BTC Analysis July 2023

Key Insights

- Relative stability in new addresses and the Bitcoin price, indicating sustained market interest. Users are cautious and waiting for clearer signals, which is reflected in address activity and the BTC price remaining stable.

- The number of transactions on the Bitcoin network fluctuates but is gradually recovering, which may indicate increased user activity and use of Bitcoin for transactions.

- Bitcoin's high NVT ratio indicates that the crypto market value is relatively high compared to its network activity. A stable BTC price and low network activity may indicate consolidation or reduced trading activity.

On-chain data is the one that has been validated and recorded on a blockchain ledger. Access to on-chain data is open to anyone, as it is publicly recorded on blockchain ledgers.

This Bitcoin analysis is conducted using the following metrics: number of active and new addresses, number of transactions, balances on exchanges, mean hash rate. And, for the first time, we took NVT ratio (Network Value to Transactions Ratio) as a metric as well.

Look out for updates as we post new BTC on-chain analysis every one-two months.

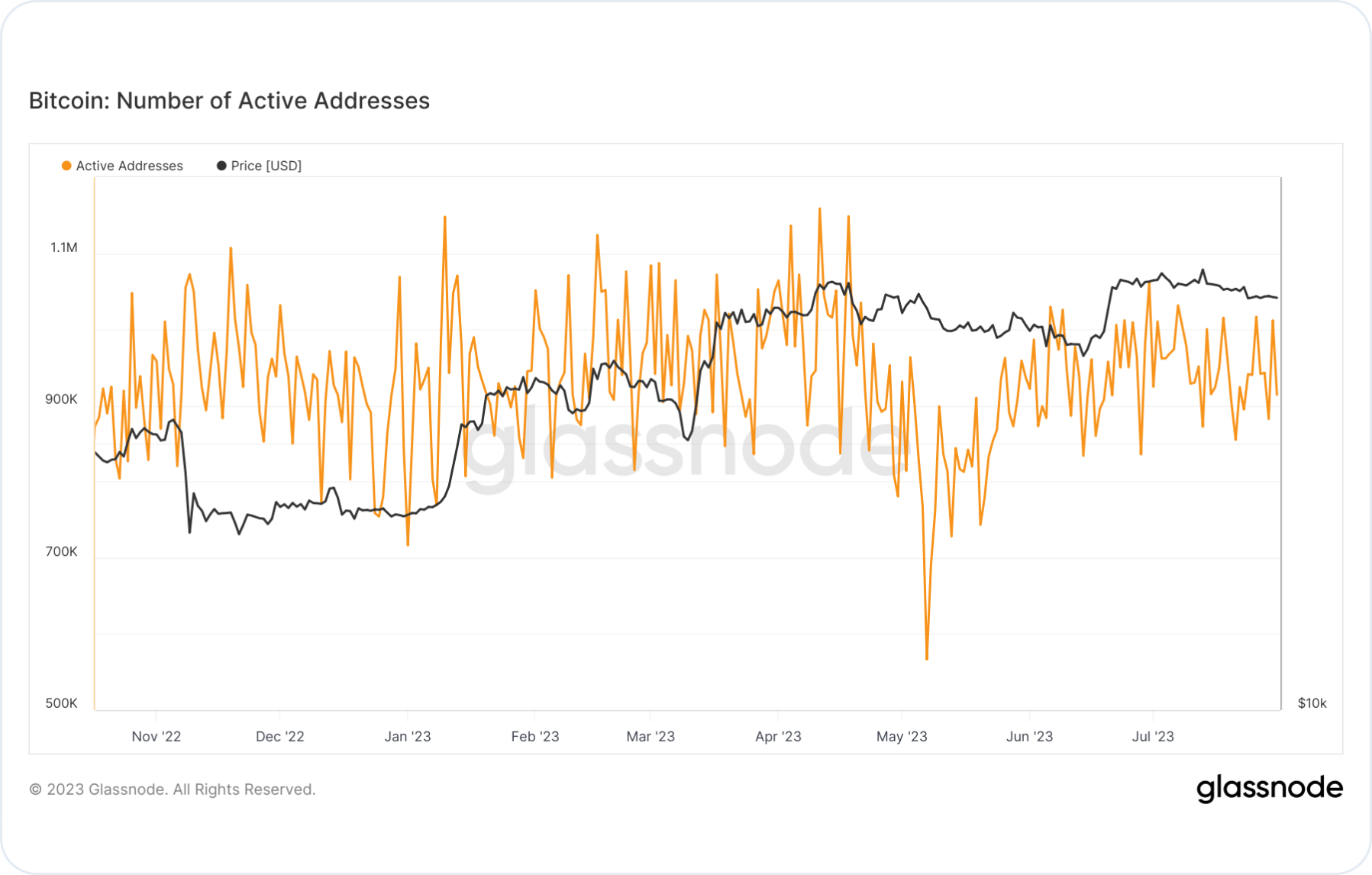

Number of Active Bitcoin Addresses

In July, the number of new BTC addresses is observed in a sideways formation, which indicates relative stability in the metrics after recovering from the May slump and temporary fluctuations.

This could imply a certain level of sustained interest in Bitcoin, as it remains relatively steady at its current levels. Perhaps the crypto market is going through a cooling-off period with fewer fluctuations in user activity.

Simultaneously, the BTC price has also been in a sideways pattern throughout July, following a slight uptick in June. Globally, the Bitcoin price is trading sideways, indicating that there is no clear upward or downward trend.

The sideways formation might be associated with the crypto market being in a state of anticipation, not showing any evident fundamental factors that could push the BTC price out of its current range.

Users might be cautious and waiting for clearer signals regarding the crypto market direction, which is reflected in the Bitcoin address activity. In such a situation, the number of active addresses may remain stable or change insignificantly until new trends affecting the crypto market and user activity emerge.

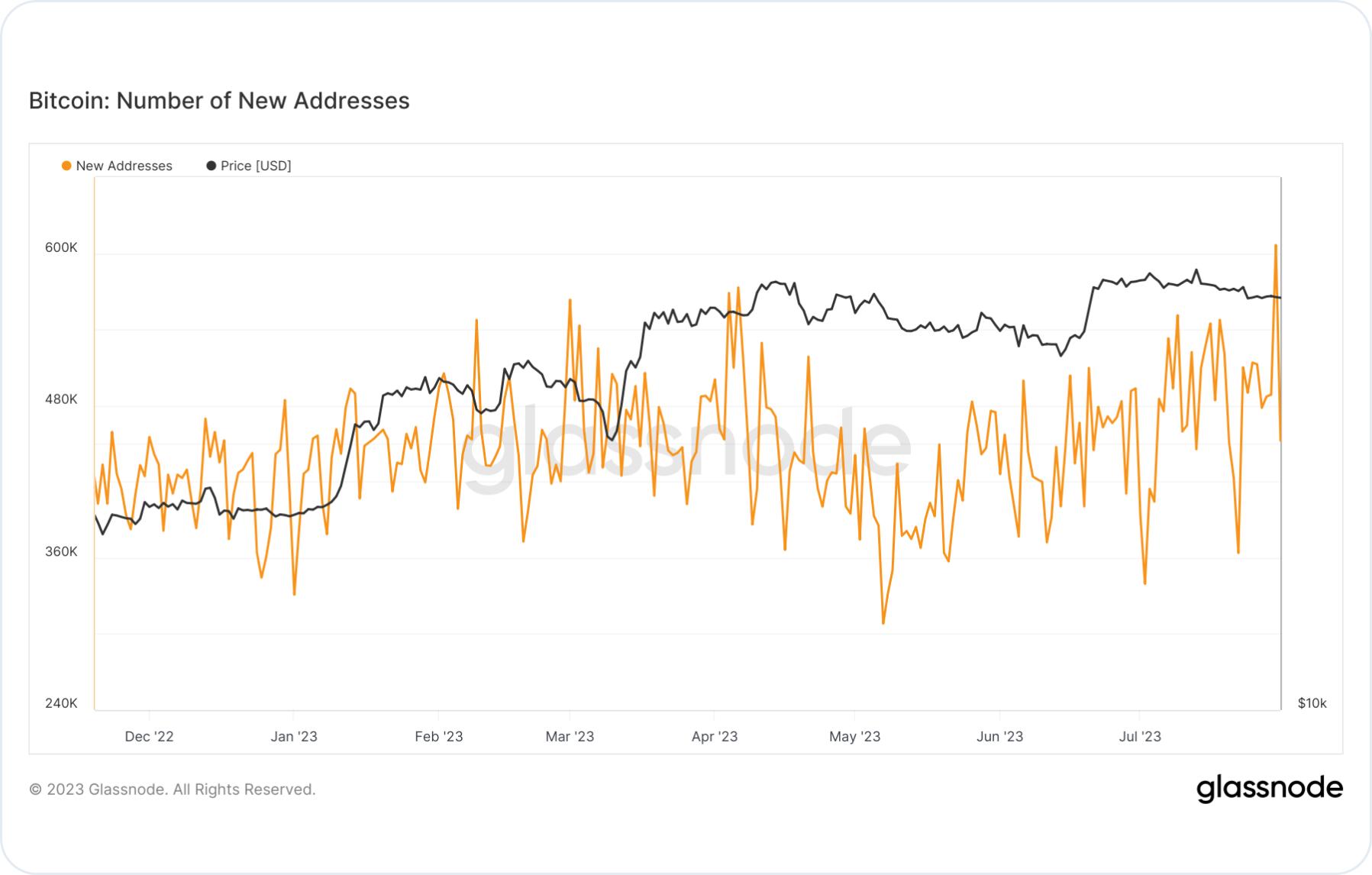

Number of New Bitcoin Addresses

It is interesting to note that the number of new Bitcoin addresses decreased to 300,000 in May and then gradually started to recover in June. In July, the number of new addresses fluctuated between 330,000 and 550,000, and by the end of the month, it sharply increased to 606,000.

The decline in the number of new addresses in May could have been related to temporary instability or a combination of factors that momentarily subdued interest in Bitcoin.

However, the gradual recovery in June and the significant growth in July indicate increasing interest from new users and investors. This may suggest a rising popularity of Bitcoin and its acceptance as an investment instrument.

The influence of price stability on address activity: The fact that BTC price is in a sideways pattern and not showing significant volatility may have a positive impact on the activity of new addresses. Bitcoin price stability can reduce risks for new users and provide opportunities for long-term investments.

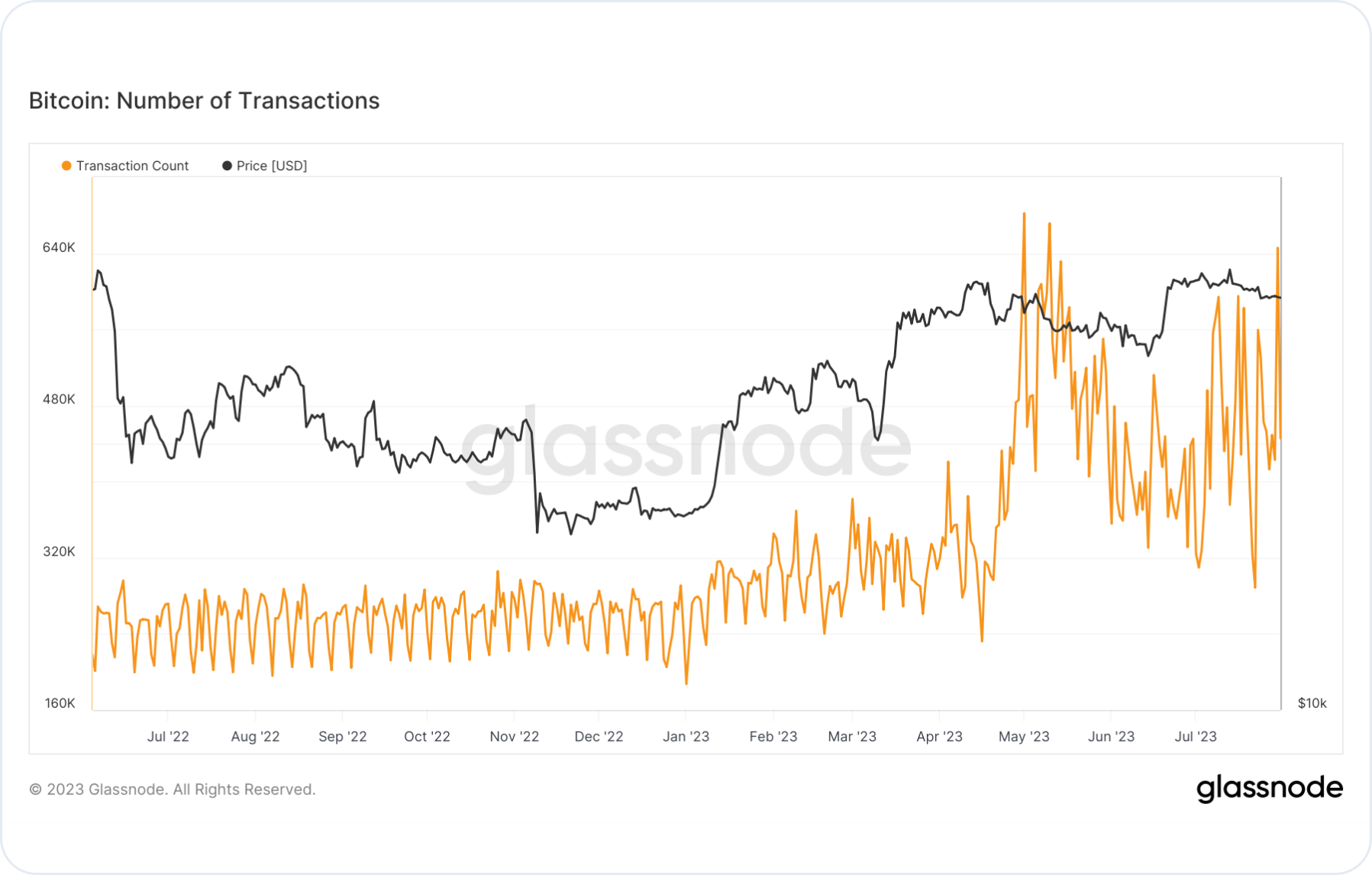

Number of BTC Transactions

The price of Bitcoin remains within a narrow range of volatility, indicating that the crypto market is currently characterized by stability and the absence of significant price fluctuations. This may create conditions for more predictable and moderate price movements, which can attract interest from both investors and users, promoting greater usability of Bitcoin as a medium of exchange and a store of value.

While the price of Bitcoin stays stable, the Number of Transactions metric shows sharp fluctuations. The decrease in the number of transactions from 800,000 in May to 400,000 in June might suggest a temporary decline in user activity on the network.

However, the number of transactions gradually starts to recover afterwards, fluctuating between 300,000 and 400,000 by the end of July. This could indicate increased user activity in the Bitcoin network and utilization of Bitcoin for transactions and fund transfers.

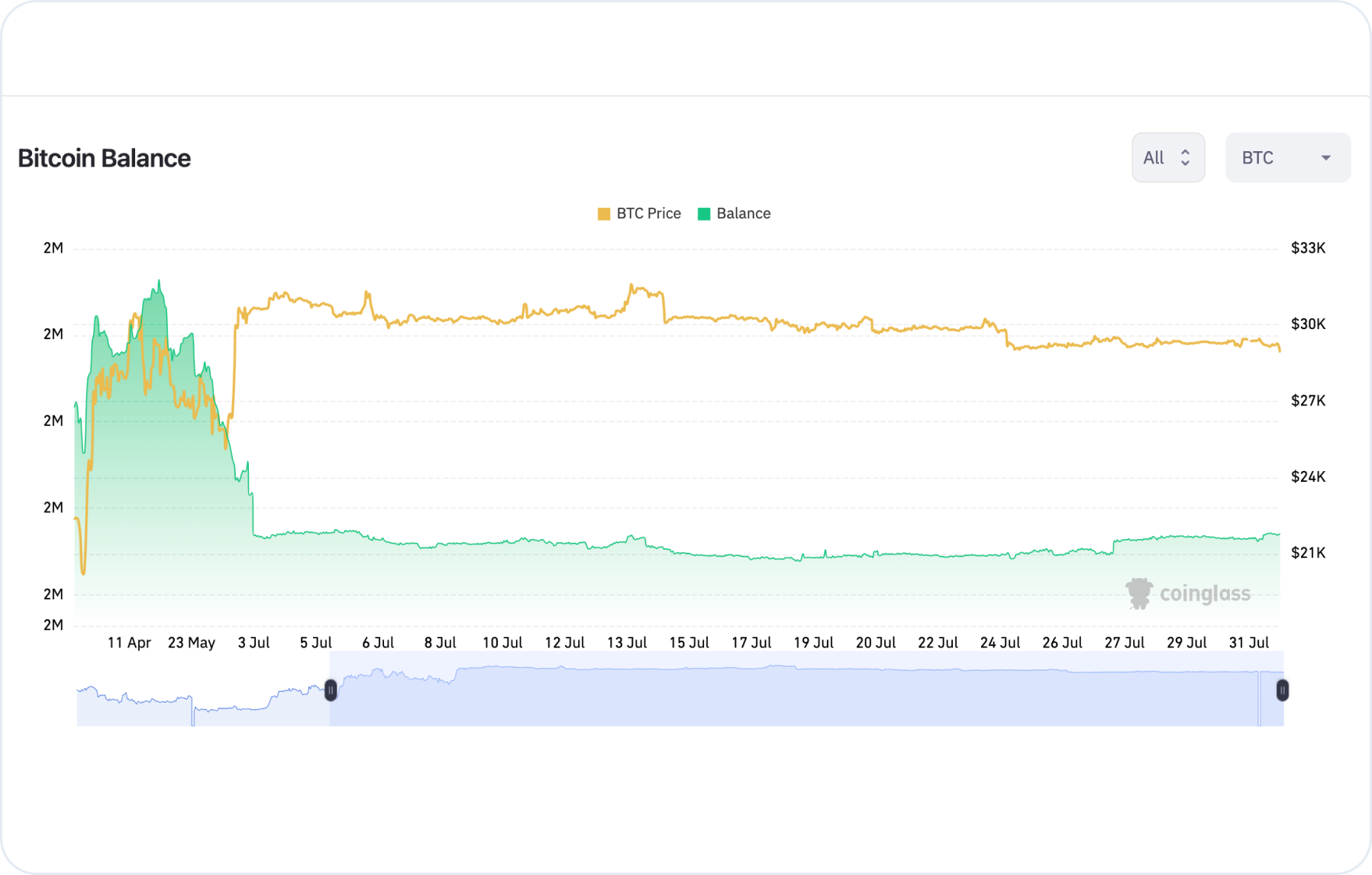

BTC Balances on Exchanges

Sideways price movement means that the price of Bitcoin is trading within a relatively narrow range without clear and significant changes over a certain period of time.

Such movement can occur when supply and demand in the market are roughly equal, and there are no strong factors exerting pressure on the BTC price in a specific direction.

Low exchange balances during sideways price movement may indicate that traders and investors prefer to hold their funds off exchanges and refrain from trading at the moment.

This could be related to waiting for a more definite crypto market direction or a desire to avoid potential risks associated with trading in low volatility conditions.

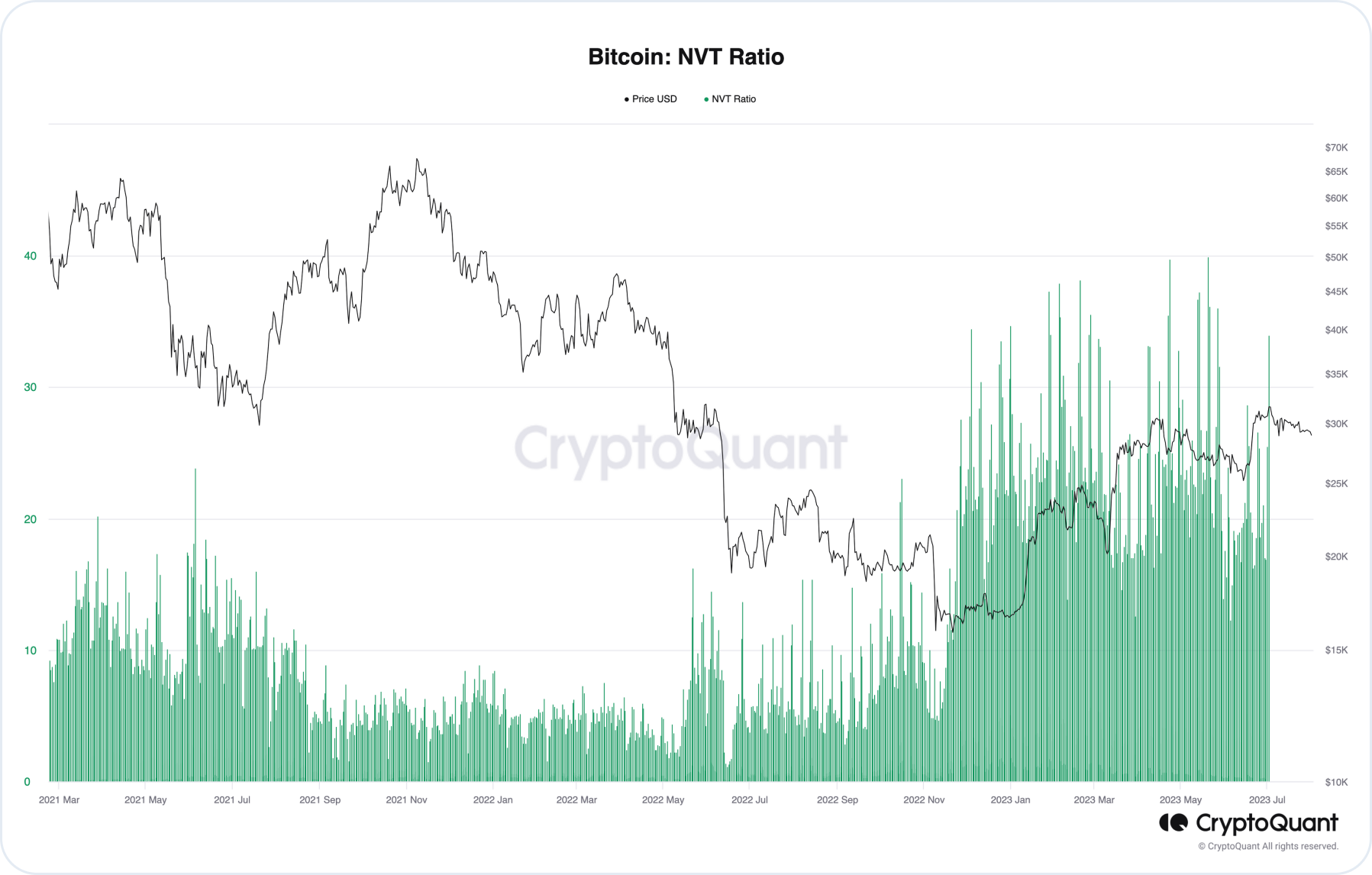

Bitcoin Analysis: NVT Ratio

Bitcoin’s NVT Ratio (Network Value to Transactions Ratio) measures the relationship between the cryptocurrency's market valuation and its transactional activity.

This ratio compares market capitalization ofBitcoin to its transaction volume over a specific period. By examining the NVT Ratio, investors can gauge whether Bitcoin is overvalued or undervalued.

A high or increasing NVT Ratio suggests that Bitcoin's market value is high relative to its transaction volume, indicating potential overvaluation.

On the other hand, a low or decreasing NVT Ratio indicates that Bitcoin's market value is low relative to its transaction volume, suggesting potential undervaluation.

The NVT Ratio serves as a tool to determine if a cryptocurrency's value is misaligned with its transaction activity, reflecting the market's health. It helps in assessing macro market cycles and providing buy or sell signals.

Currently, the NVT Ratio is significantly higher than the levels seen during the bullish trend in 2021, indicating that market value of Bitcoin is relatively high compared to its on-chain activity.

The stable price of BTC around $30,000 may suggest that the market is experiencing a period of consolidation or reduced trading activity.

Investors should be cautious and take into account the potential impact of low Bitcoin network activity on price movements.

While a high NVT Ratio may signal an undervalued asset and attract investors seeking favorable opportunities, it is essential to carefully analyze the overall crypto market conditions and consider other factors that could be influencing Bitcoin's price stability.

The combination of a high NVT Ratio and a stable price of Bitcoin should prompt further investigation and consideration of crypto market dynamics before making any investment decisions.

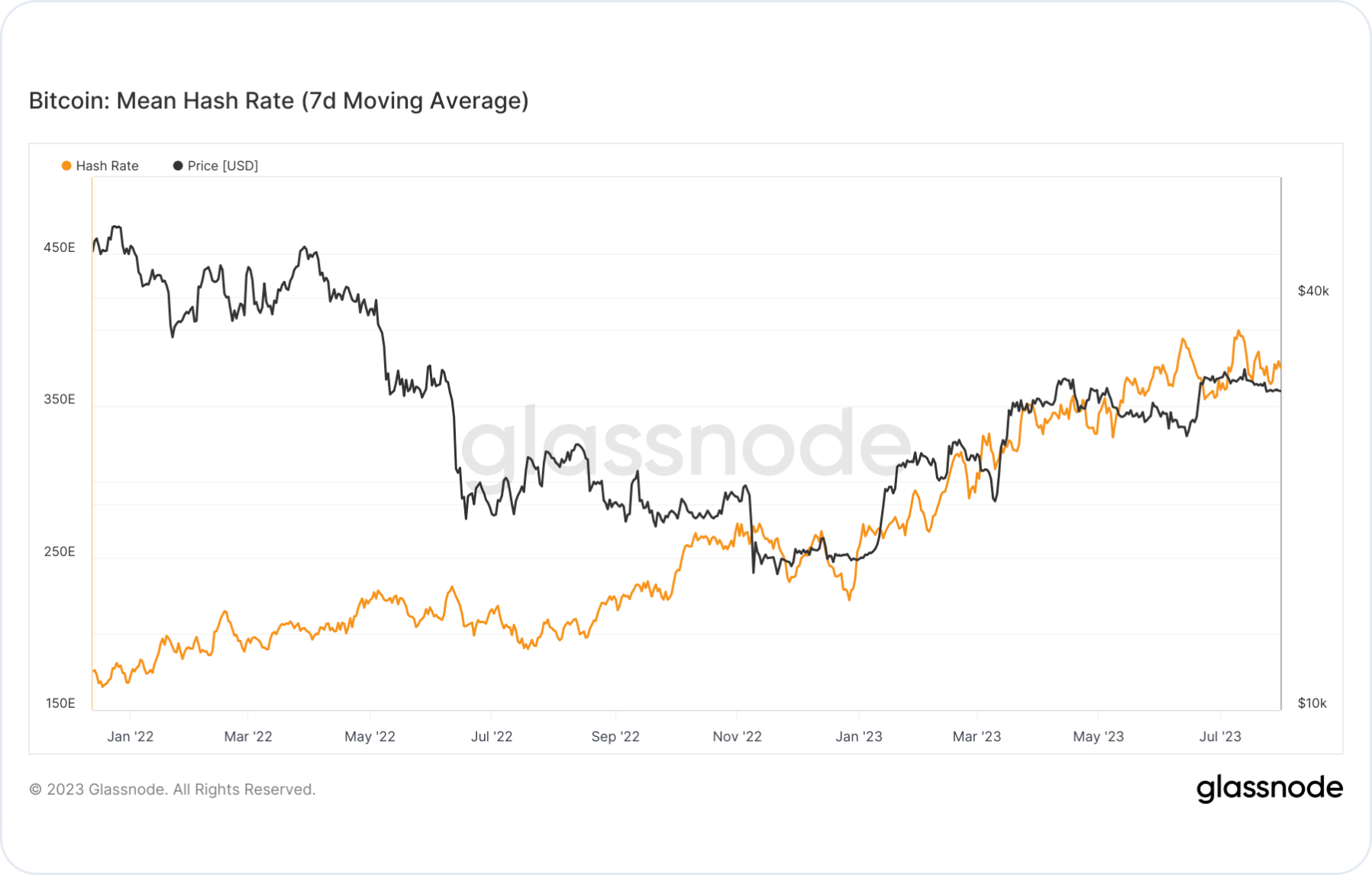

Bitcoin Mean Hash Rate

The increase in Bitcoin's average hash rate, despite price consolidation around $30,000, presents an intriguing dynamic.

Miners who continue to increase the hash rate may be expressing their long-term confidence in the prospects of Bitcoin and its resilience to price fluctuations.

Despite temporary price consolidation, miners may believe in the growth and stability of Bitcoin in the long run.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

After temporary fluctuations, the Bitcoin market displays relative stability. Sideways price movement and stable active address count indicate cautiousness and wait-and-see attitude among crypto market participants. This could be due to the absence of significant fundamental events that would lead to sharp price or activity changes.

After a dip in May, the number of new Bitcoin addresses gradually recovered in June and continues to grow in July. This suggests an increasing interest from new users and investors in the cryptocurrency.

The stability in the price of Bitcoin encourages address activity and attracts long-term investors seeking stable investment opportunities.

Despite price stability, the number of transactions experiences temporary fluctuations, possibly related to changes in user activity. This might reflect temporary shifts in demand and usage of Bitcoin.

In the context of BTC price consolidation, low activity is observed among traders and investors on exchanges, indicating a preference for holding funds off exchanges until clearer market signals.

A high NVT Ratio may indicate undervaluation of Bitcoin, attracting investor attention in search of potentially profitable opportunities. However, it is important to consider that low network activity might be temporary and related to crypto market uncertainty or instability.

The rise in the average hash rate indicates miners' long-term confidence in Bitcoin's prospects and its resilience to price changes.

Overall, the data suggests relative stability in the Bitcoin market after temporary fluctuations and supports long-term confidence in the crypto's potential.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.