Ethereum Price Analysis Amid ETFs Approval Rumors

Ethereum (ETH) price surged by 22% this week, now trading above $3700, following Monday’s news about spot ETFs potential approval. The US financial regulator requested Nasdaq and CBOE that are planning to list and trade Ethereum spot ETFs to update their 19b-4 forms. This form is used to inform the regulator about operational rule changes in financial organizations like stock and commodities exchanges. It is a crucial document that must be submitted before any trading rule changes can be approved. After filing, it takes up to 90 days for the regulator to review and approve the form.

Monday’s news about the accelerated filing of the 19b-4 form might indicate positive shifts in the approval process for Ethereum spot ETFs, which analysts previously deemed unlikely. This development could signify a milestone in US crypto regulation, which has historically been unfriendly to crypto-related businesses and assets. Rumors surrounding ETFs come on the heels of another significant regulatory development from last week. The US Senate voted to overturn the SEC Staff Accounting Bulletin 121, which previously prohibited US banks from serving as custodians of crypto assets.

However, it is still early to be overly optimistic about Ethereum ETFs' approval. Potential ETF issuers, VanEck, ARK Investments, and 21 Shares must also have their S-1 forms reviewed and approved before trading can start. The current deadline for Ether spot ETF approval is May 23, 2024.

Despite uncertainty surrounding the approval of ETFs, ETH price reacted sharply to the news. The second largest cryptocurrency by market capitalization rose by an impressive 22% since Monday, breaking through the resistance trendline and now trading above the resistance zone near $3700 with trading volume skyrocketing to $27B on Tuesday.

Source: TradingView

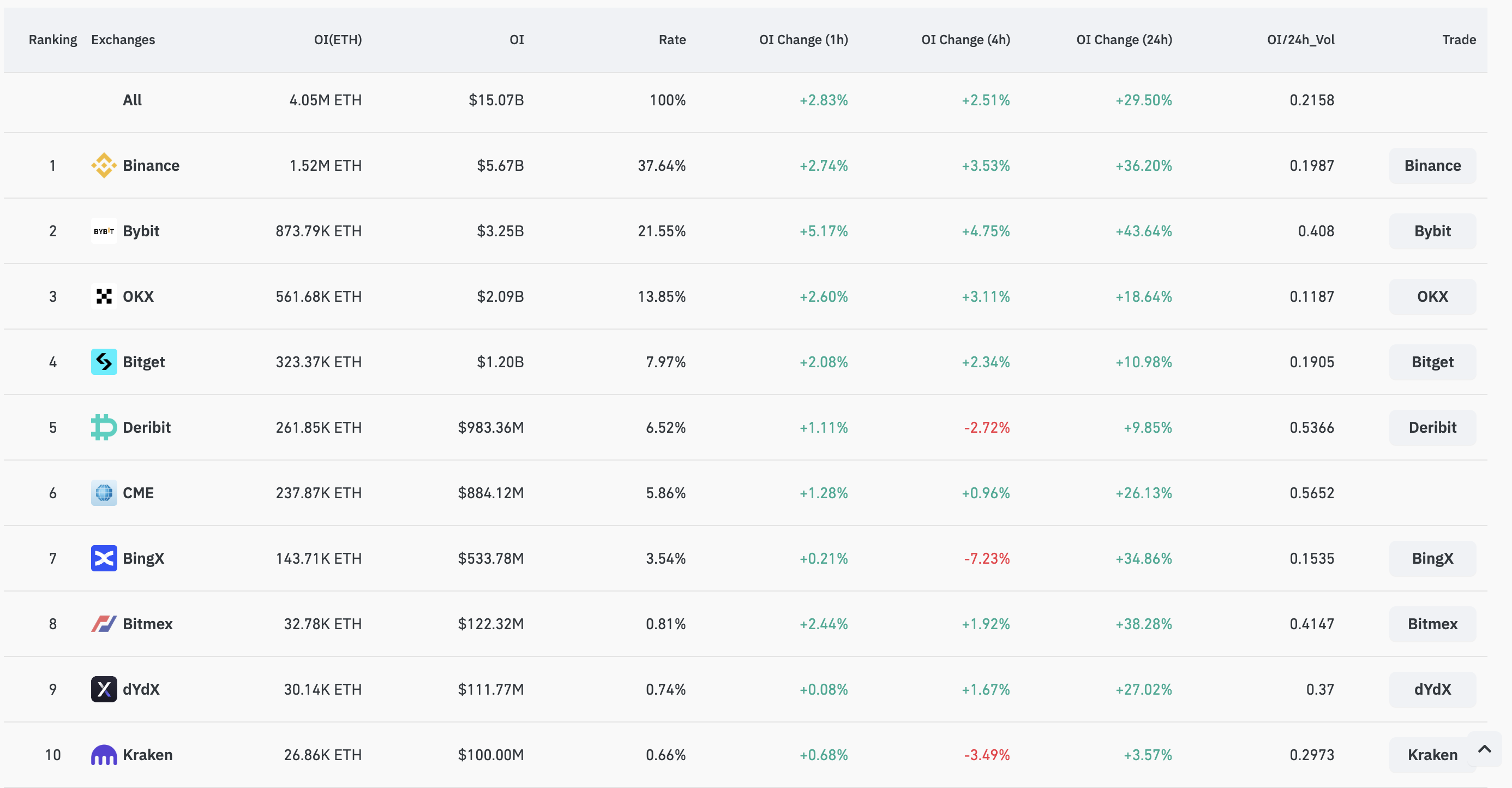

Open interest on ETH futures also hit a new high on Thursday. According to Coinglass data, open interest on the leading centralized exchanges reached $15B, a record for Ethereum and a 29.5% increase in the 24 hours. This surge reflects the growing interest in trading ETH and investors' positive sentiment about its price.

ETH Futures Open Interest. Source: CoinGlass

The approval of ETH spot ETFs would be a significant milestone for crypto adoption and regulation, as it would enable many investors to invest in ETH within a regulated framework, thereby increasing trust in cryptocurrencies. Ethereum's price could potentially reach new highs following the approval of ETFs, with analysts predicting the asset's price could soar up to $8,000 by the end of the year.

However, one major obstacle to ETF approval is the staking function used to validate Ethereum operations after its transition to a Proof-of-Stake consensus. Staking is one reason the regulator may consider ETH a security, which could complicate the approval process for ETFs.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.