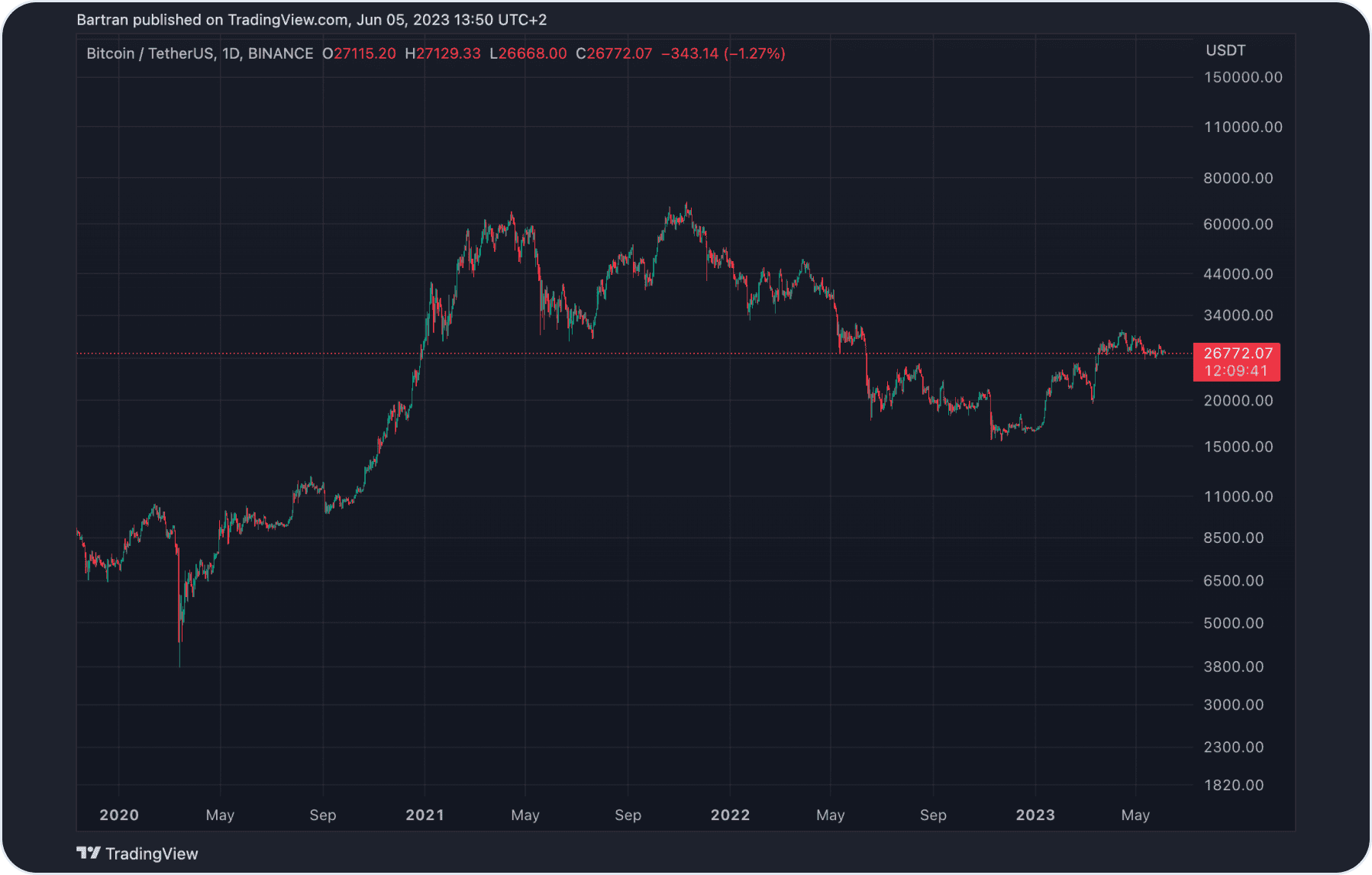

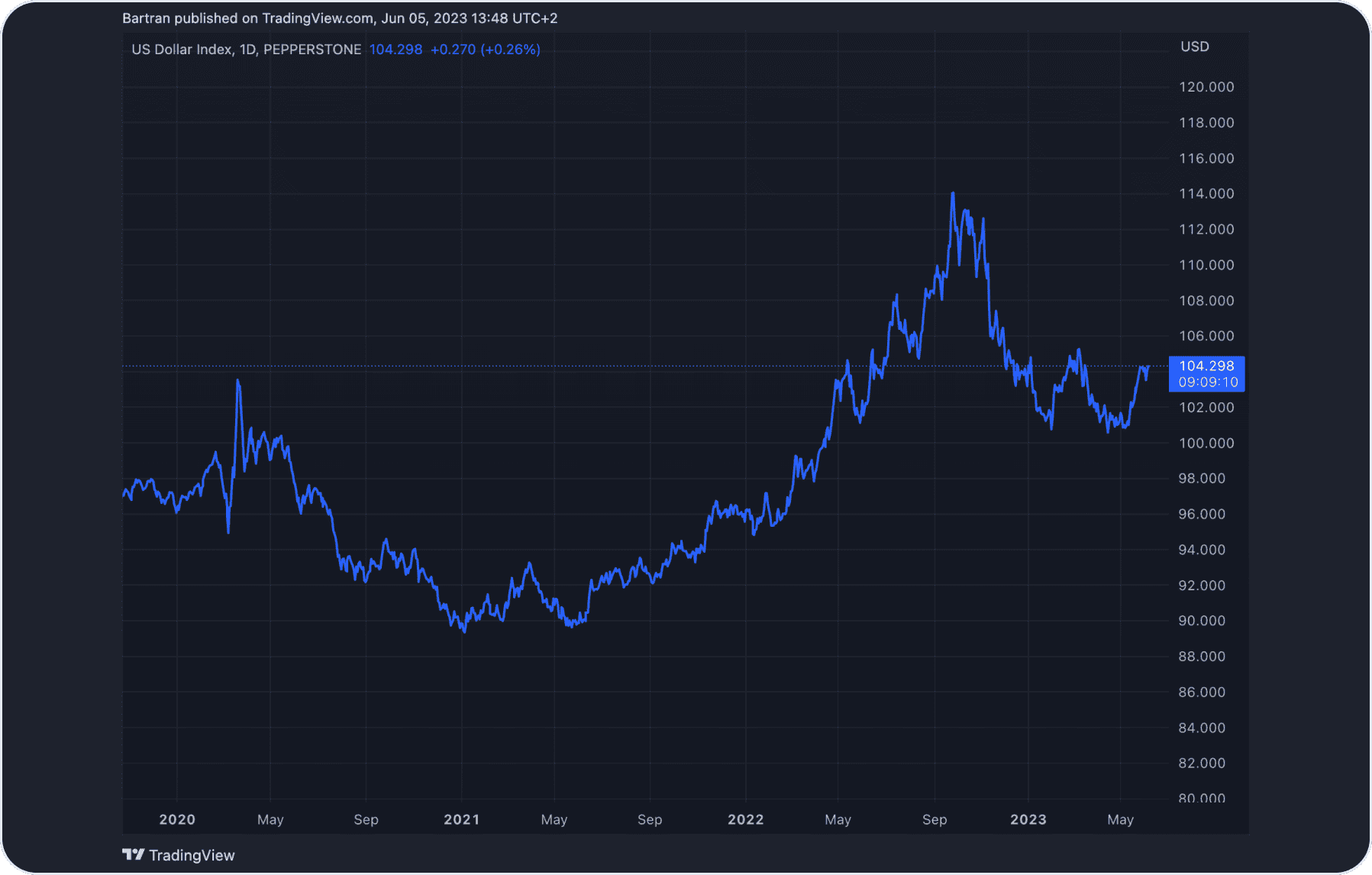

BTC & USDX Indexes correlation

Key Insights

- BTC and USDX indexes' correlation fluctuates over time between positive, negative, and neutral one, based on influencing factors.

- Positive correlation occurs when both assets rise together, often in times of economic uncertainty as investors seek safe havens.

- Negative correlation happens when BTC rises as USDX falls, typically when investors favor risky assets amid dollar weakness.

Studying the correlation between BTC and the USDX (US Dollar Index) attracts the attention of many participants in financial markets.

Correlation Between BTC and US Dollar Index

The correlation between BTC and the USDX is an interesting subject of research since both indices represent different assets and have different fundamental factors influencing their movements. However, historical data shows that the correlation between BTC and USDX them can vary and take different values in different periods and situations.

BTC, the most popular cryptocurrency, and the US Dollar Index, which reflects the value of the US dollar against a basket of other currencies, are important tools for traders and investors.

In this analysis, we will examine the relationship between BTC and the USDX, analyze the factors influencing this correlation, and evaluate its potential impact on financial markets.

BTC & USDX: Positive Correlation

In some cases, a positive correlation is observed between BTC and the USDX. This means that the rise in BTC is accompanied by the strengthening of the USDX, and the decline in BTC corresponds to the weakening of the USDX.

One possible explanation for this positive correlation may be related to the relationship between interest in Bitcoin and the strengthening of the dollar.

During periods of geopolitical or economic instability when investors seek a safe haven for their funds, they may turn to cryptocurrencies, including BTC, as an alternative asset with high liquidity.

At the same time, the US dollar, as a global reserve currency, may become an attractive asset for investors in times of uncertainty. This can lead to the strengthening of both BTC and the USDX and, therefore, a positive correlation.

BTC & USDX: Negative Correlation

In other cases, a negative correlation is observed between BTC and the US dollar Index. This means that the rise in BTC crypto index is accompanied by the weakening of the USDX, and the decline in BTC coincides with the strengthening of the USDX.

This negative correlation may result from market uncertainty and investors' preference for risky assets.

When investors perceive a certain uncertainty regarding the US dollar and its prospects, they may prefer to invest in cryptocurrencies such as BTC as an alternative and may add crypto to their portfolios.

In such cases, Bitcoin index may experience growth, while the USDX may show a decline, leading to a negative correlation.

Factors Influencing BTC & USDX Correlation

Global Economic and Political Events

Changes in the global economy and politics can have a significant impact on the correlation between Bitcoin index and the USDX. For example, macroeconomic data such as GDP growth reports, inflation levels, or employment changescan influence the movement of both instruments.

Positive economic indicators, indicating a strengthening US dollar and favorable prospects for the American economy, can contribute to the strengthening of the USDX and a positive correlation with BTC.

Political events, such as elections, legislative changes, or trade disputes between countries, can also affect the correlation between BTC and the USDX index. For instance, deteriorating relations between the USA and another country leading to a decline in the dollar may prompt investors to seek refuge in cryptocurrency.

This shift in investment preferences can result in a negative correlation between BTC and the USDX indices.

Institutional Investor Participation

The involvement of institutional investors has a significant influence on the correlation between BTC and the USDX index. The growth of institutional investments in cryptocurrencies and the dollar market can impact the demand and supply of BTC, subsequently affecting its correlation with the USDX index.

Major financial institutions and hedge funds injecting substantial capital into the cryptocurrency market can drive changes in the correlation dynamics.

For example, if prominent institutional investors allocate funds to BTC, considering it a promising asset, it can lead to increased demand for BTC and a positive correlation with the USDX.

Conversely, if institutional investors reduce their BTC positions in favor of other assets, it can result in a negative correlation between BTC and the USDX indices.

Other Major Factors

In 2020, the COVID-19 pandemic prompted many countries to implement restrictive measures, causing a sharp decline in the global economy. During this time, investors considered the US dollar a safe haven, leading to a strengthened USDX index.

Simultaneously, BTC experienced growth as individuals sought alternative investment and storage methods amidst the instability.

In early 2021, the announcement of Tesla's investments in BTC triggered a significant upsurge in the crypto market. This development reinforced a positive correlation between BTC and the USDX index, as institutional investor interest and support from a major company bolstered the prospects of cryptocurrency and the strengthening of the dollar.

Periods of geopolitical uncertainty, such as trade disputes between the USA and China, have shown a negative correlation between BTC and the USDX index.

A weakened US dollar resulting from economic uncertainties between these two countries can lead investors to turn to BTC as an alternative, driving cryptocurrency growth and a negative correlation with the USDX index.

BTC & USDX Correlation: Impact on Financial Markets

Positive correlation between BTC and the USDX index can indicate that BTC is considered an alternative asset or store of value during periods of market uncertainty or dollar weakness. In such cases, if BTC rises, the USDX index may also strengthen.

Negative correlation between BTC and the USDX index can provide opportunities for portfolio diversification and risk management. Investors seeking to safeguard their investments against a declining dollar may consider BTC as an alternative asset that can grow when the dollar weakens.

When the correlation between BTC and the USDX index is low or close to zero, it may suggest that the movements of these assets are unrelated or influenced by other factors. In such instances, investors may perceive BTC and the dollar as independent assets and make investment decisions based on separate analysis of each.

Users can purchase BTC and other crypto assets for crypto or fiat on SimpleSwap.

Summary

Studying the correlation between indices reveals that the relationship between these two assets can vary and depend on various factors. Positive correlation is observed in certain situations, where BTC growth coincides with the strengthening of the USDX index.

Negative correlation is observed in other cases, where BTC growth aligns with the weakening of the USDX index. Global economic and political events, as well as the participation of institutional investors, play significant roles in influencing the correlation between these assets.

Investors can utilize their understanding of the correlation between BTC and the USDX index in their investment strategies. Positive correlation presents growth opportunities and protection during periods of uncertainty or dollar weakness, whereas negative correlation serves as a means of diversification and risk mitigation.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.