BTC & Financial Indexes Correlation: Fake News and Average Intra-Day Metrics

Key Insights

- Bitcoin exhibits a remarkable degree of independence from traditional financial indexes like the US Dollar Index and the VIX Index, suggesting that its price movements aren't significantly influenced by these indicators.

- The dissemination of fake news like the false report of an ETF launch, can have a sudden and significant impact on Bitcoin's price, showcasing its vulnerability to external events.

- Bitcoin has a lower average intraday price volatility compared to the VIX Index. Despite its sensitivity to news, BTC maintains a more moderate level of price fluctuations on an average trading day.

BTC Autonomy

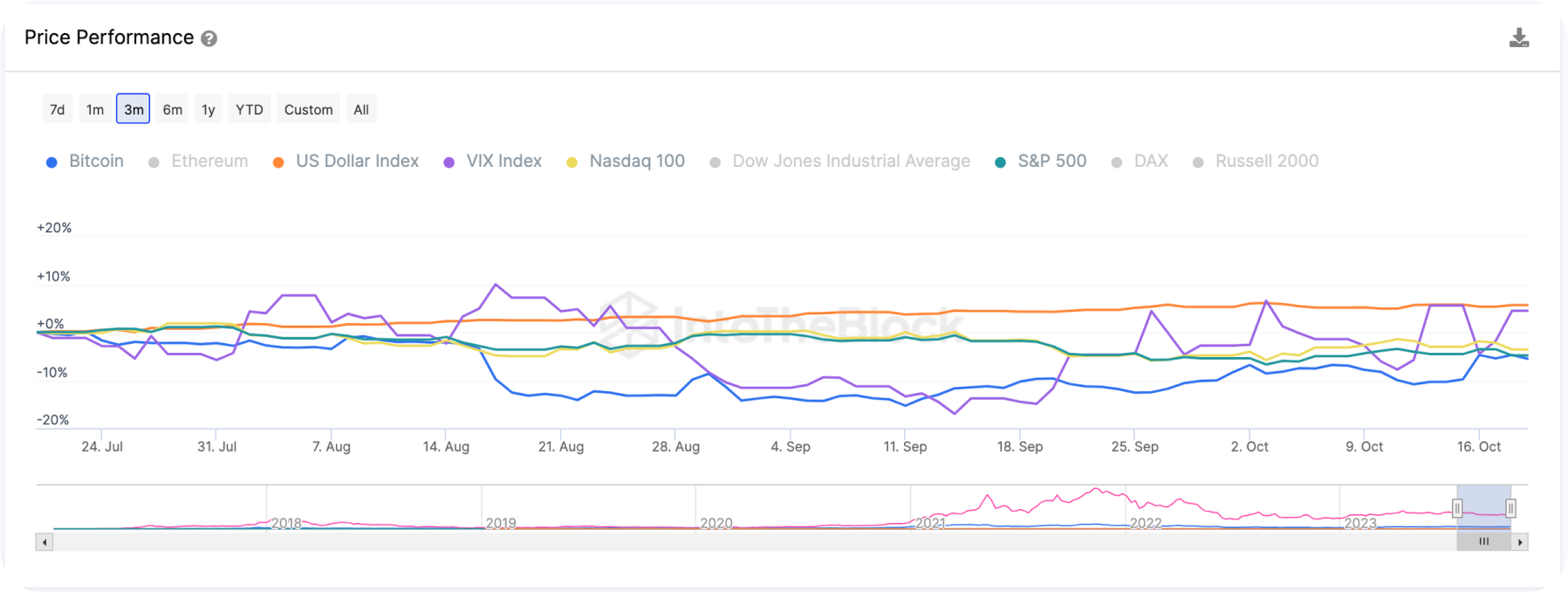

As of writing, Bitcoin has exhibited complete independence from influential financial indexes and instruments, such as the US Dollar Index, VIX Index, and S&P 500.

This neutrality indicates no statistically significant correlation between Bitcoin price movements and the aforementioned financial indicators.

BTC can be purchased on SimpleSwap for crypto or fiat.

- Independence from the US dollar

The U.S. Dollar Index (USDX) serves as a comparative gauge of the strength of the U.S. dollar (USD) when juxtaposed with a basket encompassing six significant currencies: the Euro, Pound Sterling, Japanese Yen, Canadian Dollar, Swedish Krona, and Swiss Franc. Its inception dates back to 1973.

The absence of correlation with the US Dollar Index suggests that fluctuations in the US dollar's exchange rate do not wield a decisive influence over Bitcoin price.

- No influence from volatility

Neutrality in relation to the VIX Index (volatility index) implies that changes in expected market volatility do not distinctly affect cryptocurrency price movements.

- Alternative diversification

The neutral relationship with the S&P 500 implies that investors may consider Bitcoin as an alternative asset for expanding their investment portfolio, thereby offering diversification opportunities outside of traditional stock markets.

Fake News Influence on Bitcoin

The significant upswing of Bitcoin to $30,000 following the dissemination of fake news regarding a crypto ETF (Exchange-Traded Fund) launch emerges as a primary factor explaining the neutral correlation of this crypto with traditional financial indexes.

This case vividly illustrates how impactful news, even when inauthentic, can suddenly stimulate the Bitcoin market.

However, such reactions are frequently short-lived and unstable. In this instance, the ETF launch news triggered a rapid price surge, which was subsequently followed by a steep decline.

This example also helps elucidate why Bitcoin maintains a neutral correlation with more stable and slower-moving traditional indexes, such as the S&P 500 and the US Dollar Index.

Since Bitcoin is sensitive to swift and unpredictable price changes in response to news, regardless of their authenticity, it retains its autonomy from more stable financial indexes.

BTC Average Intra-Day Move

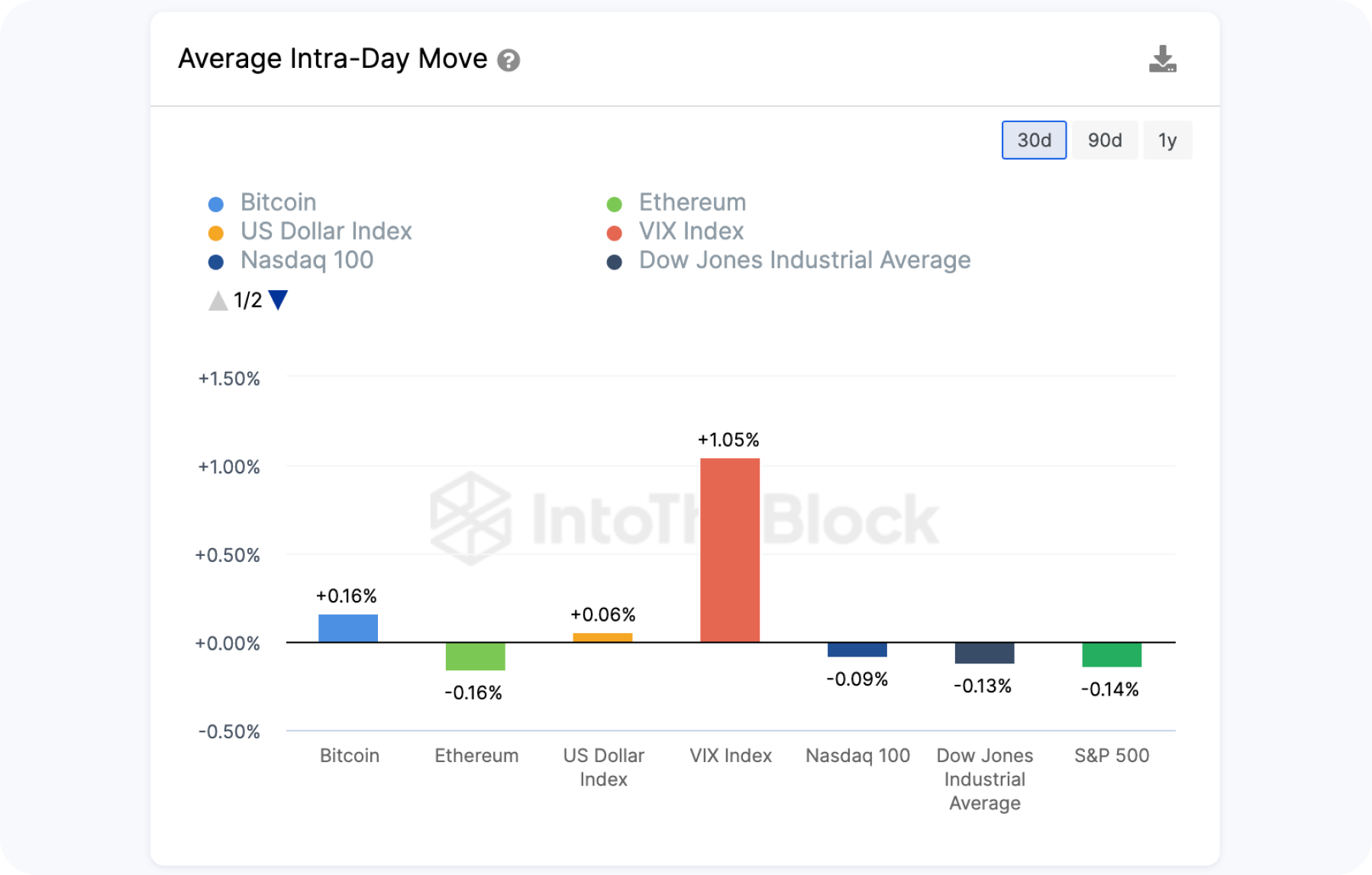

The Average Intra-Day Move metric reflects the average intraday fluctuations for various key assets and indexes.

- VIX Index +1.05%

The Volatility Index, commonly known as VIX, serves as a metric for assessing volatility within the stock market. A low VIX typically indicates subdued volatility, whereas a high VIX signifies elevated volatility.

The average intraday market volatility, as measured by the VIX Index, stands at 1.05%. This index gauges the expected volatility in the S&P 500 market.

- BTC +0.16%

The average intra-day price variation for Bitcoin, which amounts to 0.16%. Bitcoin, being a cryptocurrency, displays comparatively moderate price fluctuations on an average trading day.

- US Dollar Index +0.06%

The mean intraday change in the US Dollar exchange rate is 0.06%. This means that the price of the US dollar typically fluctuates by 0.06% during a single trading day.

- Nasdaq 100 -0.09%

The Nasdaq Stock Market, referred to simply as Nasdaq, stands as the world's second-largest stock exchange, providing a platform for investors to engage in the buying and selling of stock shares. Originally, Nasdaq derived from the acronym NASDAQ, representing the National Association of Securities Dealers Automated Quotations.

The average intra-day fluctuation in the Nasdaq 100 index is -0.09%. This index represents technology companies and demonstrates the typical intraday volatility in their stock prices.

- S&P 500 -0.14%

The mean intraday shift in the S&P 500 index is -0.14%. This index encompasses the largest American companies and showcases the average intraday market volatility in the stock market.

Comparing the VIX Index and BTC with respect to the Average Intra-Day Move metric reveals that the VIX Index exhibits a higher average intraday volatility, quantified at 1.05%. The expected market volatility, as reflected by the VIX Index, is typically higher on average. These fluctuations may be linked to events influencing the S&P 500 market.

Summary

Conversely, BTC displays a lower average intraday volatility, standing at 0.16%. This suggests that Bitcoin's price changes within a single trading day are, on average, less drastic compared to the VIX Index. Despite news developments and abrupt price swings, Bitcoin maintains a more moderate level of volatility.

Bitcoin's independence from conventional financial indexes remains apparent, even during periods of market turbulence. The observed volatility in Bitcoin in response to false news about an ETF launch underscores its position as an autonomous asset.

The Average Intra-Day Move metric indicates a moderate level of volatility in comparison to other indexes. Bitcoin continues to draw attention as an alternative means of diversifying an investment portfolio.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.