From Skepticism to Strategy: The Warming of US Crypto Regulation

This blog post will cover:

- Key Points of Cryptocurrency Regulation in the US

- What Happened in May This Year?

- Political Shifts in US Crypto Regulation: A Tug-of-War

Recent events involving an unexpected shift towards a "warming" of crypto regulation in the United States, the largest center for finance and technology, have sparked lively debates about the nature of these changes and the future of the cryptocurrency industry in the US.

Let's delve into the intricacies of crypto market regulation in the United States and trace the evolution of American policymakers' views on this rapidly developing sector.

Key Points of Cryptocurrency Regulation in the US

This section provides an overview of the regulatory framework governing cryptocurrency in the United States, highlighting the legislative efforts at the federal level, the roles of key government agencies, and the diverse approaches taken by individual states.

Federal Level

At the federal level, cryptocurrency regulation is spearheaded by the Senate and the House of Representatives, which craft and implement laws affecting the crypto industry. Key legislative measures include the Responsible Financial Innovation Act (RFIA) of 2022. This act seeks to clarify the regulatory authority over digital assets, establish a structured environment for crypto assets, particularly stablecoins, and integrate them into the existing banking and tax frameworks.

Other notable legislative initiatives such as the Toomey Stablecoin Bill, the Digital Commodities Consumer Protection Act (DCCPA), the Digital Trading Clarity Act, and the Financial Innovation and Technology for the 21st Century Act (the McHenry-Thompson Bill) build on the RFIA. These laws address various aspects of crypto regulation including the trading and circulation of digital assets, determining their status as commodities or securities, investor protection, and broader regulatory issues.

Government Agencies

The enforcement of these laws and regulatory oversight of the cryptocurrency sector are handled by several government agencies. The primary regulatory bodies are the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Other agencies involved include the Federal Trade Commission (FTC), the Department of the Treasury, the Office of the Comptroller of the Currency, and the Financial Crimes Enforcement Network (FinCEN).

The jurisdiction of the SEC and CFTC over crypto assets varies based on their classification. The SEC is responsible for regulating securities, so if a cryptocurrency is deemed a security, it falls under the SEC's purview. Conversely, the CFTC oversees commodity futures, and cryptocurrencies classified as commodities come under its jurisdiction.

State Level

At the state level, the regulatory landscape for cryptocurrencies varies significantly. Larger states with robust economies typically adopt stricter regulatory measures, while smaller states often take a more lenient and crypto-friendly approach.

For example, Wyoming has enacted progressive laws allowing the establishment of special banks or "depository institutions" specifically for the custody of crypto assets. It was also the first state to recognize and regulate decentralized autonomous organizations (DAOs) as limited liability companies (LLCs). Moreover, Wyoming introduced the "Wyoming Stable Token Act," setting the stage for the creation of the first state-issued stablecoin backed by the US dollar.

These efforts reflect the diverse regulatory approaches across the United States, illustrating a dynamic and evolving regulatory environment for the cryptocurrency industry.

What Happened in May This Year?

The end of May marked a "breakthrough" in the regulation of the cryptocurrency market in the US due to several decisions of executive and legislative authorities:

SEC's Accelerated Approval of ETH ETF Applications: After multiple delays, the SEC unexpectedly requested expedited updates (form 19b-4) from companies wishing to launch ETH ETFs and approved their applications. Trading of these ETFs is expected to begin within the next few months.

Senate Vote on Repealing SAB 121: The US Senate voted to repeal SAB 121 (Staff Accounting Bulletin), which was adopted by the SEC in 2022 and limits the ability of financial institutions to act as custodians for crypto assets. However, President Biden later vetoed the repeal of SAB 121. The president's administration stated that it "will not support measures that jeopardize the well-being of consumers and investors."

Passage of the FIT21 Act by the House of Representatives: The House of Representatives passed the FIT21 - "Financial Innovation and Technology for the 21st Century Act" - a significant bill aimed at providing comprehensive regulation of the crypto market in the US, delineating the powers of regulatory bodies, and creating a regulatory framework for the oversight of digital assets, stablecoins, and anti-money laundering schemes. However, it is unlikely that FIT21 will be approved by the Senate in the near future due to existing disagreements among lawmakers. Additionally, the Biden administration has stated that it is not ready to support FIT21 in its current form but is open to discussions and amendments to the bill.

Political Shifts in US Crypto Regulation: A Tug-of-War

Recent changes in cryptocurrency regulation have sparked debates about the future of crypto regulation in the world's leading economy. Many point out that the unexpected "warming" in this area is politically motivated. It is already evident that the contenders in the upcoming presidential election will once again be Joe Biden and Donald Trump, both actively campaigning for voters' support. In light of the close race and the absence of a significant lead by either candidate, the campaign teams are seeking new leverage to attract voters, including the crypto community, despite both politicians having previously expressed negative views about the crypto industry.

Trump's Changing Stance on Crypto

Trump has been critical of cryptocurrencies in the past, emphasizing that he saw no need for currencies other than the dollar. However, during his speech at the Libertarian Party convention in May 2024, Trump changed his rhetoric, declaring support for the crypto industry and promising to back its development if elected president. Additionally, Trump pledged to fight against crypto critics in the Senate and to prevent the creation of a Central Bank Digital Currency (CBDC). Beyond these programmatic statements, Trump's campaign announced it would accept donations in crypto assets.

Biden's Cautious Approach

In response to Trump's overtures to the crypto community, Biden's team has also taken steps to improve the incumbent president's image among crypto industry participants. Reports indicate consultations between the president's team and several individuals working in the industry. The recent SEC actions to approve ETH ETFs, coupled with positive news from Congress, might be part of Biden's team's strategy to "clean up" his reputation in the eyes of the crypto community. However, the current president is much more cautious, expressing a willingness to block legislative initiatives until a compromise on contentious issues is reached.

Political Dynamics and Crypto Community Sentiment

Unsurprisingly, Biden's stance within the crypto community appears much weaker compared to Trump's. His presidency has been marked by stricter crypto regulations and several unfriendly actions towards companies engaged in crypto business in the US. The SEC played a central role, filing lawsuits against several major US crypto players such as Coinbase and Binance and recognizing a number of crypto assets as securities. It seems that the SEC's actions aligned with the president's policy in this area. In March 2023, the White House released an Economic Report, which specifically mentioned cryptocurrencies, emphasizing that crypto assets do not hold economic value, are speculative instruments, and are not an effective alternative to fiat currencies.

Crypto Ownership and Voter Influence

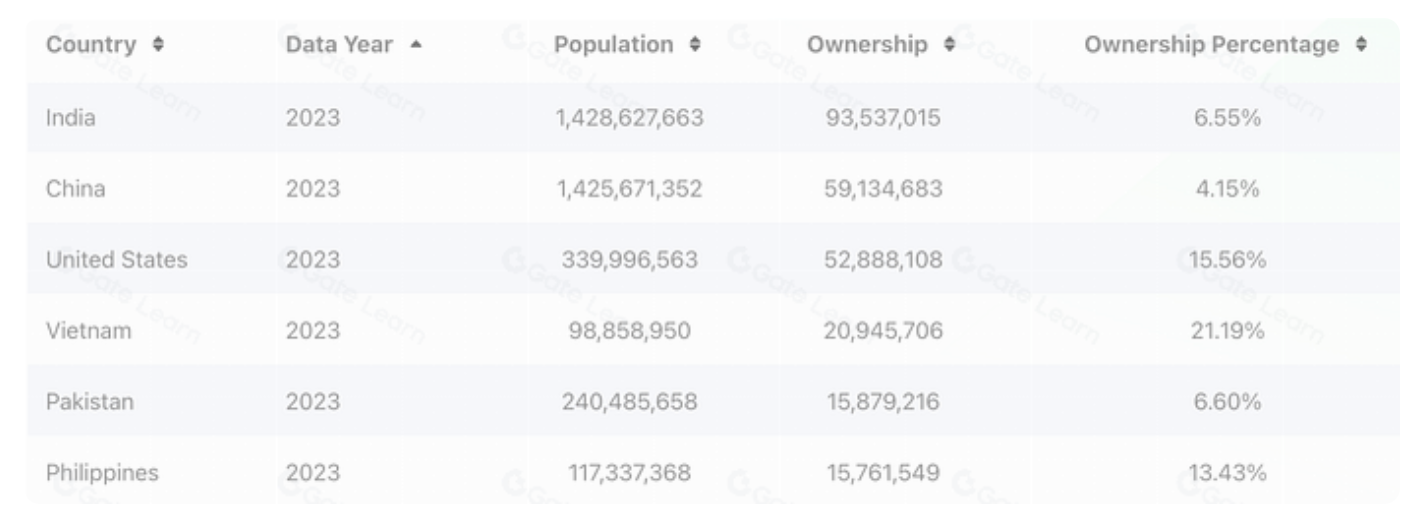

According to research conducted in 2022, over 50 million Americans own crypto assets, representing 15.5% of the US population, making the country a leader in the percentage of the population owning cryptocurrencies.

Source: Gate.io Cryptocurrency Market Research Report

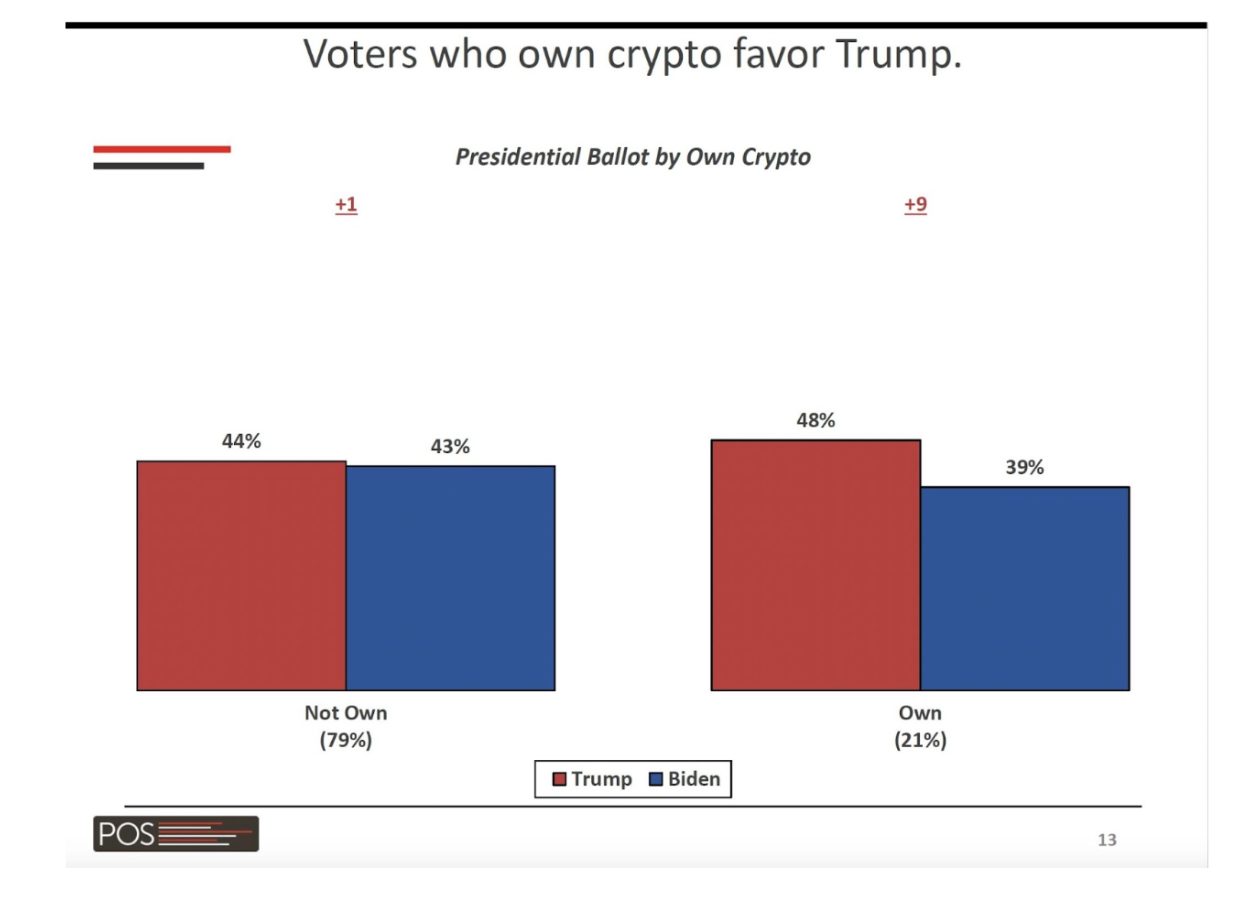

A survey conducted by Paradigm in March 2024 found that the number of crypto asset owners was even higher, with 19% of registered voters in the US owning crypto assets, accounting for one-fifth of the electorate—significant numbers for politicians. Notably, 49% of respondents expressed distrust in both Republicans and Democrats regarding crypto regulation and digital assets. Meanwhile, 48% planned to vote for Trump, compared to only 39% for the incumbent president, with 13% undecided.

Source: Paradigm March 2024 Polling

Conclusion: A Window of Opportunity

It seems that politicians have underestimated the size and influence of the crypto community and have not considered this large group in their campaigns. Now, they have limited time to attract the votes of industry participants. The political situation creates a "window of opportunity" for the crypto community to improve the regulatory climate in the US and transform the crypto industry into a full-fledged participant in the investment and financial system of the world's leading economy.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.