Digital Currency's Birth: Tracing Back to the Dot-com Bubble

This blog post will cover:

- David Chaum and His Unappreciated Digital Money

- Adam Back's Battle Against Spam with Proof-of-Work

- Nick Szabo: One Step Away from Bitcoin

- The Dot-com Bubble

- A Catalyst for Cryptocurrency

- The Phenomenon of Market Bubbles

- Conclusion

Bitcoin (BTC) is often referred to as the world's first cryptocurrency. However, it might be more accurate to describe it as the first successful implementation of the idea of transforming traditional currency into a digital format.

On January 3, 2009, Satoshi Nakamoto mined the genesis block of Bitcoin, thereby opening the door to the previously unexplored Сrypto World. However, the history of the emergence of such digital assets began long before this event.

This article details the events leading up to the official birth of cryptocurrency in 2009 and introduces the key figures, alongside the enigmatic Satoshi Nakamoto, who contributed to its creation.

David Chaum and His Unappreciated Digital Money

One of the earliest crypto enthusiasts was David Chaum, an American scientist and inventor, who was once a simple graduate student in the computer science department at the University of California, Berkeley. In 1983, he published a paper called “Blind Signatures for Untraceable Payments” that essentially became the first to describe the concept of digital money.

In his work, Chaum emphasized anonymity, claiming it as the primary distinction between "new generation" money and the existing financial systems. He introduced the ideas of "blind signatures" and "digital envelopes," aimed at quickly solving privacy issues. In 1989, Chaum, along with his partner Stefan Brands, founded DigiCash Inc., a company that started issuing electronic money under the same name. Unfortunately, it neither gained the deserved fame nor profits, leading to DigiCash's bankruptcy in 1999.

David Chaum, often referred to as the "godfather of anonymous communication," was ahead of his time by approximately 25 years. People in the late 1980s were not ready for intangible electronic money, let alone cryptocurrency. Additionally, while Chaum proved to be a good ideologist and inventor, he was not a successful businessman. Despite his groundbreaking innovations, Chaum struggled to translate his technical success into commercial viability. His DigiCash faced numerous challenges, including a lack of widespread Internet usage and an early market that was not yet receptive to the idea of digital money. Chaum's idealistic vision often clashed with practical business realities, leading to management and operational difficulties within the company.

Thus, in 1989, cryptocurrency might have appeared, but it failed to establish itself in public consciousness – it simply proved to be unnecessary. Furthermore, Chaum did not solve the problem of centralized issuance, which became one of the major stumbling blocks for the system's advancement. It wasn't until the late 2000s and early 2010s that the world began to catch up with Chaum's vision, as technological advancements and changing attitudes towards digital currencies created a more conducive environment for their adoption.

Adam Back's Battle Against Spam with Proof-of-Work

In 1997, a young cryptographer named Adam Back actively promoted the Hashcash project – a solution aimed at combating spam emails. At that time, the Internet, and emails in particular, were still an unexplored but highly attractive novelty, captivating the minds of technology enthusiasts. Few could naively believe that the new system would only serve the good of society without creating problems or dangers.

"In particular, the easy and low cost of sending electronic mail, and in particular the simplicity of sending the same message to many parties, all but invite abuse," wrote IBM researchers Cynthia Dwork and Moni Naor. They later became the creators of the Proof-of-Work (PoW) algorithm, initially intended to protect Internet users from spam, unwanted advertisements, and hacker emails. Today, PoW is actively used in blockchain technology and is experiencing a resurgence in popularity.

Alongside Dwork and Naor, Adam Back and many other activists, calling themselves “cypherpunks,” fought against spam. Their ideas converged in 1997 with the emergence of the Hashcash project.

While the creators of Proof-of-Work primarily proposed methods to combat spam, Back and his team took a step further. Cypherpunks aimed for the following objectives in their activities:

Maintaining anonymity on the Internet

Preserving privacy

Protecting potential transactions online

Furthermore, Back expanded the application of the technology to include countering abuse of anonymous emailers. The Hashcash technology became one of the foundational points in the creation of the first blockchain. Based on it, the well-known digital projects B-money created by Wei Dai and BitGold by Nick Szabo, were launched in 1998.

Nick Szabo: One Step Away from Bitcoin

Unraveling the identity of Satoshi Nakamoto will undoubtedly be one of the most sensational events of the digital age. Various prominent figures, including Elon Musk and Gavin Andersen, as well as less known individuals like Dorian Nakamoto, have been proposed as potential candidates. However, cryptographer Nick Szabo is considered to have been the closest to Bitcoin.

Although Szabo has consistently denied any connection to the Satoshi Nakamoto phenomenon, his contributions to the cryptocurrency industry cannot be overlooked. Bit Gold, developed by Nick Szabo, not only inspired Bitcoin but also formed the foundation of the world's first cryptocurrency. His innovative design incorporated several key principles that would later be adopted and refined by BTC.

Moreover, Szabo was the progenitor of the concept of smart contracts, which were implemented in Ethereum in 2014.

In 2001, Nick Szabo published a widely acknowledged article titled "Trusted Third Parties are Security Holes," which systematically elaborated on his core opinions regarding security protocol design. Szabo argued that the presence of a "trusted third party" inherently introduces a security vulnerability. He believed that reliance on a trusted third party in a security protocol leads to centralization, which, in turn, introduces significant security risks and incurs high security costs.

Szabo was closer to Bitcoin than anyone else because he focused not only on anonymity and confidentiality but also on radically moving away from centralized controlling entities. According to him, the inflation and hyperinflation of the 20th century were caused by excessive trust in third parties. Eliminating intermediaries was the first step towards peer-to-peer (P2P) exchanges and a free monetary system.

The Dot-com Bubble

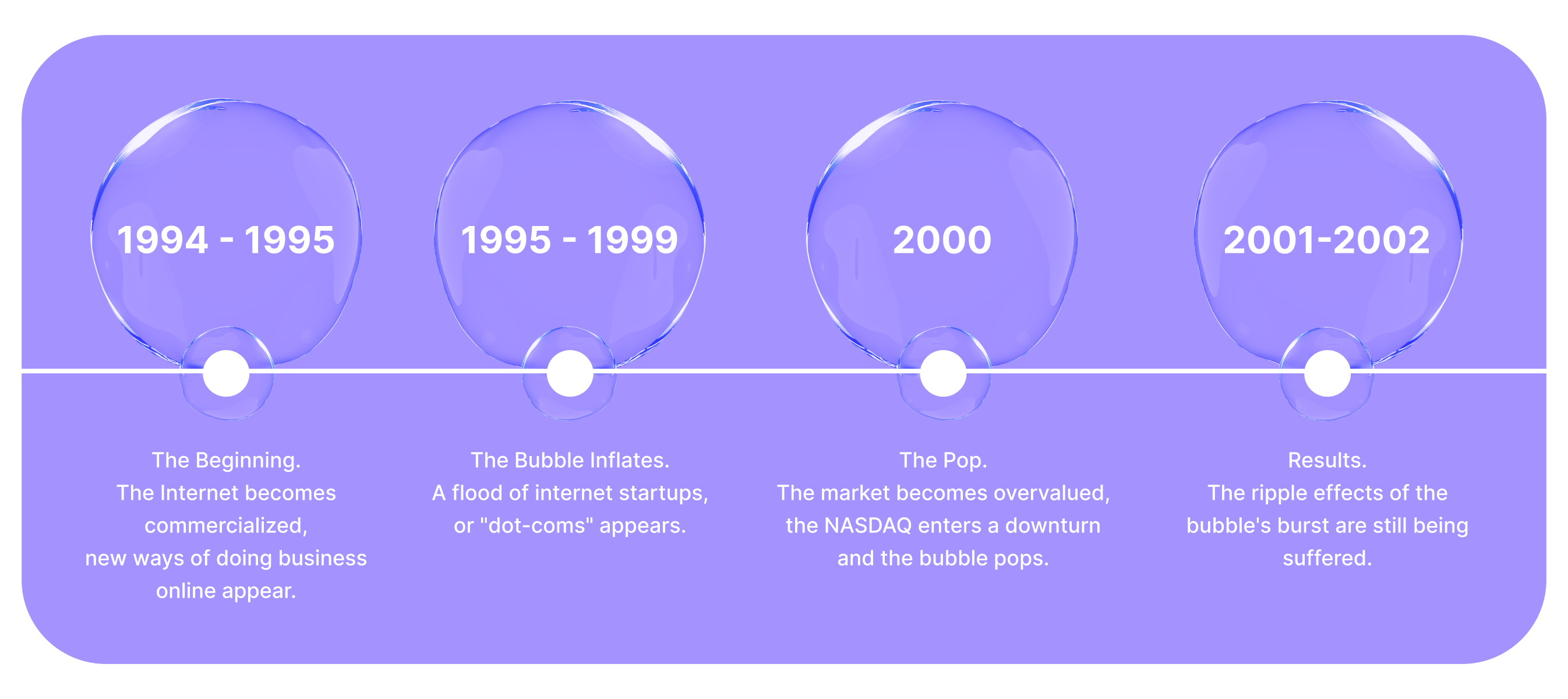

As we can see, the 1990s and 2000s marked a rapid start for the future rise of digital currencies, driven by both breakthroughs and failures. The former were largely technological, while the latter were economic. During exactly this period, the world experienced one of the largest financial crises, with total losses exceeding $5 trillion.

"The Dot-com Bubble burst" became a common refrain, even among those who didn't fully understand its implications. This bubble has since been used to caution investors, and its specter looms even now, 20 years later. Usually, stock market bubbles are most actively inflated by investors, influencers, and the media. The attention drawn to these markets drives investment, and the race for profit in a highly volatile market encourages faster and larger trades – until it crashes. That’s what happened in the 2000s.

The Dot-com Bubble refers to an economic period from 1995 to 2001. During this time, fueled by the rapid growth of the Internet, a massive number of IT startups emerged. This unjustified optimism led companies to trade and speculate on overvalued stocks, resulting in a significant market crash and enormous losses. In 2002, the NASDAQ technology index fell by 78%, losing $5 trillion in capitalization.

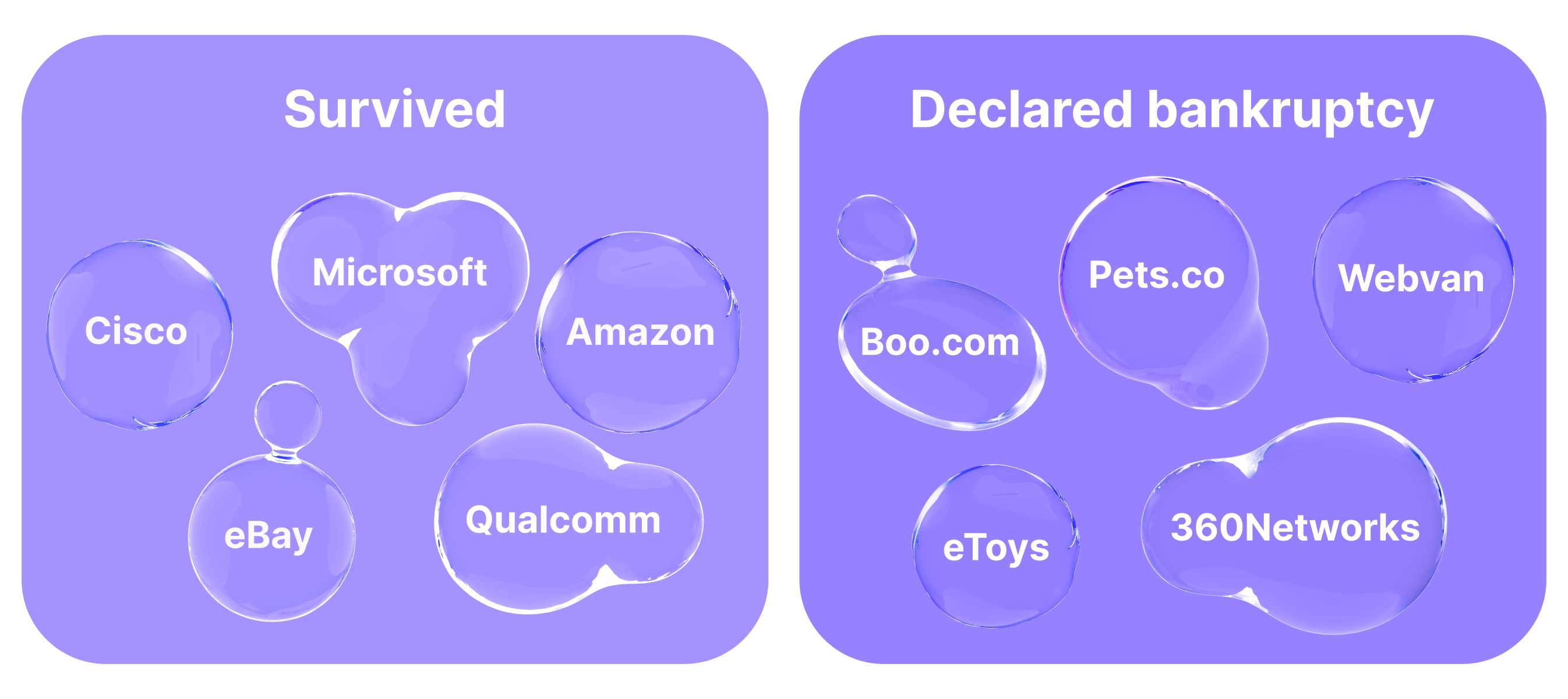

The euphoria surrounding the invention of the Internet and the new opportunities led people to make reckless decisions. However, as we can see on the picture above, some companies managed to survive this period. They became world-famous giants that are still on the market.

A Catalyst for Cryptocurrency

The Dot-com Bubble, spanning from 1995 to 2001, was characterized by the explosive growth of Internet companies and the subsequent burst of speculative investments. During this time, the widespread enthusiasm for the Internet and its potential led to the creation of numerous tech startups. Although many of these companies eventually failed, the period was marked by significant technological innovations and the establishment of many modern technologies. For example, origins of digital currencies can be traced back to the Dot-com Bubble of the 1990s.

On the one hand, the 1995 to 2001 period resulted in significant financial losses and a more cautious investment climate. However, the technological advancements and ideas developed during this time did not disappear. It was a period of rapid technological advancement and speculative investment in Internet-based companies. This era set the stage for the development of the technologies that would later become the foundation of cryptocurrencies.

Here are innovations and concepts, that appeared during Dot-com Bubble period, and that became a starting point for crypto formation:

Cryptographic advances. The late 1990s saw significant advancements in cryptography, which is the backbone of modern digital currencies. Innovations such as public-key cryptography and hash functions were critical in ensuring secure transactions and data integrity, laying the groundwork for blockchain technology.

Digital payment systems. Early attempts at creating digital payment systems, like David Chaum's DigiCash, emerged during this period. Although DigiCash ultimately failed due to a lack of widespread adoption and business challenges, it introduced the concept of secure, anonymous digital transactions.

Smart contracts. As was mentioned above, Nick Szabo was the one who introduced the idea of smart contracts in the late 1990s. These self-executing agreements with the terms directly written into code would later become a key feature of blockchain platforms.

In 2009, Satoshi Nakamoto created Bitcoin, the first successful decentralized digital currency. Bitcoin used many cryptographic ideas and decentralized concepts from the Dot-com era. Its invention started a new age in digital finance, leading to the creation of thousands of other cryptocurrencies and blockchain technologies.

The Phenomenon of Market Bubbles

In economic terms, a "bubble" refers to trading an asset at a price or within a price range that significantly exceeds the asset's intrinsic value. Simply put, it means speculation. Investors are advised to remember the rule: "When the market overestimates reality, a bubble forms."

The main characteristics of any bubble include:

Widespread adoption. A large number of people invest in the asset, driven by the fear of missing out (FOMO) and the belief that prices will continue to rise. This adoption is often fueled by media hype and the promise of high returns.

Extremely narrow and limited current applications. Despite the hype, the asset has very few practical uses in its current state. The actual application of the asset is often limited, and its real-world utility is not proportional to its high valuation.

Difficulty in valuing the asset. Determining the true value of the asset becomes challenging. The market is filled with speculation rather than grounded analysis, and prices are driven more by sentiment and expectations than by fundamental value.

Looking back, history is replete with examples of bubbles like the Dot-com, such as the Dutch Tulip Mania of the 1630s and the South Sea Bubble in the 1720s. These events all shared the common traits of widespread speculation, limited real-world application at the time, and a subsequent market correction that brought asset prices back to more rational levels.

When the bubble bursts, which it inevitably will, a period of decline will follow. This decline may last several months or even years until new leaders emerge who can rebuild and lead the industry. A phase of renewal will ensue, taking the industry to new heights. It's important to remember that bubbles are a natural component of the investment process.

Conclusion

The emergence of digital currency is a natural outcome of the innovative technological progress initiated in the late 1990s. The invention of accessible Internet, solutions to data preservation issues, protection against spam, increased data processing speeds, and the expansion of possibilities all laid the groundwork for creating a new currency system, now known as cryptocurrency.

Today, crypto assets require support and promotion. Despite its impressive background and enormous potential for use, it remains an unstable system. Developers believe that the more people are attracted to it now, the more refined it will become.

Testers, users, investors, sponsors, and many other participants in the Crypto World are currently helping cryptocurrency strengthen its position. Some even believe that the growing popularity of crypto assets might even prompt governments to adapt traditional economic systems, enriching them with new, faster, more flexible and secure functions.

Nowadays crypto is actively utilized worldwide as a means of payment, a source of income, or an investment tool, used both for preserving and multiplying capital. According to some optimistic analysts' forecasts, in the future, people may fully transition from cash to cryptocurrency, making the economy more transparent, secure and reliable.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.