Atomic Swaps Explained

This blog post will cover:

- A brief history

- How do they work?

- Atomic swaps and cross-chain bridges: key differences

- Advantages

- Disadvantages

Atomic swaps, also known as peer-to-peer or cross-chain swaps, let entities swap various cryptos directly without needing to resort to middlemen, like centralized exchanges. They are referred to as “atomic” because the exchange either takes place in full or not at all. In essence it is the “atom” or the core of the asset that’s swapped.

Atomic swaps provide a guarantee that the entities on both sides of the transaction are safe from loss and fraud.

Atomic swaps use self-executing smart contracts whose code includes preset terms. These self-executing mechanisms enable the safe and trustless asset exchange between numerous blockchain ecosystems. Even if the consensus mechanisms or underlying protocols are different, assets can be swapped directly in separate networks using time locks and compatible hash functions.

A brief history

In 2012, Daniel Larimer created P2PTradeX, a trustless exchange platform. Many seasoned members of the crypto community consider this the first case of an atomic swap mechanism. Contrary to popular belief, Tier Nolan did not create atomic swaps. It was not his idea to carry out peer-to-peer cross-chain trades.

Nolan did come up with the notion of direct exchanges a year after Larimer. He laid the groundwork for creating crypto exchanges that year, which involved blockchain utilization.

Charlie Lee, the founder of Litecoin, de facto created atomic swap technology six years ago. As his first transaction, he exchanged 10 LTC for 0.1167 BTC. Many autonomous traders as well as decentralized exchange platforms have been using atomic swaps to exchange cryptocurrencies ever since.

How do they work?

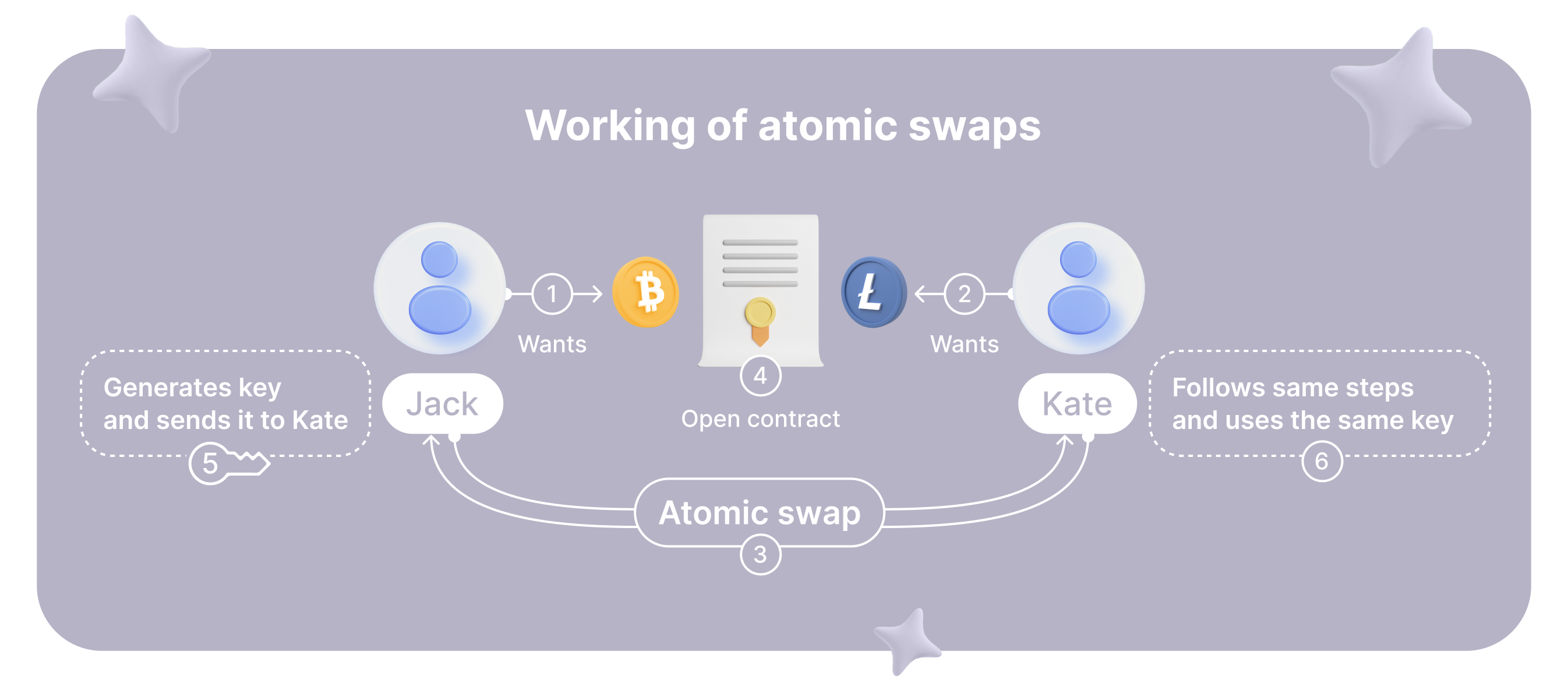

Atomic swaps have the potential to transform the mechanisms of crypto exchange and trade. The stages of operations include getting a smart contract ready, hash locking, verification, clandestine exchange, and redeeming the asset that’s subject to exchange. Here’s how it looks:

- To do an atomic swap, you need a cryptocurrency wallet and HTLC smart contract. Unfortunately, now there are only a few atomic swap wallet providers and DEXes that can be utilized in such a swap (for example, Uniswap or PancakeSwap). However, soon there will be more options available if the atomic swaps get more popular.

- To prepare the smart contract, the entities agree on the swap’s conditions, including what and how many assets they will swap, and any additional terms. All the conditions are reflected in the smart contract.

- The next stage is hash locking. Each entity creates a cryptographic hash of a concealed value. The hash is shared between the parties, but the value itself isn’t.

- Now, each entity verifies the hash the other entity has provided. The smart contract locks the assets if the hashes match. If both assets aren’t locked at the same time, there is no swap.

- At this stage, the entities share the hidden value with each other. They need this value to unlock the assets. They communicate off the blockchain to maintain security.

- Finally, it’s time to redeem the locked assets. The hidden value is verified by the contract. The entities get the assets if the secret is valid.

Atomic swaps and cross-chain bridges: key differences

Cross-chain bridges are similar to atomic swaps in that they both involve swapping crypto between different blockchains. However, they have some differences as well.

Cross-chain bridges do involve middlemen, and there are differences in how assets are transferred. Their scripting languages and hash algorithms differ.

Intermediaries in the operations of cross-chain bridges can include a multi-sig wallet or an exchange. Atomic swaps execute smart contracts as soon as the agreed terms are fulfilled. To transfer assets on a cross-chain bridge, you must build a connection between blockchains.

Atomic swaps use the same language type or hashing algorithm. Cross-chain bridges utilize permanently altering ones.

Advantages

The benefits of atomic swaps include relatively good security, a decentralized nature, lower costs, peer-to-peer trading, and altcoin exchange flexibility.

- High securityAtomic swaps use HTCL contracts, which integrate the so-called time and hash lock technologies. These technologies give users more reliability and security. If the transaction doesn’t take place on time or there is another issue, the entities involved get their assets back. They always have full control.

- Decentralized Some members of the crypto community lament that we haven’t achieved decentralized finance completely yet. A lot of progress has been made in this direction, but centralized exchanges are still unavoidable in many cases. Crypto traders enjoy full privacy of their transactions with atomic swaps. A direct exchange of assets can take place without resorting to a specific platform.

- Almost all altcoins are supported for trade Atomic swaps allow almost all altcoins to be traded, ensuring that customers have a high level of flexibility. It happens that centralized exchanges don’t support direct swaps of all altcoins. For some of them, you have to exchange the first altcoin for Bitcoin, and then sell your Bitcoin to buy the second altcoin.

- Better prices Atomic swaps are more affordable than centralized exchanges. Their trading fees and operational costs are far below those of the latter.

Disadvantages

As with everything else, atomic swaps aren’t without their downsides. They come with strict trading conditions and can entail an unenviable degree of complexity. After all, this is the price to pay for higher security.

- Entities must interact without communicating directlyThey must swap data as well as cryptographs, while conventional exchanges require nothing more than pressing a button to carry out a trade.

- Special knowledge neededAtomic swaps require some knowledge of programming and blockchain technology. If you are an inexperienced trader, you might struggle with the interface at first. If you’re willing to invest time in learning, though, this shouldn’t be a serious issue.

- Privacy concerns Atomic swaps’ time locking technology can prolong the transaction depending on its timeframe. The longer the process remains active within the ecosystem, the more time a malicious entity will have to interrupt it and steal confidential details.

- No centralizationThis is both an advantage and a disadvantage. Centralized exchanges let you swap fiat for crypto, which isn’t possible with an atomic swap.

All in all, atomic swaps make it possible to exchange cryptos without resorting to intermediaries. They are relatively safe and support the vast majority of altcoins. They are also more affordable than traditional exchange platforms.

Talking about swaps. To perform secured and fast crypto exchanges, you could also use SimpleSwap instant exchange. It is a safe and quick option that doesn’t require a sign up.