Ekubo Protocol: DeFi Evolution on Starknet

Key Insights

- The Ekubo Protocol features cutting-edge concentrated liquidity management, an efficient singleton architecture, and adaptable extensions. This innovative design harnesses the full power of Starknet to provide seamless execution for traders while enhancing profitability for liquidity providers.

- By utilizing the till pattern to optimize gas fees, Ekubo enables users to make transactions within targeted price ranges at reduced costs.

- By tapping into the strong infrastructure of Starknet and leveraging zero knowledge rollups, the Ekubo Protocol significantly lowers transaction fees and overall expenses.

Ekubo Protocol Explained

Ekubo is an automated market maker specifically designed for Starknet, offering distinct features such as concentrated liquidity and a gas-efficient, modular structure. Its innovative singleton design and flexibility emphasize Ekubo's leading role in DeFi advancements.

Starknet is a Layer 2 network ZK Rollup built on Ethereum. It allows decentralized applications to scale significantlywithout sacrificing security. Starknet enhances performance by grouping multiple transactions into a STARK proof, which is computed off-chain.

This proof is then sent to Ethereum as a single transaction, leading to much higher throughput, quicker processing, and greatly reduced fees, all while maintaining the strong security offered by Ethereum's settlement layer.

The Ekubo platform strives to streamline asset management while delivering groundbreaking solutions for both liquidity providers and traders.

Significant milestones in Ekubo Protocol's journey include the launch of its mainnet on August 26, 2023, and a major funding round on October 29, 2023, where Uniswap Labs Ventures invested $12 million.

These key developments have strengthened the presence of Ekubo Protocol in the Starknet DeFi ecosystem, paving the way for future growth and innovation.

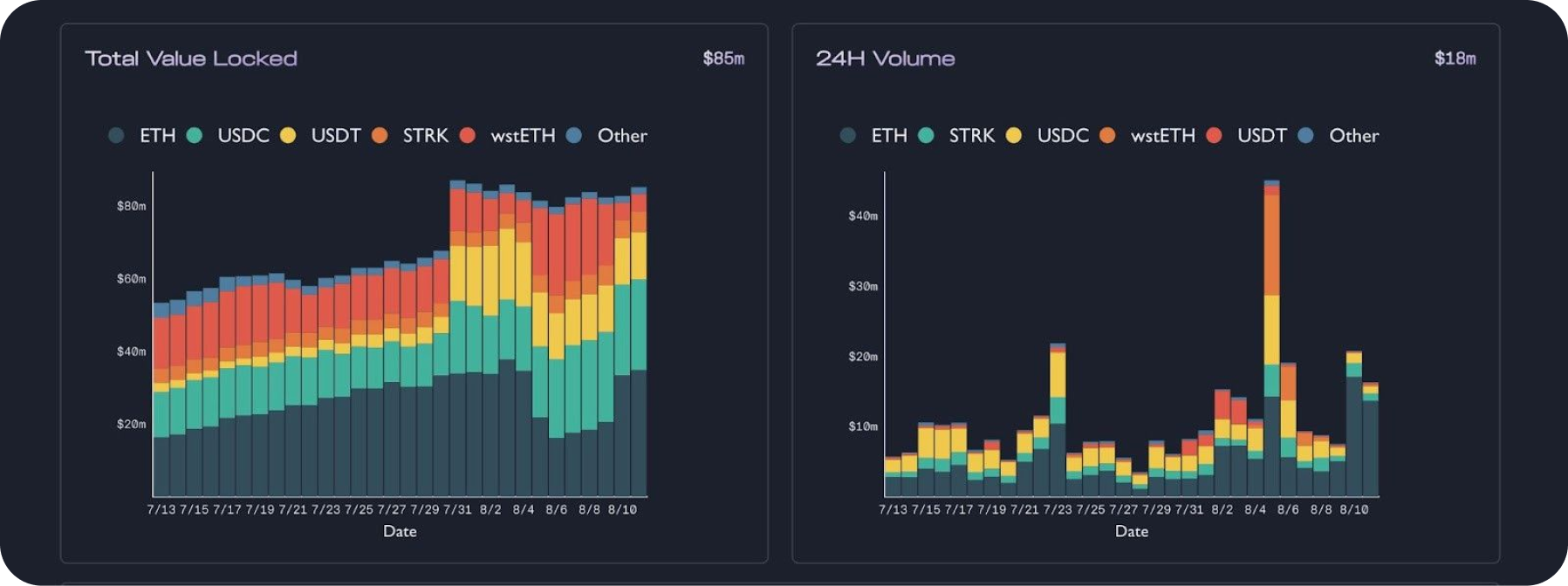

Ekubo currently has a Total Value Locked (TVL) of $85 mln. Daily volume is around $18 mln. These numbers indicate high demand for the platform, especially after the unique STRK rewards program was launched in July.

Starknet DeFi Spring

On July 1st, 2024 Starknet Foundation has announced DeFi Spring 2.0.

This program is aimed at attracting and retaining active users in the Starknet network.

At that time, the Starknet Foundation allocated 40 million STRK tokens, 14.4 million of which have already been distributed among active users.

Then Starknet Foundation allocated additional 50 million STRK tokens and launched the DeFi Spring 2.0 program. In total, the reward budget is 90 million STRK, which will be distributed to users of DeFi tools on the Starknet blockchain.

In simpler words, the season of free money from Starknet continues. The program will be available until December 31, 2024.

How To Optimize the STRK rewards

- Bigger positions generate higher rewards.

- Liquidity placed closer to the current price earns greater rewards.

- Reward distribution is influenced by the pair's 14-day realized volatility.

- Pools with higher fees will receive slightly fewer rewards.

How to participate in the rewards program:

Users don’t need to take any special steps to participate. Rewards are calculated off-chain and applied retroactively.

If you maintain an active position in an eligible pair on Ekubo, you’ll automatically accumulate rewards, which can be claimed at the end of each reward period.

Key Features of Ekubo Protocol

Below is the list of what distinguishes Ekubo Protocol from other Automated Market Maker (AMM) protocols.

- Developer Extensions

Ekubo enables third-party developers to create and launch custom pool types independently. These pools integrate smoothly with the platform’s existing ecosystem, including aggregators and interfaces, enhancing flexibility and innovation within the Ekubo protocol.

- Minimal Fees

Utilizing a till pattern combined with a singleton architecture, Ekubo offers highly cost-efficient transactions, leveraging concentrated liquidity on Starknet.

By managing all pools under a single contract, the Ekubo Protocol minimizes token transfers across multiple pools, reducing gas fees while ensuring optimal trade execution.

- Hyper-Concentrated Liquidity

Ekubo liquidity pools are designed for highly efficient capital deployment. This setup benefits traders by offering narrow spreads and offers liquidity providers enhanced returns.

- Cairo-Based Contracts

The protocol’s smart contracts are written in the Cairo programming language, fully optimizing Ekubo’s performance on Starknet. This ensures seamless integration and strong security.

Ekubo Protocol: How to Become a Liquidity Provider

To add liquidity to Ekubo and earn STRK rewards, you must create a position on Ekubo.

- Connect your wallet to Starknet using for example Argent Web Wallet WEB extension.

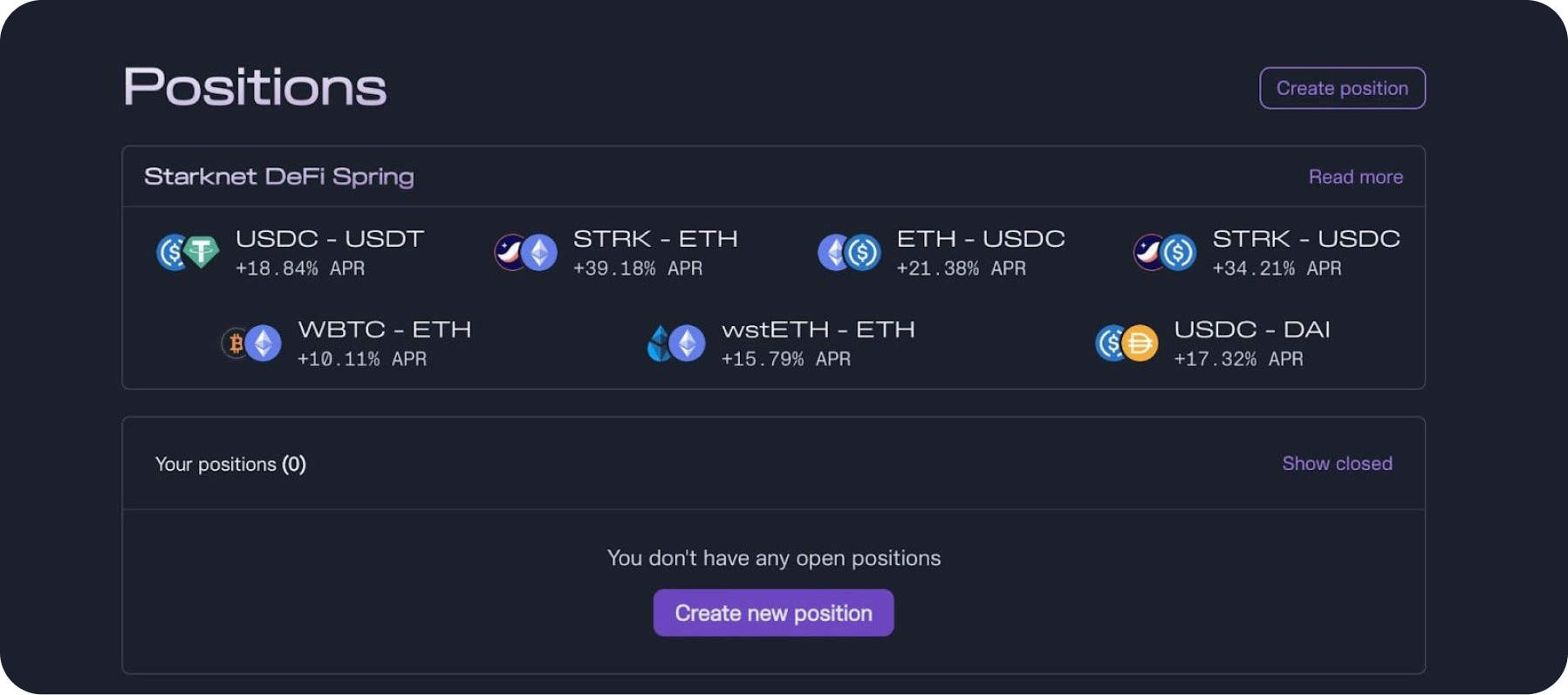

As we see the APR of platform pools is in the range of 18.84% on stablecoins (USDC-USDT) and up to 21.38% for the ETH-USDC pair.

- Select a pool

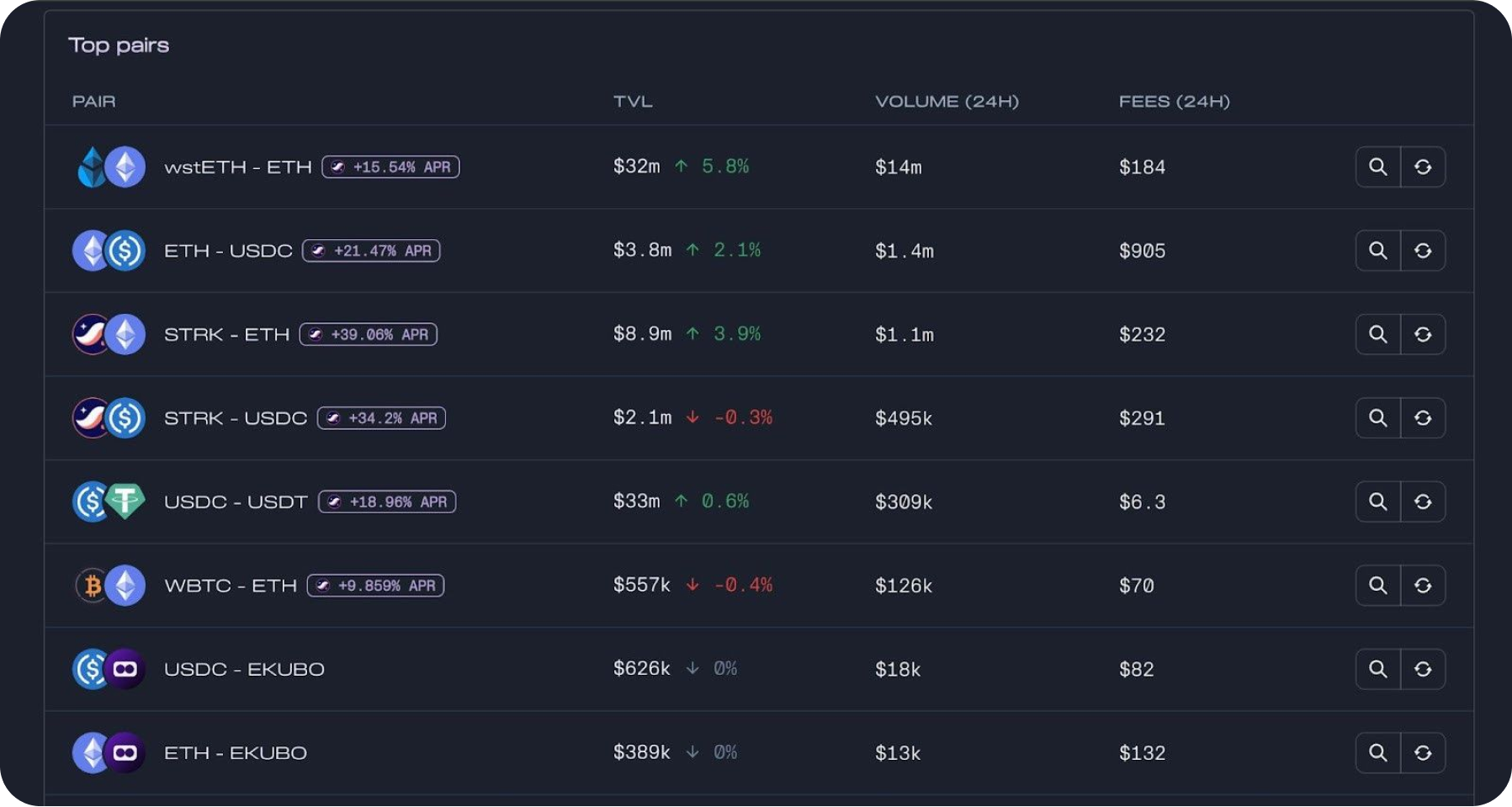

You need to choose Pools where you can see a combination of token pairs and fees. You can see the TVL and also the volume of pairs. Compare these liquidity pools and choose the best one for you.

For example, we can choose USDC-USDT liquidity pool as a low-risk one (because 2 types of stablecoins are provided). Rewards are 18.96% APR for now.

For that pair we need to have 2 stablecoins and swap USDT to USDC. Feel free to do it with a cross-chain exchange like SimpleSwap.

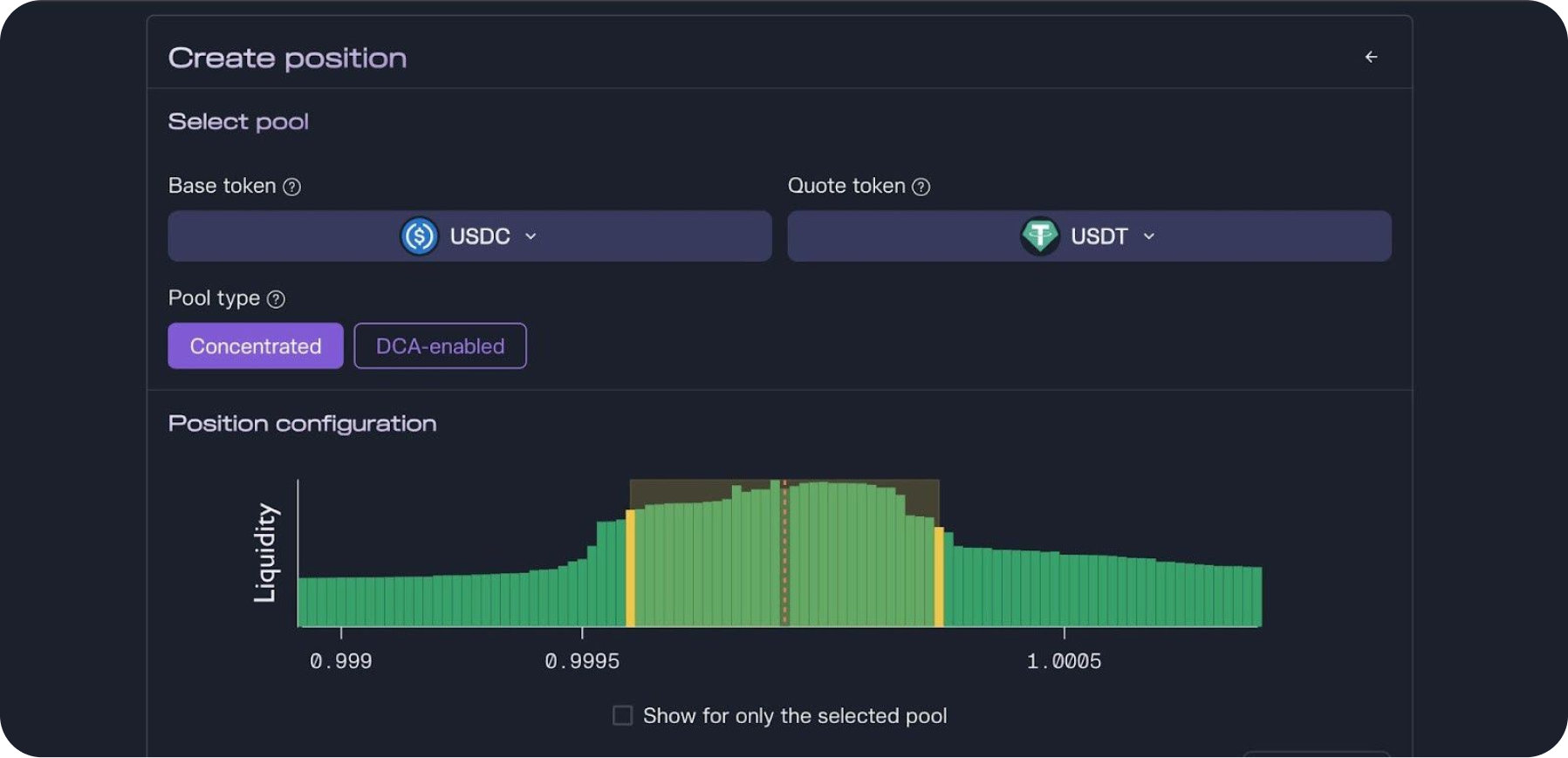

- Create a position

As you can see, the most concentrated and effective range as of writing is 0.9996-1.0002. It means that you can earn maximum rewards in that case. If the price leaves this selected price range you will no longer actively earn STRK fees.

For creating USDT-USDC pair and adding liquidity you need to do the next steps:

- Select the range of prices, for us its 0.9996-1.0002

- Specify an amount, for example for 1000 USDT on the left side you can provide 1013.955846 USDC on the right side.

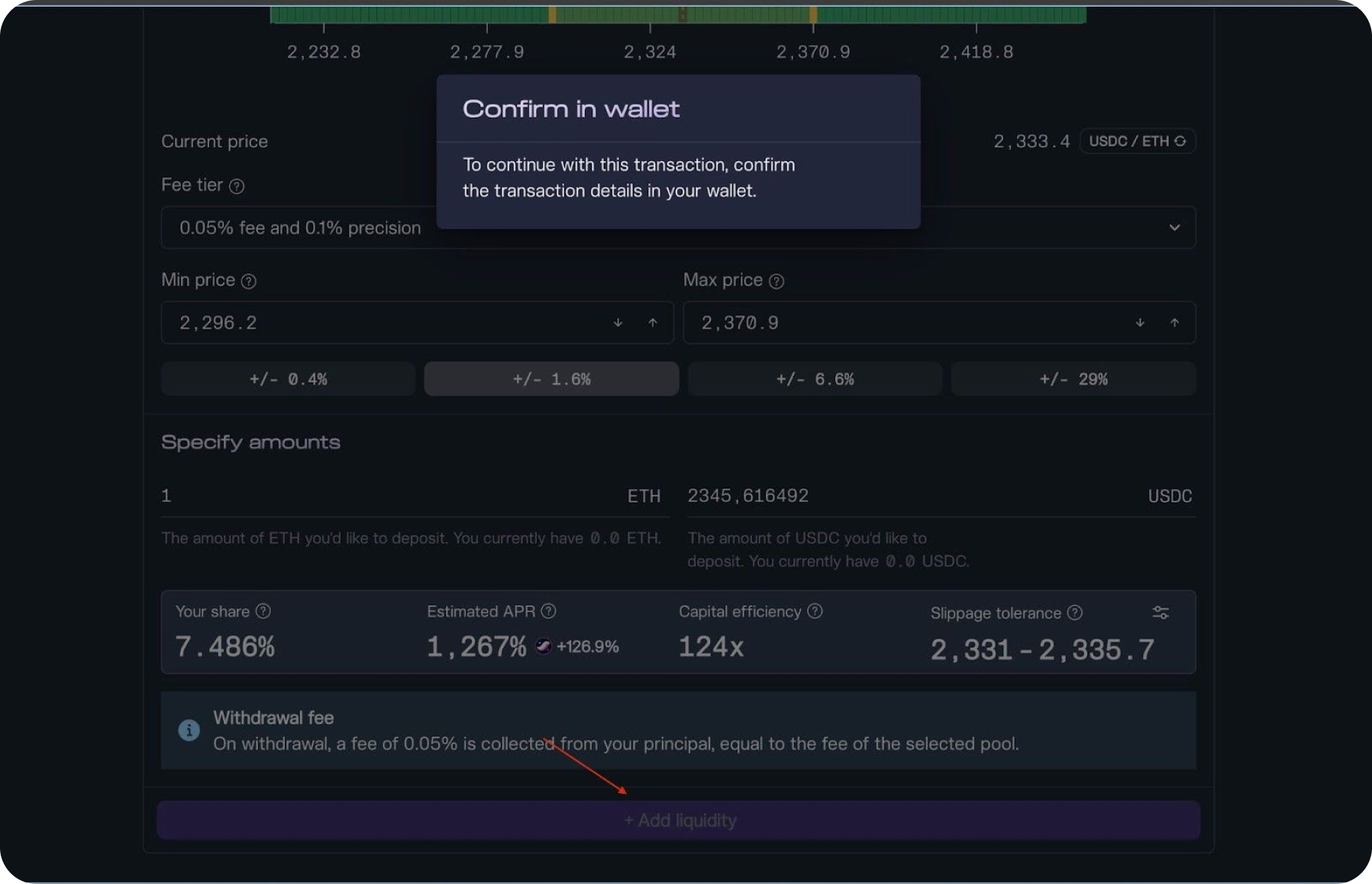

- You can see your Share (0.0310%), Estimated APR (0.03424%+18.84%), and Capital Efficiency (6.250x).

- Push the Add liquidity button and Confirm your transaction in the wallet.

Once the transaction is approved, the asset will be transferred to the Ekubo platform and you will start earning STRK rewards according to current APR (18.84%). Every day you can Claim your STRK tokens and, for example, swap to USDT.

Once the transaction is approved, the asset will be transferred to the Ekubo platform and you will start earning STRK rewards according to current APR (18.84%). Every day you can Claim your STRK tokens and, for example, swap to USDT.

You can withdraw your liquidity from Ekubo at any time by selecting the Withdraw option in your position. However, be mindful of the withdrawal fee, which is 0.002% of your principal amount.

Dollar Cost Average (DCA) Orders

A notable feature of Ekubo is its first extension, the TWAMM (Time-Weighted Average Market Maker), which appears as Dollar Cost Average orders and DCA enabled pools in the interface.

These orders allow users to sell tokens at a consistent rate over a predetermined period.

DCA enabled pools integrate this extension to manage imbalances between buy and sell Dollar Cost Average orders.

Since TWAMM pools work seamlessly with other pools within Ekubo and net opposite orders, they provide more efficient pricing and reduce fees, especially for large transactions.

Summary

Ekubo Protocol brings substantial innovation to the DeFi and Starknet realms by encouraging user involvement and improving cost efficiency with features like the till pattern.

Its collaboration with leading DeFi projects such as Jediswap, Mesh Finance, ZAP, mySwap, ZkLend, and StarkEx is expected to unlock new integration opportunities and promote greater interoperability within the ecosystem.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.