BTC Halving: Bull Run Highs & Bear Trend Lows

Key Insights

- A deep look into upsides of BTC halving and its influence on the cryptocurrency market

- BTC price growth is associated with each subsequent halving

- With trends being as they are now the estimated Bitcoin price might reach $165,000, as per Bitcoin Rainbow Price Chart Indicator

What is Bitcoin Halving

Halving is a process when the reward for mining blocks on the Bitcoin network is reduced by half. BTC halving is an event that brings the world's attention to the world of cryptocurrencies.

But why is this so important and how does it affect the future of the world's most popular cryptocurrency? Below we dive into BTC halving’s key features and advantages.

- Reducing inflation

One of the key aspects of halving is to reduce Bitcoin inflation. As the reward for mining decreases, the number of new Bitcoins put into circulation also decreases. This makes Bitcoin more deflationary and therefore more valuable in the eyes of investors.

- Incentivizing decentralization

Halving incentivizes decentralization of the network. As the reward for mining decreases, many Bitcoin miners may withdraw due to the increasing costs of mining. This may lead to mining being more evenly distributed among different participants, reducing the risk of centralizing control of the network.

- Economic Perspective

Halving also has an economic impact. A decrease in the reward for mining can lead to an increase in the value of Bitcoin in the long run. As the supply of new coins decreases and the demand for Bitcoin continues to grow, this could lead to an increase in price. This, in turn, could attract more investors and increase interest in the cryptocurrency.

- Increased Awareness

Every halving brings more attention to the world of cryptocurrencies in general. This is a great time to educate new users about what Bitcoin is, Bitcoin value, how Bitcoin works, and the benefits it offers. Having more people familiar with Bitcoin and other cryptocurrencies can encourage their wider acceptance and use.

Bitcoin Halving 2024: How it Started in 2012

- First Halving

Block: 210,000

Date: November 28, 2012

Reward for mining: 25 BTC

- Second Halving

Block: 420,000

Date: July 9, 2016

Reward for mining: 12.5 BTC

- Third Halving

Block: 630,000

Date: May 11, 2020

Reward for mining: 6.25 BTC

- Estimated fourth halving

Block: 840,000

Expected date: April 2024

Expected reward for mining: 3.125 BTC

Here are the dynamics of Bitcoin (BTC) value growth in the context of its halving. When analyzing the logarithmic Bitcoin halving chart in the weekly timeframe, it becomes clear that each subsequent halving of this cryptocurrency is accompanied by a pronounced acceleration of the Bitcoin price growth rate. We can see the bullish trend forming, which reflects the increase in demand for this asset.

Let's start with the first halving. After it was carried out, there was an rapid growth in the value of BTC by 53987%. This result is impressive and indicates the significant attention of crypto investors to this event, as well as the strength of market demand for Bitcoin.

The second halving also confirmed this trend, although already with somewhat less pronounced indicators. The Bitcoin growth amounted to 10671%, which is undoubtedly a significant result, although lower than the previous one. Nevertheless, it still shows that halving has a substantial impact on the dynamics of the Bitcoin price.

The last, third halving confirmed the established trend, yet with a more moderate performance. The growth amounted to 1988%, which in comparison with the previous halving looks more modest, but still reflects the continuing interest in Bitcoin from investors.

It should be noted that the level of percentage growth decreases as Bitcoin capitalization increases. This is because as the market size increases, more capital is required to achieve comparable percentage growth. Nevertheless, despite this, halving continues to be a key event that influences the Bitcoin exchange rate dynamics and generates interest among investors and cryptocurrency market analysts.

Bitcoin Halving Prediction

As we continue to analyze the percentage growth, we can notice an interesting pattern in the change in BTC value growth rate after each halving performed.

Let's take a look at the data provided:

- First growth: 53987%

- Second growth: 10671%

- Third growth: 1988%

For a more detailed study, we will calculate what percentage each successive BTC growth is relative to the previous one:

- Percentage of second growth relative to the first = (10671 / 53987) * 100 ≈ 19.75%

- Percentage of the third growth relative to the second = (1988 / 10671) * 100 ≈ 18.63%

Note that the percentage growth is gradually decreasing. If we maintain this pattern, we can assume that the fourth growth will be even lower. Let's assume that the percentage of the fourth growth will be about 17%. Then we can calculate the assumed fourth growth associated with the next Bitcoin halving as follows:

- Fourth growth = (1988 * 17) / 100 ≈ 337.96%

Thus, we assume that the fourth Bitcoin growth from the price bottom will be about 337.96%. This assumption is based on the observation of a decreasing percentage increase after each halving and can help in predicting further trends in the BTC price.

Thus, the assumed price peak would be around $69,300.

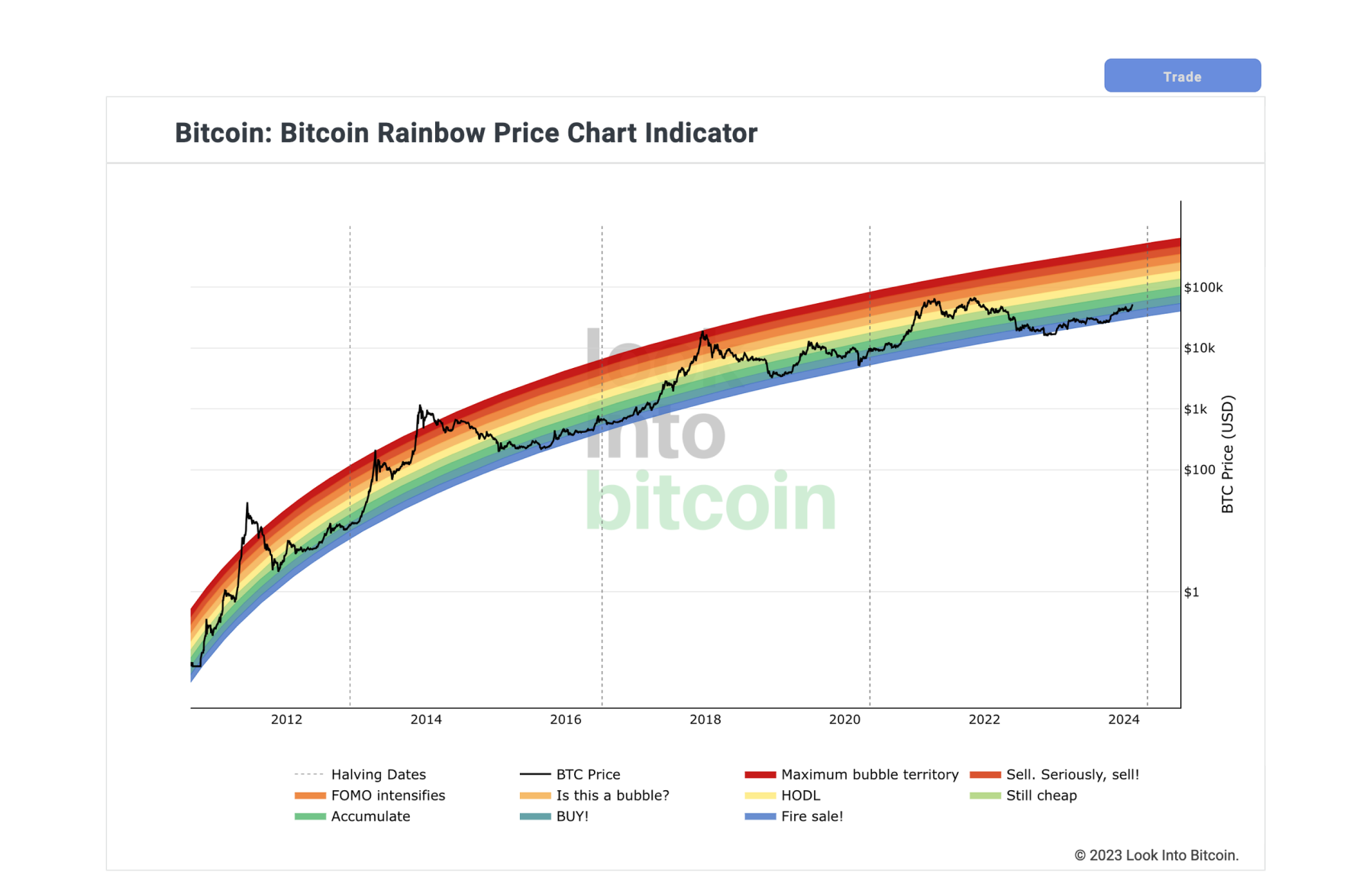

Bitcoin Rainbow Price Chart Indicator

This indicator foreshadows that when warm price levels, especially the light orange zone, are reached, the Bitcoin price could increase to $165,000. This figure is approximately 990% of the price low recorded in the previous period.

The warm price zones revealed by this indicator usually serve as notable resistance levels in the Bitcoin market, indicating possible significant changes in Bitcoin price dynamics. Therefore, this forecast suggests a high probability of BTC price growth to the $165,000 mark with the current trend.

Average BTC Value After Halving

To find the average value between the indicators of possible Bitcoin price growth after each new bullish trend with halving support, you need to add the two indicators and divide by their number.

- Average BTC value = (990% + 337.96%) / 2

- Average BTC value ≈ (1327.96%) / 2 Average value ≈ 663.98%

Thus, the average value between the indicators of possible Bitcoin price growth after each new bullish trend with halving support is about 663.98%. Hence, Bitcoin price can reach the level of about $118600.

Below are the estimated future bearish trend bottom based on the data provided.

First decline: 86%. Second decline: 83%. Third decline: 78%

To determine the trend in the sequence of declines, let's calculate the ratios of each subsequent decline to the previous decline:

- Ratio of second decline to first decline: 83/86 ≈ 0.965 Ratio of third decline to second decline: 78/83 ≈ 0.94

We see that each subsequent decline is approximately 94-96% of the previous decline. Based on this trend, let's assume that the fourth decline will be about 92-94% of the third decline.

Now let's calculate the fourth decline:

- Fourth decline = 78 * (92/100) ≈ 71.76%

Thus, we assume that the fourth reduction will be about 71.76%.

Let's apply this decline to the average possible bullish trend peak at $118600:

$118600 - 71.76% ≈ $33 630

Consequently, the Bitcoin price could reach a level of about $33,630 within the assumed future bearish trend.

BTC can be purchased for crypto or fiat on SimpleSwap.

Summary

Bitcoin halving is not just an event in the world of cryptocurrencies, it is a pivotal moment that impacts various aspects of the cryptocurrency ecosystem, as well as global economic market as a whole. Understanding its impact and implications can help investors, developers, and users better understand where this exciting world of digital currencies is headed.

BTC halving has a significant impact on the cryptocurrency market and the Bitcoin ecosystem itself. Bitcoin halving reduces inflation, encourages decentralization, increases awareness, and overall has significant economic influence. We used mathematical methods and indicators to analyze the behavior of Bitcoin during each halving.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.