Top 5 Coins Shaking Up the Crypto Market in August

This blog post will cover:

Investing has some risks, particularly for those who lack industry understanding. Demand for investment portfolios surged during the pandemic as remote, passive income allowed some people to continue operating their painstakingly built businesses, while others used savings assets to ensure their own survival.

The unstable state of tangible assets such as automobiles, apartments, and appliances, together with financial investments in the form of precious metals, stocks, and funds, drew the attention of the public toward cryptocurrencies. Investors' interest in cryptocurrency projects hasn't diminished despite the recent downturn in the value of several currencies. We want to examine the top five cryptocurrency projects in August 2024 in this article.

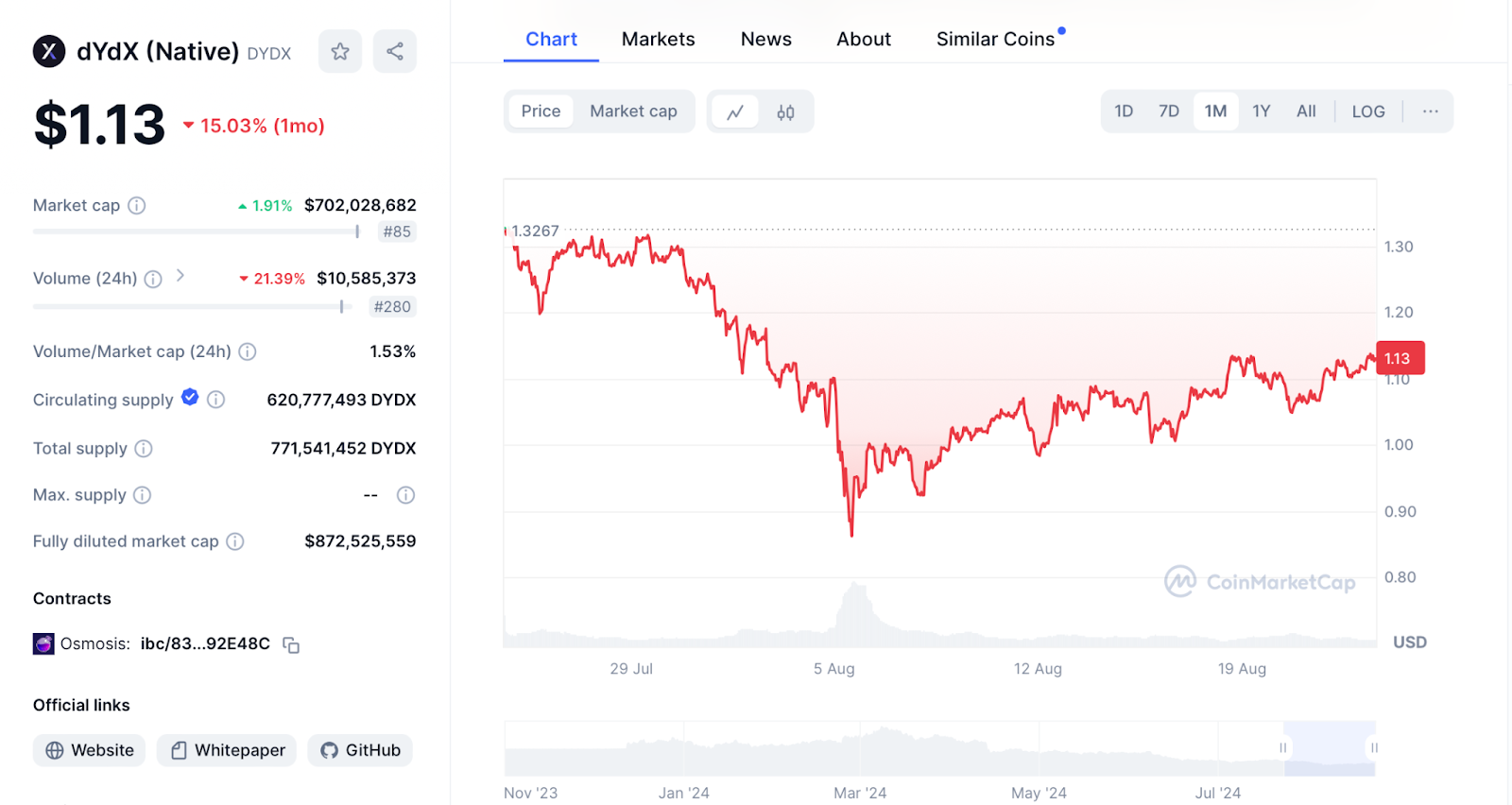

Optimism (OP)

A significant network upgrade and a superchain implementation strategy were revealed by Optimism developers at the beginning of August. Superchain is an ecosystem of L2 networks built on the OP Stack tool.

Originally, it was intended for these networks to be interoperable so that they would appear to be a single network, but as it is, they all function independently of one another. Presently, the team Optimism is diligently tackling it.

Optimism's short-term goals include:

Putting in place a protocol that allows communications (such as data, tokens, and so forth) to be sent across any network in the superchain ecosystem;

Create a global ERC20 token standard for Superchains (ERC-7683);

Enhance the system's failure tolerance to enable safe asset transfers between networks.

Since over 36% of all L2 segment transactions are now processed by over 30 networks built on top of OP Stack, Optimism's latest version will only serve to draw more users and developers to this ecosystem.

The price of OP token is now declining and selling at $1.56, however with the Superchain upgrade, it may exhibit strong growth dynamics in a favorable market and rise back to a range of $1.8-$2.1 per coin.

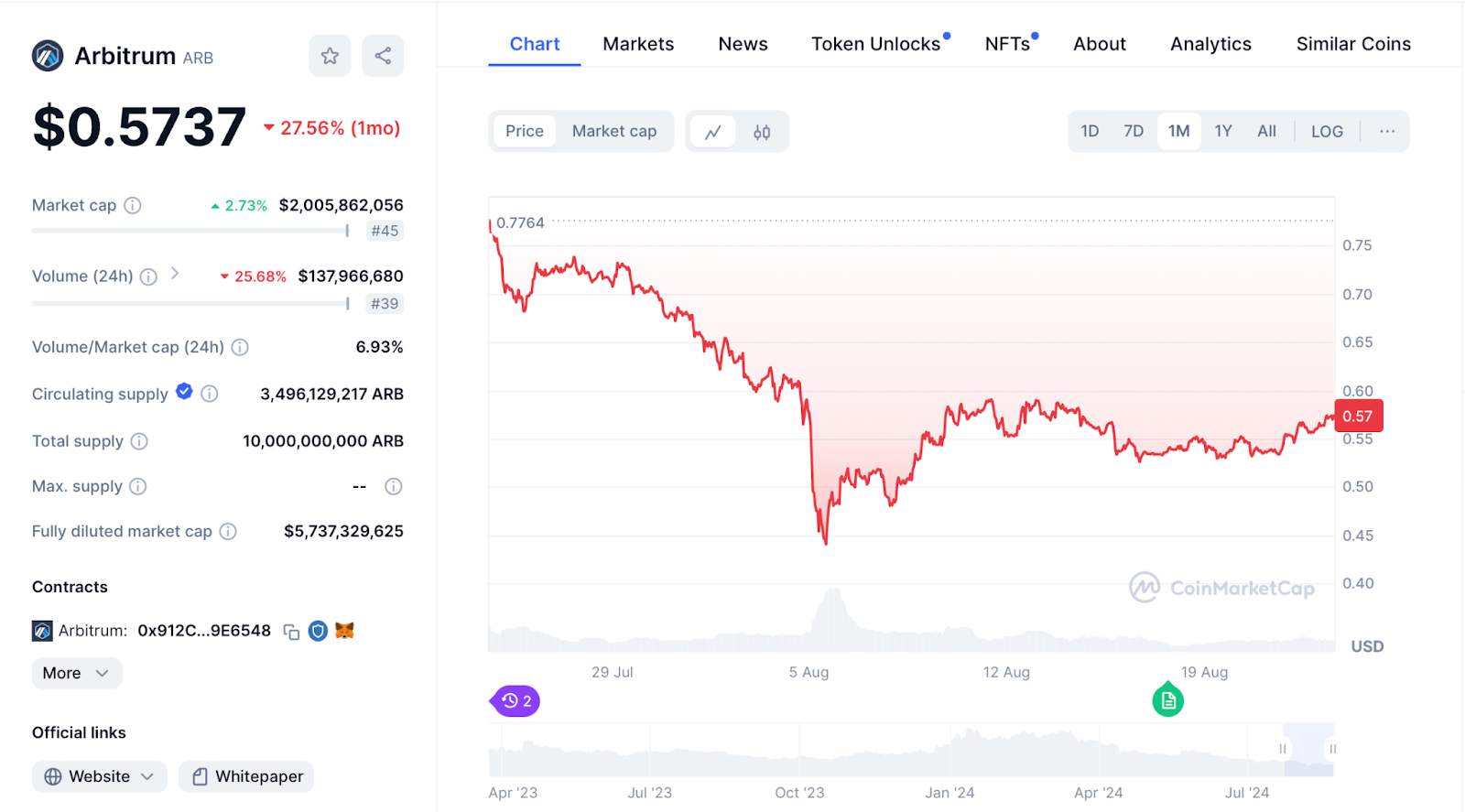

dYdX (DYDX)

In the derivative decentralized exchange segment, dYdX has long had a leading position. Last year they introduced dYdX Chain, their own blockchain, into the Cosmos ecosystem, and this year they will release dYdX Unlimited, a significant network upgrade.

The primary advancements after dYdX Unlimited are:

Users will be able to list practically any market on the platform with immediate liquidity thanks to permissionless market listings, which eliminate the requirement for verification;

The primary liquidity pool, MegaVault, will serve as a market maker for all dYdX markets;

A new referral system, Affiliates Program, will be introduced;

Permissioned keys will be utilized for improved wallet management and enhanced security. This makes specific activities exclusively accessible to approved members.

All of these will make dYdX the leading derivatives exchange and draw more customers to the Cosmos network.

Because of the sector's declining market, dYdX is currently trading at $1.13 per coin and has lost 15% of its value this month. We may anticipate a rebound to the $1.38–$1.45 per token range given the rising general market and increasing demand for the token.

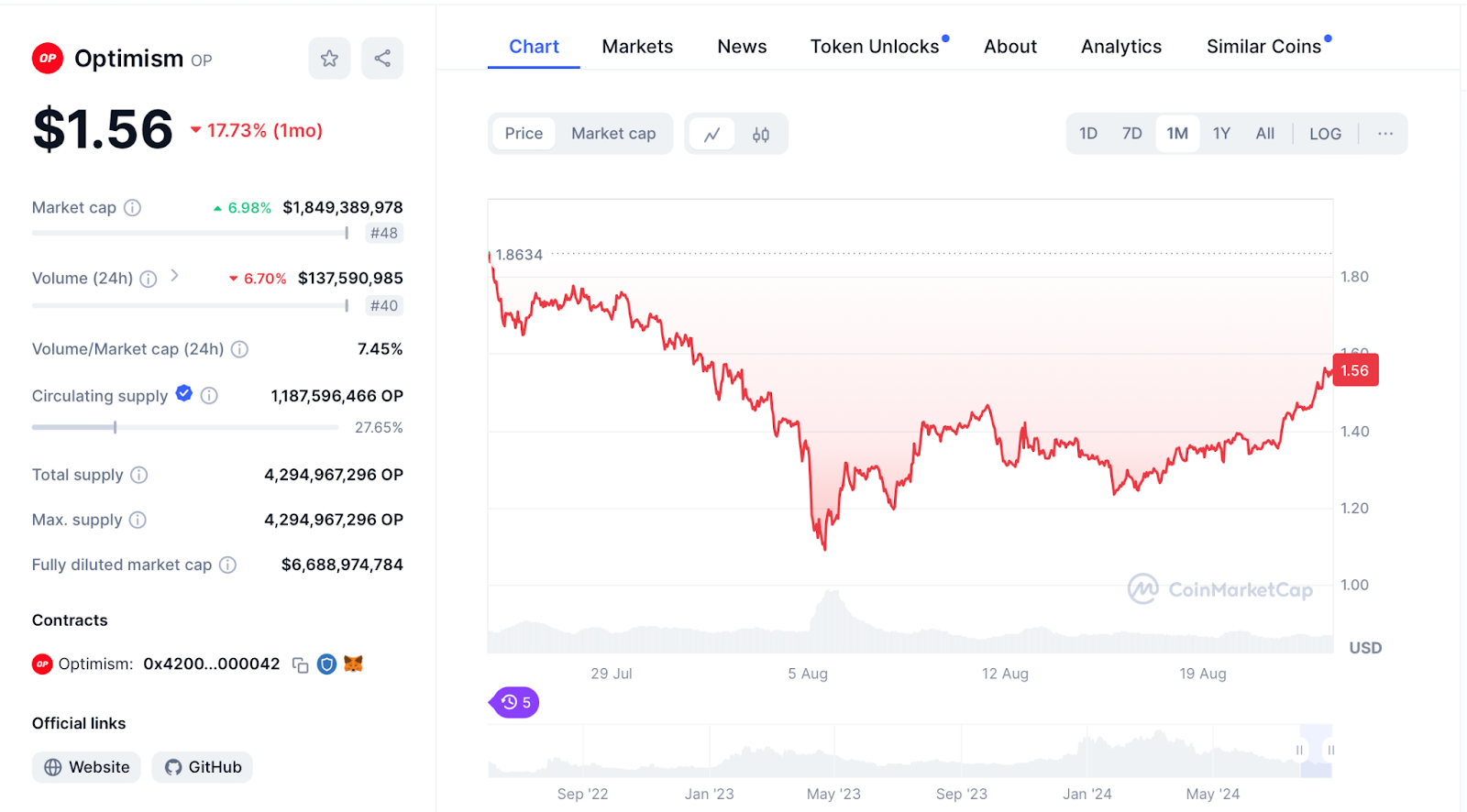

Arbitrum (ARB)

Arbitrum is the largest L2 network constructed on top of Ethereum. At $2.685 billion, Arbitrum's TVL surpasses the aggregate value of all other L2 networks. They also have a program called Orbit that they use to create new L2 networks. It is limited to the Ethereum environment at this time, but that's about to change. ARB holders recently voted on whether or not to extend outside Ethereum on DAO Arbitrum's platform. The community cast their vote in support of the expansion, and the result was verified.

What the Arbitrum network will gain from this is:

First, it will be simple for developers from the Bitcoin, Cosmos, and BNB ecosystems to construct their L2 networks in order to develop apps.

Secondly, networks developed on Orbit will provide 10% of their profit back to Arbitrum; 2% will go to the Arbitrum Developer Guild and 8% will go to ArbitrumDAO.

The value of ARB token and the expansion of the Arbitrum ecosystem may both benefit from all of this. At the moment of writing, the token is trading at around $0.5737. With a developing market, it is anticipated that the price may rebound to the $0.8–$1 range per coin within a month.

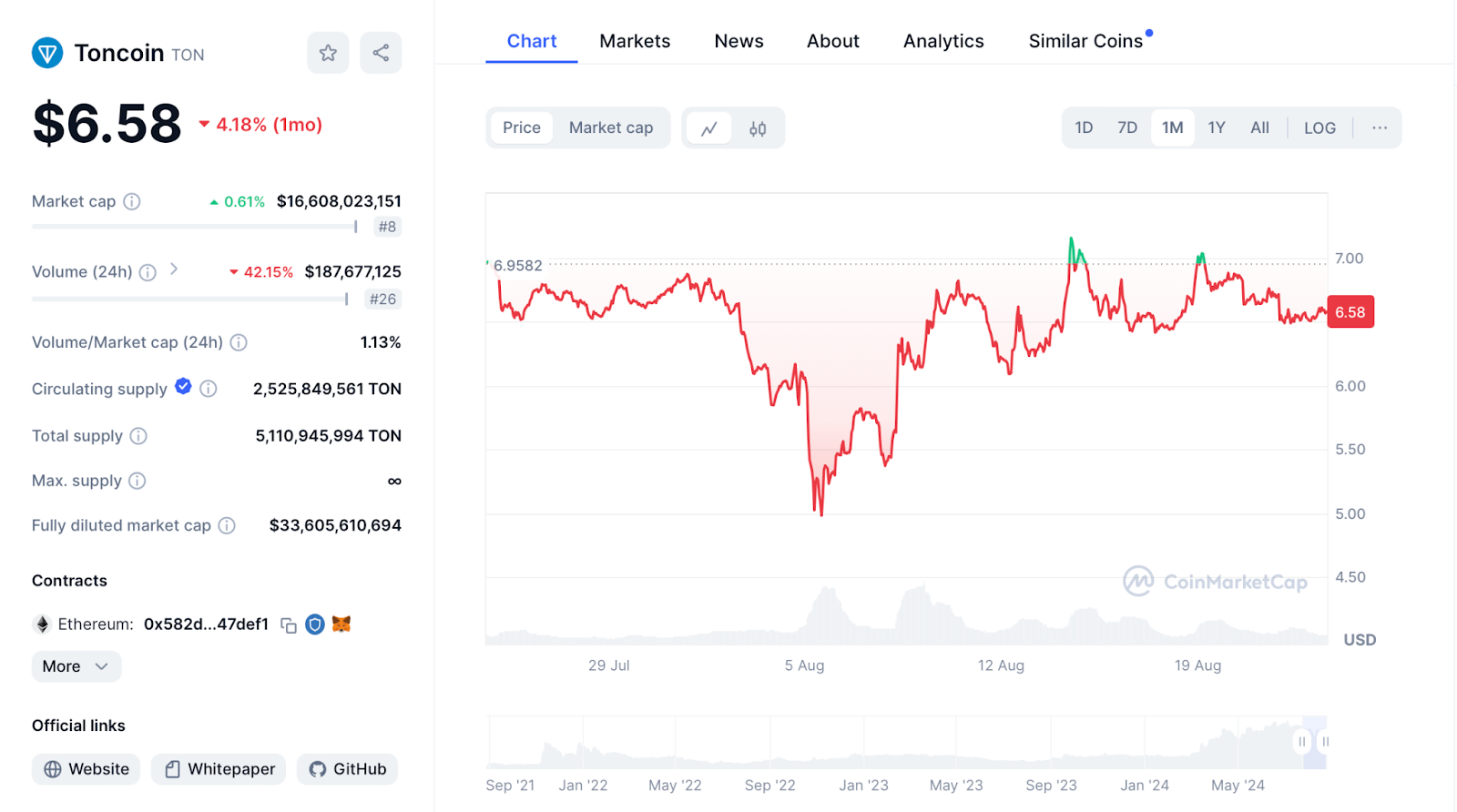

Toncoin (TON)

TON is becoming more and more well-known; in the last several months, its TVL has increased five times to $557 million.

The events that now act as a catalyst for the ecosystem's growth are:

Recently, TON Ventures got $40 million to finance the growth of startups within the TON network. The ecosystem has seen an increase in developer interest as a result of this change.

The biggest exchange, Binance, finally launched spot trading a few days ago, after much anticipation. The Binance platform's introduction of staking at 300% APR stimulated buyer demand and drove the price to its peak of $7.26.

A rise in activity on the TON network as a result of the release of well-liked clicker games like Catizen, Notcoin, and Hamster Kombat. As a result, there are now more people on the TON network than ever before, and they may easily earn.

The Block reports that there are currently over 444,000 active TON addresses on average each day, which suggests a significant degree of user activity.

At the moment of writing, TON is trading at $6.58 per coin. We anticipate that in the upcoming months, ATH will rise back to the levels of $7.2–$8 per coin due to the growth of the ecosystem and investments from major funds. Large payouts from TON farming on well-known websites Ston.Fi and Dedust have resulted in a considerable load from sellers at the same time, which can lower the price to as low as $5.8–$6.2 per coin.

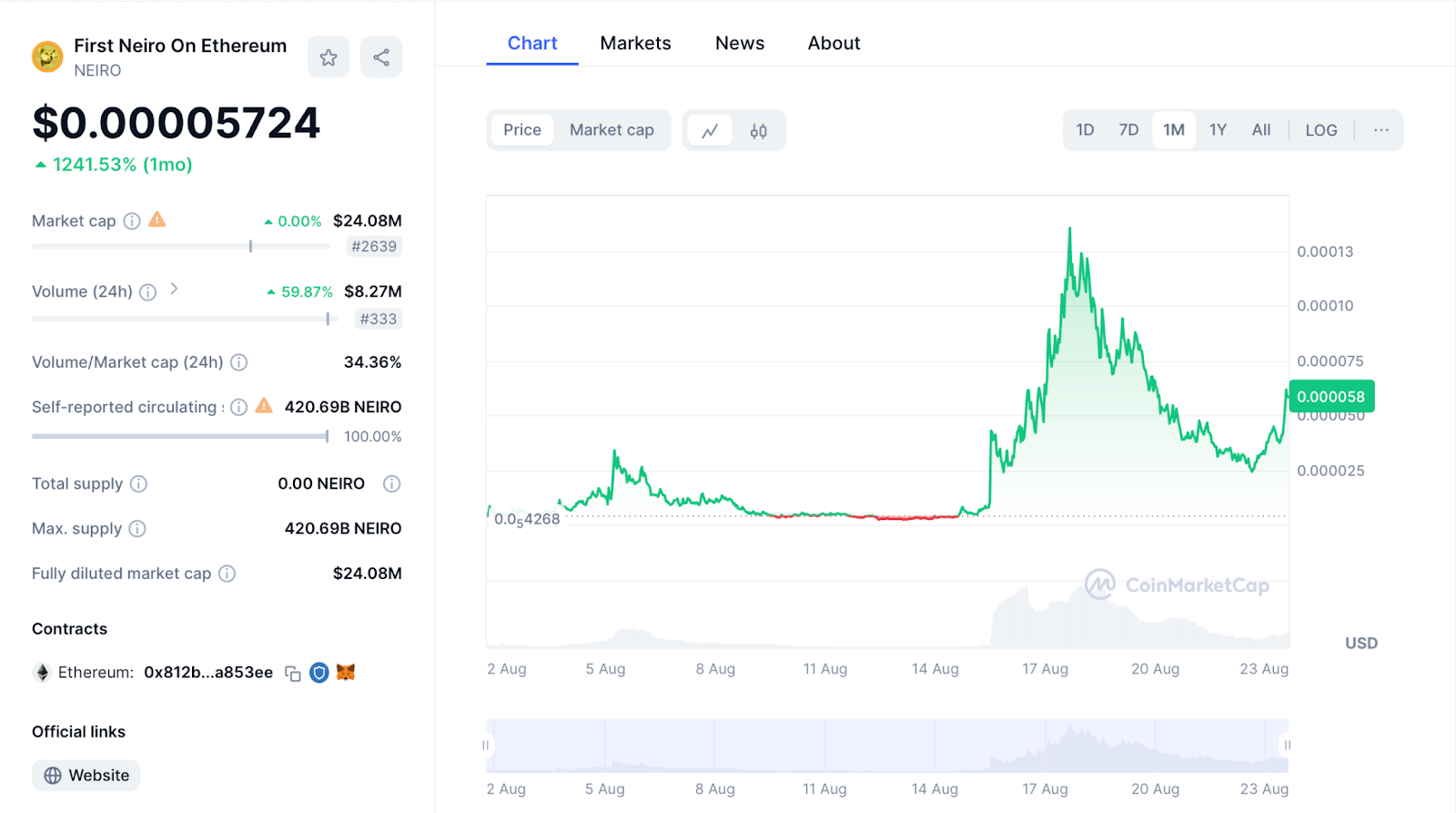

Neiro (NEIRO)

Neiro is an intriguing new entrant in the meme token space that has rapidly captured the attention of the DeFi community. Its rise in popularity has been fueled by a strong narrative centered around charitable contributions. Positioned by its community as the "sister" to the well-known Shiba token, Neiro gained significant hype when its developer donated a portion of the token supply to Vitalik Buterin, the creator of Ethereum.

The real turning point came when Buterin sold these tokens for an equivalent of 44 ETH, and subsequently made a public statement about donating the proceeds to a charity shelter where Neiro’s dog was rescued. This endorsement by Buterin added credibility and visibility to the project, propelling its momentum.

Following Buterin’s involvement, GotBit, a well-known market maker, announced a collaborative event with Neiro, further driving interest and speculation. The token’s price surged, delivering substantial returns to early holders.

The first exchange to list Neiro was MEXC, after which the token saw a remarkable 5800% increase in value since the donation to Buterin.

As of now, Neiro is trading at $0.00005724 with a market capitalization of $24.08 million. While it's difficult to predict the future price, continued listings and strong community backing could push the token to the $0.0002–$0.0005 range within the next month. There is even speculation that Neiro could emulate the success of Shiba Inu, which experienced explosive growth and widespread popularity.

This growing momentum and strategic community positioning make Neiro a project to watch closely in the rapidly evolving crypto space.

Conclusion

It's important to keep in mind that cryptocurrencies are risky investments. It is advised that novice investors begin with modest deposits and progressively increase them, while seasoned investors should consider new projects and continue to keep an eye on developments in this field.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.