What is Maverick Protocol (MAV) and What to Expect

This blog post will cover:

- What is Maverick Protocol (MAV)?

- Maverick Protocol (MAV) price, supply and Market cap

- Maverick Protocol - how does it work

- Blockchain Maverick Protocol (MAV) operates on

- Uses for MAV Maverick Protocol

- Who created the Maverick Protocol?

- How Is Maverick Protocol (MAV) Different To

- Advantages of Maverick Protocol

- Disadvantages of Maverick Protocol

- Roadmap

- Future of Maverick Protocol

- The Bottom Line

- FAQ

Disclaimer: SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.

Key Takeaways

- Maverick is a DeFi infrastructure provider with a primary objective of enhancing industry productivity.

- It utilizes the AMM system.

- The official token is MAV.

- The project runs on Ethereum.

What is Maverick Protocol (MAV)?

The platform is a provider of a DeFi infrastructure. Its primary objective is enhancing industry efficiency. The core functionality is driven by an Automated Market Maker (AMM) system.

Maverick Protocol (MAV) price, supply and Market cap

Maverick positions itself as a prominent player in the DeFi realm, offering a cutting-edge framework driving the sector effectiveness to the next level. To discover what is MAV and how it operates, we need to dive deeper into the concept.

At the heart of its operations lies the powerful AMM, a tool that lets people leverage their capital utilization. By smartly managing pools of assets, setting their prices and facilitating trades, the market maker enables people to get the maximum out of their assets, creating a smoother and more efficient financial system.

So what is MAV crypto? MAV is an utility token of Maverick, a DeFi infrastructure provider. It is used for various intents within the platform. You may see the core data on the asset below:

The price of Maverick’s coin is a deciding factor when trying to answer a question — is MAV a good investment or not. As of July 3, its cost was $0.4349. According to Coinmarketcap, this price level is slightly higher than an all time low for MAV. However, considering the volatility of the market, we may expect a change anytime. Undoubtedly the final choice is yours, but the basic rule of any trader is to buy low and sell high.

Maverick Protocol - how does it work

To understand how Maverick Protocol works, get acquainted with the further statements.

By automating the process of concentrating liquidity, Maverick AMM empowers customers to unlock unparalleled levels of capital effectiveness. This not only results in more liquid markets, rewarding traders with superior prices, but additionally creates higher fees for liquidity providers (LPs).

A remarkable aspect for LPs is the newfound ability to align themselves with the price trajectory of a particular asset, effectively placing a directional bet on its price.

The team has successfully launched its dApp on Ethereum, giving people the opportunity to experience the complete set of AMM's capabilities. By utilizing the official app of the project, users can seamlessly execute swaps, create liquidity pools, and delve into the novel liquidity modes offered by Maverick, opening new avenues for exploration and financial growth.

All in all, the Maverick project can be rather related to Proof Of Stake. To see how PoS differs from PoW (Proof Of Work) we provided a short descriptions below:

PoW

Proof of Work (PoW) serves as an algorithmic solution to safeguard systems against abuse, such as Denial of Service (DoS) attacks and spam mailings. Its fundamental principle revolves around the execution of intricate and time-consuming tasks while enabling swift and effortless verification of the work's outcome. By imposing computational effort and resource expenditure, PoW establishes a barrier that deters malicious actors from disrupting system operations, ensuring the integrity and reliability of the protected systems.

PoS

Proof of Stake (PoS) emerges as a prominent consensus mechanism within the realm of cryptocurrencies, serving as a means to process transactions and generate new blocks in a blockchain. By definition, a consensus mechanism validates entries within a distributed database and safeguards its integrity. In the context of cryptocurrencies, this database takes the form of a blockchain, and it is the consensus mechanism that ensures the security and immutability of the blockchain, fostering trust and reliability in the system.

More about the differences between the two consensus types can be found in our article Proof Of Work Vs Proof Of Stake.

Blockchain Maverick Protocol (MAV) operates on

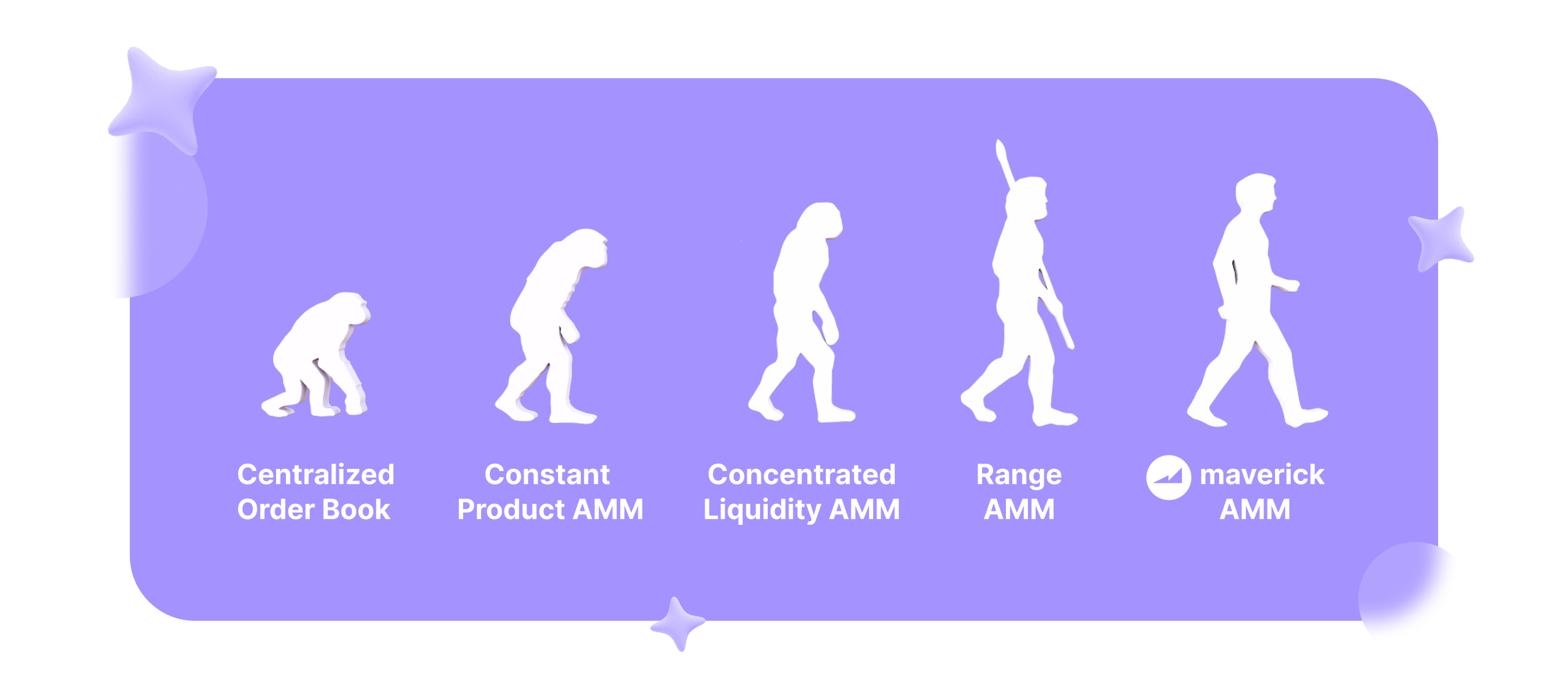

Many crypto enthusiasts who discover the project, often ask — what is the Maverick Protocol blockchain? The answer is quite simple, it is Ethereum. The Maverick’s team illustrated the progression of AMM:

Maverick AMM provides a variety of distinctive characteristics:

- Custom LP distributionsNow, LPs can stake their liquidity within a customized price range.

- Enhanced capital effectivenessThe smart contract of AMM takes it a step ahead by automatically adapting the liquidity distribution of LPs to align with price fluctuations. This dynamic repositioning ensures that LPs' liquidity stays within the expected price range more.

- Minimal LP upkeepMaverick AMM simplifies LP upkeep by automating the compounding of concentrated liquidity fees. This automated process reduces the burden on LPs, giving them a chance with the aim of increasing their capital effectiveness and overall returns.

Uses for MAV Maverick Protocol

MAV owners enjoy several benefits and opportunities within the ecosystem. Checkout the points below to learn what is Maverick Protocol used for:

- Getting involved in protocol governance votingMAV holders possess the privilege to exercise their voting rights when it comes to crucial protocol governance matters. They can actively participate in shaping the direction and policies of the Maverick by casting their votes on various proposals, upgrades, or other governance-related decisions.

- Staking MAV for veMAVMAV owners have the option to stake their tokens and earn veMAV (voting-enabled MAV). veMAV grants additional community voting rights, providing token holders with an amplified influence over important governance matters. This mechanism ensures that the community's voice is heard and helps maintain a decentralized decision-making process within the protocol.

- Allocation of protocol incentivesHolding veMAV grants token holders the power to influence the allocation of protocol incentives. They can contribute to the allocation of rewards and incentives to particular pools or positions within the Maverick AMM ecosystem. This democratic approach allows the community to collectively shape the distribution of benefits and leverage the protocol's economic dynamics.

Overall, the MAV token not only represents a financial asset but also offers governance and participation opportunities, empowering token holders to actively shape the development and direction of the Maverick.

Who created the Maverick Protocol?

The project’s mainnet was launched in March 2023 by Alvin Xu and Bob Baxley.

- Bob stands as a multifaceted individual, blending the roles of a technologist, entrepreneur, and developer of technology companies. Within the realm of decentralized finance, Bob serves as the core builder at Maverick Protocol.

- Alvin emerges as an product leader, equipped with expertise and knowledge across various pioneering industries. His skill set encompasses addressing technical intricacies, user-centric challenges, and business dilemmas.

The major stakeholders of Maverick Protocol

The Maverick is backed by various companies. Here’s a full list available on the official website: Pantera Capital, Altonomy, Circle Ventures, CMT Digital, Coral Ventures, Gemini etc.

How Is Maverick Protocol (MAV) Different To

Ethereum Crypto

The main difference between these two coins is that MAV operates on a platform running on an AMM. Maverick has other goals and is made with a purpose to ease the most liquid markets for traders, liquidity providers etc. Ethereum can process other financial transactions, execute smart contracts and store data for 3rd party applications.

Bitcoin Crypto

In this case, the key difference would be — MAV’s blockchain is Ethereum based, and Bitcoin operates on the blockchain of its own. This is the primary divergence between the two. The other key difference is the fact that MAV is a PoS token thus much more eco friendly and less demanding from the hardware standpoint.

Lido DAO Crypto

Lido DAO is a staking infrastructure provider. It lets people stake PoS digital currencies without locking them up. This means you can freely trade them while still earning rewards. On the other hand, Maverick Protocol has a different goal. It helps users make the most of their money by optimizing its effectiveness.

Advantages of Maverick Protocol

MAV advantages include:

- Using an AMMBy leveraging the AMM, the platform can provide customers with a range of distinctive features, including personalized LP distributions, minimal LP upkeep, and improved capital effectiveness.

- Experienced team The team has broad experience within the IT sector. This gives them an opportunity to work efficiently on the Maverick Protocol and deliver better solutions which could be implemented into the platform.

Disadvantages of Maverick Protocol

- Not completely decentralizedAlthough becoming fully decentralized is a core goal of the team, and Maverick hasn’t reached it yet.

These were the Maverick Protocol pros and cons you might consider while doing research on this project.

Roadmap

According to social networks, we can see the goals the team is working on:

- Maverick aspires to become decentralized and fully owned and governed by the community. To fulfill that goal, the team is diligently constructing a decentralization roadmap. It will gradually transfer control and decision-making power to the community.

- Building partnerships helps Maverick develop faster. For example, lately Maverick integrated with LayerZero in order to exclude Cross-Chain capital inefficiency.

- Getting MAV listed on various crypto exchanges.

- Attracting investors. The project is already backed by Founders Fund, Pantera Capital, BinanceLabs, Coinbase Ventures, CircleVentures, Gemini, etc.

- Maverick Protocol also aims to eliminate inefficiencies in DeFi by assisting users in allocating their liquidity to the most optimal locations for best performance.

Future of Maverick Protocol

The concept is made to increase industry efficiency and get rid of inefficiency via aiding users to put their liquidity where it can do the most work. It’s building in 3 phases:

- Effectiveness of the capital was solved via launching the 1st Dynamic Distribution AMM;

- Liquidity Incentivization Efficiency — launched liquidity shaping tool and boosted position;

- Voting Escrow — ve-Model and metaprotocol design.

The project seems to be promising. Considering its innovative solutions and the use of AMM, it could someday become one of the leading companies in the DeFi space.

The Bottom Line

Maverick stands as a versatile DeFi infrastructure, allowing builders and LPs to optimize their capital effectiveness and implement their preferred LP strategies. At the core of Maverick lies MAV, the native token that fuels the ecosystem.

The primary mission is to get rid of ineffectiveness within DeFi by enabling people to strategically allocate their liquidity for maximum impact. AMM plays a vital role in this endeavor by offering a wide array of LP strategies, surpassing the capital efficiency of both constant product and range AMMs. Notably, the platform automates a set of liquidity strategies, ensuring that users from all backgrounds can benefit from dynamic concentrated liquidity and its associated advantages.

The team is working hard on their concept, and based on the up-to-date achievements, we can conclude that this project is worth paying attention to as an ambitious one.

FAQ

Where Do I Get Maverick Protocol (MAV)?

You may buy MAV tokens via SimpleSwap or any other trusted crypto exchange. If you plan to purchase it via SimpleSwap, all you have to do is follow the steps below:

- Select the cryptocurrency you would like to exchange (for instance, Bitcoin).

- Enter the amount you want to swap.

- Choose MAV in the second drop-down list (the crypto you would like to receive). You will see the estimated amount that you will get after the exchange.

- Click the Exchange button.

- Enter the Recipient's Address. MAV will be sent there. Please ensure you enter the right address.

- Create the exchange.

- You will see the BTC deposit address. You have to transfer the necessary sum of BTC to this address to start the exchange. After that, wait for tokens to reach your wallet.

How Do I Mine Maverick Protocol (MAV)?

Right now you can not mine MAV tokens.

Should I Consider Buying Maverick Protocol (MAV)

Yes, you might consider purchasing MAV if you’ve done your careful research and understand what is MAV crypto.

Who uses Maverick Protocol

Maverick can be utilized for various purposes of LPs, traders and DAO Treasuries.