Chainlink (LINK) Price Prediction 2025, 2030, 2040 — The Future of Chainlink (LINK)

This blog post will cover:

- Chainlink (LINK) Market Data

- Chainlink Monthly Price Estimates

- Chainlink (LINK) Price Forecast 2025, 2030, 2040

- Chainlink Price Technical Analysis

- Chainlink Correlation Currencies

- Chainlink (LINK) Overview

- What Is Chainlink (LINK) Crypto?

- Should You Consider Buying Chainlink (LINK)?

- Chainlink (LINK) Price Forecast FAQs

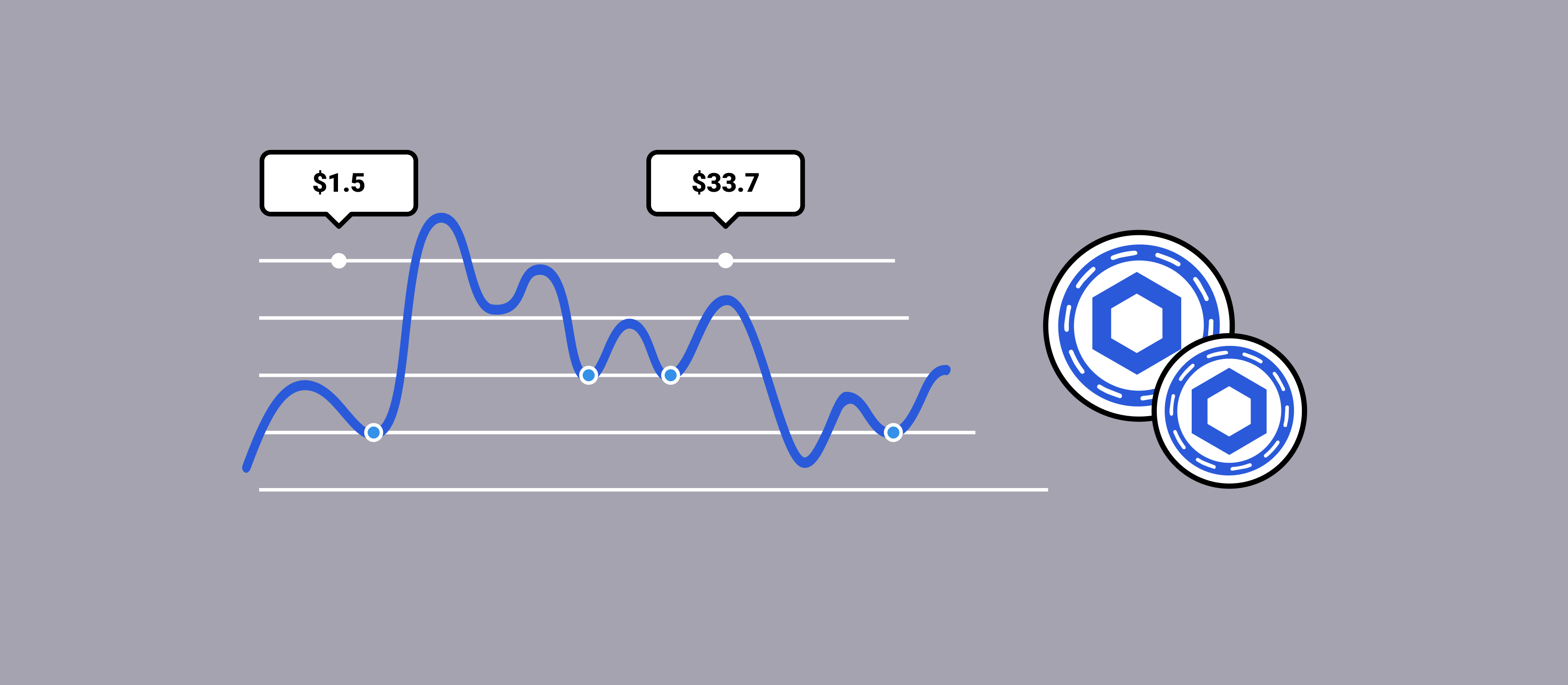

Chainlink (LINK) coin price prediction starts with utility: securing real‑world data, cross‑chain messaging, and tokenized‑asset plumbing. This Chainlink (LINK) price forecast frames near‑term levels and long‑horizon ranges.

Chainlink (LINK) Market Data

Short‑term LINK price prediction points to range‑bound movement as crypto volatility remains a primary driver of intraday swings. Sentiment is assessed via technical indicators and the Fear & Greed Index to gauge momentum and risk appetite for entries and exits. Given this setup, consider staged entries with clear risk limits if you plan to buy LINK.

Coin Name | Coin Symbol | USD Price | Market Cap | 24h Volume | Total Supply |

Chainlink | LINK | $17.33 | $12.07B | $609.79M | 1B LINK |

Source: CoinMarketCap

Disclaimer: This is educational content, not financial advice. Crypto markets are volatile and speculative. Always do your own research (DYOR), consider risk tolerance and time horizon, and never invest money that you can’t afford to lose.

Chainlink Monthly Price Estimates

Chainlink price prediction shows November basing near $16.85–$18.88, followed by a higher December range. Through 2026 the tape swings broadly before accelerating in 2027–2029, with 2030 printing low‑$100s tops. Long‑dated 2040 scenarios expand materially.

Chainlink (LINK) Price Forecast 2025, 2030, 2040

Scenario planning beats single‑number targets. The sections below align utility and liquidity drivers with disciplined risk management across multiple horizons.

Chainlink (LINK) Future Price Prediction for 2025

Competition, tokenomics, and on‑chain activity remain critical variables for any 2025LINK valuation path. Regulatory clarity can rerate sector valuations quickly, so scenario planning is essential. Traders may prefer confirmation signals before they buy LINK as narratives shift.

Table: LINK price prediction 2025

Month | Minimum Price | Average Price | Maximum Price |

Dec 2025 | 19.06 | 20.13 | 21.18 |

Chainlink (LINK) Price Forecast for 2026

Expanding institutional rails, custody solutions, and market data access can deepen liquidity and reduce operational frictions for LINK participants. Regulatory progress may gradually lower uncertainty and attract broader capital, though policy divergence can still cause regional fragmentation. Crypto’s volatility profile warrants disciplined entries and systematic exits to manage drawdowns and opportunity costs. A rules‑based playbook clarifies when to buy LINK versus waiting for higher‑probability setups with favorable reward‑to‑risk.

Table: LINK price prediction 2026

Month | Minimum Price | Average Price | Maximum Price |

Jan 2026 | 19.12 | 20.19 | 21.00 |

Feb 2026 | 20.89 | 22.19 | 22.35 |

Mar 2026 | 20.04 | 21.68 | 21.43 |

Apr 2026 | 17.94 | 20.26 | 20.93 |

May 2026 | 17.52 | 19.88 | 19.15 |

Jun 2026 | 17.12 | 20.40 | 19.93 |

Jul 2026 | 18.42 | 22.43 | 21.73 |

Aug 2026 | 18.46 | 22.24 | 20.88 |

Sep 2026 | 18.50 | 26.85 | 26.55 |

Oct 2026 | 23.87 | 31.89 | 33.45 |

Nov 2026 | 27.24 | 33.37 | 31.85 |

Dec 2026 | 28.15 | 35.24 | 34.52 |

Chainlink (LINK) Coin Price Forecast 2030

Developer ecosystems and strategic partnerships can strengthen utility and defensibility of Chainlink (LINK) by 2030, supporting differentiated use cases. Policy harmonization and consumer protections could broaden access, improving liquidity while lowering barriers for institutions and retail alike. Even with maturation, crypto remains susceptible to sentiment shocks and liquidity vacuums that accelerate price dislocations. Use systematic triggers to guide when to buy LINK instead of reacting to headlines or short‑term noise.

Table: LINK price prediction 2030

Month | Minimum Price | Average Price | Maximum Price |

Jan 2030 | 79.88 | 82.00 | 92.32 |

Feb 2030 | 82.34 | 84.42 | 94.80 |

Mar 2030 | 84.03 | 86.15 | 96.91 |

Apr 2030 | 85.35 | 87.59 | 99.05 |

May 2030 | 87.18 | 89.40 | 101.00 |

Jun 2030 | 89.01 | 91.46 | 103.685 |

Jul 2030 | 91.40 | 93.92 | 106.50 |

Aug 2030 | 93.29 | 95.73 | 108.63 |

Sep 2030 | 95.41 | 99.08 | 112.67 |

Oct 2030 | 98.77 | 102.43 | 117.07 |

Nov 2030 | 101.71 | 104.63 | 118.98 |

Dec 2030 | 103.99 | 107.10 | 122.13 |

Chainlink (LINK) Crypto Price Prediction 2040

Forecasting decades ahead is inherently uncertain given shifting regulation, technology, and macro regimes, which can change assumptions quickly. CBDC adoption trajectories may indirectly influence crypto’s roles in cross‑border flows, programmability, and settlement preferences. Diversified, rules‑based approaches can mitigate timing risk and reduce reliance on point forecasts for long horizons. Risk‑managed entries make sense if you plan to buy Chainlink (LINK) for ultra‑long investment horizons.

Table: LINK price prediction 2040

Month | Minimum Price | Average Price | Maximum Price |

Jan 2040 | 869 | 910.62 | 1032.93 |

Feb 2040 | 1366.90 | 1437.71 | 1637.46 |

Mar 2040 | 1864.53 | 1966.63 | 2245.08 |

Apr 2040 | 2361.49 | 2494.35 | 2851.06 |

May 2040 | 2859.35 | 3023.34 | 3458.54 |

Jun 2040 | 3356.74 | 3551.30 | 4064.90 |

Jul 2040 | 3854.33 | 4079.73 | 4671.16 |

Aug 2040 | 4351.49 | 4608.01 | 5278.33 |

Sep 2040 | 4850.56 | 5138.03 | 5886.16 |

Oct 2040 | 5348.68 | 5667.55 | 6494.595 |

Nov 2040 | 5845.22 | 6194.94 | 7100.70 |

Dec 2040 | 6343.12 | 6723.10 | 7706.28 |

Chainlink Price Technical Analysis

Technical readings lean mixed: shorter SMAs lag some EMAs, while oscillators sit neutral‑to‑soft, consistent with range‑within‑trend behavior into late November.

Key LINK Trading Indicators

Signals cluster around spot. Slope changes and crossovers often foreshadow the next leg.

Daily Simple Moving Average (SMA)

Period | Value |

SMA 3 | 19.53 |

SMA 5 | 19.2 |

SMA 10 | 18.96 |

SMA 21 | 18.18 |

SMA 50 | 20.3 |

SMA 100 | 21.03 |

SMA 200 | 17.9 |

Daily Exponential Moving Average (EMA)

Period | Value |

EMA 3 | 19 |

EMA 5 | 19.97 |

EMA 10 | 21.37 |

EMA 21 | 22.19 |

EMA 50 | 20.99 |

EMA 100 | 19.07 |

EMA 200 | 17.65 |

Weekly Simple Moving Average (SMA)

Period | Value |

SMA 21 | 33.89 |

SMA 50 | 27.25 |

SMA 100 | 20.57 |

SMA 200 | 5.43 |

Weekly Exponential Moving Average (EMA)

Period | Value |

EMA 21 | 19.11 |

EMA 50 | 17.54 |

EMA 100 | 15.98 |

EMA 200 | 13.16 |

Oscillators

Period | Value |

RSI (14) | 41.19 |

Stoch RSI (14) | 67.36 |

Stochastic Fast (14) | 29.21 |

Commodity Channel Index (20) | -66.67 |

Average Directional Index (14) | 25.54 |

Awesome Oscillator (5, 34) | -1.37 |

Momentum (10) | -1.86 |

MACD (12, 26) | 0.12 |

Williams Percent Range (14) | -70.79 |

Ultimate Oscillator (7, 14, 28) | 41.6 |

VWMA (10) | 17.68 |

Hull Moving Average (9) | 18.14 |

Ichimoku Cloud B/L (9, 26, 52, 26) | 17.58 |

Chainlink (LINK) Key Price Levels

Price is boxed by bids near the mid‑$16s and offers just under $18.20. A decisive break can unlock trend continuation or a deeper retest of prior value.

Support Levels

# | Price |

S1 | 16.9 |

S2 | 16.53 |

S3 | 16.25 |

Resistance Levels

# | Price |

R1 | 17.55 |

R2 | 17.82 |

R3 | 18.2 |

Chainlink Correlation Currencies

Correlation clusters can aid diversification and relative‑value views. Note these relationships can change with liquidity regimes and narratives.

Positively Correlated Currencies

Name | Correlation |

0.974 | |

0.969 | |

0.968 | |

0.968 | |

0.967 |

Negatively Correlated Currencies

Name | Correlation |

-0.564 | |

-0.486 | |

-0.395 | |

-0.261 | |

-0.18 |

Chainlink (LINK) Overview

Chainlink is the leading decentralized oracle network, delivering verified data, randomness, and cross‑chain messaging to smart contracts. LINK powers staking‑secured services (feeds, VRF, Proof of Reserve, and CCIP) providing reliable off‑chain connectivity many general‑purpose blockchains lack.

What Is Chainlink (LINK) Crypto?

Chainlink is a decentralized compute and oracle platform connecting smart contracts to real‑world data, off‑chain computation, and cross‑chain messaging. LINK underpins staking and network economics that secure services like price feeds, verifiable randomness, Proof of Reserve, and CCIP, enabling DeFi, gaming, tokenization, and enterprise integrations across multiple chains.

Chainlink (LINK) Rivals

Band Protocol (BAND): Oracle network competing on multi‑chain data delivery and cost.

Pyth Network (PYTH): High‑frequency market data oracles targeting latency‑sensitive use cases.

API3 (API3): First‑party oracle approach via “Airnodes” run by data providers.

Tellor (TRB): Permissionless oracle with miner/validator‑submitted data.

UMA (UMA): Optimistic oracle design for synthetic assets and dispute resolution.

The Foundation of Chainlink (LINK)

Chainlink launched as a decentralized oracle network to feed external data into smart contracts. Over time it added VRF, Proof of Reserve, and cross‑chain messaging (CCIP), plus staking v0.2 to harden cryptoeconomic security, supporting DeFi, gaming, and tokenization use cases across many chains.

Chainlink (LINK) Token Functions

Network security via staking

LINK is locked in staking v0.2 to secure oracle services and support alerting/slashing mechanics for node operators.

Payment and incentives

LINK compensates node operators and funds service delivery (feeds, VRF, Proof of Reserve, CCIP).

Collateral/liquidity in DeFi

LINK serves as collateral, LP liquidity, and incentive units across protocols integrated with Chainlink‑secured data.

Cross‑chain operations

LINK can be moved and used across chains through CCIP‑enabled applications and token transfers.

Chainlink (LINK) Development Roadmap

Public signals emphasize: expanding CCIP (General Availability across multiple mainnets), continued staking v0.2 evolution, and enterprise tokenization pilots (e.g., DTCC Smart NAV) alongside Swift interoperability experiments connecting public/private chains. Focus areas: more chains/tokens, security hardening, and broader fee capture.

Crypto Community about Chainlink (LINK)

Community tone is energetic yet split. “LINK Marines” highlight CCIP’s GA, enterprise pilots (Swift, DTCC), and staking v0.2 as catalysts. Skeptics debate token‑value capture and transparency around revenues/unlocks. Broadly, sentiment oscillates with price: enthusiasm during breakouts, andcaution when momentum fades, which is typical for a widely held mid‑large cap.

Where and How to Buy Chainlink (LINK) Crypto?

From the Buy page, set the purchase amount, select Chainlink (LINK), and provide your destination wallet address carefully. Follow any required KYC steps with the payment partner, then complete checkout using an approved card or payment method. Funds arrive after confirmations, streamlining future plans to Buy LINK in just a few clicks using saved preferences. Double‑check address and network details before submission to minimize operational errors.

Tip: access the Buy flow at simpleswap.io.

Should You Consider Buying Chainlink (LINK)?

Breakouts with volume and constructive retests often signal continuation, though false breaks remain common in volatile markets. Cross‑checking momentum with trend filters helps reduce whipsaw risk and avoid entering after exhaustion moves.

Use predefined invalidation to decide quickly whether to hold or exit when price underperforms expectations. This framework clarifies when to buy Chainlink (LINK) while keeping downside tightly controlled during rallies.

Chainlink (LINK) Price Forecast FAQs

What is Chainlink?

A decentralized oracle and compute network that delivers data and cross‑chain messaging to smart contracts. LINK fuels staking, incentives, and service payments across feeds, VRF, Proof of Reserve, and CCIP.

What is the Chainlink Price Prediction 2025?

Tables indicate late‑2025 averages around $17.62–$20.13 with maxima near $21.18: range‑bound but firming into December.

What is the Chainlink Price Prediction 2026?

Monthly bounds span roughly $17.125–$34.52 in 2026, reflecting wide swings and potential late‑year acceleration.

What is the Chainlink Price Prediction 2030?

Projected monthly ranges cluster around $79.88–$122.135 in 2030, with averages rising through the year.

What is the Chainlink Price Prediction 2040?

Long‑horizon scenarios broaden substantially, from about $869 minimums to peaks near $7,706.28 across 2040.

Is Chainlink a Good Investment?

That depends on risk tolerance and belief in oracle demand, CCIP adoption, and staking economics. Volatility remains significant. Rules‑based entries and clear invalidation are prudent.

Does Chainlink Have a Future?

Enterprise pilots (Swift tokenization experiments, DTCC Smart NAV) and CCIP’s GA point to durable utility, while staking v0.2 strengthens security incentives, although execution and fee capture will remain in focus.