BTC Analysis June

Key Insights

- A sharp decline in the number of active addresses during price consolidation is explained by long-term wallet storage and market expectations. Users become cautious during periods of price uncertainty, which leads to a decrease in activity and the number of active addresses.

- Reaching the lower boundary of BTC price consolidation may lead to an increase in the number of transactions due to the activity of traders who see an opportunity to buy or sell at a more favorable price.

- Users prefer to safely store BTC in their wallets, expecting a clearer picture of the market. The average hash rate indicates the network participants' expectations for the further BTC growth and willingness to invest more computing resources.

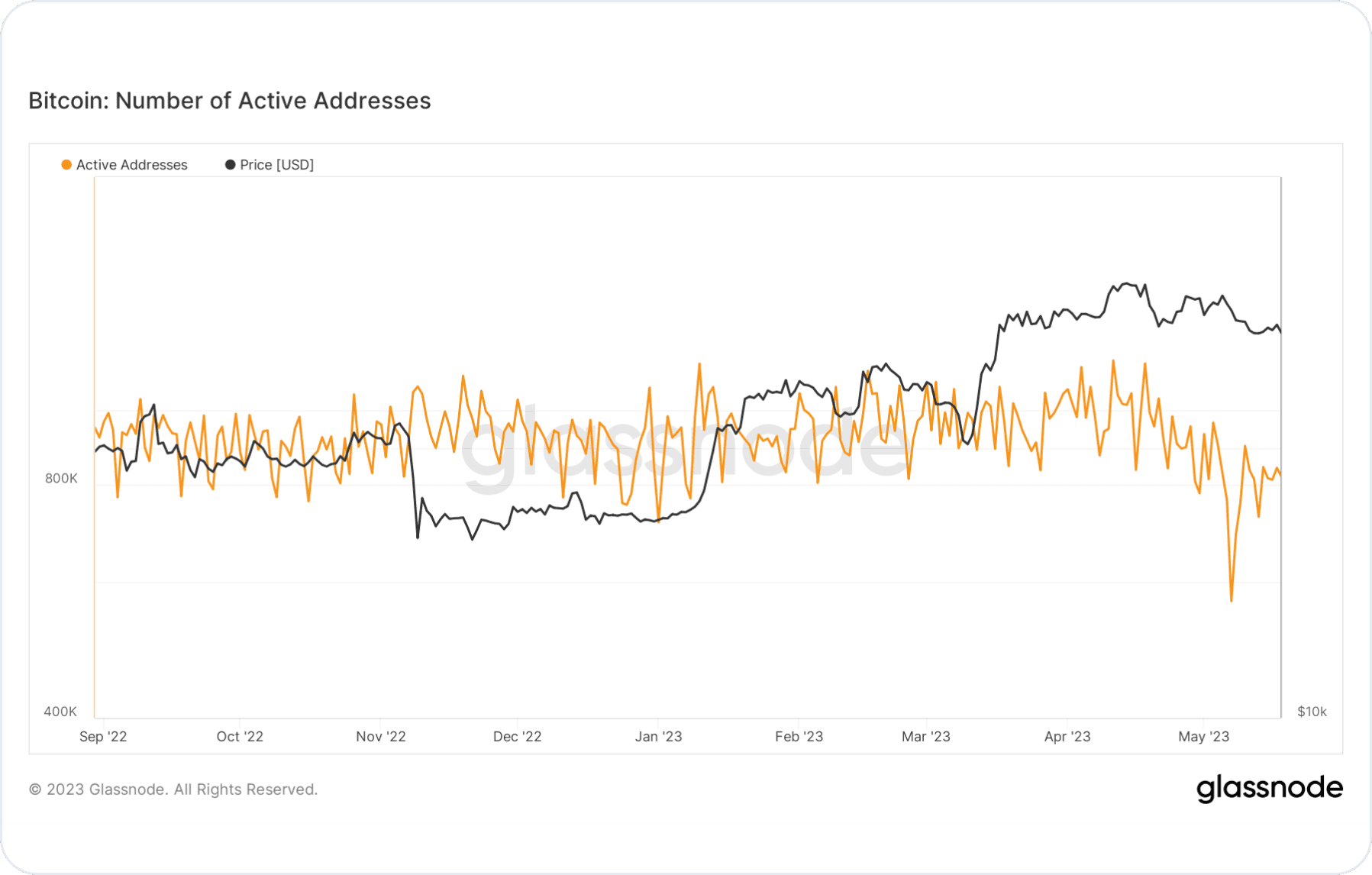

The observed sharp decrease in active Bitcoin addresses from one million to 560,000 during the price consolidation in the range of $30,000 to $26,000 can be attributed to the factors described below.

Number of Active Addresses

- Long-term wallet holding

Some users may prefer to hold their coins in long-term wallets rather than engaging in frequent transactions. This behaviour may be driven by their expectations of future BTC price growth. Users choose to retain their coins for long-term investments and are less inclined to engage in active transactions, leading to a decrease in the number of active addresses.

- Market expectations

During a period of price consolidation, when the BTC price fluctuates within a narrow range, users may become cautious or indecisive. Uncertainty regarding the future direction of the price can lead to a reduction in active addresses as users prefer to observe and wait for market clarity before taking active actions. Thus, users may reduce transaction activity and coin movements, which is reflected in the decrease in the number of active addresses.

This might explain the observed decline in active Bitcoin addresses during a period of price consolidation for BTC.

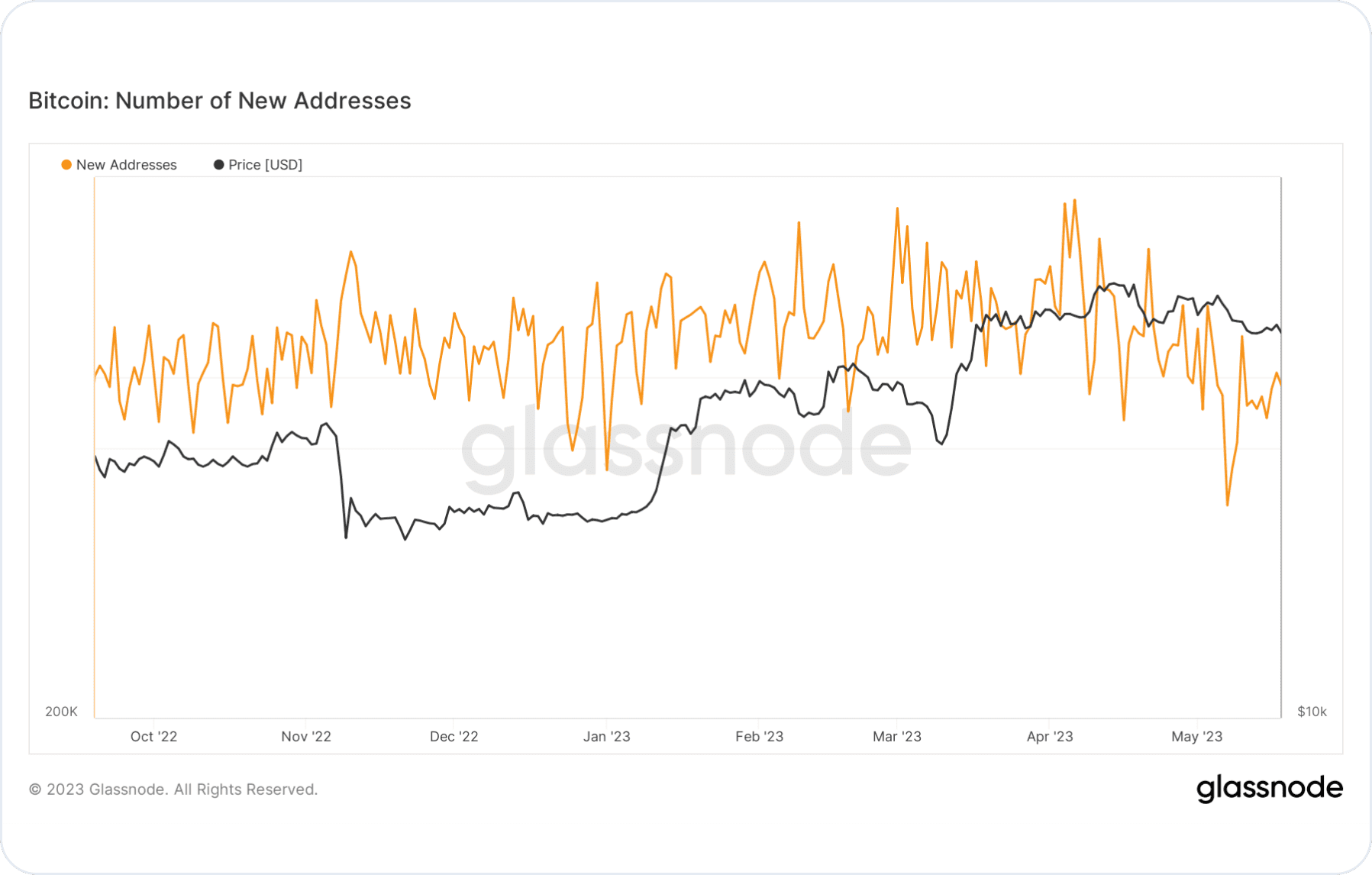

Number of New Addresses

The decrease in the number of new Bitcoin addresses during a period of sideways price movement and limited volatility can be explained as follows.

- Changing interest of new users

Some potential users may postpone their entry into the world of cryptocurrency or the creation of new addresses. The temporary decline in interest from new users in Bitcoin may be due to the absence of clear upward trends or uncertainty about the future price. However, a sharp recovery in the number of new addresses may indicate a return of interest and the attraction of new users after a period of temporary decline.

- Expectations of price growth

During a period of sideways price movement, when there is limited volatility, users may, as stated, anticipate further price growth in Bitcoin before deciding to create new addresses. When the price starts to recover after a period of decline, it may present an opportunity for users to enter the market and register new addresses.

The sudden recovery in the number of new addresses may be associated with users' confidence in the prospects of price growth and their desire to participate in a growing market. Users can get BTC on SimpleSwap.

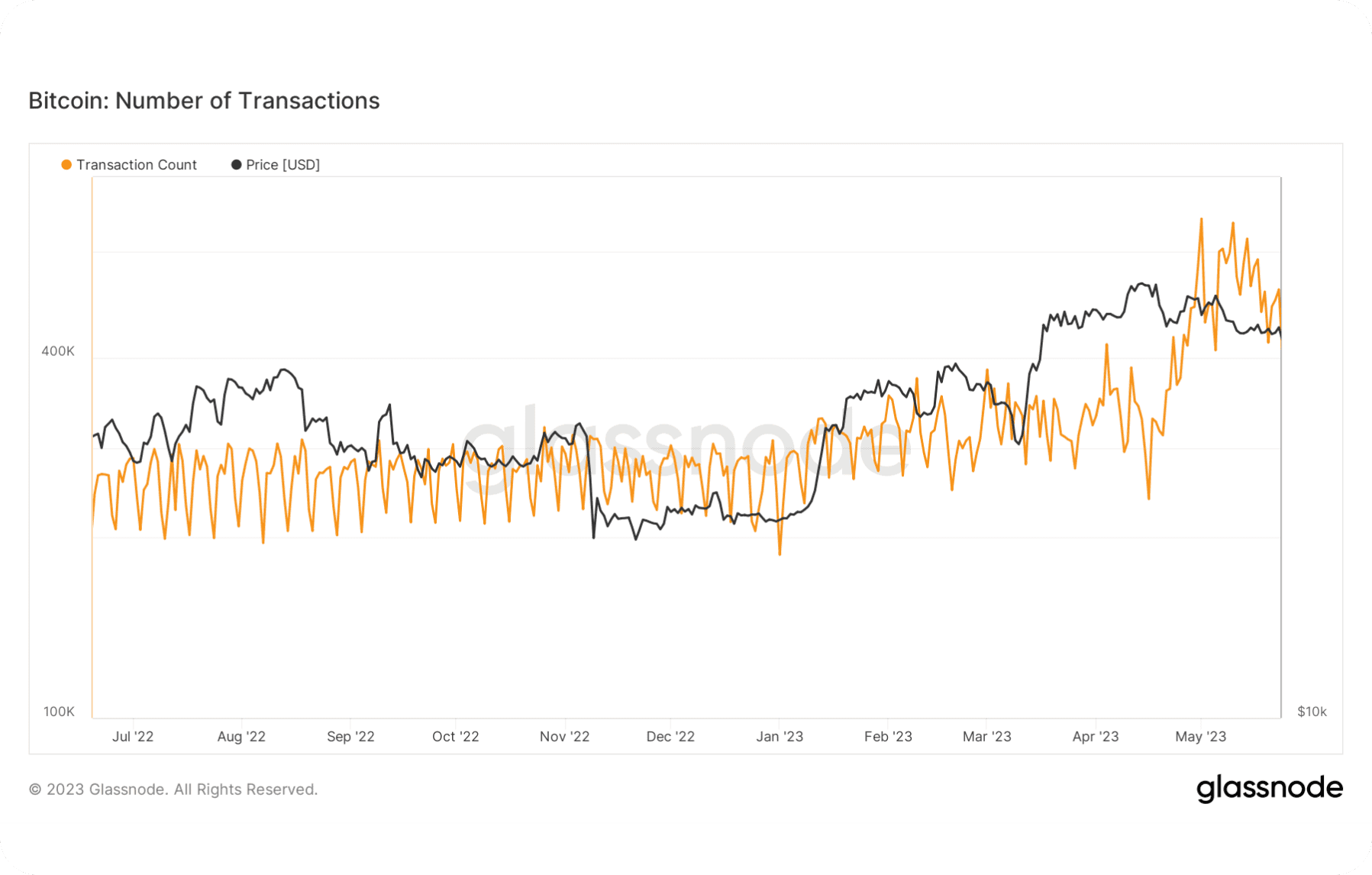

Number of Transactions

There’s been a certain increase in the number of transactions in the Bitcoin network upon reaching the lower boundary of price consolidation for BTC.

The activity of traders and investors can significantly increase when the Bitcoin price reaches or drops below a certain level

This is associated with the opportunity to buy or sell at a more favorable price. Traders see the potential for profit and actively participate in the market by conducting buy and sell operations for Bitcoin. The increase in the number of transactions reflects this trader activity, as they react to price changes.

The sharp increase in the number of transactions can be linked to a response to current market conditions

When the Bitcoin price reaches the lower boundary of consolidation, users may see an opportunity to buy Bitcoin at a low price and decide to transact in order to capitalize on these opportunities. They may consider the Bitcoin price to be at an acceptable level and choose to enter the market or increase their positions.

Both factors, trader activity and response to market conditions, can interact and contribute to the increase in the number of transactions in the Bitcoin network.

It is important to note that increased activity does not always indicate the direction of price movement or future changes in the Bitcoin network.

Additional analysis and consideration of other factors, such as trading volumes and news events, can help provide a more comprehensive understanding of the reasons for the increase in the number of transactions in this context.

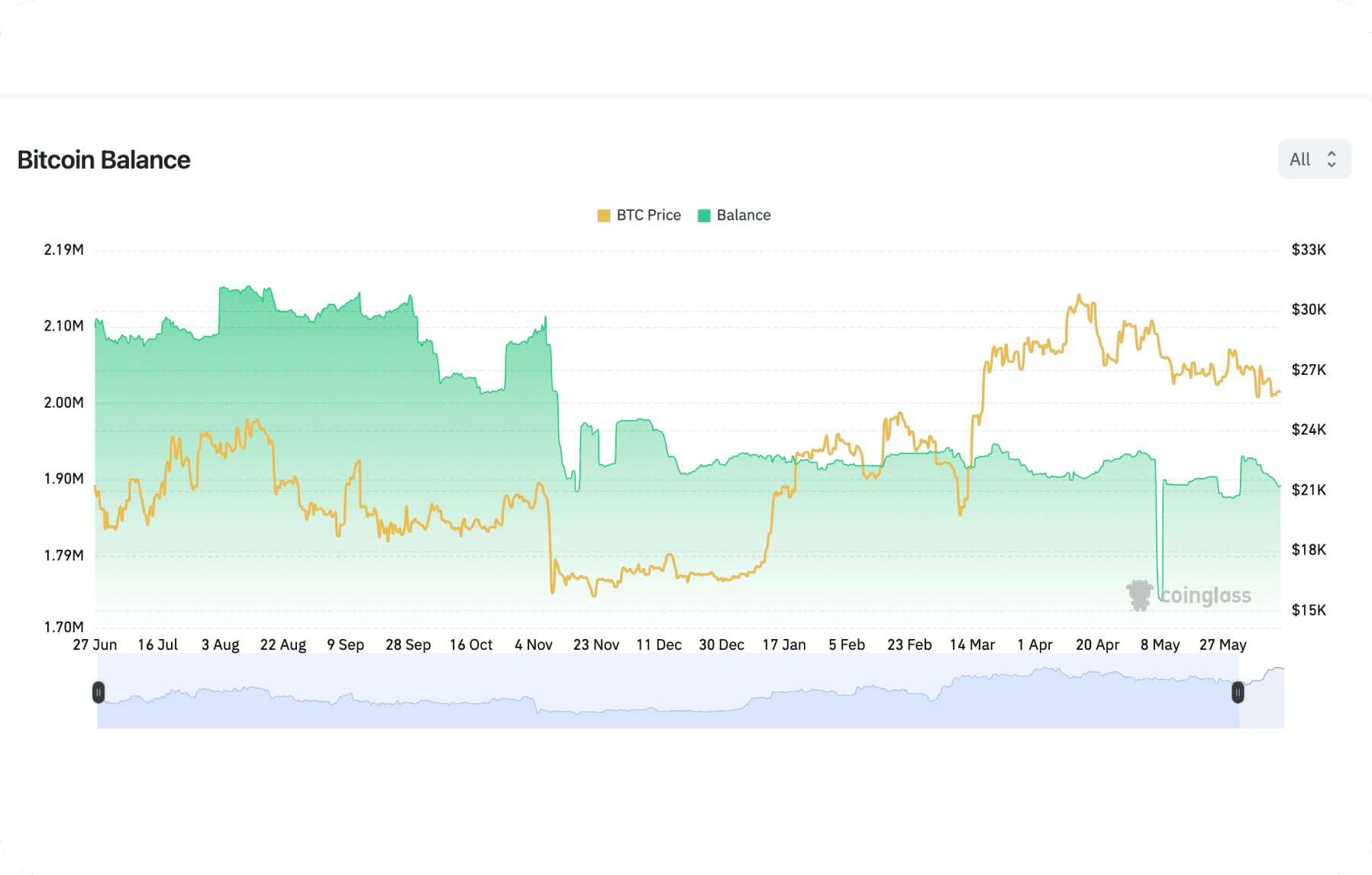

Balances on Exchanges

The decrease in Bitcoin balances on exchanges, along with a gradual decline in Bitcoin price, can be attributed to a decrease in overall trading activity.

When the price of Bitcoin decreases and market volatility remains low, users may exhibit less interest in active trading and prefer to hold their Bitcoin off exchanges until clearer market signals and trends emerge.

The price decrease and low volatility can induce caution and hesitation among traders and investors.

Users may prefer to wait until the market clarifies and there is a clearer direction in Bitcoin price movement before making active trading decisions. Under such conditions, users may choose to hold their Bitcoin securely in their own wallets rather than keeping them on exchanges.

This behaviour can be driven by a desire to avoid potential risks associated with holding Bitcoin on centralised exchanges and an expectation of a clearer market picture to make more informed trading decisions.

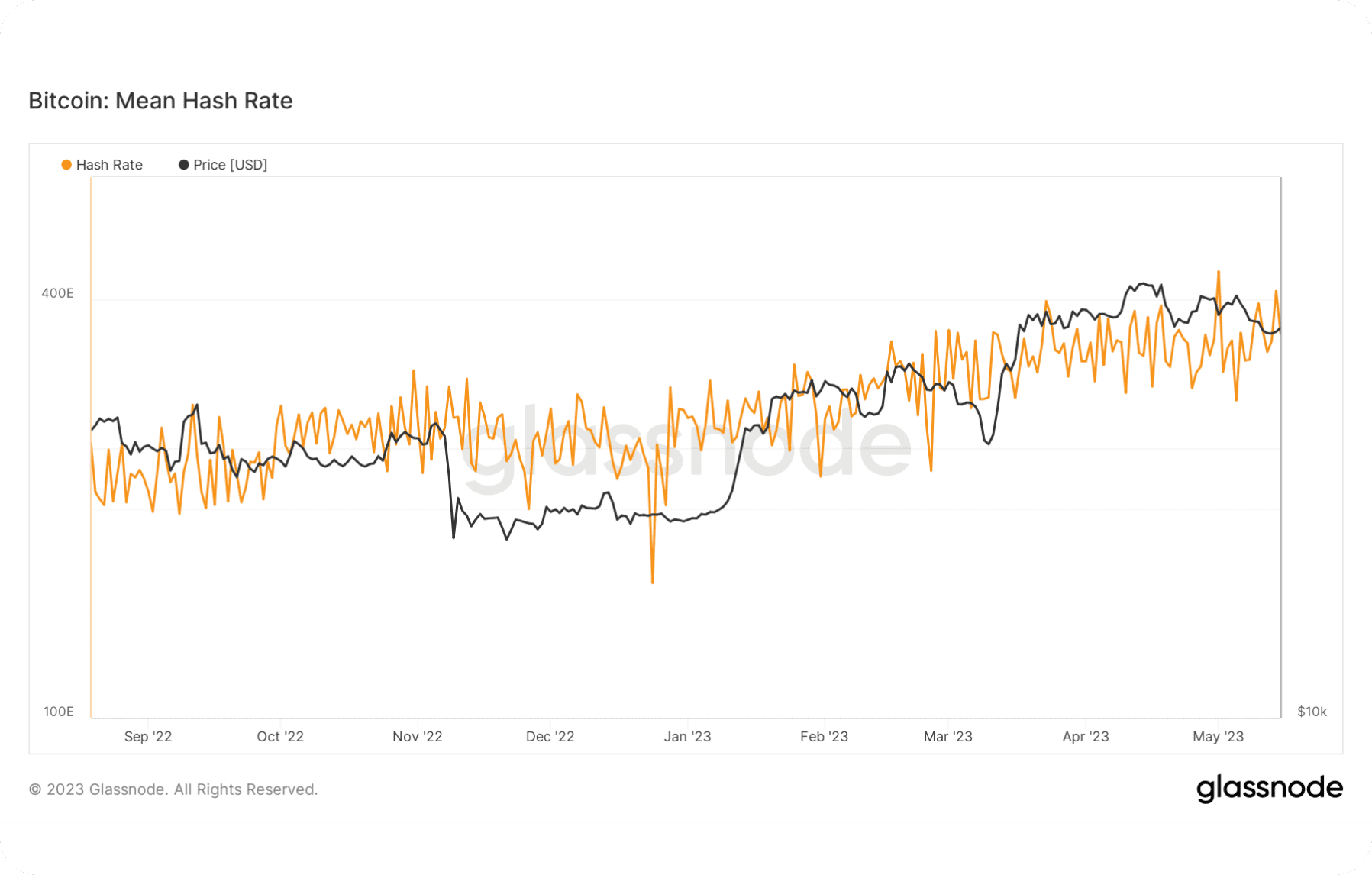

Mean Hash Rate

Interestingly, the hash rate of the Bitcoin network can grow faster than the price of Bitcoin. This can indicate that network participants anticipate further development and growth of the crypto in the future and are willing to invest more computational resources to support the network.

The hash rate is not always directly linked to the price of Bitcoin. In some cases, the hash rate may continue to grow even during a decrease in the price of Bitcoin. This may be due to long-term investment strategies of miners who continue to mine Bitcoin in anticipation of future price growth and increased profitability.

Summary

Analysing these factors related to Bitcoin allows for several general conclusions.

Periods of price consolidation and limited volatility can influence user activity and the number of active addresses on the Bitcoin network

Users may be cautious, preferring to hold their coins in long-term wallets and await market clarity before taking active actions.

Expectations of Bitcoin price growth play a significant role in user behaviour.

Periods of price consolidation can cause uncertainty and hesitation among traders and investors, leading to decreased activity and increased caution in creating new addresses.

BTC balances on exchanges may decrease during periods of gradual price decline and low volatility.

Users may prefer to hold their coins off exchanges, waiting for a clearer market picture and making more informed trading decisions.

The increase in transaction volume and the growth of the Bitcoin network's hash rate can be linked to the activity of traders, investors, and network participants

Who react to price changes and anticipate future cryptocurrency growth.

Overall, these factors are interconnected and reflect the complex dynamics and uncertain behaviour of Bitcoin market participants.

Users can get BTC for fiat or crypto on SimpleSwap.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.