What is Solana (SOL) cryptocurrency, and how does it work?

This blog post will cover:

- What is Solana (SOL)?

- Solana (SOL) price, supply and Market cap

- How does Solana work?

- Blockchain Solana (SOL) operates on

- What Makes Solana Unique?

- History of Solana

- How Is Solana (SOL) Different To

- Advantages of Solana

- Disadvantages of Solana

- How Is the Solana coin Secured?

- Buying Solana (SOL)

- How to Stake Solana (SOL)

- Solana Roadmap

- Future of Solana

- The Bottom Line

- FAQ

Initial perceptions of Solana among cryptocurrency aficionados are often shaped by its NFT, multibillion-dollar valuation, and regular placement within the top ten of the CoinMarketCap TOP-100. But this is just the very top of the iceberg. A blockchain platform called Solana (SOL) was created to facilitate transactions in the area of decentralized finance (DeFi) as well as other applications requiring scalability, speed, and security. This article aims to explain Solana and explore the history of Solana as well as provide a solution to the topic of how it works.

Key Takeaways

Blockchain Solana is particularly intended for demanding applications like decentralized finance (DeFi) and is built for speed, scalability, and security.

Because it combines the unique characteristics of delegated proof-of-stake (dPoS) and proof-of-history (PoH) to achieve high transaction throughput, Solana is among the fastest and most efficient blockchains.

With its fast growth since introduction, Solana has become well-known in the cryptocurrency world by drawing in a large number of NFTs, DeFi projects, and decentralized apps.

Due to its cheap transaction prices and quick processing speed, Solana is a formidable rival to other blockchains such as Ethereum, Cardano, and Avalanche.

In spite of its advantages, Solana still has to contend with issues like network failures and competition from other blockchain platforms, which may limit its potential for expansion and uptake in the future.

What is Solana (SOL)?

Solana is a high-performance base-level blockchain that has no parallel blockchains or parachains. It was developed to speed up, scale, and secure transactions in the field of decentralized finance and other applications.

The primary goal of the project is to provide an alternative to existing blockchain systems, such as Ethereum and Bitcoin, that have issues with scalability and expensive fees.

Solana (SOL) price, supply and Market cap

Understanding the price, supply, and market cap of Solana is crucial for anyone interested in what is SOL coin. Here are Solana’s key metrics.

Metric | Value |

Current Price | $139.70 |

Circulating Supply | 466.62M |

Market Cap | $65.13B |

How does Solana work?

When learning what is SOL cryptocurrency, it's important to find out how it works. Combining proof-of-history and delegated proof-of-stake protocols underpins Solana's operations. Solana aims to handle a lot of transactions fast, which is why it uses a variety of protocols.

Since the purpose of blockchain technology is to create decentralized networks, Solana seeks to preserve Bitcoin's decentralization while handling transactions at a rate similar to large centralized organizations. Solana systems can scale more quickly due to their lower environmental and financial costs.

Further layers of blockchain security are necessary due to the Solana blockchain's rapid block addition rate. Solana's proof-of-history approach is useful in this situation. Each block is time stamped by this method in a way that preserves system security.

Blockchain Solana (SOL) operates on

For its blockchain, the Solana team has created 8 new technologies.

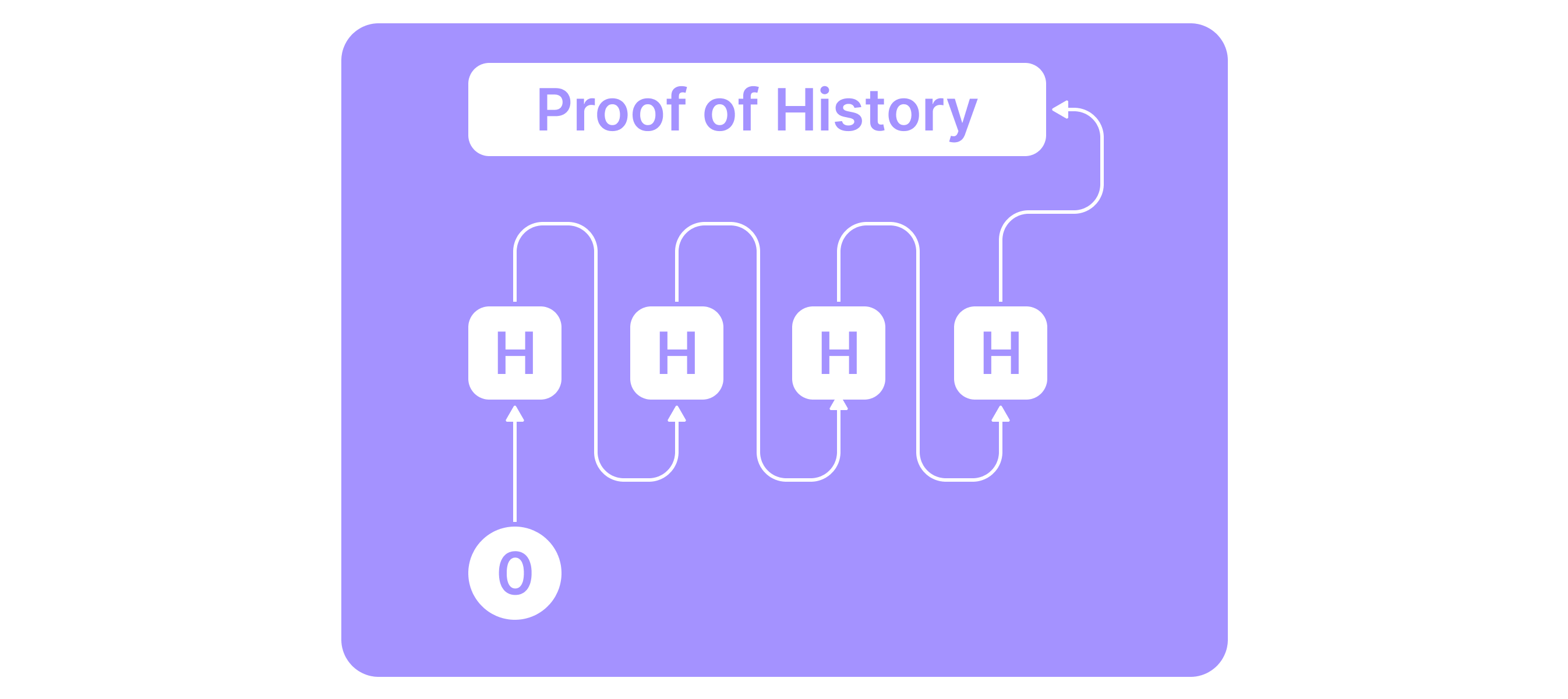

Proof of History

In essence, it is a blockchain-based version of a clock. Blocks processed in separate network nodes may appear at various times as it is not practical to link every node to a single time synchronizer. This causes faulty and contradictory blocks, which cause network disruption. This issue is resolved by Proof-of-History technology. Because of it, the network keeps track of which transaction happened before and after it, rather than just the start and finish times.

Tower BFT

A mechanism that increases network responsiveness by letting validators cast votes on the registry's current state. It is a Proof of Stake-based consensus technique. The "clock" on Ethereum is based on Proof-of-History, which sets it apart from traditional PoS. Data transfer latency and bandwidth loss are decreased as a result.

Turbine

A unique technique that divides crucial information into manageable chunks. These chunks can be transferred to processing nodes more quickly and easily with less delay.

Gulf Stream

This is protocol for data transport without the need of a mempool (a storage for transactions that are waiting to be processed).

All new transactions that arrive before the previous ones are completed are sent to the network's least burdened node since the Solana blockchain lacks a mempool. This makes it possible to divide the burden across the nodes and expedite the processing of transactions.

For instance, when you visit the hospital, a certificate is required. When you arrive at the first office, you are told that you must go to the second office since the first one is busy. They direct you to proceed to the third in the second, and so forth. And only at the fifth office can you receive the certificate. You could have gone directly to the fifth, received a certificate, and saved a lot of time by not spending as much effort on transitions.

In other words, the Gulf Stream protocol knows ahead of time which office you must visit in order to receive the certificate as soon as feasible. However, this is now being projected onto the Solana blockchain.

The number of transactions that the system has delivered to a certain node for processing is known to it. Thus, it forwards new transactions to the least busy node ahead of time so that they can be handled there.

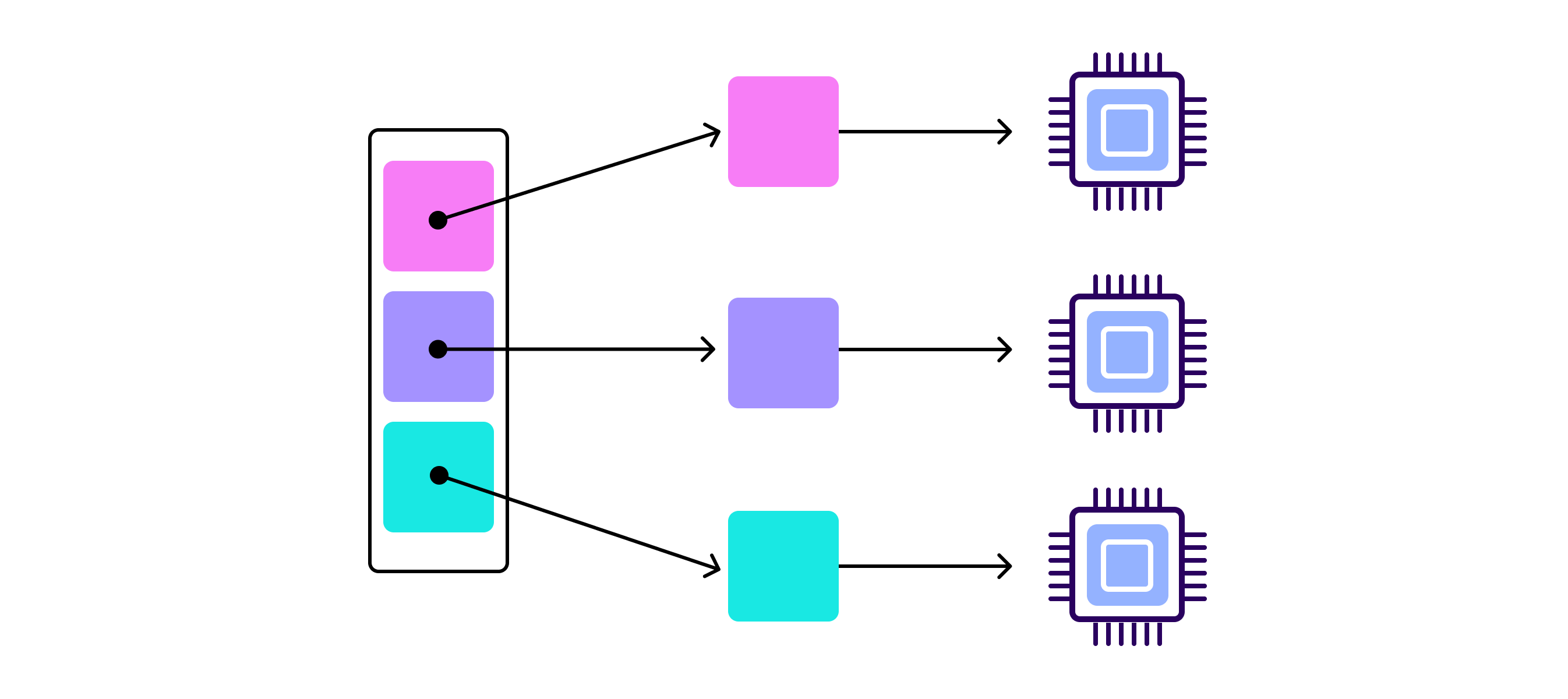

Sealevel

This is the primary protocol that is in charge of transaction processing speed. Throughput is increased by dividing the execution of a single transaction among many GPUs.

Pipeline

On certain hardware, various kinds of data are processed at different rates. As a result, on the Solana blockchain, specific kinds of data are sent to machines that can handle them more quickly.

Cloudbreak

A technique that makes it possible to read data from databases more quickly. Nodes process a new block before the preceding block is encoded in order to do this. Consequently, the information may be read by the system without requiring it to spend time decoding the prior block. This significantly streamlines and expedites the data reading process.

Archivers

An information storage protocol that uses Proof-of-Replication technology. The protocol's foundation was taken from Filecoin.

What Makes Solana Unique?

Let's delve into the main features of the project.

While SPL tokens can be created based on the Solana network, SOL tokens operate on a deflationary paradigm and are partially burned to restrict the overall amount. The demand for SOL is strong because of its widespread application in the ecosystem, which establishes its value and investment potential.

The SOL currency, as a native token of the Solana blockchain, serves several essential functions for the ecosystem. It is used for transaction fees and smart contract activation in addition to staking, where token holders can allocate tokenization to protect the network.

Instead of mining, the Solana network use staking and the Proof-of-History consensus technique. Token owners can designate their tokens as security deposits or turn them into validators themselves.

Proof-of-History is a creative consensus approach that expedites transaction processing and schedules blockchain events. Up to 50,000 transactions per second may be completed at a 400 ms confirmation time. The Tower BFT algorithm is used to optimize node consensus, while the hardware-supported Gulf Stream data transmission protocol reduces latency.

History of Solana

Solana explained as a high-performance blockchain that continues to draw interest from investors and developers. Let's take a look at how this all evolved.

Who created Solana?

Anatoly Yakovenko, an engineer with a wealth of expertise at firms like Qualcomm, Mesosphere, and Dropbox, started the Solana project in 2017.

According to Anatoly, he was frustrated with the slow transaction processing speed and scalability problems of other blockchain systems, which gave rise to the idea to build Solana.

Early Development (2017-2019)

Anatoly put together a group of like-minded people, including Greg Fitzgerald (previously of Intel and Google) and Raj Gokal (formerly of Qualcomm and Google), after developing the PoH idea. They collaborated to create the initial iterations of Solana and tested the platform with success.

The initiative had its first financing round in 2018, and it was a huge success, raising over $25 million. The team was able to considerably speed up the platform's development thanks to these funding.

Mainnet Launch and Growth (2020-2021)

With the 2020 launch of Solana's mainnet (Mainnet Beta), developers could create and implement decentralized apps on the platform. The project held a sale of its SOL coin, which is used for staking and network security, in the same year. Solana's ecosystem attracted a multitude of decentralized apps and initiatives, making it one among the blockchains with the quickest rate of growth by 2021. The blockchain was a formidable rival to Ethereum because of its low latency and capacity to process thousands of transactions per second, particularly when network congestion was severe.

Rise to Prominence (2021-2023)

Both Solana's price and adoption skyrocketed at this time. Numerous DeFi projects, NFTs, and gaming apps grew the Solana ecosystem. But the network also encountered difficulties, such as a few outages brought on by excessive transaction volumes. Through a number of initiatives, including Solana Hackathons and Grants for Developers, Solana draws developers and entrepreneurs to its ecosystem.

Recent Developments (2023-Present)

In 2024, Solana will still be innovating, with an emphasis on growing its ecosystem and improving network stability. The goal of the improvements and addition of new tools is to solve past issues while preserving the speed and scalability of the blockchain.

The major stakeholders of Solana

When discussing who owns Solana, it's important to highlight the major backers that have significantly contributed to its growth and success. Among these, industry titans include:

Multicoin Capital: a venture capital firm that finances several blockchain initiatives. In 2018, it became one of Solana's initial investors, entering the project at a nascent stage;

Foundation Capital: a venture capital firm that focuses on funding tech businesses in their early stages;

Sino Global Capital: a fund dedicated to investing in blockchain technologies and innovation startups.

How Is Solana (SOL) Different To

Let's examine the differences between Solana and Cardano, Avalanche, Ethereum, and Polkadot.

Solana vs Cardano (ADA)

Cardano (ADA) is renowned for its emphasis on sustainability and security as well as its research-driven methodology. It functions using Ouroboros, a proof-of-stake consensus algorithm that is extremely safe and energy-efficient. Solana's proof-of-history integration allows for quicker processing speeds, setting it apart from Cardano's more systematic and deliberate approach, even though both Cardano and Solana employ PoS.

Cardano is frequently seen as a more methodical, slower-moving platform with a stronger emphasis on academic integrity, formal code verification, and extensive peer-reviewed research. On the other hand, Solana prioritizes speed and efficiency, which makes it more suited for applications that need low latency and high throughput. While Solana's quick execution and scalability may draw developers with performance-focused attention, Cardano's strong emphasis on security and sustainability may appeal to projects that prioritize these aspects.

Solana vs Avalanche (AVAX)

Another blockchain network called Avalanche was created to address scalability concerns without sacrificing security or decentralization. While providing high-performance solutions is the shared goal of Solana and Avalanche, their methods diverge in this regard. Avalanche uses the Avalanche consensus technology, which enables fast throughput, low latency, and subnets—customizable blockchain networks. PoH consensus allows Solana to achieve very low latency and fast transaction speeds.

Avalanche differs significantly from Solana in that it has a more flexible subnet structure that enables developers to design customized blockchain networks for certain use cases. Although Solana is renowned for its lightning-fast transaction speeds, Avalanche concentrates on offering a flexible and adaptive setting for a range of needs. Both platforms have competitive transaction costs, however, because of its more effective consensus process, Solana often has cheaper fees.

Solana vs Ethereum (ETH)

Decentralized applications and smart contracts are ascribed to Ethereum, the leading blockchain development platform. In contrast, Solana performs far better and is more scalable than Ethereum. While Ethereum employs a hybrid approach that includes proof-of-stake and proof-of-work (PoW), heading fully toward PoS with Ethereum 2.0, Solana has a distinct PoH consensus mechanism in combination with PoS. Consequently, Solana can handle transactions much faster.

Furthermore, because of Solana's high efficiency and lower transaction costs, it is more suitable for applications that need quick and affordable transactions. The advantages of Ethereum, however, include a better developed environment, a bigger development community, and wider acceptance. Solana has a competitive advantage in speed and cost-effectiveness since Ethereum's scalability problems persist despite updates.

Solana vs Polkadot (DOT)

With the use of its special relay chain, Polkadot, a multi-chain network, allows many blockchains to communicate with one another and share security. Conversely, Solana functions as a single-chain network with the goal of providing low latency and high throughput. While Solana's strength resides in its scalability and high-speed execution, Polkadot's ability to link various blockchains allows developers seeking to construct interconnected apps tremendous freedom.

Because Polkadot's design enables developers to construct unique blockchains, or parachains, that can function independently while still interacting with other chains in the network, it may be used for a broad range of applications. Even though Solana is less adaptable in this aspect, it excels at offering a high-performance setting that can manage a big volume of transactions at affordable costs.

Advantages of Solana

For those who want to know how to use Solana, it's important to know the pros of the project.

Excellent performance and scalability because of the Proof-of-History technology;

Low prices for transactions and smart contracts;

Continuous development of the decentralized application ecosystem and smart contracts;

Advantageous conditions for developers and investors.

Disadvantages of Solana

There are difficulties with any cryptocurrency project, and Solana is no different.

Rivalry from alternative blockchain platforms such as Cardano, Ethereum, Aptos, and Polkadot;

A history of network issues has tarnished the blockchain's reputation in the cryptocurrency space;

The intricacy and complexity of SOL tokenomics may be overwhelming to many users;

The future of Solana will be greatly impacted by the development and success of competing initiatives such as Aptos.

How Is the Solana coin Secured?

What is SOL token? It is the native currency of the Solana blockchain, and by staking in it, you may pay transaction fees, boost security, and participate in network governance.

Solana uses a novel consensus process called proof-of-history together with proof-of-stake, along with a number of state-of-the-art cryptographic algorithms, to protect its network and the Solana coin. By timestamping every transaction and producing a verifiable sequence of events, PoH improves the security and efficiency of the network. In order to speed up transaction validation and fortify the blockchain against assaults, network validators employ the Proof-of-Stake technique with their SOL tokens.

Buying Solana (SOL)

Major cryptocurrency exchanges including Binance, Coinbase, and Kraken allow you to buy SOL using fiat money or other cryptocurrencies. SimpleSwap provides a smooth way to convert your current cryptocurrency straight into SOL without the need for registration or time-consuming verification, making it a speedy and hassle-free choice. For a more private transaction, you may also use decentralized exchanges (DEXs), such as Raydium or Serum. Purchasing SOL is now easier than ever, regardless of expertise level with cryptocurrencies or investments.

How to Stake Solana (SOL)

Staking Solana is an easy method to contribute to network security and receive incentives. You'll need a suitable wallet, such as Phantom or Solflare, to get started. Once your SOL tokens are in the wallet, you may assign them to a network maintenance validator. You may increase the stability of the network and get passive revenue through staking rewards by staking your SOL. All you have to do is pick a trustworthy validator, assign your tokens, and observe as your holdings increase over time.

Solana Roadmap

The main objectives and upcoming changes intended to improve the functionality and performance of the platform are detailed in Solana's roadmap.

Upgrades to the mainnet:

Enhanced Security: Solana's security mechanisms are constantly being improved to provide a reliable and secure network.

The ability to scale Improvements: Additional improvements to manage an even higher volume of transactions per second while preserving Solana's advantage in speed and effectiveness.

Ecosystem Development:

DeFi expansion: Support for fresh initiatives in decentralized finance (DeFi), such as cutting-edge loan systems and trading platforms.

NFT Ecosystem: Platform and tool development to support Solana's non-fungible token (NFT) production and trade.

Tools for developers:

Improved SDKs: Updated software development kits (SDKs) have been made available to make developing on Solana easier for developers of all skill levels.

Developer Bonuses: initiatives such as scholarships, hackathons, and instructional materials are aimed at drawing in and keeping top talent.

Global Adoption:

Partnerships: To increase Solana's worldwide reach, strategic alliances with important blockchain industry participants.

Community Engagement: Attempts to develop and fortify the Solana community via gatherings, internet discussion boards, and regional assistance.

Future of Solana

Because of Solana's emphasis on innovation, more features and stronger security will probably be added, appealing to both users and developers. Furthermore, Solana's impact in the cryptocurrency market is expected to increase dramatically as it builds its ecosystem through new alliances and integrations. Solana has a vibrant community and is well-positioned to be a significant player in decentralized finance in the future and beyond.

The Bottom Line

Without a doubt, Solana is an intriguing initiative that has had a significant impact on the cryptocurrency market and might yet be useful in the future. Public investors should be cautious of the project for a few reasons, though, including the network problems and the tokenomics' complexity and one-sidedness. Understanding these aspects is crucial when considering what is SOL Solana and how it fits into the broader crypto landscape.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.

FAQ

Here are some answers to often asked questions to assist you learn more about this cutting-edge blockchain technology.

What is Sol coin used for?

It is utilized for staking to promote network security, paying transaction fees, and taking part in platform governance choices.

Is Sol and Solana the same?

No, Solana refers to the blockchain platform itself, whereas SOL is the native cryptocurrency.

How do Solana transactions work?

Proof-of-stake in conjunction with proof-of-history constitutes a novel consensus technique used to process Solana transactions. This facilitates speedy and effective transaction validation, allowing the network to handle thousands of transactions per second at cheap costs.

Who is the owner of Solana?

Important investors in Solana include Polychain Capital, Andreessen Horowitz (a16z), and Multicoin Capital, three well-known venture capital companies. Furthermore, a non-profit organization called the Solana Foundation is heavily involved in managing the platform's growth and governance.

What is so special about Solana?

Solana is notable for its proof-of-history consensus process, which enables fast transaction rates and minimal costs. Because of this, it is among the quickest and most effective blockchain systems, able to facilitate financial services as well as extensive decentralized applications.