Crypto Market Overview: February 2024

This blog post will cover:

- Market News and Events that Matter

- BTC Performance: A New ATH Soon?

- Key Market Statistics

- Closing Thoughts

Despite the initial concerns following the approval of BTC ETFs and BTC price correction to $35.8K in January, February emerged as one of the most positive months for the crypto industry in recent years. With Bitcoin's price soaring to local highs almost daily, it appears that we are now in a true "bull run," fueled by a significant influx of fresh capital from institutional investors and the emergence of new crypto narratives that will shape the industry's future.

The SimpleSwap team has compiled an overview of key market news, events, and projects that were significant for the Crypto World in February and are expected to have a long-term impact on the industry. Let's gain insight into what lies ahead for the industry!

Market News and Events that Matter

First of all, we are going to analyze what happened in the market that became a catalyst for the major shifts we can observe.

Bitcoin ETFs: New Investment Paradigm

Following the much-anticipated approval of BTC ETFs in January, institutional investors have maintained a steady interest in the new product. Financial giants like BlackRock, Fidelity, and others have significantly bolstered their BTC holdings for their ETFs over the past month. Despite outflows from Grayscale ETFs, total net flows into BTC spot ETFs remained positive in February.

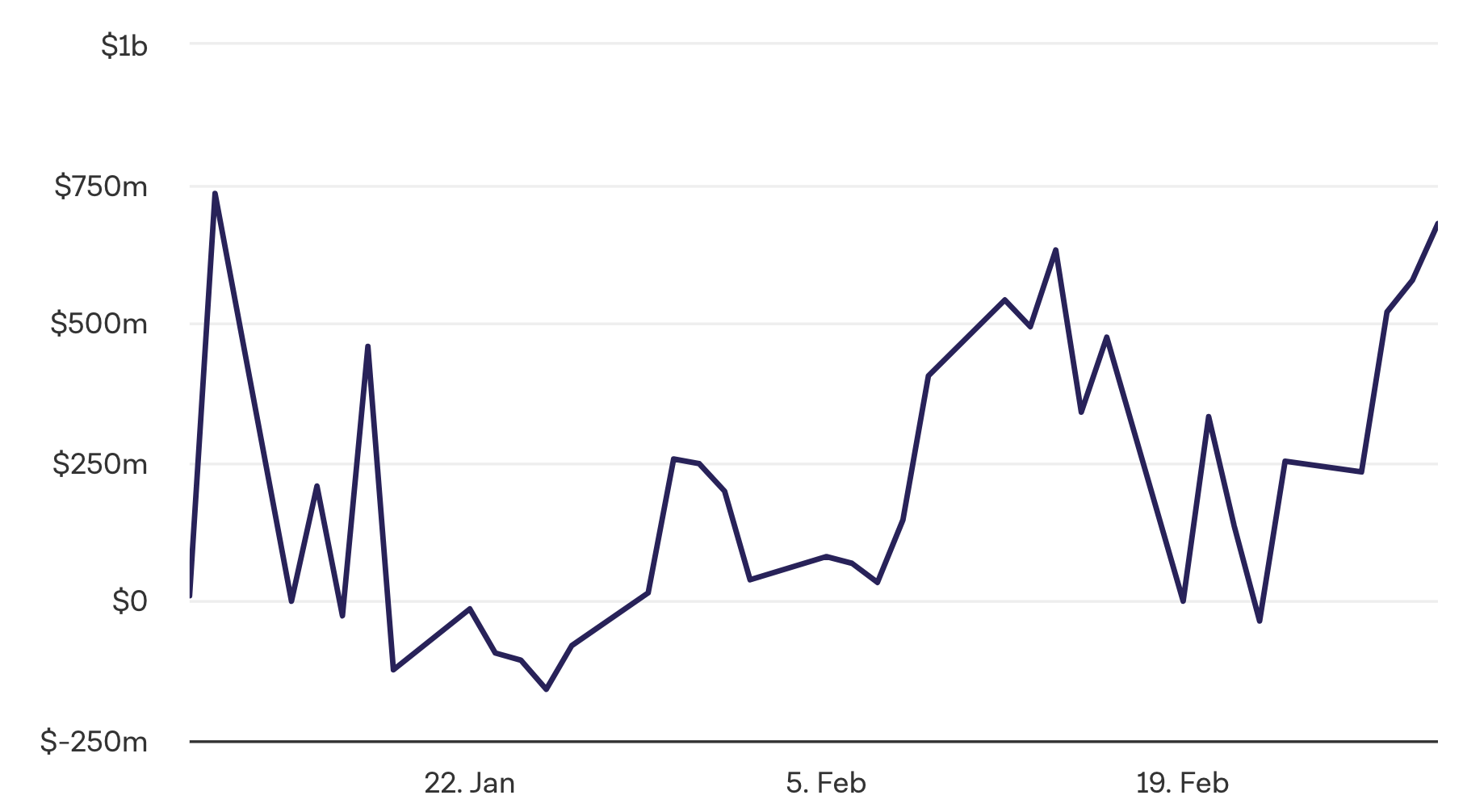

Spot Bitcoin ETF Total Net Flows. Source: The Block

In February, BlackRock's IBIT ETF shattered records with unprecedented trading volumes and fund inflows. On Tuesday, February 27, the ETF saw a historic inflow of $520.2M, surpassing the combined inflow of all other US-based ETFs. This remarkable influx of funds was accompanied by an impressive trading volume of $1.36B. Overall, cumulative spot Bitcoin ETF trading volume exceeded $55B in February.

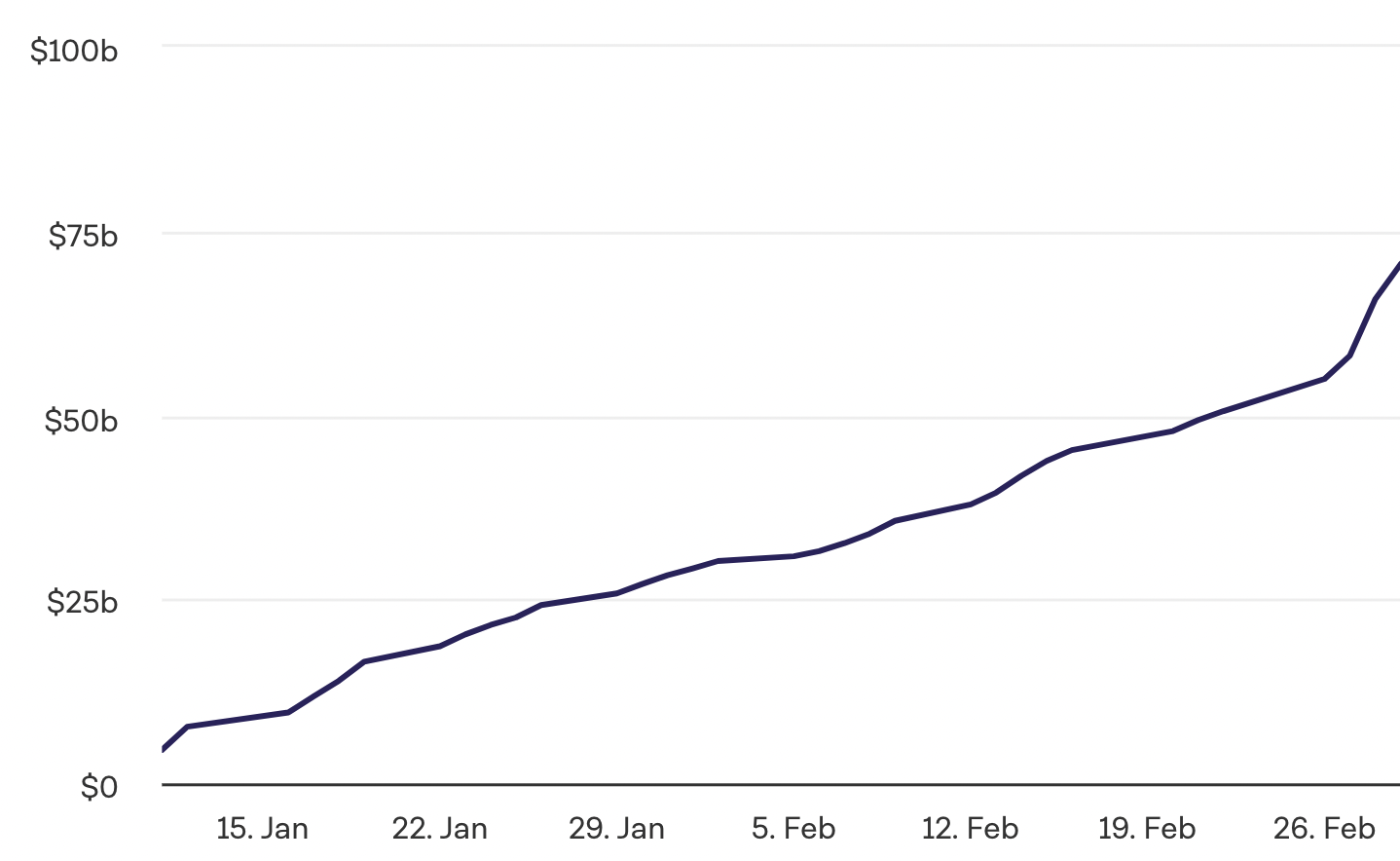

Сumulative BTC spot ETF Volume. Source: The Block

The remarkable performance of ETFs in February underscores the significant potential that institutional players from the traditional finance industry see in Bitcoin. Their readiness to invest in this asset marks a groundbreaking narrative that is poised to have a lasting impact on the entire crypto industry.

New players in the Layer-2 Landscape

The Layer-2 (L2) solutions sector is experiencing rapid growth in the crypto industry. While leaders like Arbitrum and Optimism have already established their value, new players are entering the scene. In February, we witnessed the highly anticipated mainnet launch of Blust, an Ethereum L2 solution with native yield for ETH and stablecoins. Prior to its mainnet launch, Blust attracted significant attention from users and developers, reaching $2B in locked asset value through its early user reward program. Following the mainnet launch, Blust quickly rose to the third place by the total value locked (TVL), with $2.5B in locked assets.

In February, another major event took place with the launch and airdrop of the STRK token, the native token of StarkNet, an Ethereum L2 solution based on ZK-Rollup technology. The airdrop made over 1.3M wallets eligible to claim STRK, resulting in 45M tokens being claimed within the first 90 minutes of the claim opening. Additionally, STRK was listed on major exchanges, e.g. Binance. Following the token launch, StarkNet's TVL surged, surpassing $2B and placing the project among the top 5 L2 solutions by TVL.

Ethereum restaking boom

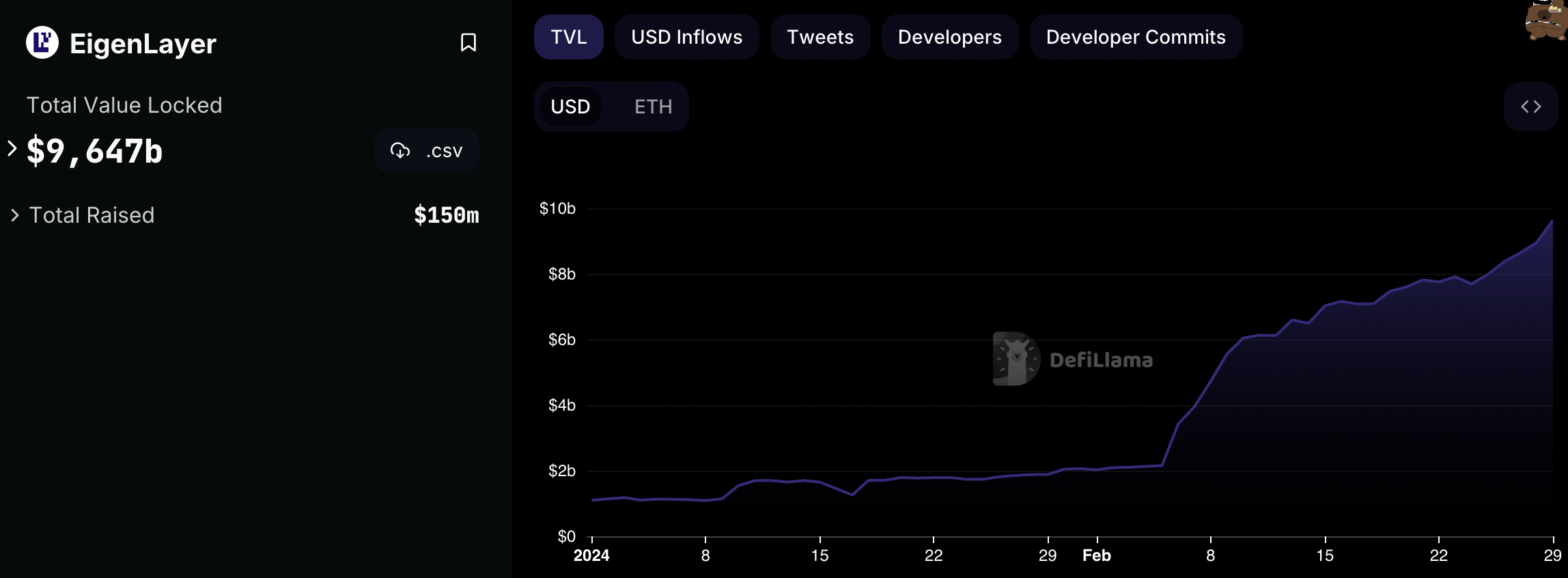

Ethereum restaking is emerging as a new DeFi primitive, enhancing the capital efficiency of staked Ethereum while introducing new security tools for DApps and protocols. Restaking protocols experienced exponential growth in users and locked liquidity last month, with EigenLayer, the leading restaking protocol, climbing to the 3rd position among DeFi projects by combined TVL. EigenLayer saw an impressive growth of 373% in February alone.

EigenLayer TVL Growth in 2024. Data source: DefilLama

The emergence of Ethereum restaking protocols not only elevates the security of decentralized protocols but also offers Ethereum stakers additional yield opportunities and enhances the liquidity of their ETH holdings.

BTC Performance: A New ATH Soon?

February has historically been a bullish month for BTC, and 2024 was no exception. Despite a correction in January to $38.5K, BTC surged throughout February, reaching $64K by month-end, marking a remarkable 47% growth. This upward momentum brings BTC closer to its all-time high of $69K.

BTC Performance (1W). Source: TradingView

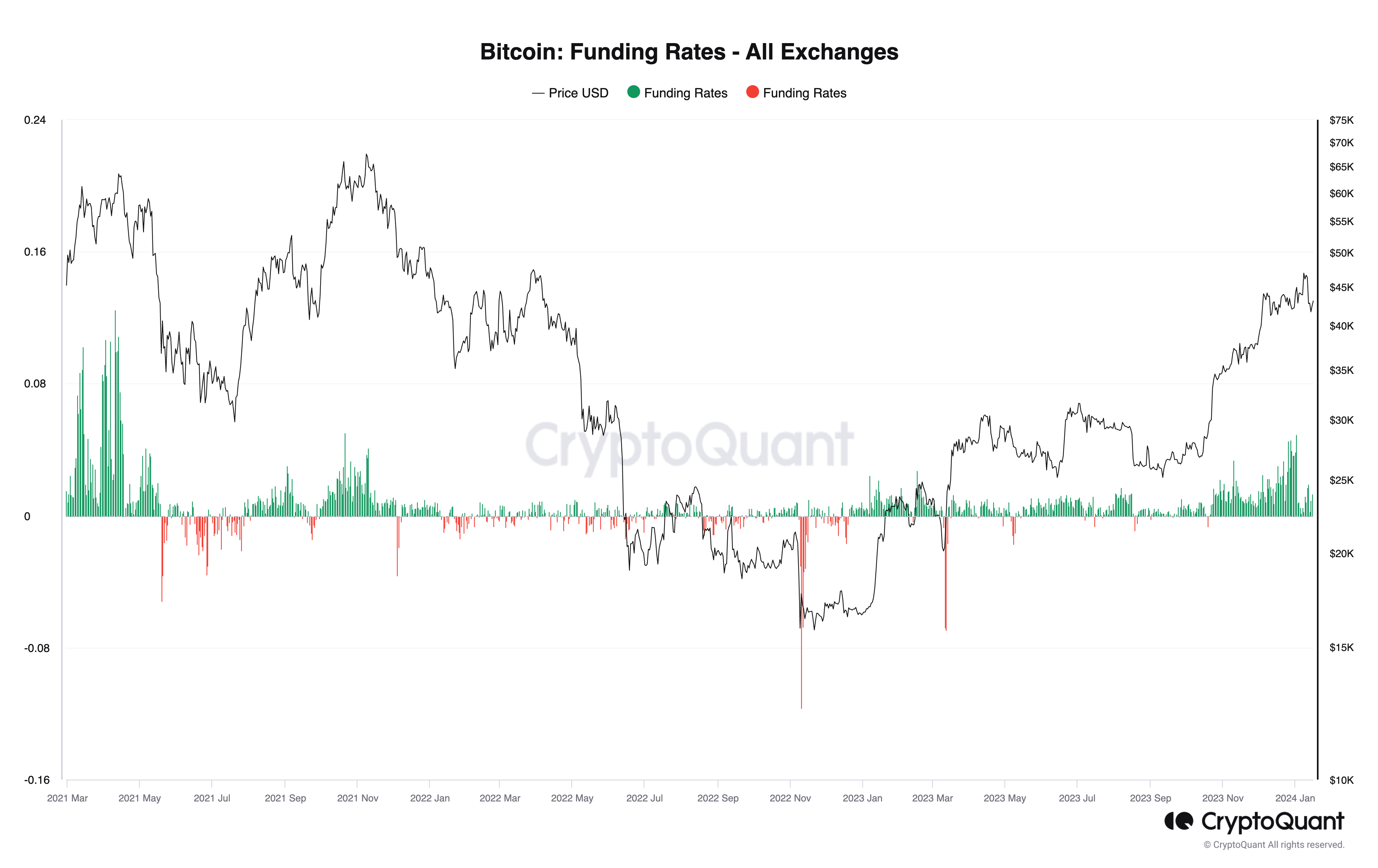

The surge in BTC price during February coincided with rising funding rates, signaling a strong bullish sentiment. This increase in funding rates indicates a potential for heightened volatility in the market.

BTC Funding Rates. Data Source: CryptoQuant

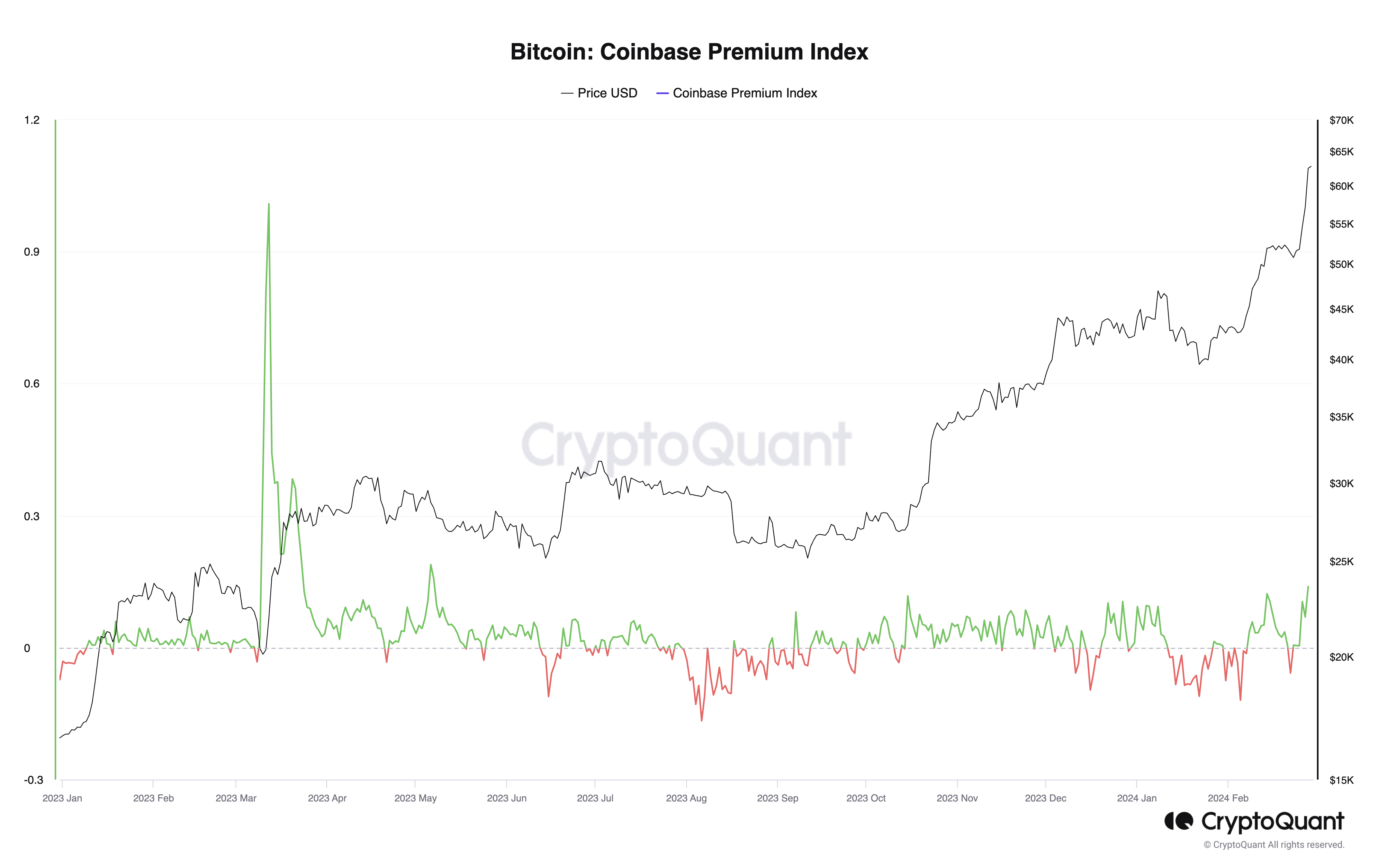

BTC's growth in February was largely driven by a surge in demand from US investors. Coinbase, a major US-based exchange, experienced technical difficulties due to a significant influx of users on February, 28. Additionally, CryptoQuant reported a notable spike in the Coinbase Premium Index during February, suggesting heightened buying pressure from US investors.

Coinbase Premium Index. Data Source: CryptoQuant

The upcoming Halving event could potentially fuel further rally in BTC price, possibly leading to a new all-time high for the first cryptocurrency. Additionally, bullish projections for BTC's price extend throughout 2024, although there is also a chance of price correction following the Halving.

Key Market Statistics

In this section, we will look into what data suggests about the current processes in the crypto market and their future development prospects.

Trading Volumes

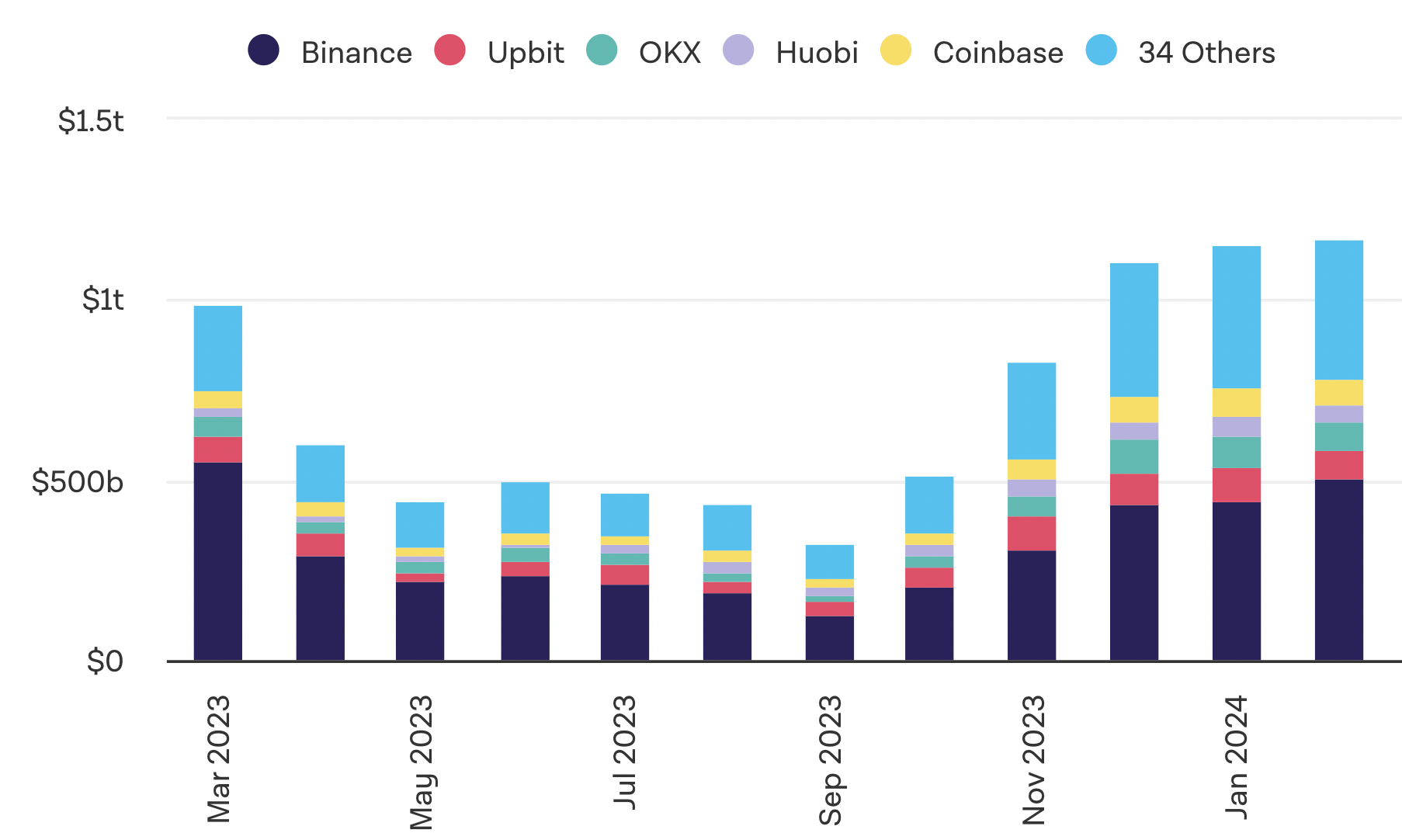

Amidst growing optimism within the crypto community regarding the onset of a bull run and the surge in BTC price, trading volumes on major centralized exchanges experienced remarkable growth in February. Total trading volumes surpassed $1T last month, marking a 12-month record. Additionally, February marked the third consecutive month where spot volumes on centralized exchanges exceeded $1T.

Centralized Exchanges’ Trading Volumes. Source: The Block

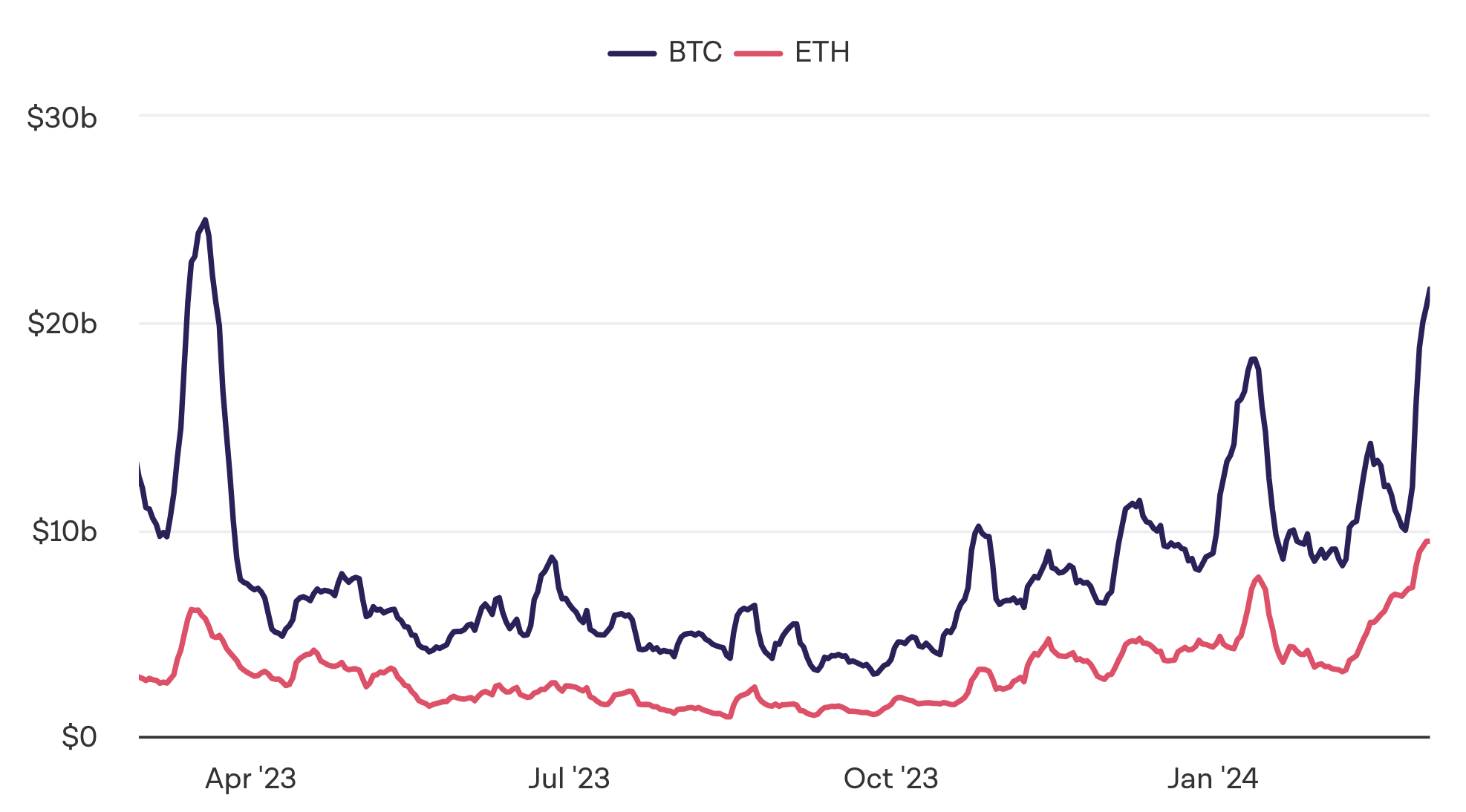

Bitcoin and Ethereum, as the top cryptocurrencies by trading volumes, played a pivotal role in driving the surge in trading volumes. Both assets achieved multi-month highs in terms of volumes, with Bitcoin surpassing $20B and Ethereum reaching $10B in trading volume.

BTC and ETH Trading Volumes (7D Average). Source: The Block

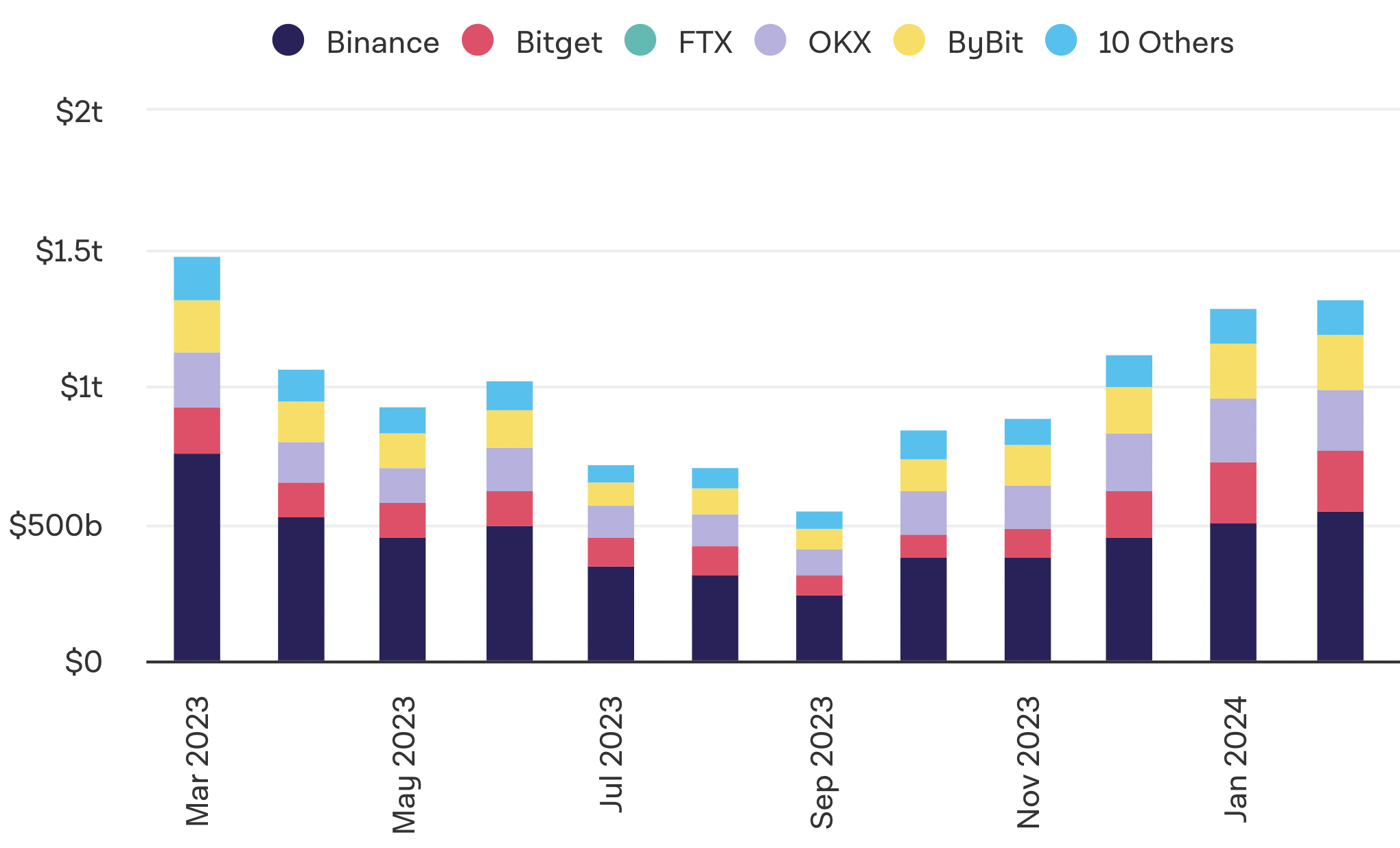

The most popular crypto derivative, BTC futures, also experienced significant growth. In February, the volume of BTC futures on the leading centralized exchanges exceeded $1T, marking the highest result since March 2023, when trading volumes almost reached $1.5T.

BTC Futures Trading Volumes. Source: The Block

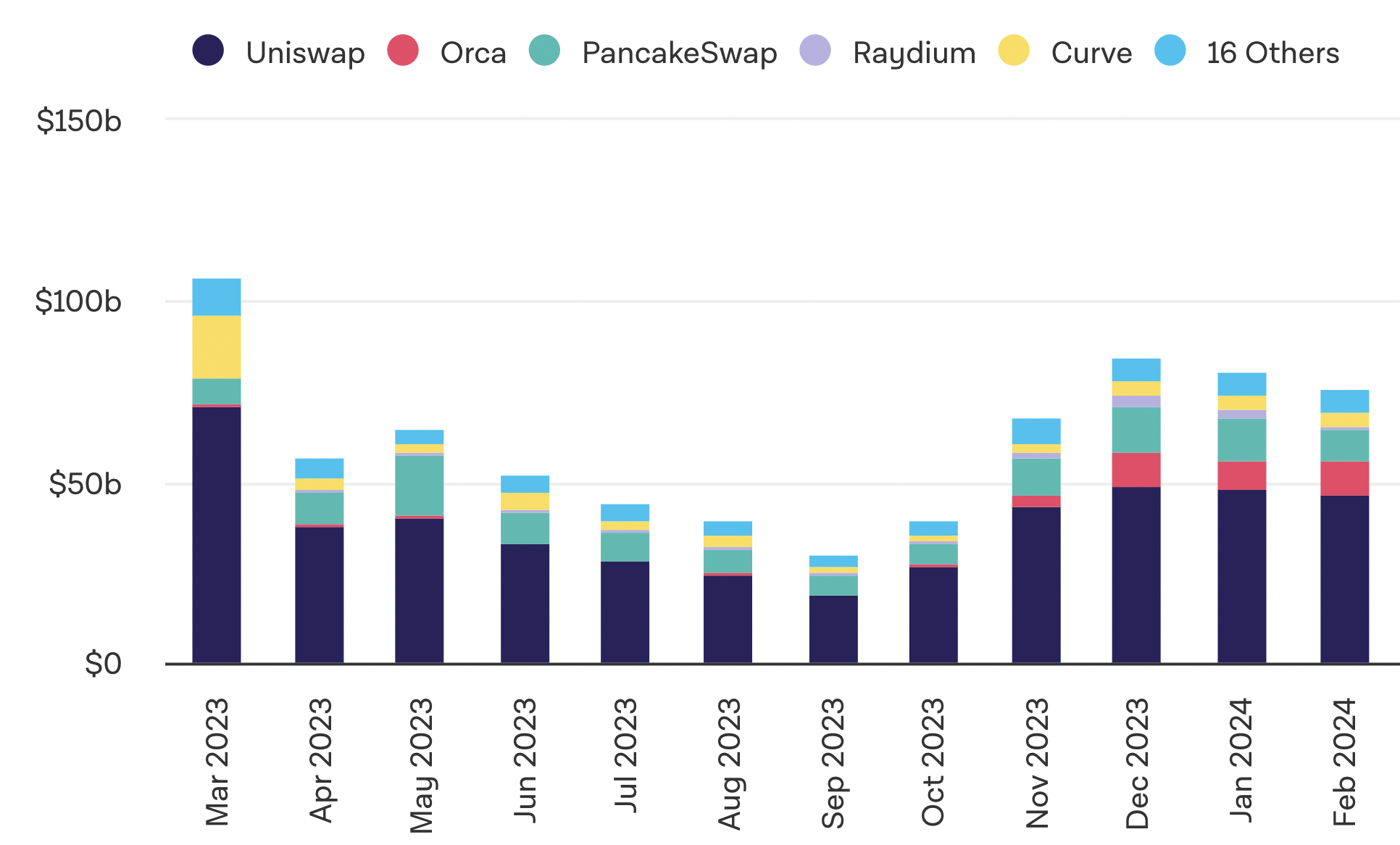

Decentralized exchanges (DEXs) continue to lag behind centralized exchanges in terms of trading volumes. Despite the rally of many assets in February and the "greed" sentiment among investors, DEX trading volumes slightly decreased compared to the previous month. Uniswap maintains its position as the leader among DEXs in terms of trading volume.

DEX Trading Volumes. Source: The Block

On-chain activity

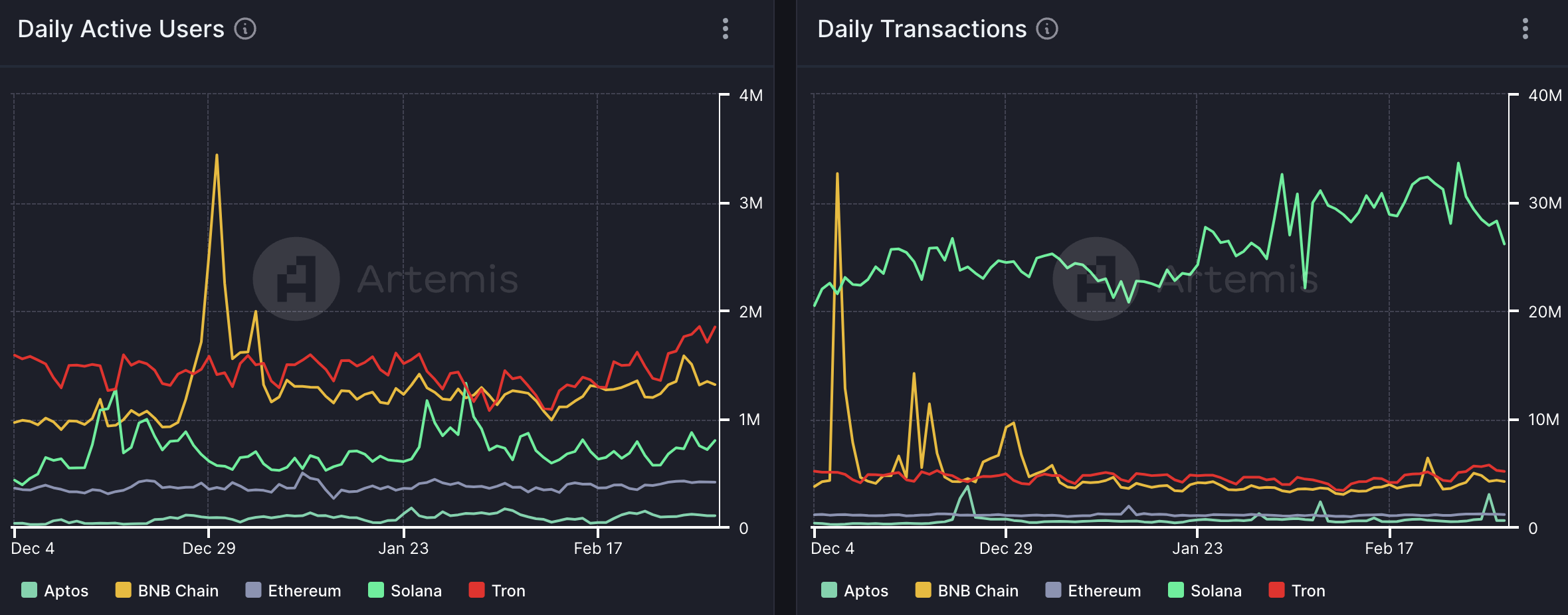

Tron was the leading blockchain solution by active users in February, followed by BNB Chain and Solana, while Solana significantly surpassed all competitors by daily transactions, exceeding 30M at the end of the month.

Leading L1 Chains by Active Users and Daily Transactions. Source: Artemis

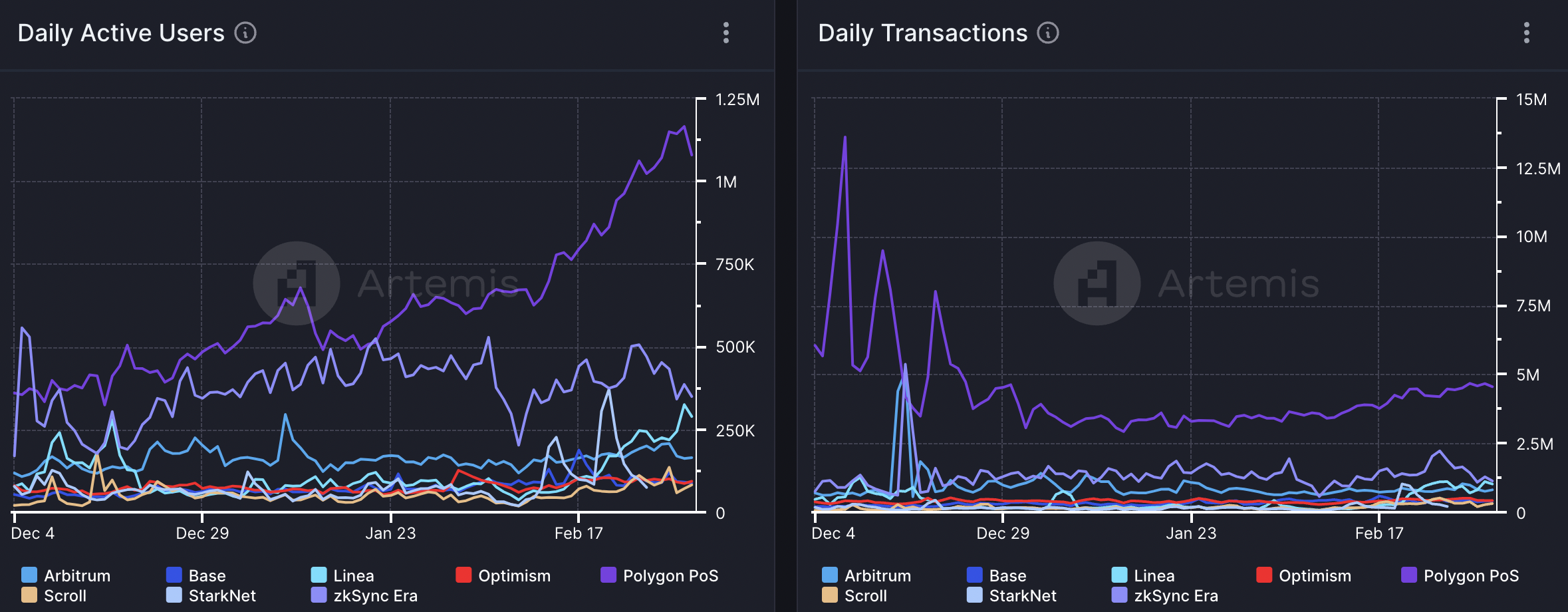

Polygon POS leads by active users and daily transactions among L2 solutions, demonstrating a significant growth in February. zkSync and Linea were in top 3 L2 by users and transactions last month, followed by Arbitrum, Optimism, and Scroll.

Leading L2 Chains by Active Users and Daily Transactions. Source: Artemis

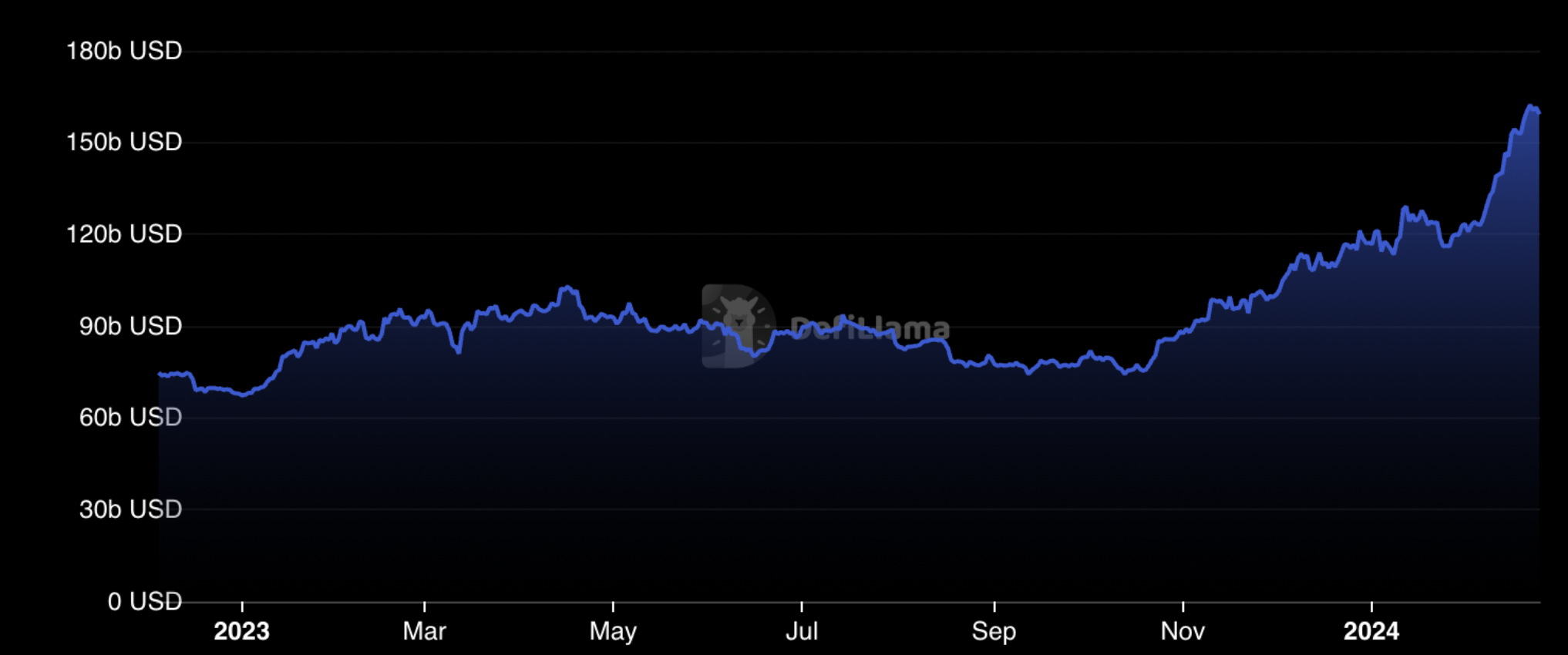

In February, the TVL in DeFi protocols experienced a significant surge, reaching $175B by the end of the month, marking a 44.6% monthly increase. This growth was largely driven by the excitement surrounding Ethereum liquid restaking (LRT) protocols. EigenLayer, a leading LRT protocol, saw an impressive 370% monthly growth in TVL, propelling it to the third position by TVL among all DeFi projects.

Total Value Locked Change. Source: DefiLlama

Closing Thoughts

February was an exceptionally positive month for the crypto industry, with Bitcoin almost rising to its all-time high driven by institutional investor inflows. The prevailing "greed" sentiment among market participants reflects a readiness for the anticipated bull run and new records. With 2024 poised to be a significant year for crypto, March is anticipated to be a pre-halving period, potentially witnessing BTC hitting a new all-time high. However, heightened volumes and interest could introduce volatility and short-term corrections. It is essential to maintain composure and conduct thorough market research before making any financial decisions.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.