Mechanisms of Yield Farming in DeFi

This blog post will cover:

- What is Yield Farming?

- Mechanisms of Yield Farming

- Risks and Challenges of Yield Farming

- Successful Examples

- How to Get Started with Yield Farming

- Conclusion

As decentralized finance (DeFi) reshapes conventional financial paradigms, yield farming stands out as a notable aspect, luring investors with enticing prospects of substantial returns. Yet, beyond its surface allure, DeFi yield farming (YF) conceals intricate layers of complexity intertwined with blockchain protocols. This exploration endeavors to demystify the concept, illuminating its mechanisms and ramifications for the broader landscape.

What is Yield Farming?

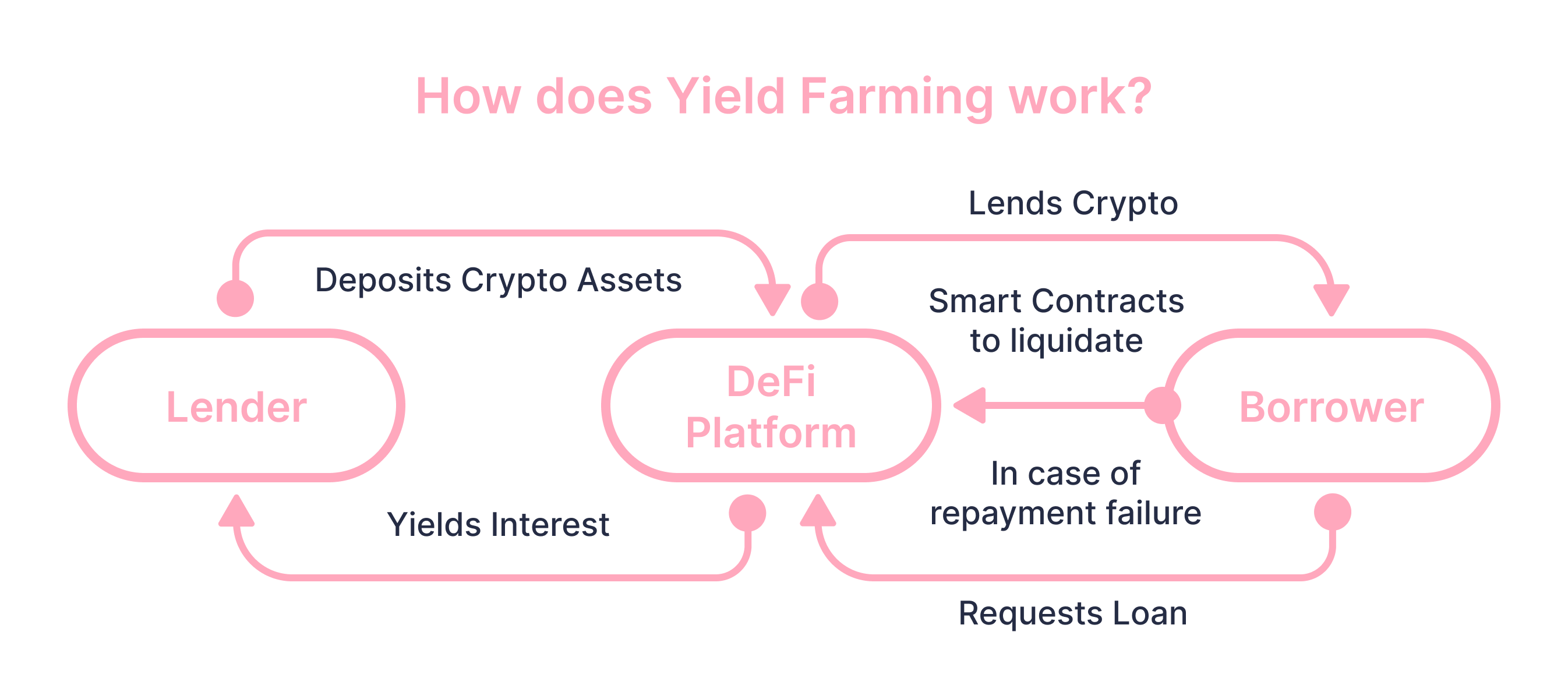

Yield farming, also known as liquidity mining, is a crucial element of the decentralized finance ecosystem. It provides cryptocurrency holders with opportunities to earn rewards on their assets. This involves placing cryptocurrencies into smart contracts to supply liquidity for various DeFi applications. In exchange, participants are granted rewards, which may comprise interest earned from loans or a portion of transaction fees, frequently dispensed in token form.

Asset lending is a key component of YF, allowing users to deposit their tokens into lending platforms for others to borrow, generating interest that is subsequently distributed back to the initial lenders, also known as yield farmers.

The earning tokens process is entirely managed by smart contracts, which automatically carry out transactions according to predefined conditions embedded in the contract, removing the need for intermediaries.

However, it's crucial to recognize that although YF offers potential profits, it also comes with inherent risks, which will be discussed later in this article. Prospective yield farmers should thoroughly understand these risks and perform comprehensive research before getting involved.

Mechanisms of Yield Farming

At the heart of YF lies liquidity provision, wherein users deposit assets into a smart contract, establishing a pool utilized by DeFi apps for trading or lending purposes. In return for their contribution, participants receive Liquidity Provider (LP) tokens, symbolizing their stake in the pool and granting them the ability to access a portion of the transaction fees generated or earn supplementary rewards through staking.

Besides, the following mechanisms are usually employed:

Smart contracts manage farming pools, where users contribute assets for activities like borrowing or trading. The transaction fees generated from these activities are subsequently distributed among the liquidity providers based on their proportional share in the pool.

Staking plays a vital role in yield farming, where users lock their tokens in a proof-of-stake (PoS) system to help validate blocks and earn rewards. Moreover, staking can also include depositing liquidity provider (LP) tokens into farming pools to receive additional rewards.

Advanced strategies such as yield optimizers aim to boost returns by dynamically shifting funds across different protocols to take advantage of the most profitable opportunities. These systems utilize sophisticated algorithms to assess factors like transaction fees and potential rewards.

Risks and Challenges of Yield Farming

Although YF offers a number of potential gains, it's essential to comprehend the dangers associated with it.

Smart contract vulnerabilities: smart contracts play a crucial role as automated agreements that execute transactions under predefined conditions. Despite their effectiveness, these contracts may harbor bugs or weaknesses that malicious actors could exploit, potentially leading to financial losses even from minor coding errors.

Impermanent loss: happens when the prices of deposited assets undergo significant fluctuations, leading to a reduction in value when withdrawn from a liquidity pool.

Market volatility: the inherent volatility of the cryptocurrency market poses a significant risk due to its tendency for rapid price swings. These fluctuations can impact the Annual Percentage Yield (APY) of investments and potentially result in substantial losses if market conditions deteriorate.

Liquidity risk: another concern is the potential loss of liquidity for specific tokens. Insufficient market demand or supply may hinder the sale of tokens without affecting their price, resulting in liquidity challenges.

Regulatory uncertainty: DeF faces evolving regulatory landscapes. Changes in legislation can impact the viability of certain yield farming strategies, introducing regulatory uncertainty into the equation.

Successful Examples

Let’s delve into a few successful examples in the DeFi space:

Yearn Finance (YFI)

Yearn Finance exemplifies successful yield farming practices. Serving as an automated protocol, it aids users in identifying the most profitable YF opportunities. Through the dynamic allocation of funds across different protocols to maximize Annual Percentage Yield (APY), Yearn Finance simplifies the journey, allowing users to earn passive income from their crypto assets without the need for manual intervention.

Compound (COMP)

Compound emerges as another vibrant player amongst DeFi yield farming platforms, offering opportunities for YF. Users can opt to lend their assets on Compound, earning interest that adjusts according to market conditions. This interest rate varies based on the asset's supply and demand dynamics, with heightened demand leading to higher interest rates.

Curve Finance (CRV)

Curve Finance functions as a decentralized exchange tailored for stablecoin trading. Users can provide liquidity to Curve's pools and earn trading fees as incentives. Moreover, participants can also acquire CRV tokens, which function as Curve's inherent governance token.

These examples illustrate the variety of yield farming strategies available. Each platform offers unique opportunities and risks, and successful outcome often involves diversifying across multiple platform

How to Get Started with Yield Farming

Curious about how to begin? Below are the steps outlining the general process:

Selecting a protocol: participants, known as liquidity providers or yield farmers, decide on a yield farming protocol. An instance could be an automated market maker (AMM) platform like PancakeSwap or exchanges like SimpleSwap.

Depositing assets: users deposit their digital assets into a liquidity pool. For example, they could submit BNB and CAKE to the BNB/CAKE pool.

Acquiring tokens: after depositing assets into the trading pool, users are awarded LP tokens, which signify their ownership stake in the liquidity pool.

Earning rewards: subsequently, users leverage their LP tokens by staking them in the yield farm, such as the BNB/CAKE yield farm, to receive rewards. These are distinct from the transaction fees users earn as their share of the liquidity pool. In addition, DeFi yield farming rates might vary.

Governance tokens: numerous protocols provide governance tokens as incentives for yield farmers. These tokens empower holders to engage in decision-making processes concerning the platform by voting and can also be exchanged on various platforms.

It’s worth noting that yield farming primarily comprises two types: liquidity pool (LP) farms and staking farms. Despite both requiring the deposit of cryptocurrency into smart contracts, they diverge significantly in their operational mechanisms.

Liquidity pool (LP) farms: these involve users depositing cryptocurrency assets into smart contracts to form liquidity pools. These pools operate similarly to decentralized trading pairs, enabling transactions between multiple cryptocurrencies. In return for providing liquidity, participants receive LP tokens representing their stake in the pool.

Staking Farms: staking farms entail participants contributing cryptocurrency to a smart contract specifically created to provide a staking pool.

Conclusion

Comprehending the intricacies of yield farming enables investors to make informed decisions and capitalize on opportunities in the DeFi domain. While vigilance is necessary due to associated risks, the potential rewards and DeFi yield farming development make it an appealing path for exploration. As the market progresses rapidly, yield farming is positioned to shape the future of decentralized finance significantly. Stay informed, exercise caution, and embrace the journey!

Disclaimer: SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.