Crypto ETF, ETN, ETC, ETP

Key Insights

- Crypto ETPs blend the advantages of cryptocurrencies with the regulatory framework of traditional finance, providing investors with a regulated pathway into the digital asset market.

- With options like ETFs, ETNs, and ETCs, investors can tailor their exposure to the crypto market based on their preferences and risk appetite, choosing from a variety of ETP types.

- SEC's approval of Bitcoin ETFs signals a regulatory shift, opening doors for institutional players. Established financial institutions entering the crypto market through ETPs may usher in significant capital, impacting cryptocurrency market dynamics.

The evolution of cryptocurrency exchange-traded products (ETPs) has become a true financial phenomenon, providing an easy and accessible bridge for investors who want to delve into the world of cryptocurrency.

What Is ETP

Financial landscape of today offers investors various opportunities to gain profit. One of the most prominent of those is a crypto ETPs, convenient and diverse instruments that mark an intersection of cryptocurrencies and traditional finance.

Various types of the ETPs trade on stock exchanges at set hours. What makes them stand out is the inferred capability to track and react to the returns of an underlying asset, benchmark or portfolio, thus providing investors with convenient and regulated access to a variety of market possibilities.

ETP Instrument Types

- ETF (Exchange-Traded Fund)

This is an investment fund that is a portfolio of assets that is traded on an exchange as a single security.

- ETN (Exchange-Traded Note)

This is a debt security that represents the issuer's obligation to pay holders an amount related to changes in the value of the underlying asset.

- ETC (Exchange-Traded Commodity)

This is a type of security that represents the issuer's obligation to pay holders a certain amount of money at a future date. What makes ETCs special is that this amount might not necessarily be linked to a change in the value of the underlying asset.

ETP Structure

- What Is ETF (Exchange-Traded Fund)

Structure: An ETF is an investment fund that contains a portfolio of different assets or a single asset, such as Bitcoin ETF, Ethereum ETF or others.

Ownership: Investors can make an ETF investment by way of purchasing a stake in an ETF, which allows them a share in the portfolio of assets managed by the fund. The investors do not own specific assets within the fund, however they own a share of said fund as a whole.

Income from value changes: If the value of the digital assets in a crypto ETF portfolio increases after acquiring a share of the fund, the investor can gain profit, executing the sale of their share. In the opposite case, if the value of the assets declines, the investor may suffer capital losses.

- What Is ETN (Exchange-Traded Note)

Structure: an ETN is issued in the form of a debt security by the issuer which is most often a financial institution. It shows that the issuer is commited to pay holders a certain amount of money at a future date.

Ownership: Although ETN holders do not own the assets directly, they receive payments based on changes in the value of a particular index or asset to which the ETN is linked.

Income from value changes: This means that if the value of the underlying asset rises, ETN holders can expect to receive a corresponding payout. If the price of the underlying asset moves inversely, the payouts may be less favorable or even non-existent.

- What Is ETC (Exchange-Traded Commodity)

Structure: The structure of ETC being also a security, can vary and it depends on the specific product. Unlike an ETN, an ETC is most often linked to changes in the value of an asset, but is not a debt instrument.

Ownership: Owning an ETC also entitles investors to an income from changes in the value of the underlying asset, but investors do not own specific assets within the fund (which is the case of ETFs)

Income from value changes: When the value of the underlying asset changes, investors may gain profit or suffer a loss depending on the direction of those changes. For instance, if an ETC is linked to a cryptocurrency and its value rises, ETC holders may profit by selling their shares.

Crypto ETFs are a financial instrument that combines the upsides of cryptocurrencies and traditional funds at the same time. ETFs' structure, being that of an exchange traded investment fund, allows its investors to access a variety assets without having to own them directly.

In the case of a Crypto ETF, this means that the fund invests in various cryptocurrencies or cryptocurrency assets such as Bitcoin, Ethereum, Ripple and others, thus providing investors with the ability to trade these assets on an exchange as if they were regular stocks.

Crypto ETF Main Characteristics

- Portfolio diversification

A crypto ETF can invest in several different cryptocurrencies, providing risk diversification. This can cater to those investors who look to gain exposure to a variety of assets in the cryptocurrency domain.

- Liquidity

Since the ETF trading is exchange-based, investors can buy or sell its shares at any point during the trading day. This provides higher liquidity when compared to direct investment in cryptocurrencies.

- Transparency

A crypto ETF is required to adhere to transparency standards by providing investors with regular reporting on its portfolio. This allows investors to keep track of what they are investing in and assess risk.

- Risk management

Fund managers can actively manage the portfolio in response to changes in the cryptocurrency market. This may include rebalancing the portfolio to reduce risk or utilizing other risk management strategies.

It should be noted that crypto ETFs are subject to regulation by financial institutions, and how they launch and operate may vary from country to country depending on legislation. Crypto ETFs may interest investors who want to minimize risks while taking advantage of the benefits of cryptocurrencies.

SEC decision on Bitcoin ETFs

On 10 January, the SEC approved 11 applications for spot Bitcoin ETFs. Trading started the following day. The admitted issuers include Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity, and Franklin Templeton. The SEC has always had a great impact on the crypto market.

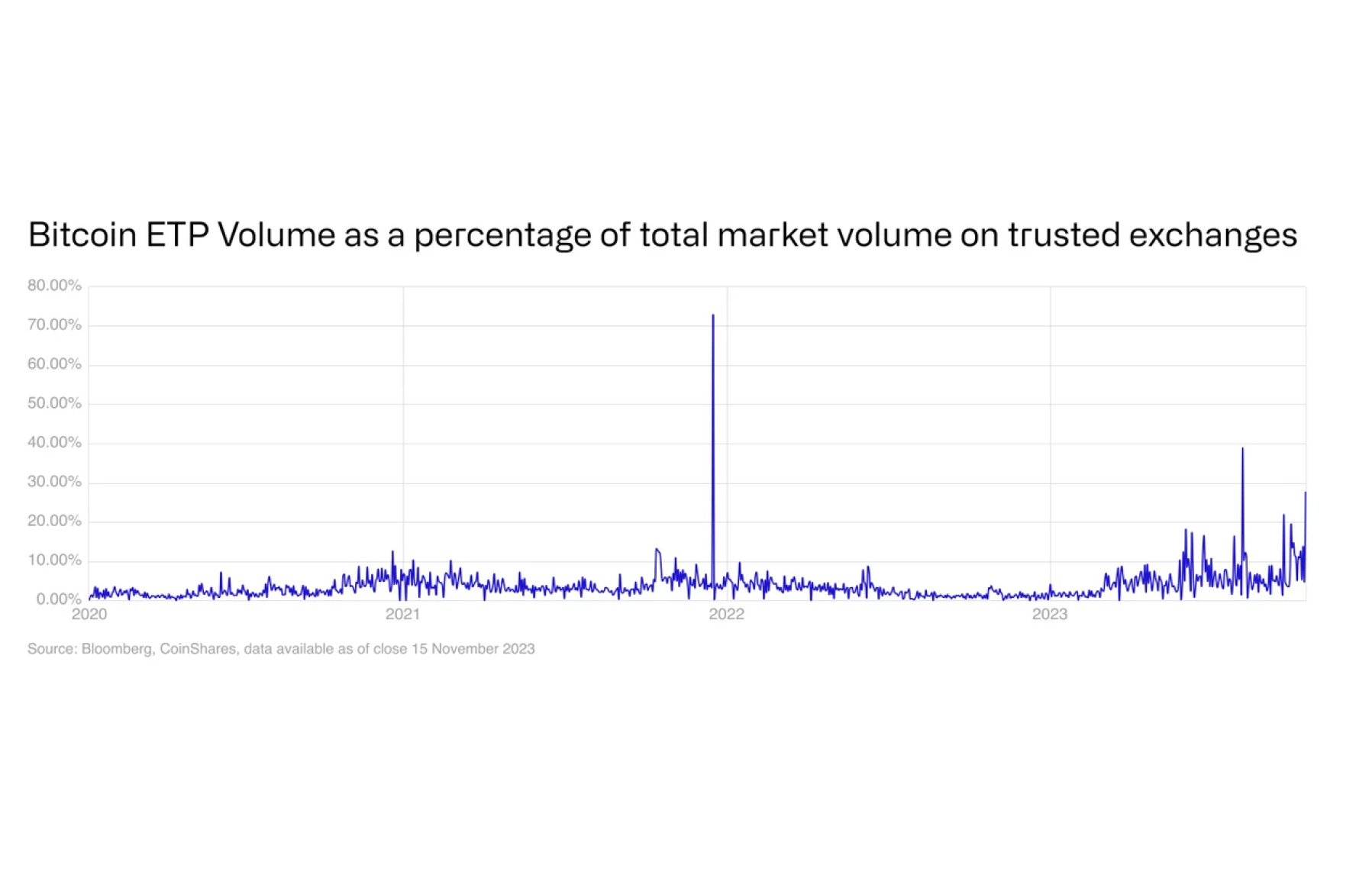

Several exchange-traded funds (ETFs), including gold, have trillions of dollars in assets under management. The cryptocurrency community believes that even a small percentage of this capital could potentially impact the global crypto market. Buying shares in the funds implies the delivery of Bitcoin as an underlying asset, which directly affects the market rate.

Crypto ETNs are debt securities that provide investors with access to the world of cryptocurrencies without the need for direct ownership of assets. Unlike cryptocurrency ETFs, which are investment funds that hold assets, crypto ETNs are debt obligations of the issuer linked to the performance of a cryptocurrency index or other asset.

Crypto ETN Main Characteristics

- Debentures

Crypto ETNs are debt instruments where the issuer (often a financial institution) commits to paying holders a certain amount of money at a future date. These payments may depend on the performance of a cryptocurrency index or other asset.

- Convenience and Security

Investors can access cryptocurrencies by purchasing crypto ETNs, which eliminates the need to worry about storage and security issues associated with cryptocurrency wallets. They only own the securities that represent the issuer's debt obligations.

- Index Tracking

Crypto Exchange Traded Notes (ETNs) are frequently associated with the performance of a specific cryptocurrency index or asset. Investors can earn returns from price changes that align with the selected index.

- Liquidity

Similar to cryptocurrency ETFs, crypto ETNs are traded on an exchange, providing liquidity and the option to buy or sell the instrument at any time during the trading day.

Crypto ETNs offer investors an alternative means of investing in cryptocurrencies, providing convenience and security through trading securities on an exchange.

Crypto ETCs are securities that allow investors to access the world of cryptocurrencies without owning the assets directly. Unlike crypto ETFs, which are investment funds, crypto ETCs represent the issuer's obligations related to the performance of a cryptocurrency index or other asset.

Crypto ETC Main Characteristics

- Debentures

Crypto ETCs are securities issued by financial institutions that promise to pay holders a predetermined amount in the future. The payments are based on the performance of a cryptocurrency index or other asset.

- Convenience and Security

Investors can access cryptocurrencies by investing in crypto ETCs, which eliminates the need for cryptocurrency wallets and the associated storage and security concerns. By investing in these securities, they become holders of the issuer's liabilities.

- Index Tracking

Crypto ETCs are frequently associated with the performance of a specific cryptocurrency index or asset. Investors receive returns based on price changes in the chosen index.

- Liquidity

Similar to crypto ETFs, crypto ETCs are traded on an exchange, offering liquidity and the flexibility to buy or sell at any time during the trading day.

Crypto ETCs offer investors a convenient way to invest in cryptocurrencies, providing the ease of trading securities on an exchange while gaining exposure to the cryptocurrency market.

Cryptocurrency ETPs are regulated investment products that aim to increase access to cryptocurrency. They provide access to a broad audience of investors who may lack the tools, time, or technical knowledge to invest directly in cryptocurrency. ETPs do not eliminate intermediaries in the crypto industry, but rather expand access to cryptocurrency.

Additionally, institutional investors who face limitations or prefer to avoid direct ownership of crypto assets for various reasons find ETF investment and other options and products appealing.

- Asset custody by ETP issuers

Custodians preferred by ETP issuers include Coinbase, Fidelity Digital Assets, Komainu, BitGo, Copper, Swissquote, Tetra Trust, Zodia Custody, and Gemini.

Market Makers (MM) are liquidity providers employed by ETP issuers to ensure financial flexibility. They create contractually agreed terms by offering bilateral quotes on stock exchanges. Participants such as Flow Traders and GHCO are among them.

BTC and other coins can be purchased for crypto or fiat on SimpleSwap.

Summary

Cryptocurrency ETPs eliminate many of the obstacles associated with acquiring and managing cryptocurrencies, making it easier to invest in them. These products offer investors a variety of strategies for exposure to the cryptocurrency market while maintaining a level of control and security.

Successful investments require careful research of each instrument and an awareness of all the risks associated with the cryptocurrency markets. Crypto ETPs offer attractive prospects for those seeking to combine the benefits of traditional finance and the world of crypto.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.