Aerodrome Finance Ecosystem Review

Key Insights

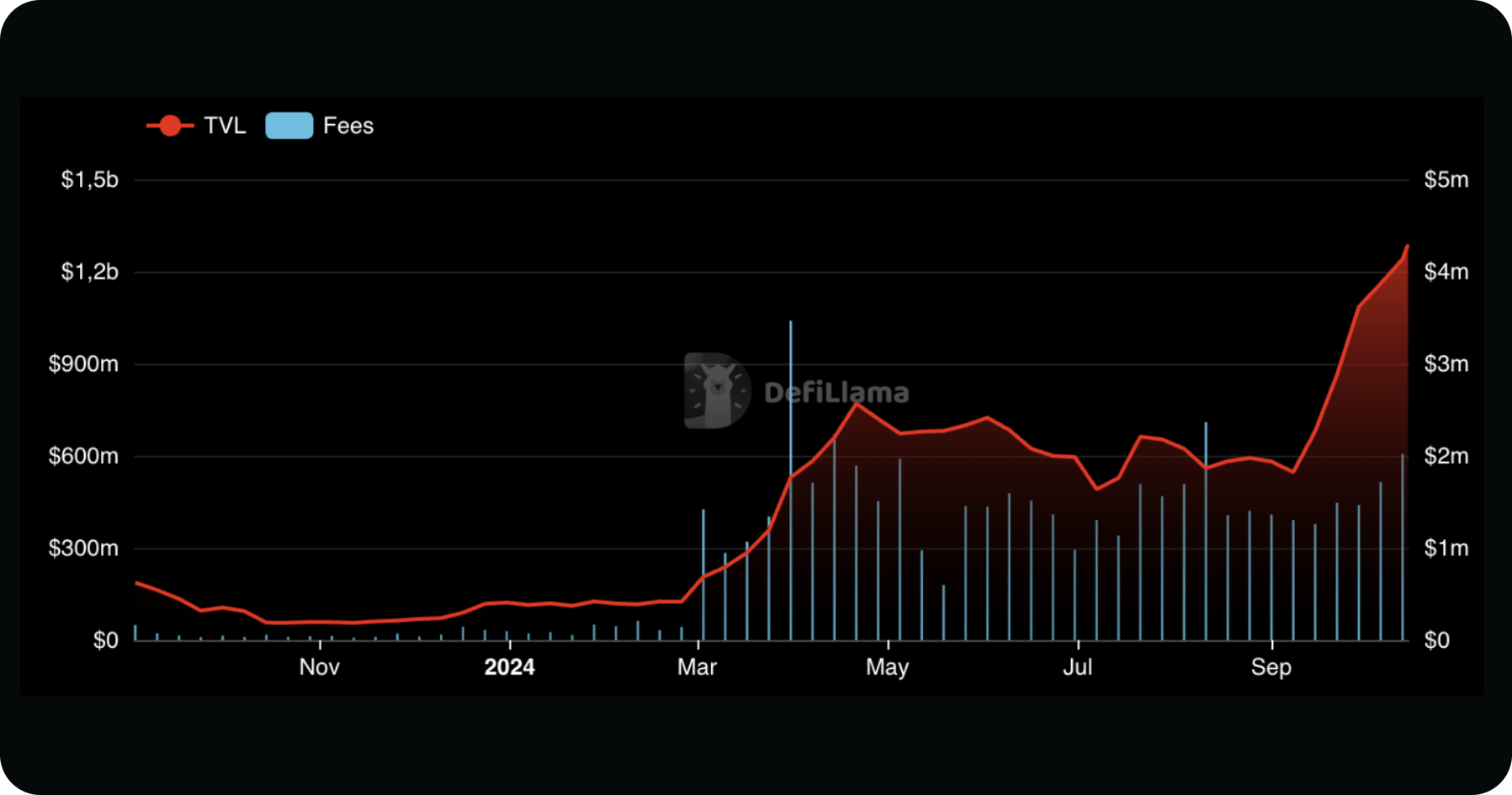

- With a total value locked (TVL) of $1.24 billion, which is about half of all Base blockchain value, Aerodrome Finance drives over $1 million in weekly fees, making it a dominant player in the Base ecosystem.

- Aerodrome employs Velodrome V2's advanced concentrated liquidity pools, allowing better capital efficiency and reduced slippage in trades.

- The AERO coin powers Aerodrome Finance ecosystem, offering liquidity providers and veAERO holders various incentives, such as voting rights and rewards, creating a robust participation structure.

What is Aerodrome Finance

Aerodrome Finance is a decentralized exchange (DEX) powered by an automated market maker (AMM). Aerodrome was launched in August 2023 on Ethereum Layer 2 Base and is built on the Velodrome V2 protocol technology stack with advanced features such as concentrated liquidity, customizable pools and veNFT tokenization.

Today, Aerodrome is the leading DeFi protocol on the Base network with a TVL of $1.24B, which is about half of all blockchain value on Base. Commissions from the protocol exceed $1M per week, making Aerodrome the leading DEX in the Base ecosystem.

Velodrome V2

Aerodrome is built on the Velodrome protocol stack and its second version launched in July 2023. Velodrome V2 has improved capital efficiency and introduced the clAMM model - concentrated liquidity pools.

These pools allow to identify active trading ranges for pairs and concentrate liquidity in them, thereby improving order execution, reducing slippage and providing greater profitability for liquidity providers.

Slipstream

Slipstream is a concentrated liquidity pool model developed by Velodrome and implemented on Aerodrome in 2024. Slipstream is a fork of Uniswap V3 and improves the efficiency of pools and the concentrated liquidity model.

In Slipstream, token issuance ($AERO) is directed to liquidity providers whose positions are within the active trading range for a token pair.

To reduce the need for rebalancing to be within the active trading range, Slipstream introduces improved minimum ranges based on liquidity and volatility.

For example, a price range of 0.5% (50 ticks) is provided for stablecoin pools (USDC, DAI, LUSD), a price range of2% (200 ticks) is provided for volatile assets such as ETH, and an extended range of 20% (2000 ticks) is provided for new tokens.

How Does Aerodrome Finance Work

Aerodrome operates on the basis of AMM, allowing traders to execute trades in the liquidity pool without an order book.

A key feature of Aerodrome is the reward mechanism for liquidity providers. Unlike traditional AMM models such as Uniswap, where liquidity providers (LPs) receive a commission on exchanges executed, Aerodrome presents aninnovative approach to this issue.

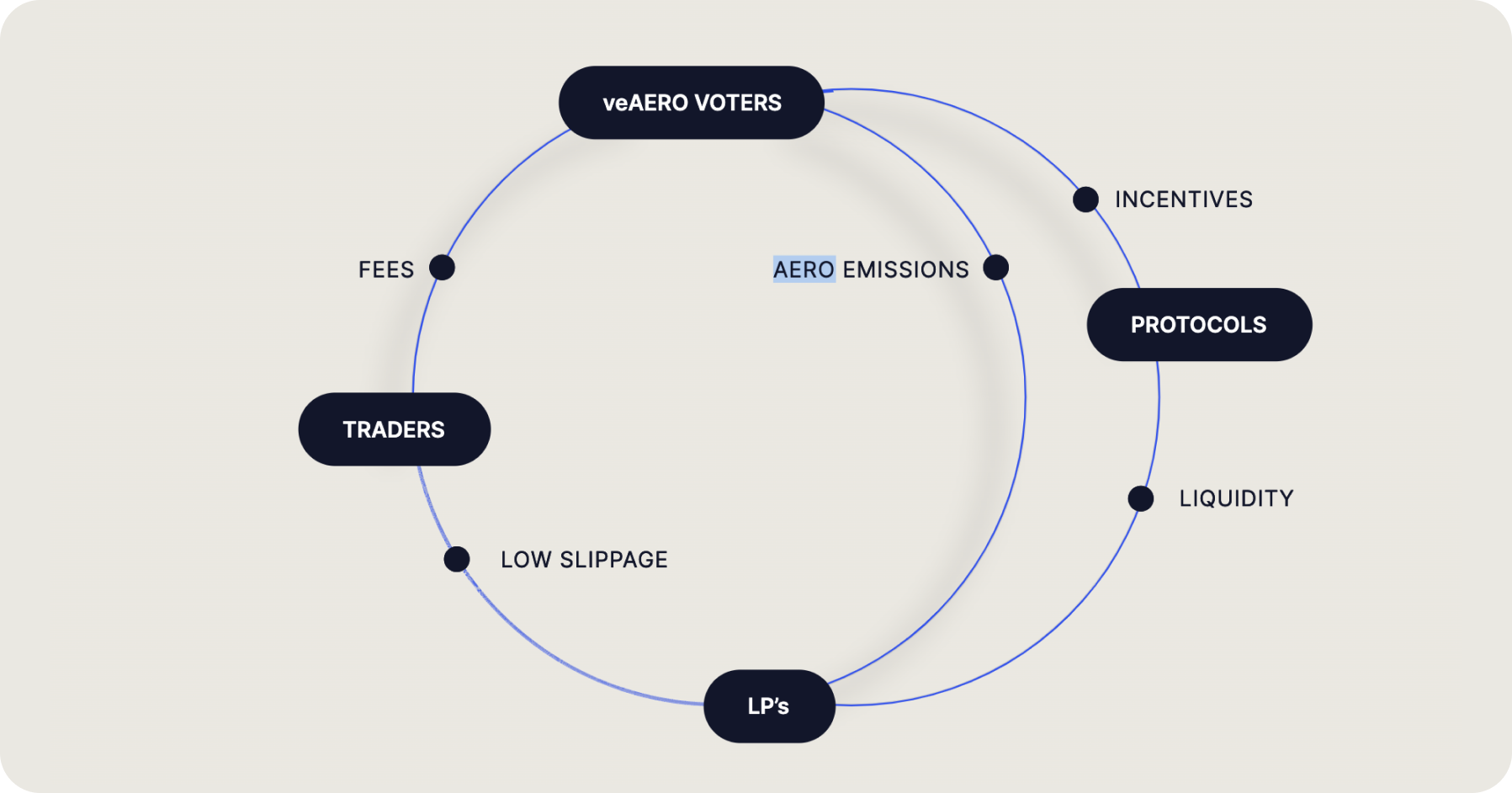

The main element of the incentives system is the AERO token, which redistributes protocol revenues to different stakeholders.

Let's consider two main categories:

- Liquidity providers

Liquidity providers in Aerodrome pools receive issues of AERO coin in proportion to the votes that the pool has collected from AERO holders during an epoch (an epoch lasts 7 days).

- AERO and veAERO holders

Holders of an AERO coin can block it to obtain voting rights on token issues to liquidity pools. In exchange for a blocked AERO, users receive veAERO (vote-escrow AERO) in the form of NFT.

There is a linear dependence of the duration of the AERO lock on the amount of veAERO received in exchange. For example, for a 1-year lock, the conversion will be 100 AERO = 25 veAERO, for a 4-year lock 100 AERO = 100 veAERO.

The longer the token vesting (lock period), the more weight the tokens have in voting. Holders of veAERO are rewarded with 100% of the protocol commissions and additional rewards provided in the current epoch.

Aerodrome Finance: Key Features

- Low slippage exchanges

Aerodrome integrates the best mechanics of Uniswap V3, Curve and Velodrome V2 to provide the best trading experience for the user.

Aerodrome AMM allows users to trade a large selection of tokens with minimal slippage in both stable and volatile pairs. Aerodrome is the largest DeFi protocol on Base for exchanging tokens issued on this blockchain.

- veTokenomics and incentives mechanism

A new rewards model for protocol participants allows Aerodrome to distribute rewards more efficiently and increase the value of its own AERO crypto.

Unlike other DEXs, such as Uniswap, where the native token is only used in management, AERO is a key element in the Aerodrome economy, used to reward liquidity providers and to manage the protocol through the vote-escrow mechanism.

- Permissionless pools and gauges

Anyone can create a liquidity pool on Aerodrome without permissions, as well as create additional pools to attract liquidity and vote holders veAERO.

Aerodrome Tokenomics

Aerodrome uses two main tokens to power the economic model and manage the protocol:

- AERO

A standard ERC-20 token, the main utility token of Aerodrome Finance. AERO crypto is used to reward liquidity providers in Aerodrome pools. Rewards are awarded in the form of token issues depending on the final vote for pools of veAERO holders (the more votes, the more AERO tokens a pool receives).

AERO issuance is distributed every epoch (7 days). The current capitalization of AERO is $898M, FDV is $1.81B. The token ranks 82nd among all cryptocurrencies in terms of market capitalization. AERO is an inflationary tokenand its supply increases over time through the issuance of new tokens.

As a reminder, you can use SimpleSwap to purchase AERO tokens, e.g. exchange them for ETH on the Ethereum network.

- veAERO

ERC-721 management token in the form of NFT. veAERO represents locked AERO for voting rights for liquidity pools and commissions from transactions in the pools.

Holders of veAERO will also have control over the protocol's monetary policy and determine the size of AERO issues for epochs. Since veAERO is an NFT, they can be purchased not only through the AERO blockchain, but also on NFT marketplaces.

Shortcomings of Aerodrome

Despite growing popularity of Aerodrome among users of the Base blockchain, its functionality is only available on a single blockchain, which significantly reduces the user base, revenue, and scalability of the protocol. At the same time, leading DEXs such as Uniswap offer users access to multiple networks to make exchanges.

Aerodrome's economic model depends on user activity in the protocol and in the Base network. If interest in the blockchain declines, Aerodrome could experience a sharp decline in trading activity and revenue.

In addition, the emergence of new competitors increases competition and may lead to a decline in Aerodrome's market share.

The AERO crypto token is inflationary, which in the long run may have a negative impact on its price due to excessive token issuance and constant pressure from the sale of rewards received by protocol participants.

In addition, like any DeFi protocol Aerodrome is subject to risks associated with various smart contract vulnerabilities, potential hacks and cracking, which may result in the loss of user funds.

Summary

Aerodrome Finance is one of the promising DeFi protocols that is leading the rapidly growing DeFi segment on theBase blockchain.

Utilizing the best mechanics of other DEXs combined with an innovative economic model has allowed Aerodrome to attract significant TVL and generate high revenues. Today, Aerodrome is the market leader of DEX on Base, far ahead of all competitors.

The AERO token is a key element of Aerodrome's economic model and veTokenomics project. AERO serves as the main source of profit for all protocol participants and decentralizes Aerodrome's management through a vote-escrow mechanism.

Weaknesses of Aerodrome Finance include operating on only one blockchain, the inflationary nature of the AERO offering, and the dependence of revenue and operation of the protocol on the influx of users to Base and its ecosystem.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.