The Arrest of the Head of Gotbit Hedge Fund

This blog post will cover:

- How Does Manipulation Happen in Crypto?

- Gotbit's Involvement

- FBI's Role and New Investigative Methods

- SEC Charges Against Saitama Inu Creator

- Conclusion

The recent arrest of Aleksei Andriunin, the head of market maker Gotbit, in Portugal at the request of the U.S., has sent shockwaves through the crypto community. This is part of a broader operation from the American legal structures targeting a number of market makers (MMs), including Gotbit, ZM Quant, and others. These entities are accused of manipulating tokens by creating fake trading volumes and using other schemes to distort market indicators.

Crypto has long struggled with fraudulent schemes like trade volume manipulation and "pump and dump" tactics, which undermine investor trust. Wash trading has been banned in traditional financial markets, and many people hold the opinion that the crypto sphere is long overdue for introducing similar measures.

In this article, we are going to look into what happened and how it might affect the industry.

How Does Manipulation Happen in Crypto?

Some cryptocurrency projects hire MMs for wash trading, aiming to create the illusion of strong interest in a token and attract investors who buy at inflated rates. The MMs get a fee or some other reward in return. One of the accused admitted the aim was to attract other buyers using fake volumes and price growth. Tokens manipulated included Water, VZZN, SAITAMA, and many others.

An example of this manipulation can be seen in the chart of the meme token Water, where a price pump occurs due to artificially increased volumes, followed by a dump when the MM sells off the asset, crashing its price.

Source: DEXtools.io

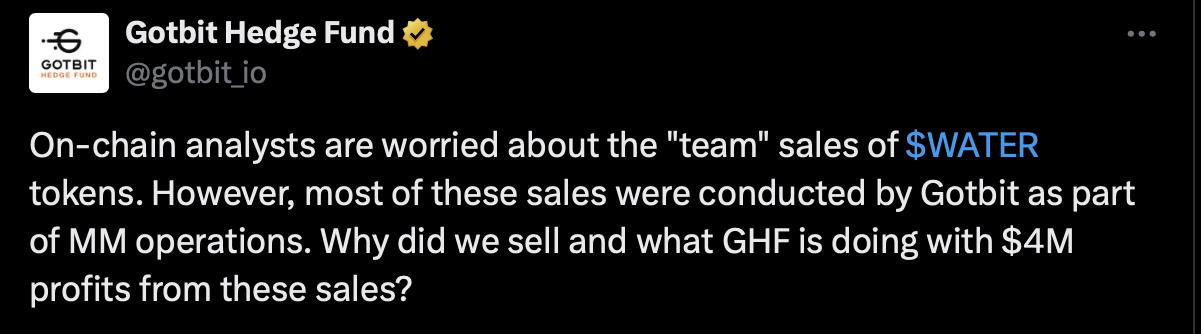

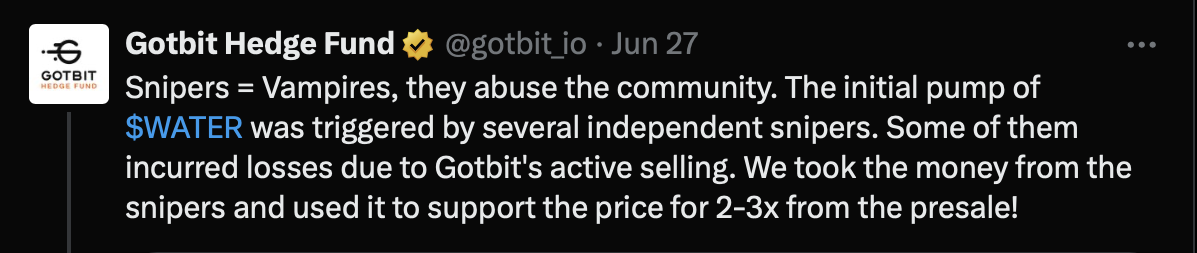

Gotbit's Involvement

Gotbit Hedge Fund, which acted as a MM for the Water meme token, has explained their activity as trying to fight so-called Vampires:

The situation with the Water token and their post on Twitter (X) sparked outrage in the community. Many users expressed their dissatisfaction in the thread and in other discussions.

FBI's Role and New Investigative Methods

The FBI was involved in the arrest and the situation in general. In an unprecedented move, the bureau created its own token on the Ethereum network, called NextFundAI. They used it to find, stop, and prosecute alleged scammers, demonstrating that law enforcement is becoming more active in the crypto industry and is using unconventional methods to uncover fraud.

Acting U.S. Attorney Joshua Levy commented on the case: "The message today is, if you make false statements to trick investors, that’s fraud. Period."

These kinds of charges can carry serious consequences. If found guilty, violators face up to 20 years in prison, as well as fines of up to $5 million or twice the gross profits or losses from the crime. In some cases, asset confiscation is also possible. This demonstrates the authorities' determination to stop any attempts at market manipulation in the crypto sphere.

SEC Charges Against Saitama Inu Creator

On October 9, another significant event occurred. For the first time in history, the U.S. Securities and Exchange Commission (SEC) filed charges against a private individual Vy Pham for fraudulent promotion of Saitama Inu. Its MM was Gotbit as well.

This is a key moment, highlighting that even meme tokens, often considered insignificant assets, are now under regulatory scrutiny. The Saitama Inu case shows that now even the unserious cryptocurrencies will be held accountable for market manipulations.

Here is an example of the scheme with SAITAMA, where the token goes through artificial pumps, followed by price crashes:

Source: CoinMarketCap

Conclusion

The legal attention that the MMs got recently, along with charges against individuals like the creator of Saitama Inu, suggest increasing regulation in the cryptocurrency market. Legal authorities in the U.S., and potentially other countries soon, appear poised to strengthen their efforts to combat cryptocurrency scams.

Going forward, we can expect such actions to intensify, making the crypto market more mature and safe for all participants.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.