BTC and S&P 500 Indexes Correlation: Sharpe and Sortino Ratios

Key Insights

- Strong relationship between Bitcoin and S&P 500 indexes emphasizes the growing importance of the cryptocurrency market and its role in the global economy

- Bitcoin is gaining attention as a stable and promising asset to invest in, as seen by its high market capitalization that surpasses that of some of S&P top companies

- Both the Sharpe and Sortino ratios are higher for Bitcoin than for S&P 500

BTC & S&P Indexes Correlation Overview

In today's world, Bitcoin has long ceased to be just an experiment or an alternative investment tool. It has become an important part of the global economy, demonstrating resilience and significant influence on global financial markets.

Back in April 2023 we already delved into the correlation between BTC and S&P 500 indexes. There we took a look into several possible reasons why Bitcoin and the S&P 500 move together. Namely, the growing interest in cryptocurrencies, rise of interaction of crypto with the technology sector, and global economic factors (inflation, volatility, etc.).

It must be noted that the correlation between BTC and S&P 500 might not have a causal nature. It might be a coincidence. Nevertheless, investors shouldn’t ignore the possible correlation between Bitcoin and the S&P 500. For instance, it’s important for crypto market investors to know how S&P indexes affect the BTC cryptocurrency price (e.g. the fall in S&P index might lead to a increased demand for Bitcoin).

Factors Influencing BTC and S&P 500 Correlation

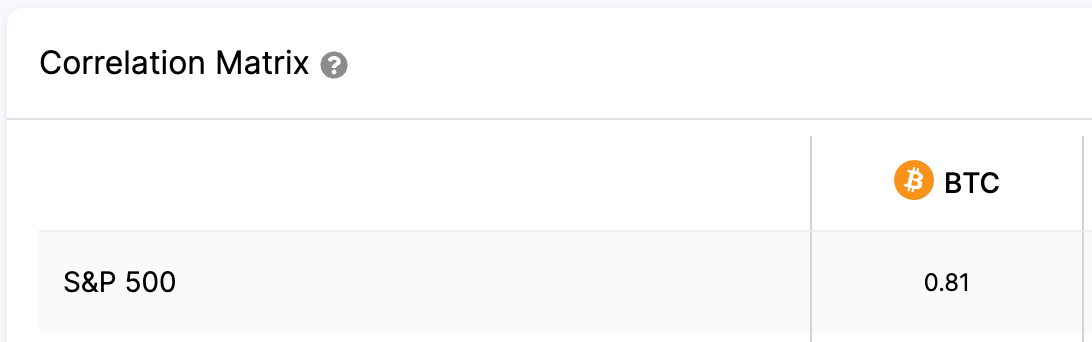

One of the key factors still emphasizing Bitcoin's growing importance is the correlation index between BTC and the S&P 500, which, at 0.81, indicates that changes in the S&P 500 market can have a significant impact on Bitcoin price. Investors are increasingly paying attention to this correlation, taking it into account when making decisions in the market.

The approval of the spot ETF has led to an impressive rise in Bitcoin's market cap, which has surpassed the capitalization of large companies such as Meta Platforms, Inc. (META), a top-10 S&P 500 company by capitalization. Bitcoin is becoming an integral part of the investment portfolio of both large funds and individual investors.

Bitcoin's recent rise above $72,000 has made it the eighth largest asset in the world, surpassing even silver, with a market capitalization of $1.41 trillion. This growth also underscores the cryptocurrency's appeal to investors who see it as an opportunity for long-term growth.

The next competitor in seventh position in terms of capitalization is Alphabet Holding, which runs Google. This emphasizes that Bitcoin is becoming a serious competitor to large traditional corporations and asserts its role as an important player in the global economy.

Thus, Bitcoin has long since ceased to be just an alternative asset. It is becoming an important part of the global financial landscape, attracting the attention of investors and confirming its role as a promising asset for long-term investment.

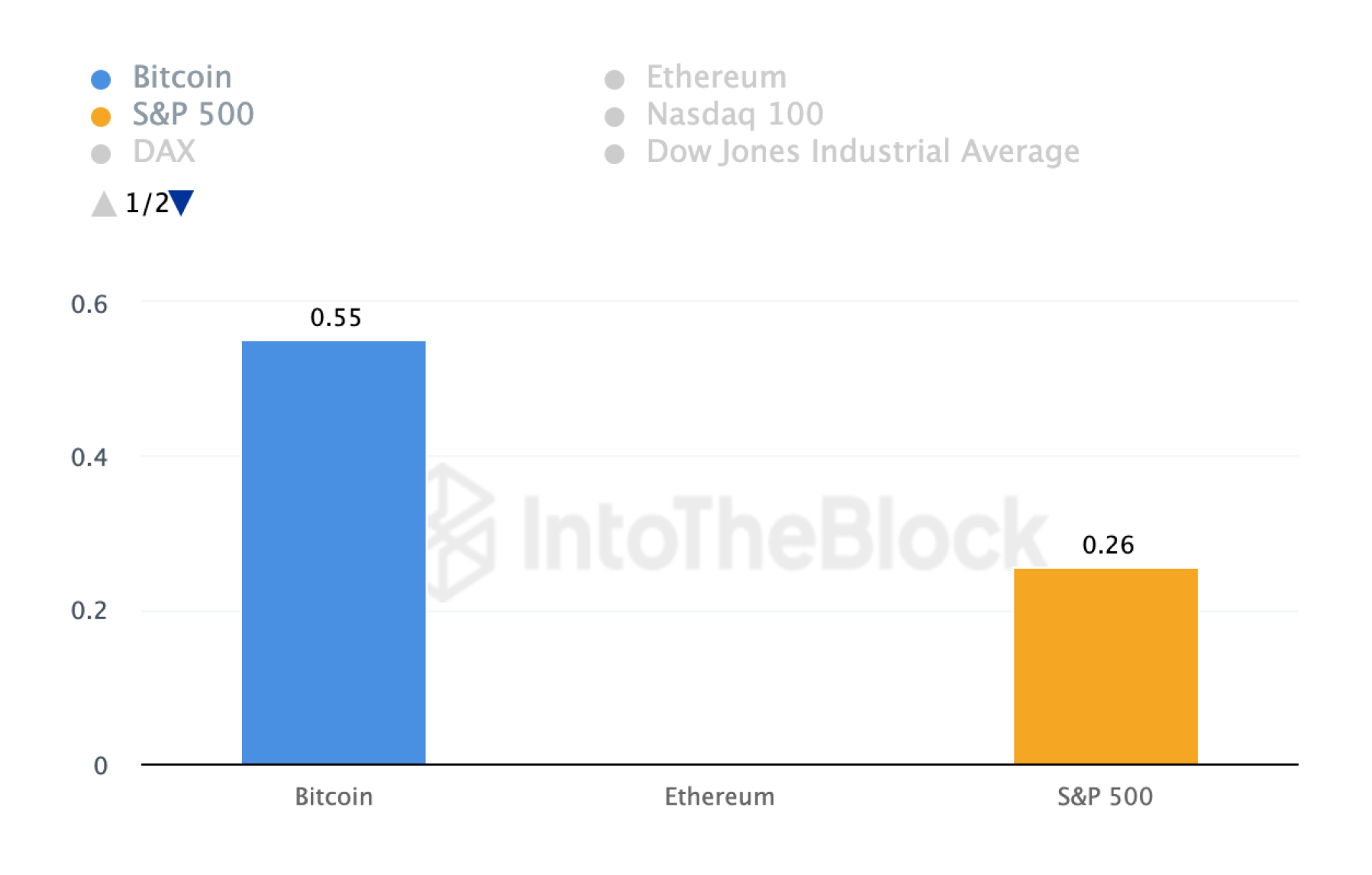

Sharpe Ratio

Sharpe Ratio is a measure of the return on an asset relative to its risk and is used to assess investment performance. The higher the Sharpe Ratio, the better the ratio of an asset's return to its risk.

Sharpe ratios for Bitcoin (BTC) and the S&P 500 Index (S&P 500) are as follows:

- BTC: 0.55

- S&P 500: 0.26

The Sharpe Ratio of Bitcoin (BTC) is higher than that of the S&P 500, which may indicate that investing in Bitcoin yields a higher return relative to risk than investing in the S&P 500. This could be an interesting signal for investors looking for more efficient ways to increase their capital.

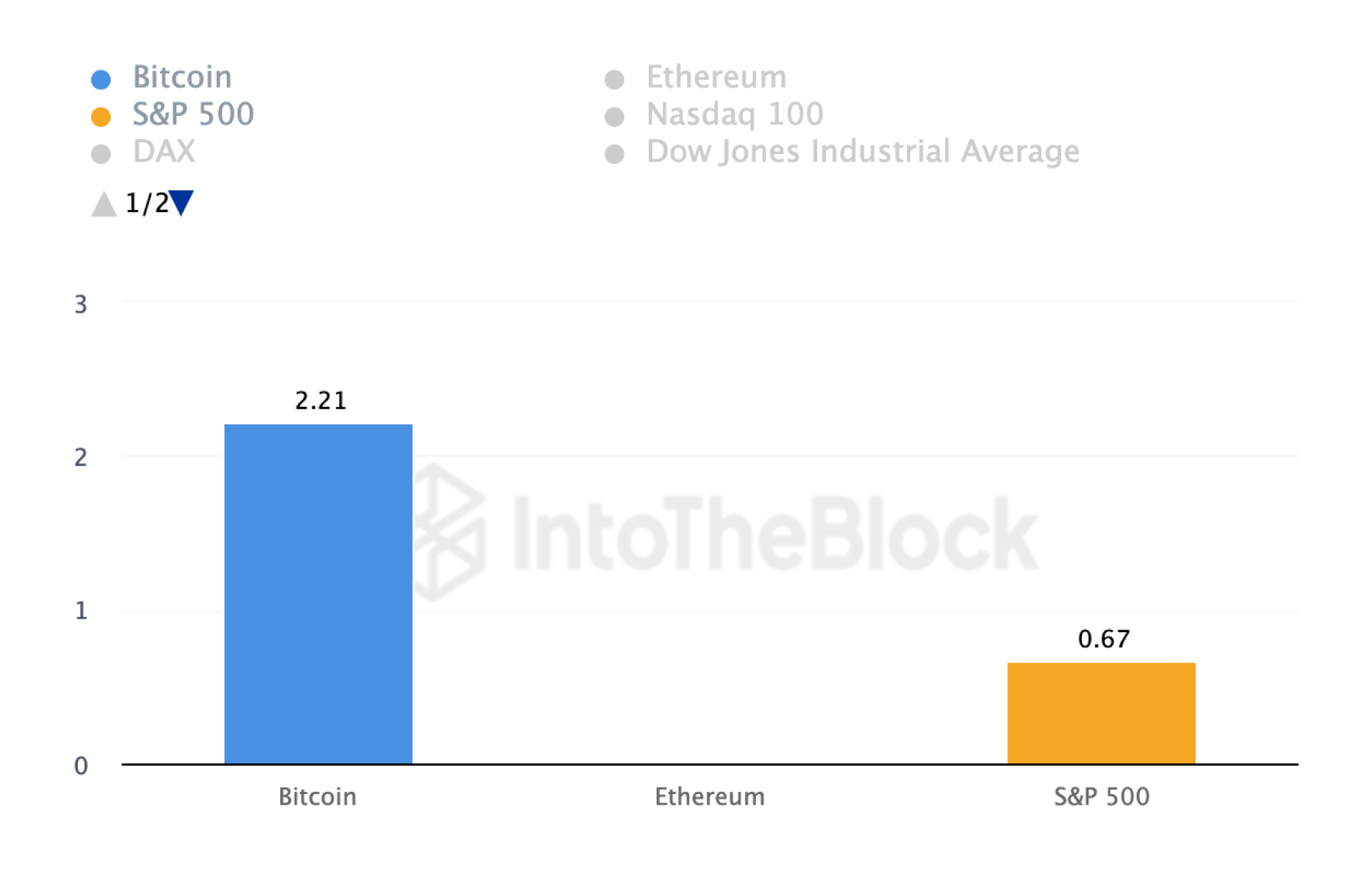

Sortino Ratio

Sortino Ratio is also a measure of investment performance, similar to the Sharpe Ratio, but taking into account only negative fluctuations in the asset price, i.e. the risk associated with losses. It is therefore a more conservative measure of investment performance than the Sharpe Ratio.

Sortino ratios for Bitcoin (BTC) and the S&P 500 Index (S&P 500) are as follows:

- BTC: 2.21

- S&P 500: 0.67

The Sortino Ratio value for Bitcoin (BTC) is higher than for the S&P 500, indicating a higher return to risk considering only negative asset price fluctuations. This may indicate that investing in Bitcoin provides more stable returns compared to investing in the S&P 500, especially when accounting for losses.

Users can buy Bitcoin for fiat or crypto on SimpleSwap.

Summary

Bitcoin has become an integral part of the global economy, showing a significant impact on the financial markets. Its close correlation with the S&P 500 index, high Sharpe ratio and Sortino ratio indicate its attractiveness as an investment asset. Bitcoin's capitalization growth exceeds even the largest companies in the world, highlighting its importance.

This cryptocurrency asset is becoming a serious competitor to traditional corporations and offers investors the prospect of stable returns relative to risk. Thus, investing in Bitcoin is an effective way to increase capital and provide more stable returns today.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.