Long-term Portfolio Building Strategy on DeFi

Key Insights

- This strategy aims to build a long-term portfolio focused on capital growth over long period of time

- The strategy provided in this article allows not only to diversify investments, but also to generate stable income in the long term using DeFi's innovative tools and technologies.

- Asset allocation to different DeFi protocols (liquidity pools, staking, and other possible actions and operations)

Long-term Crypto Strategy Steps

- Fundamental Asset Selection

Start by selecting key assets that have strong fundamentals and widespread use in DeFi protocols. These can be highly capitalized cryptocurrencies such as Ethereum (ETH), Wrapped Bitcoin (WBTC), Polygon (MATIC), Avalanche (AVAX), Solana (SOL)

- Defining your investment objectives

Before you start building your portfolio and selecting assets, you need to clearly define your investment objectives and risks. Given our Buy and Hold strategy with a focus on growing our balance sheet with DeFi, we can formulate the following objective: capital growth over time. We are willing to hold assets in the portfolio over a long period of time to bet on their potential growth in the future.

- Asset Allocation

Allocate your portfolio across a variety of assets and protocols to provide diversification and reduce risk.

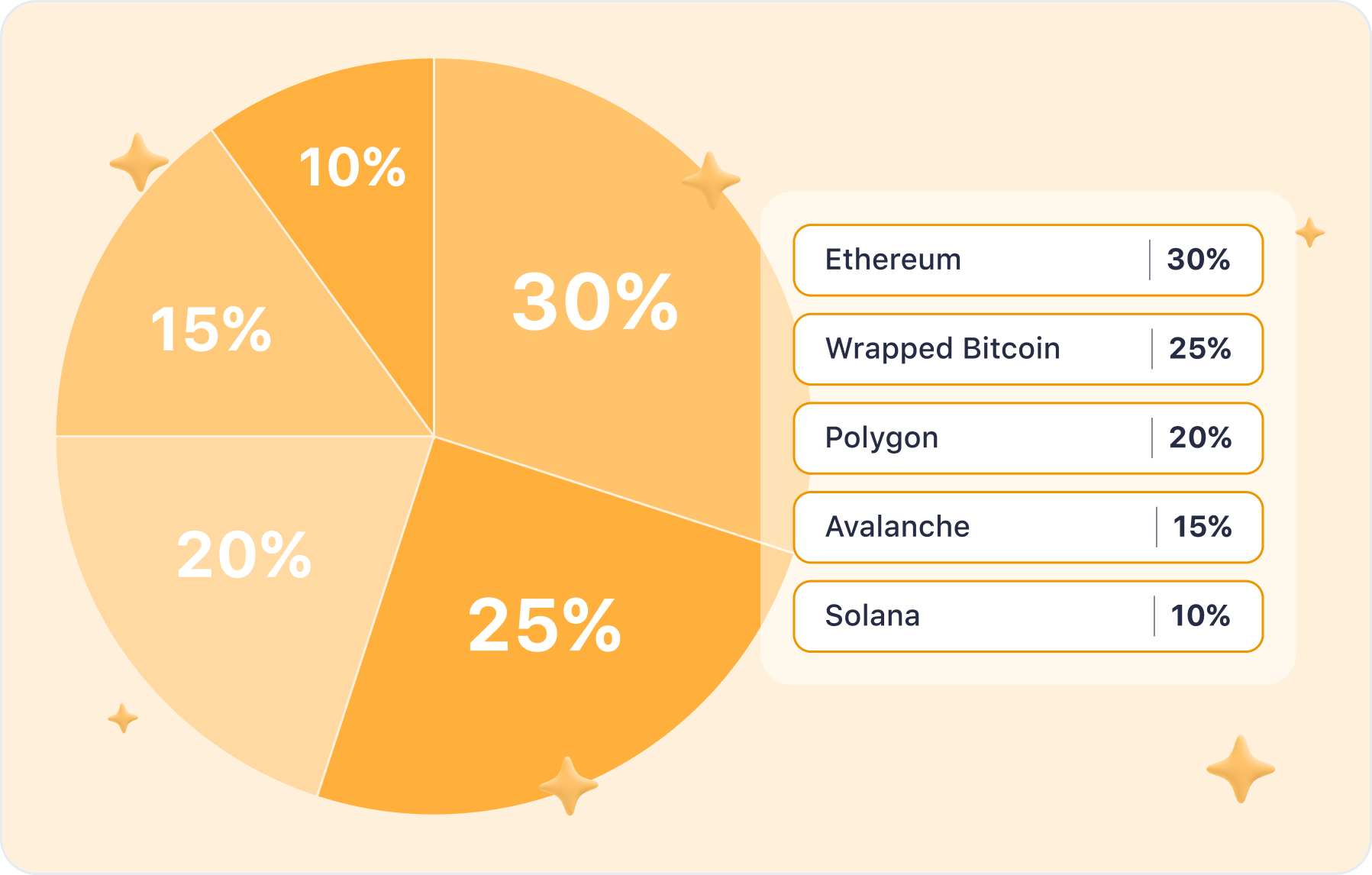

Example of Long-term Diversified Portfolio

Here is one possible allocation among the selected assets that allow for a diversified crypto portfolio:

Ethereum (ETH): 30%

Wrapped Bitcoin (WBTC): 25%

Polygon (MATIC): 20%

Avalanche (AVAX): 15%

Solana (SOL): 10%

This approximate allocation can be adapted depending on your investment objectives, risk level and preferences. It is also recommended that you regularly review your portfolio and rebalance it according to market changes and your financial goals.

Participation in DeFi protocols: Use selected assets to participate in various DeFi protocols. Participate in liquidity pools, staking, deposits and other operations to earn returns on your investments.

Monitoring and rebalancing: Monitor the performance of your portfolio regularly and review it, rebalancing as necessary. Take note of changes in the market and adapt your strategy to new conditions.

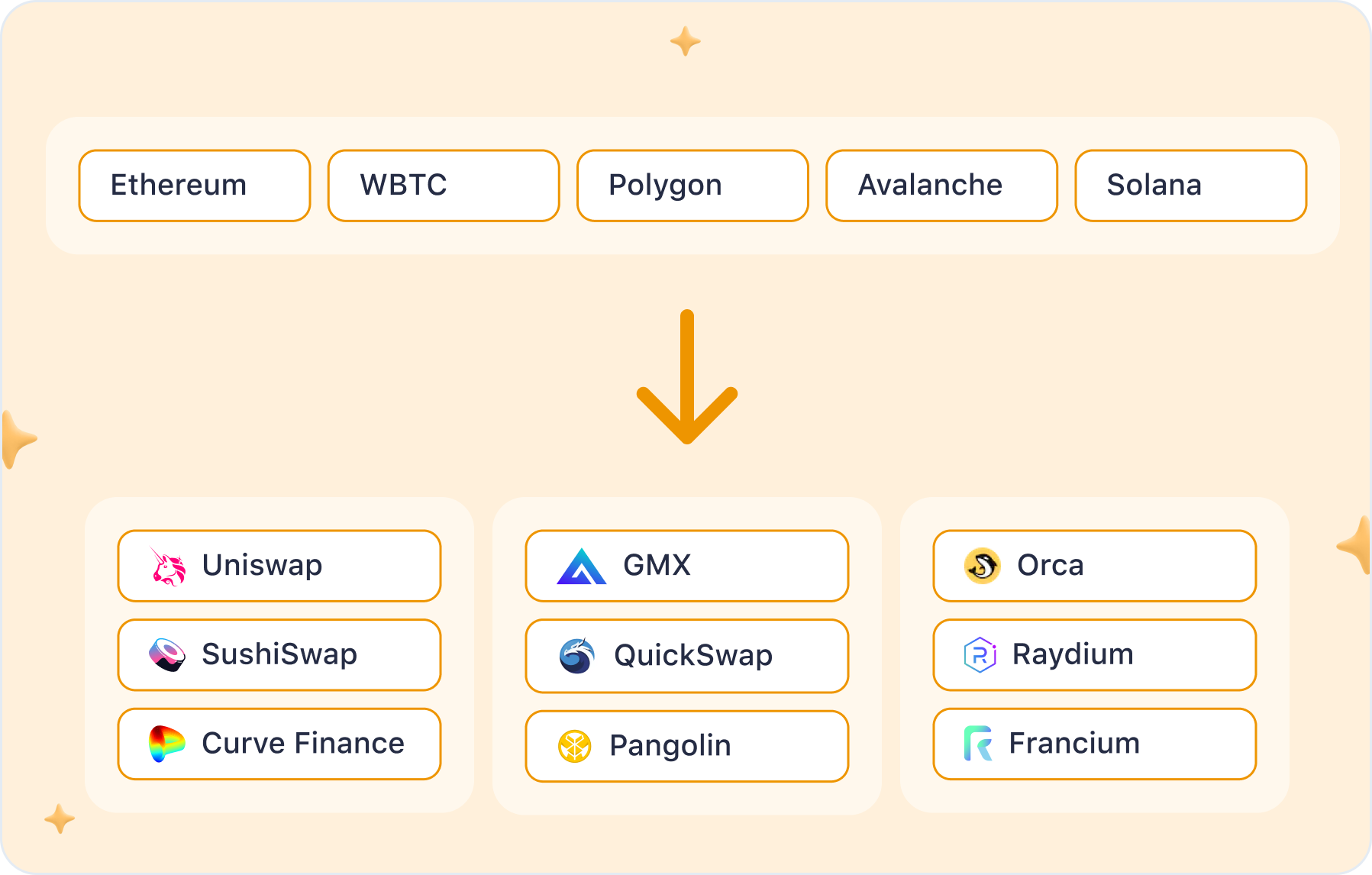

Taking into account the proposed asset allocation and their ratio to the total portfolio, let's allocate them to different DeFi protocols:

- Ethereum (ETH) - 30%

Ethereum is a project and technology that facilitates digital currency ETH, global payments, and decentralised applications. The Ethereum community has created a thriving digital economy and innovative methods for online creators to earn income.

Participation in liquidity pools: Uniswap, SushiSwap, Curve Finance.

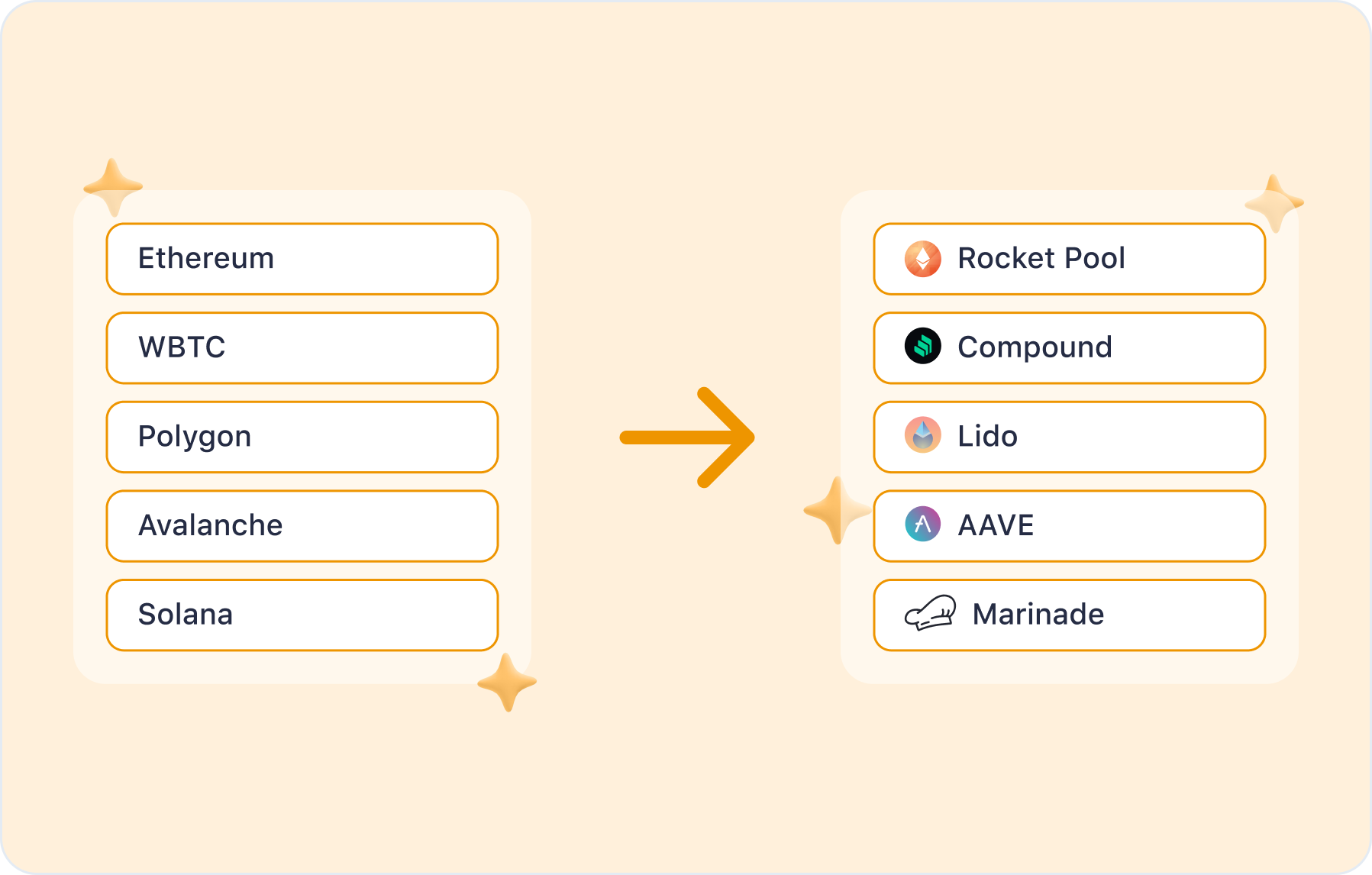

Staking: For network support rewards: Lido, Rocket Pool.

- Wrapped Bitcoin (WBTC) - 25%

Wrapped BTC is a digital assets collateralized 1:1 to its cryptocurrency. Unlike stablecoins, the collateral WBTC is usually a volatile digital asset instead of fiat currencies. The purpose is to promote interoperability by creating native versions of established cryptocurrency on multiple networks. In essence, this technique enables the transfer of liquidity between blockchain networks that are technically incompatible.

Participation in liquidity pools: Uniswap, SushiSwap, Curve Finance.

Depositing in lending protocols: AAVE, Compound

- Polygon (MATIC) - 20%

Polygon is a scalable and resilient platform for building and deploying decentralized applications and blockchain services. The primary focus of Polygon crypto platform is to enhance the performance of the Ethereum blockchain by providing multi-chain solutions and development tools.

Participation in liquidity pools: Uniswap, QuickSwap, SushiSwap, Aave to provide liquidity on Polygon.

- Avalanche (AVAX) - 15%

Avalanche is a scalable blockchain platform that allows to create low code applications. The goal of the Avalanche Blockchain is to provide developers with tools to create decentralized applications and smart contracts with superior performance and scalability. The platform provides a flexible infrastructure that supports multiple cryptocurrencies and tokens.

Participation in liquidity pools: Pangolin, SushiSwap, GMX

Staking: in Avalanche to receive rewards for supporting the network.

- Solana (SOL) - 10%

Solana is a blockchain platform that offers high performance and scalability. It supports various decentralized applications and provides fast transactions. Solana's combination of Proof of History (PoH), Proof of Stake (PoS), Tower Byzantine Fault Tolerance (BFT), and turbocharged replication ensures high throughput and low fees, making it an excellent choice for high-performance DApps.

Participation in liquidity pools: Orca, Raydium, Francium

Staking: Solana for network support awards in Marinade.

DeFi Protocols for Asset Allocation

Below is a comprehensive overview of DeFi protocols the assets might be allocated to.

Liquidity Pools

- Uniswap

Uniswap is a decentralized cryptocurrency exchange that utilizes an automated market-making (AMM) model to facilitate trades without intermediaries. It operates on the Ethereum blockchain and was among the earliest decentralized exchanges to achieve widespread adoption.

- SushiSwap

SushiSwap is a fork of Uniswap. Like Uniswap, SushiSwap operates as an automated market maker (AMM) where liquidity providers add funds to liquidity pools instead of using an order book exchange model. SushiSwap enables community governance from the outset and rewarding supply-side network contributors with the SUSHI token. SUSHI is also a governance token that grants holders the right to vote on future protocol developments.

- Curve Finance

Curve is an Ethereum-based exchange liquidity pool designed for highly efficient stablecoin trading and low-risk supplemental fee income for liquidity providers, without any opportunity cost.

- QuickSwap

Quickswap is a decentralized exchange that operates on automated market makers. It is a fork of Uniswap on Polygon. Anyone can provide liquidity and receive rewards based on a spread, also known as a liquidity fee (0.25% of the volume, with 0.05% going to QUICK token holders).

- Pangolin

Pangolin is a decentralized exchange (DEX) that operates on the Avalanche and Ethereum networks. It offers fast settlement, low transaction fees, and a democratic distribution system, all powered by Avalanche. The exchange uses the automated market-making (AMM) model, which is the same as Uniswap V2*. This model utilizes the constant product formula.

- GMX

GMX is a decentralized crypto exchange (DEX) that allows users to utilise short or long major coins with leverage as high as 50x while maintaining full control of the assets. User identity on GMX crypto platform remains anonymousby connecting the digital wallet.

- Orca

ORCA is a Solana token that governs the Orca decentralized exchange. Orca enables low-fee, near-instant token swaps using an automated market maker (AMM) model. Users supply tokens to liquidity pools, and algorithms set market prices based on supply and demand.

- Raydium

Raydium is an automated market maker (AMM) that operates on the Solana blockchain. It leverages the central order book of the Serum decentralized exchange (DEX) to enable fast trades, shared liquidity, and new features for earning yield. Solana blockchain was chosen due to its ability to facilitate low-cost and high-speed transactions.

- Francium

Francium is a decentralized global payment token based on TRC-20 powered blockchain that supports Open Science and Open Innovation. It serves as the credit token for scientists, researchers, scholars, entrepreneurs, enterprises, start-ups, universities. Francium encourages innovative and creative thinkers to freely develop their programs within a decentralized, community-based infrastructure.

Staking

- Rocket Pool

Rocket Pool is a staking pool for Ethereum 2.0 that aims to lower the capital and hardware requirements for staking, enhance decentralization, and improve security. Users can choose to stake with a variety of node operators and maintain custody of their funds while staking towards any node operator they choose.

- Compound

Compound is a lending protocol built on the Ethereum blockchain. It faces minimal credit risk and does not require external funding. Depositors mutually own the economic benefits of the protocol, similar to how a mutual insurance company operates. This allows Compound to intermediate funds in a pseudonymous information environment.

- Lido

Lido Finance is a platform that enables users to earn rewards from staking their crypto assets without locking them up. This process is known as liquid staking. Users can deposit Ethereum and receive Lido crypto in return. Lido tokens represent the users' stake in the Ethereum network and can be traded freely at any time while still earning the users Lido staking rewards.

- AAVE

AAVE is a decentralized financial platform that allows users to earn interest on their crypto deposits and take out loans against their deposits.

- Marinade

Marinade Finance is a decentralized protocol on the Solana blockchain that simplifies staking cryptocurrencies. Users can stake their SOL tokens on the platform to earn rewards while maintaining liquidity. Users can stake their Solana coins on the platform and receive liquid Marinade tokens in return, which represent their staked position.

Summary

Building a long-term portfolio in DeFi Protocols is an important strategy for investors who seek stable returns over the long term. A properly designed strategy based on fundamental assets and protocols allows investors to take full advantage of the DeFi ecosystem and succeed in their investments.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.