Blend Controversy

This blog post will cover:

- What is Blend?

- What are the main features of Blend?

- The controversy

- Conclusion

The non-fungible token (NFT) craze might have gone down in 2022, but the companies that deal with them not only stay on the market but also keep on diversifying their services. Blur, an NFT marketplace that positions itself as a product for professional traders of digital art, came out with Blend, a perpetual lending protocol, at the beginning of May 2023.

In this article, we are going to discuss the protocol which caused quite a stir in the crypto community.

What is Blend?

Blend is a peer-to-peer lending protocol that uses NFTs as collateral. It was created by the crypto project Blur which disrupted the crypto market when it was first launched in October 2022. The company started off strong and quickly rose in popularity thanks to giving users access to advanced analytics and great speed. What is more, the users can compare prices of NFTs from other marketplaces, take advantage of fast snipe reveals (purchasing undervalued NFTs on secondary markets), and have flexible royalties. In February 2023, there was a large airdrop of the platform’s native coin BLUR which is used for governance. Even though Blur is relatively new, it was the largest NFT marketplace by volume at the time of writing this article (May 2023).

Blend was created in cooperation with a Web3 venture capital firm called Paradigm with which Blur has been working since November 2022.

What are the main features of Blend?

Blend is not the first lending platform that uses NFTs as collateral (for instance, there are such projects as Drops, NFTfi, etc.), however, there are a few features that make it stand out.

- There are no dependencies on an oracle or expiration dates, meaning that borrowed positions might be maintained without restriction in duration.

- Fees are not required.

- On-chain transactions are necessary only given that one of the participants wishes to exit the agreement or the interest rate changes.

- A Dutch auction system is utilized if the lender wants to terminate the loan against the borrower's will; the platform will conduct an auction that reduces the price until it finds a different buyer.

- Borrowers have an opportunity to repay the loan whenever they want. Another option is to obtain a new loan utilizing the collateral so they have the ability to pay off the previous loan if they desire to modify the amount borrowed or get a more favorable interest rate.

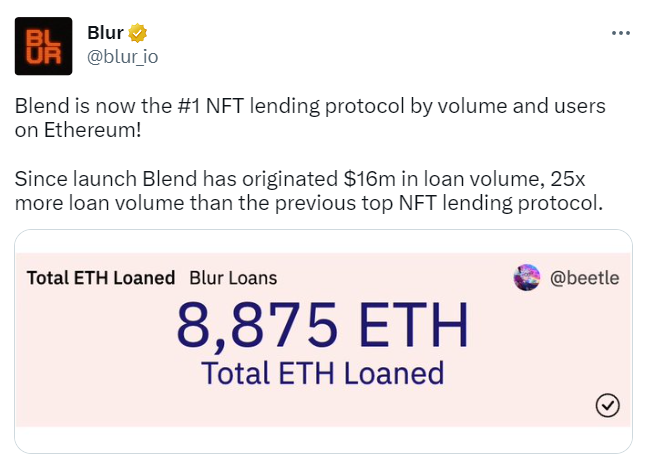

Basically, the main idea is to match users who want to borrow with lenders who offer the best rate and provide both parties with conditions as flexible as possible. This approach made the news, and the very next day after the product launch, Blend could boast the statistics:

The controversy

Despite the quick boost in popularity, the protocol caused mixed reactions from the community. Some people really appreciated the innovative approach which has the possibility of bringing high rewards. Others were not so sure about it pointing out that dealing with loans in a risky NFT space might lead to great losses.

Some users went as far as theorizing how the provided algorithm might potentially be used for money laundering and other financial schemes.

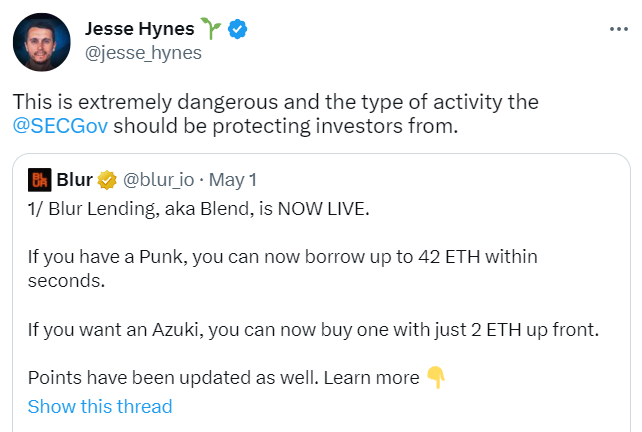

Jesse Hynes, a layer who works with the Web-3 space, called upon the SEC (Securities and Exchange Commission) which has been strict on crypto companies lately, to protect investors.

Conclusion

As always with anything crypto-related, users should do proper research before making any decisions, never put in any assets they cannot afford to lose, and stick to reliable risk-management strategies. Those who follow these basic investment rules might find the Blend instrument convenient.

According to the initial statistics, there is clearly an interest in the peer-to-peer platform among NFT buyers, but it is still early for any long-term conclusions.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.