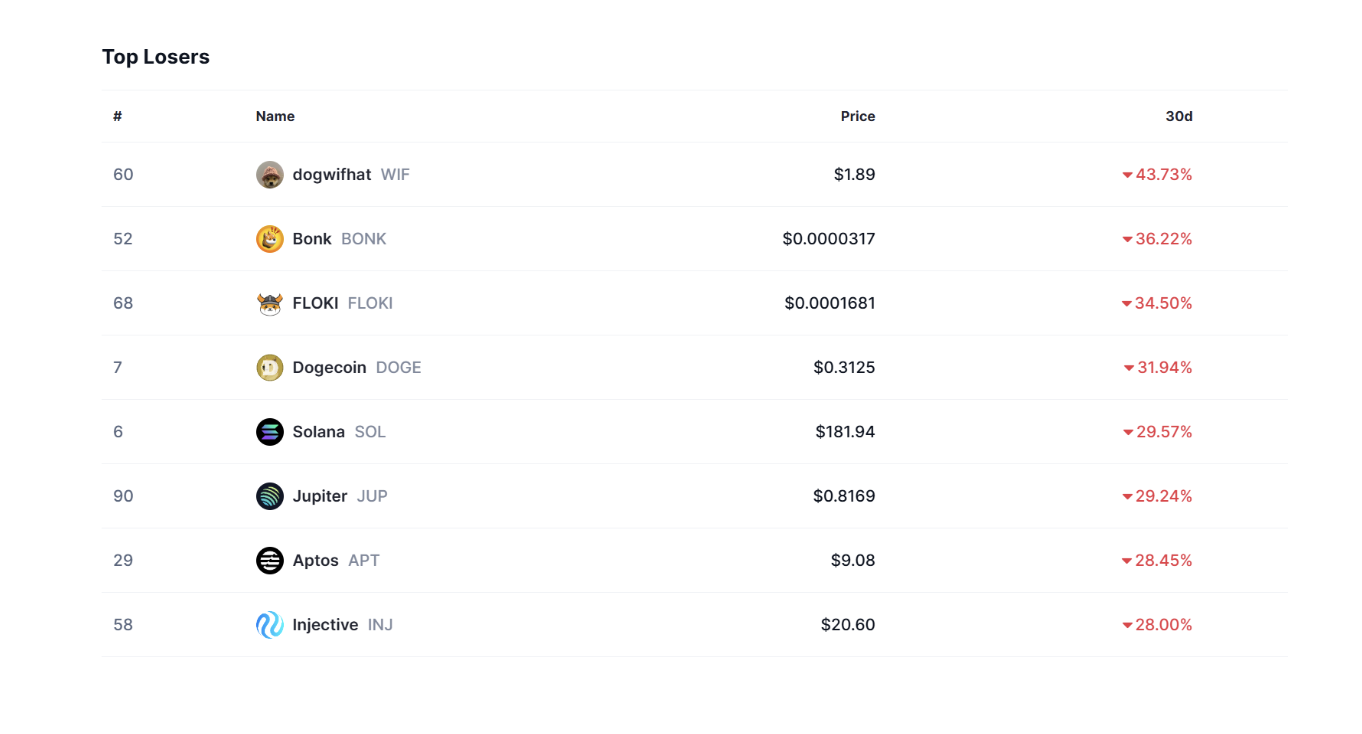

Several altcoins capitalized on Bitcoin’s upward trend during the first half of the month and, despite the subsequent market correction, ended December with significant gains. Among the top 100 cryptocurrencies, the following stood out:

Hyperliquid (HYPE): +744.72% (We already noted its potential in our November overview)

Pudgy Penguins (PENGU): +420.02%

Virtuals Protocol (VIRTUAL): +355.59%

Bitget Token (BGB): +172.48%

However, a substantial portion of altcoins faced pressure following Bitcoin’s local reversal. The biggest losers included:

Top 10 Crypto Asset Performance in December. Source: CoinMarketCap

The decline in meme coins, which had seen significant growth in previous months, was particularly pronounced. Deep corrections in these assets can be attributed to their high volatility and speculative nature, making them more susceptible to sharp price movements during periods of market instability.

Bitcoin Dominance

In November and early December, Bitcoin dominance showed a steady decline from 61.53% to 54.56%. This shift created favorable conditions for significant altcoin growth, attracting the attention of many investors. However, this momentum stalled, and dominance began to rebound, reaching a local high of 59.92%.

In our October review, we highlighted the importance of the 0.618 Fibonacci retracement level at 60.18%. As expected, a local reversal in dominance occurred near this level, temporarily boosting altcoin performance.

When applying a Fibonacci retracement to the downward impulse, it is evident that the recovery surpassed the 0.618 level and halted at the 0.75 level, which acted as resistance. While the downward momentum has slowed, the trend suggests the potential for further decreases in dominance. Monitoring the chart closely is crucial to identify potential altcoin growth opportunities.

In the near term, Bitcoin dominance may continue to decline from current levels or retest the 61% zone, which could technically form a "double top" pattern. In any case, dominance trends will remain a key indicator for the onset of an altcoin season.

Bitcoin Dominance Chart. Source: TradingView

Trading Activity and Volumes

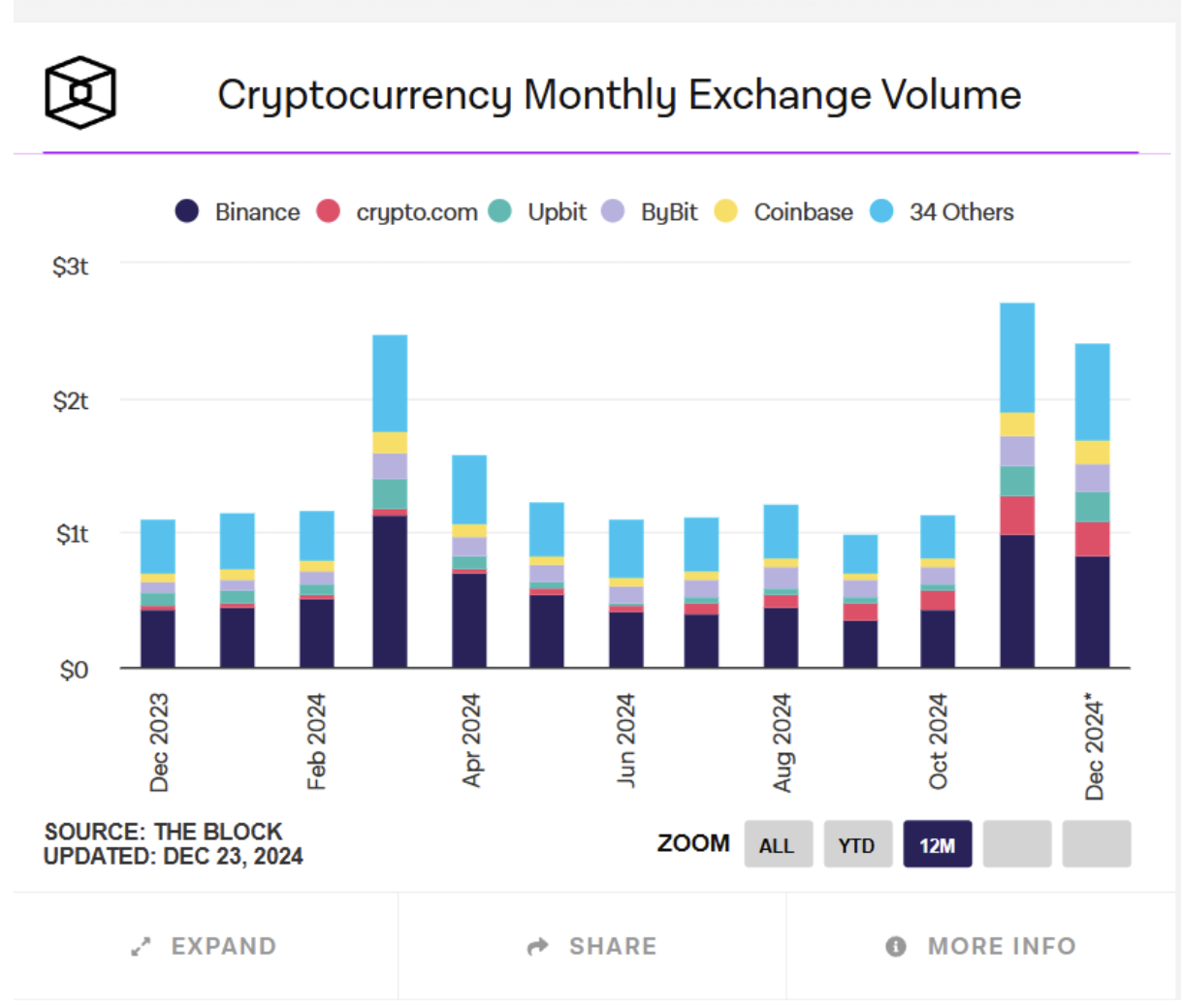

The highest trading volume of the year on centralized exchanges (CEX) was achieved in November, reaching $2.71 trillion. Although December is not yet over, the total trading volume has already reached $2.41 trillion, indicating that November’s growth signaled increased activity and attracted more investors and traders. This performance strongly underscores the renewed interest in the market, and despite the negative trend for most assets in December, enthusiasm remains robust.

Spot Trading Volume on CEX. Source: The Block

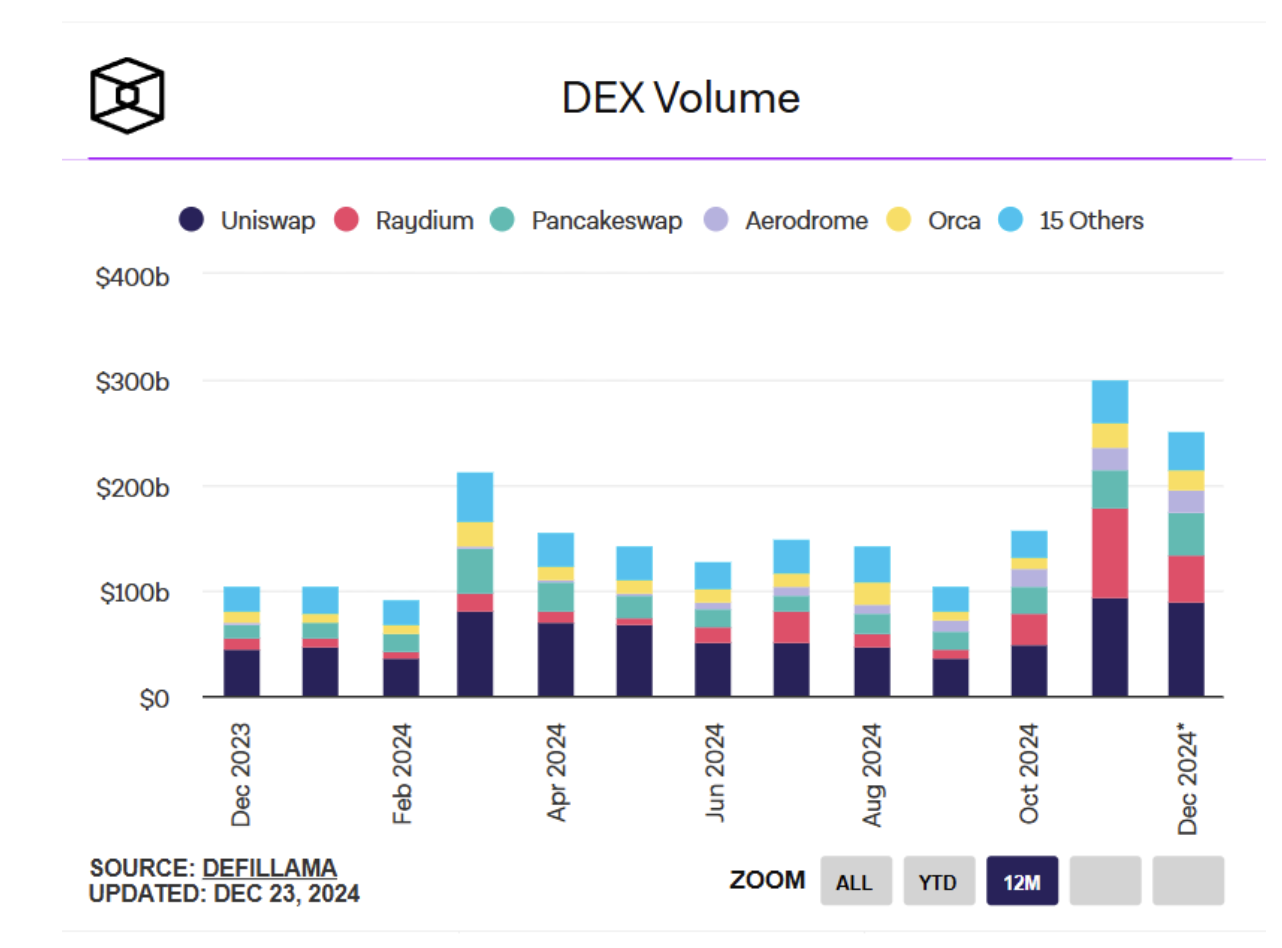

Trading activity on decentralized exchanges (DEX) in December also shows record-breaking results. In November, DEX trading volumes hit $300 billion, the highest figure of the year, and within the first three weeks of December, $240 billion has already been recorded.

The rising interest in DEX can be attributed to several factors:

Persistent demand for decentralized platforms as alternatives to centralized solutions, particularly amid increasing regulatory scrutiny and privacy concerns.

Advancements in DEX infrastructure, including improved user interfaces, low-fee solutions, and enhanced liquidity.

Spot Trading Volume on DEX. Source: The Block

These growing figures confirm the strengthening interest in cryptocurrencies and the maturing market infrastructure, offering users more choices between centralized and decentralized platforms.

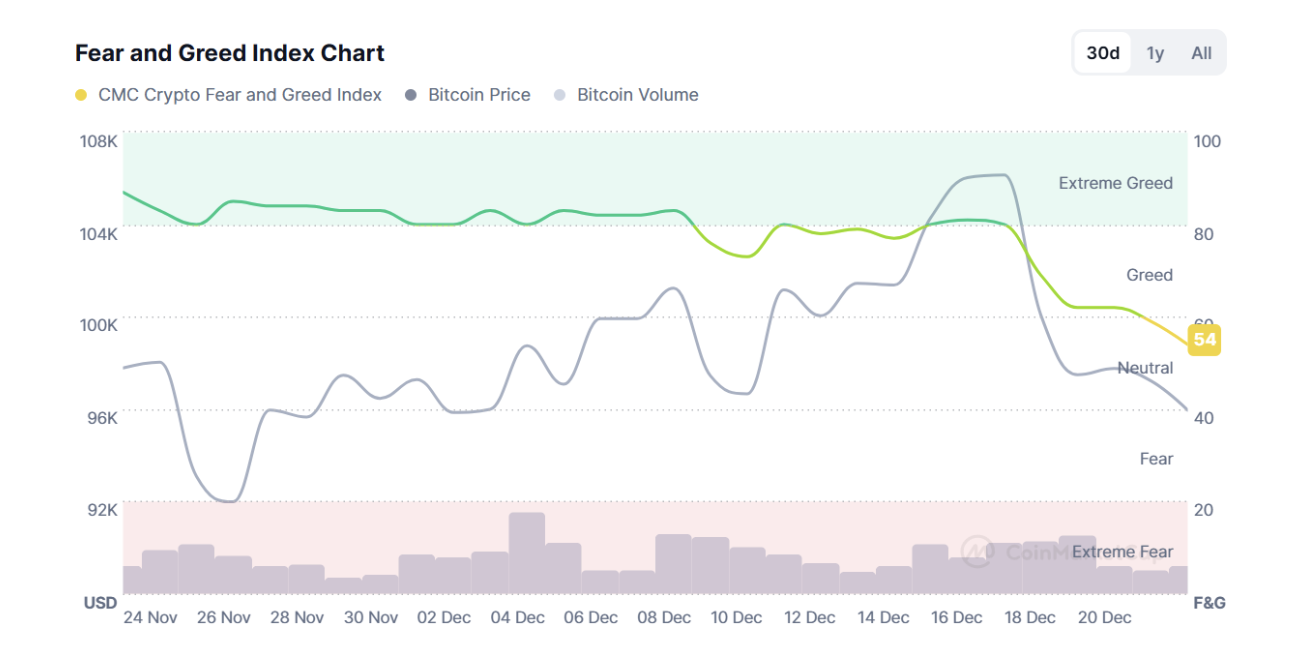

Market Sentiment in December

In November, the cryptocurrency market was characterized by overwhelmingly positive sentiment, as reflected in the Fear and Greed Index, which remained in the extreme greed zone (indicator value > 80) for most of the month. This optimism carried into the first half of December, with the market maintaining a state of strong positivity.

However, after December 18, sentiment shifted, and the index dropped into the neutral zone at 54. Market sentiment is a crucial leading indicator, as emotional peaks are often followed by cooling-off periods. After a phase of extreme greed, a correction typically occurs, presenting investors and traders with opportunities to acquire assets at more attractive prices.

Psychological sentiment plays a key role in sustaining bullish trends, reinforcing the prospects for continued growth.

Fear and Greed Index. Source: Coinmarketcap

Has the Meme Coin Trend Ended?

Meme coins, which held a central position in the cryptocurrency market throughout the year with impressive performance, faced significant pressure in December. Among the month’s top losers were four projects from the meme sector. Additionally, December did not witness the emergence of a major new meme coin capable of capturing attention as GOAT did in October or PNUT in November. Even prominent meme coins like DOGE, WIF, and FLOKI experienced notable declines, further underscoring the weakness in this segment during recent weeks.

However, the results of a single month cannot signal the end of a trend. The decline in meme coins during December, following their earlier growth, likely indicates a natural correction rather than a reversal of the trend. It’s important to note that meme coins remain particularly sensitive to shifts in market sentiment. Their success is often driven by hype surrounding new launches, which was absent in December, reducing excitement in this sector.

Additionally, meme coins often serve as a barometer of retail investor sentiment. During market downturns, they tend to suffer greater losses due to their speculative nature and weaker ties to intrinsic value. If the cryptocurrency market begins to show renewed strength, meme coins could once again gain traction, acting as an early indicator of a rebound in retail activity.

Should the broader market enter a phase of sustained growth, meme coins may receive an additional boost. Conversely, if they remain weak during the next wave of market growth, it may be time to consider whether their trend has truly ended. For now, it’s too early to make such a conclusion.

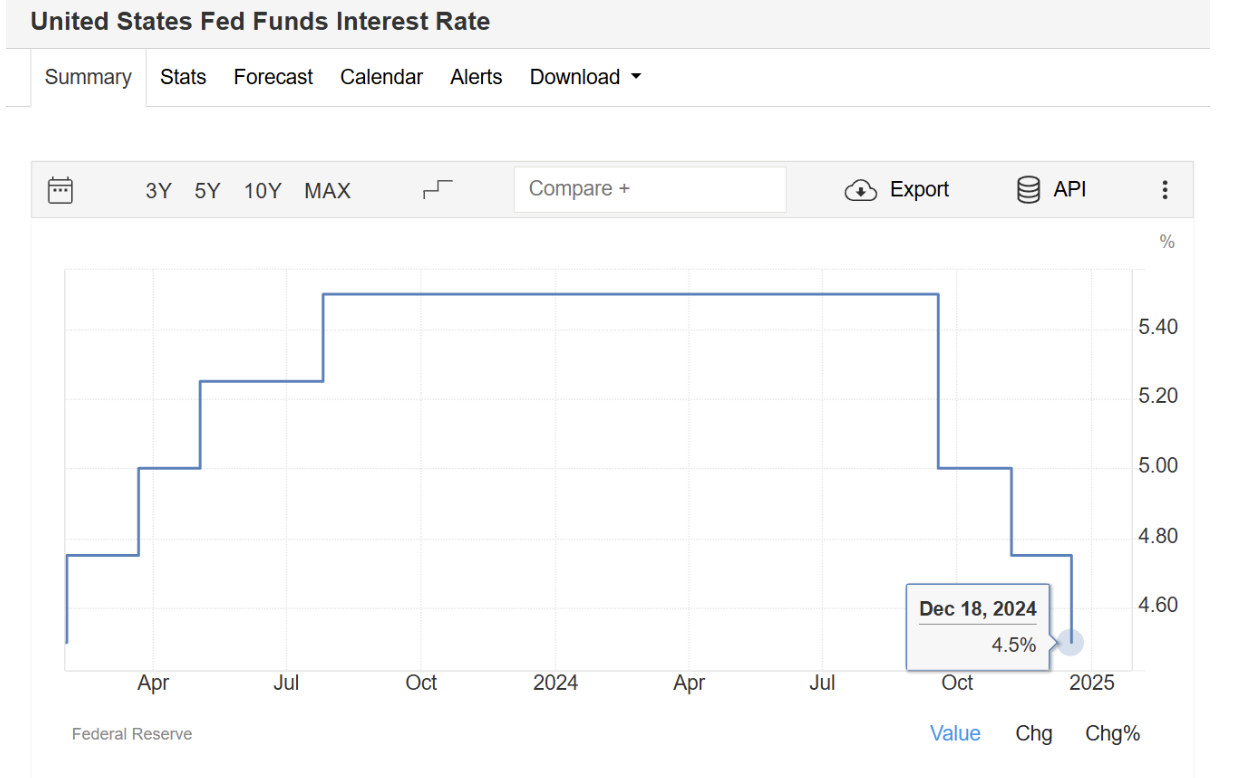

Fed Rate Cut

On December 18, the U.S. Federal Reserve reduced its interest rate by 25 basis points, setting a new range of 4.25% to 4.5% annually. This decision aligned fully with analysts’ forecasts and reflects the Fed’s commitment to its long-term objectives.

According to the FOMC statement, the primary goal of the rate cut was to support balanced economic development while mitigating risks to employment and price stability. The committee emphasized its commitment to maximizing employment and achieving long-term inflation at 2%.

During the press conference, Fed Chair Jerome Powell confirmed that the pace of rate cuts would slow, consistent with the current phase of the economic cycle. When asked about the potential use of Bitcoin as a reserve asset, Powell categorically rejected the idea, stating that matters related to digital assets fall under Congress's jurisdiction. These remarks caused a short-term dip in the cryptocurrency market, as mentioned earlier in this review.

Despite the short-term corrections triggered by Powell’s statements, the rate cut signals a shift toward a more stable economic policy. This creates favorable conditions for recovery and growth in both traditional and cryptocurrency markets. Most importantly, the Fed’s actions indicate an intent to maintain economic stability, which could positively influence the investment climate in 2025.

Hype of the Month – Hyperliquid

As mentioned earlier, one of December’s top gainers was the token of the Hyperliquid project (HYPE). Hyperliquid is a Layer 1 blockchain featuring a unique HyperBFT consensus algorithm designed to support a secure and high-performance financial system. At the core of its ecosystem is a decentralized derivatives exchange operating on an on-chain order book.

In December 2024, Hyperliquid emerged as the leader in the derivatives DEX sector, recording a trading volume of over $80 billion — four times that of its closest competitor.

HYPE is the native token of Hyperliquid, used for paying fees in the HyperEVM. Its total supply is capped at 1 billion tokens, with 76.2% allocated to the community and 6% reserved for the Hyper Foundation’s budget. Token generation (TGE) occurred on November 29, 2024, including an airdrop of 310 million HYPE for active ecosystem participants. At the current price, the airdrop is valued at $7.9 billion, making it one of the largest in history. The impressive growth of HYPE has reached nearly 1,000% within just a month.

HYPE/USDT. Source: CoinMarketCap

Conclusion

December 2024 upheld its reputation as a month filled with events and volatility in the cryptocurrency market. Bitcoin reached a historic all-time high but subsequently faced a sharp correction, highlighting its speculative nature and the need for cautious investor strategies. Altcoins also came under pressure, though individual projects like Hyperliquid demonstrated impressive growth, securing their place among the month’s leaders.

The U.S. Federal Reserve’s decision to lower interest rates by 25 basis points had mixed effects on the market. Despite the local cooling following Jerome Powell’s remarks, the decision fosters positive expectations for future economic stability. This could become a key factor in reviving investment activity in the crypto industry in 2025.

The meme coin market, which previously served as a growth driver, showed signs of cooling but it’s too early to declare the trend over. These assets remain an indicator of retail investor sentiment, and their dynamics largely depend on the overall state of the crypto market.

Overall, December was a month of contrasts, with the optimism of the first half giving way to caution in the second. Nonetheless, the long-term prospects for the cryptocurrency market remain positive, especially as infrastructure continues to evolve and interest in digital assets as an investment class grows.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.