Christmas Rally: Myth or Reality in Crypto?

This blog post will cover:

- Christmas Rally in the Stock Market

- What About the Cryptocurrency Market?

- Christmas Rally in Cryptocurrencies

- Conclusion

Many investors are familiar with the concept of a Christmas rally. This is a period when markets show positive momentum at the end of December and the beginning of January. This phenomenon gained popularity thanks to American analyst Yale Hirsch, who first noted this pattern in the 1970s. His research, published in the Stock Trader's Almanac, demonstrates that stock indices often rise during the final days of December.

But how does this phenomenon affect the cryptocurrency market? Given its unique characteristics, such as high volatility and independence from traditional financial systems, the Christmas rally in cryptocurrencies becomes an intriguing and yet underexplored topic.

Christmas Rally in the Stock Market

The Christmas rally is often seen as a positive event in stock markets, and data supports this pattern. The Stock Trader’s Almanac conducted a study spanning 70 years (1950–2020) and found that the Christmas rally occurred 58 times during this period. Analysis of historical data reveals:

In 79.2% of cases, the stock market demonstrated growth in the final week of December.

The average S&P 500 index gain during this period was 1.3%.

However, the absence of a rally could signal trouble. For instance:

In 2000, the market lost 4% during the rally, foreshadowing the dot-com bubble burst.

In 2008, a 2.5% drop during the rally preceded one of the largest bear markets in history.

What About the Cryptocurrency Market?

Cryptocurrencies, which have emerged relatively recently, have characteristics that set them apart from traditional markets. Their performance during the Christmas period is inconsistent:

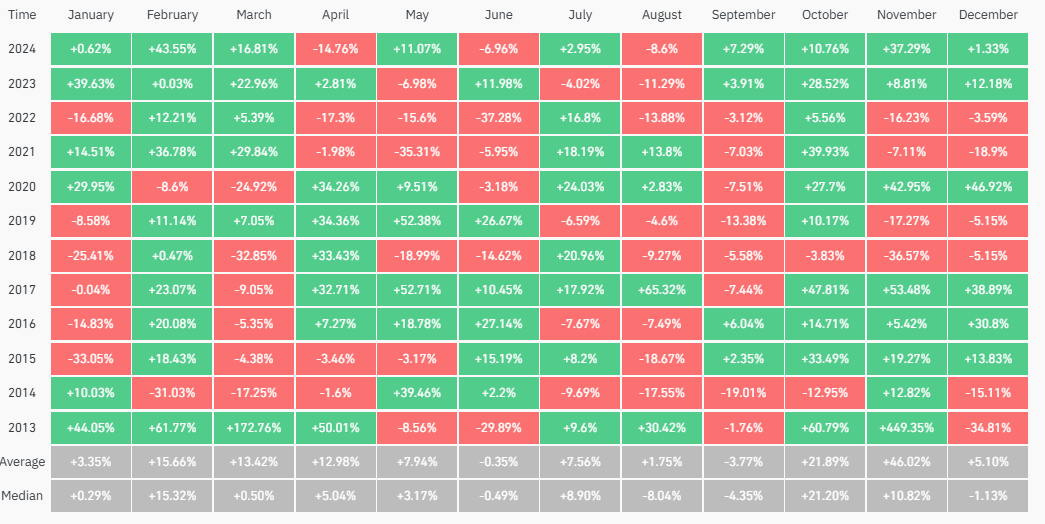

Over the past 11 years, December has been negative six times and positive five times.

December losses were more common during bear markets.

However, there is an intriguing pattern: if November was successful, December often continued the trend.

Source: CoinGlass

This year, November was one of Bitcoin's most successful months, leaving hope for a positive end to December.

Christmas Rally in Cryptocurrencies

To analyze trends, let’s examine Bitcoin's weekly performance in December over the past seven years. We use weekly closing data (excluding wicks) to identify real trends.

Year | Rally | Description |

2023 | No | Mostly positive, more of a moderate growth than a clear rally. |

2022 | Partial | December ended flat for Bitcoin. The Christmas rally shifted to the start of the new year. |

2021 | Partial | Bitcoin was in a strong correction phase after a prolonged bull trend. Despite this, the final week of December saw an 8% rise. |

2020 | Yes | A prime example of a Christmas rally. Bitcoin accelerated, gaining around 70% in the last weeks of December. |

2019 | No | The first week of January showed strong growth, highlighting that the effect can appear at the start of the year. |

2018 | Partial | December was negative overall, but Bitcoin rose 25% in the last two weeks of the month. |

2017 | Yes | In the last week of December and the first week of January, Bitcoin gained 20%. |

Conclusion

The Christmas rally remains a fascinating phenomenon for both traditional and cryptocurrency markets. However, its manifestation in cryptocurrencies depends on trends, market sentiment, and the results of previous months.

In 2024, a successful November leaves hope for a positive December, but traders should consider risks and avoid relying solely on seasonal effects. As history shows, the crypto market does not always follow traditional seasonal patterns. Still, under the right conditions, a Christmas rally can serve as a powerful growth catalyst.

Will Santa Claus be generous to crypto investors this year? We’ll find out very soon.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.