How to Invest in Crypto Without Buying It

This blog post will cover:

- Short overview

- Existing types

- Benefits and drawbacks

- The final word

Despite its ups and downs as a maturing one thing hasn’t changed about crypto: its utility and its sensational appeal. Crypto continues to rise as legitimate, tradable financial assets for making profit and long-term investment, and its status as a medium of exchange in all kinds of financial transactions.

The volatility of the crypto industry bothers some investors, but luckily, they have options to invest and trade in it obliquely. How? Through crypto derivatives. Read up on our full primer on this topic and learn how you could indirectly invest in crypto.

Short overview

Now, for a bit of history: financial derivatives have existed since the Babylonians. Derivatives, in essence, are financial contracts whose value is underwritten by a connected asset.

Crypto derivatives are just another iteration of financial derivatives that were a standard in the current financial system for a long time – as well as an indicator of how far the technology has matured. Along with the growth of cryptocurrency, financial products are developed more complexly.

Existing types

Derivatives can be categorized into three major types. Here they are.

Options

This type gives investors the ability (not the duty) to trade crypto at a preset cost anytime in the future. This is considered as the most usual form of a derivative.

Options allowing you to purchase crypto at a predefined cost later is a call option. Options available for selling it under the same conditions is a put option.

The strike price signifies the specific value at which the cryptocurrency will be traded.

Futures

These ones actually remind the previous type we observed, but with one important difference: futures need (read: obliged) to be realized on the stipulated date. Options, as the name implies, merely gives the opportunity to use them, but futures oblige investors to exercise said right.

For instance, if one buys Ethereum futures, he or she is obliged to purchase ETH on the expiration date for the predetermined strike price, no matter what the present prices are.

Perpetuals

They are futures contracts that don’t expire. Perpetuals trade constantly compared to futures and options.

Perpetuals are undoubtedly the most prevalent derivatives in use, giving traders a chance to bet on price changes without having to actually perform the act of trading or storing the crypto they represent.

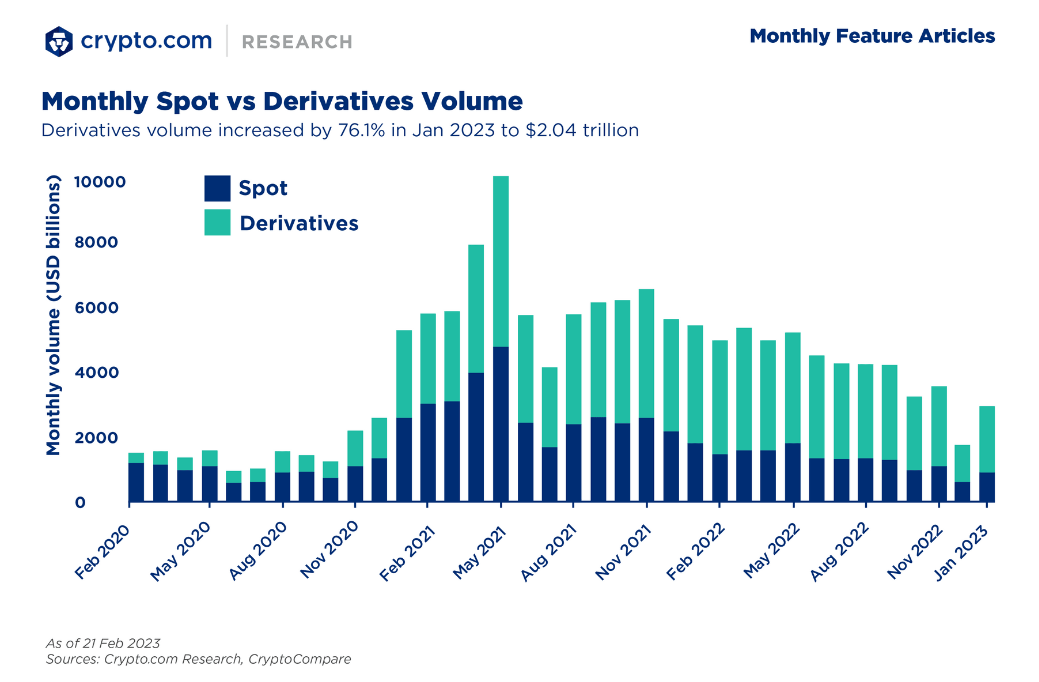

According to the research made by Crypto.com, the monthly volume of spot and derivative market differs a lot, which shows a strong interest of investors:

Benefits and drawbacks

Dealing with derivatives has its own pluses and minuses that every trader planning to play the market needs to be aware of to properly manage their risk.

Pros

- Derivatives trading is cheaper than spot trading.

- Allows non-crypto natives to bet on crypto prices with no need to work with the complex technology.

- Permits investors to hedge their other investments as portfolio insurance.

- Gives traders an ability to trade with plenty of leverage and to maximize their gains (at the risk of greater loss of capital).

Cons

- Requires a better knowledge of financial concepts and can be unsafe for beginners without the requisite knowledge.

- Volatility and trading with leverage on derivatives can cause big losses.

- The uncertain regulatory status of such trading may cause potential legal and compliance dangers.

- U.S.-based retail traders aren’t permitted to trade crypto derivatives.

The final word

Aim to gain exposure into crypto and benefit from its massive potential without having to work with the technical details of wallets, passkeys, and decentralized apps? Crypto derivatives might be something you’d like to look at. If it is allowed in your country of residence, you may try to explore trading in crypto futures, and other derivatives types as a way to hedge your portfolio risk and maximize your gains.

However, always remember to do your own research before engaging in order to gain a better foundational understanding of the market, its inherent volatility, and the associated benefits and risks that trading the said market involves.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.