Grayscale Won Against the SEC in Court

This blog post will cover:

- Grayscale vs. the SEC

- The Judge's verdict

- Implications of the decision

- What was the community reaction to the Grayscale’s victory?

Yet another watershed court decision was announced at the end of August 2023. This time, in a clash with the U.S. Securities and Exchange Commission (SEC), crypto management firm Grayscale emerged victorious. Following Ripple's recent success, this marks the second consecutive time that the judiciary has sided with the cryptocurrency sector.

In this article, we will delve into the details of the case and explore its significance within the crypto landscape.

Grayscale vs. the SEC

The genesis of the case can be traced back to October 2021 when the SEC refused to accept Grayscale's application. The crypto management firm had sought approval to list an exchange-traded fund (ETF) designed to reflect the price movements of Bitcoin.

Grayscale's proposition centered around turning its already existing BTC trust into an ETF, a request that the Commission declined. Notably, other companies, such as Ark Investments, faced similar rejections for similar proposals but did not follow through with legal recourse. The SEC's opinion rested on concerns about investor protection and potential market manipulation associated with spot Bitcoin ETFs, despite having greenlit Bitcoin futures ETFs.

Grayscale's contention argued that the safeguard mechanisms used by futures ETFs, particularly the control over market conditions on the Chicago Mercantile Exchange (CME), should also be enough for their spot ETF. After all, both products drew from the underlying price of the cryptocurrency, and CME oversight would enhance investor protection.

The Judge's verdict

The court determined that Grayscale's ETF closely resembled the BTC futures ETFs which have been greenlit both in the assets and surveillance sharing mechanisms.

The judge criticized the Commission for failing to adequately clarify why using Bitcoin instead of Bitcoin futures would impact fraud prevention.

Consequently, the court deemed the SEC's rejection of Grayscale's application as "arbitrary and capricious."

Both sides of the case now have the opportunity to appeal the decision, which could potentially elevate the case to the U.S. Supreme Court or an en banc panel review. If Grayscale ultimately prevails, and the SEC refrains from appealing, the court will outline the execution of its decision, potentially telling the SEC to approve the ETF or reconsider the application on different conditions.

Both parties have a 45-day window to appeal the ruling, with Grayscale's CEO, Michael Sonnenshein, indicating that the legal team is currently evaluating strategic possibilities.

Implications of the decision

The result of this case has the potential to extend to other market players that have filed spot Bitcoin ETF applications. While the ruling does not mandate automatic SEC approval for Bitcoin ETFs, it could influence the SEC's future determinations regarding ETF proposals. This, in turn, could pave the way for an increased presence of cryptocurrency-based investment products within the U.S. market.

After the decision, the price of BTC increased almost 8% from $25,960 to $28,003 on the day of the court’s decision. Some other currencies also responded to the news with growth, for example, Ethereum, Litecoin, etc.

What was the community reaction to the Grayscale’s victory?

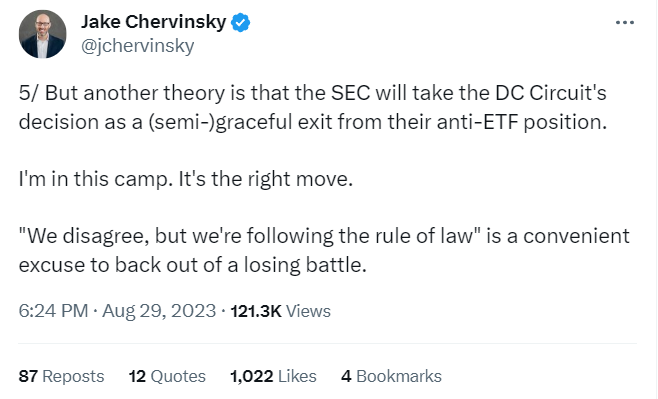

The news was received in a very positive way by the crypto community. Even though the court’s decision does not mean that the ETFs in question will be allowed any time soon, many experts believe that this is what is going to happen.

What is more, a lot of people believe that this outcome is a strong signal that not only the American judicial system, but the country’s authorities in general, are warming up to crypto. This means that more crypto-related financial instruments will be available to the general public, and the sphere will become more mainstream in the future.

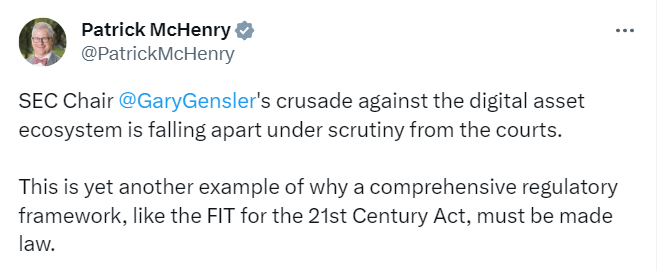

To conclude, the situation that we saw throughout 2023 with the SEC having a full-blown crusade against everything crypto-related, has changed drastically. The partial win of Ripple which is being challenged now gave some people a weak hope that the American authorities might become more pro-crypto. However, Grayscale’s victory already feels like a more tangible reason to think that the status of crypto will be stronger even sooner than we had hoped. Of course, the outcome might be different, so we should keep an eye on the developments.