Сrypto Investment In Growing Market: DCA

Key Insights

- Several crypto strategies including portfolio diversification, long-term perspective, dollar-cost averaging, and buying cryptocurrencies on dips

- Comprehensive theoretical descriptions of each crypto strategy and their implementation examples

- Ways to ensure risk management in volatile realm of cryptocurrencies

Investing in cryptocurrencies always involves a certain level of risk and calls for successful risk management. When prices are low, it can cause fear among investors due to possible further loss of crypto asset value. On the other hand, when prices are high, there is a fear of missing out on the opportunity to capitalize on further price rises or a fear of investing at the top of the market and facing a correction.

Moreover, here we dive deep into cryptocurrency risk management strategies for invedstors to be able to make informed decisions. Users can buy all mentioned coins on SimpleSwap.

Portfolio Diversification Crypto Investing Strategy

What Is Portfolio Diversification

Portfolio diversification in terms of investing in crypto involves allocating investments among different cryptocurrency assets. This crypto trading approach helps to reduce risk and increase the probability of successful investments, as not all cryptocurrencies react to market conditions in the same way. Diversity in a portfolio allows an investor to benefit from different growth areas in the cryptocurrency market.

Practical Example

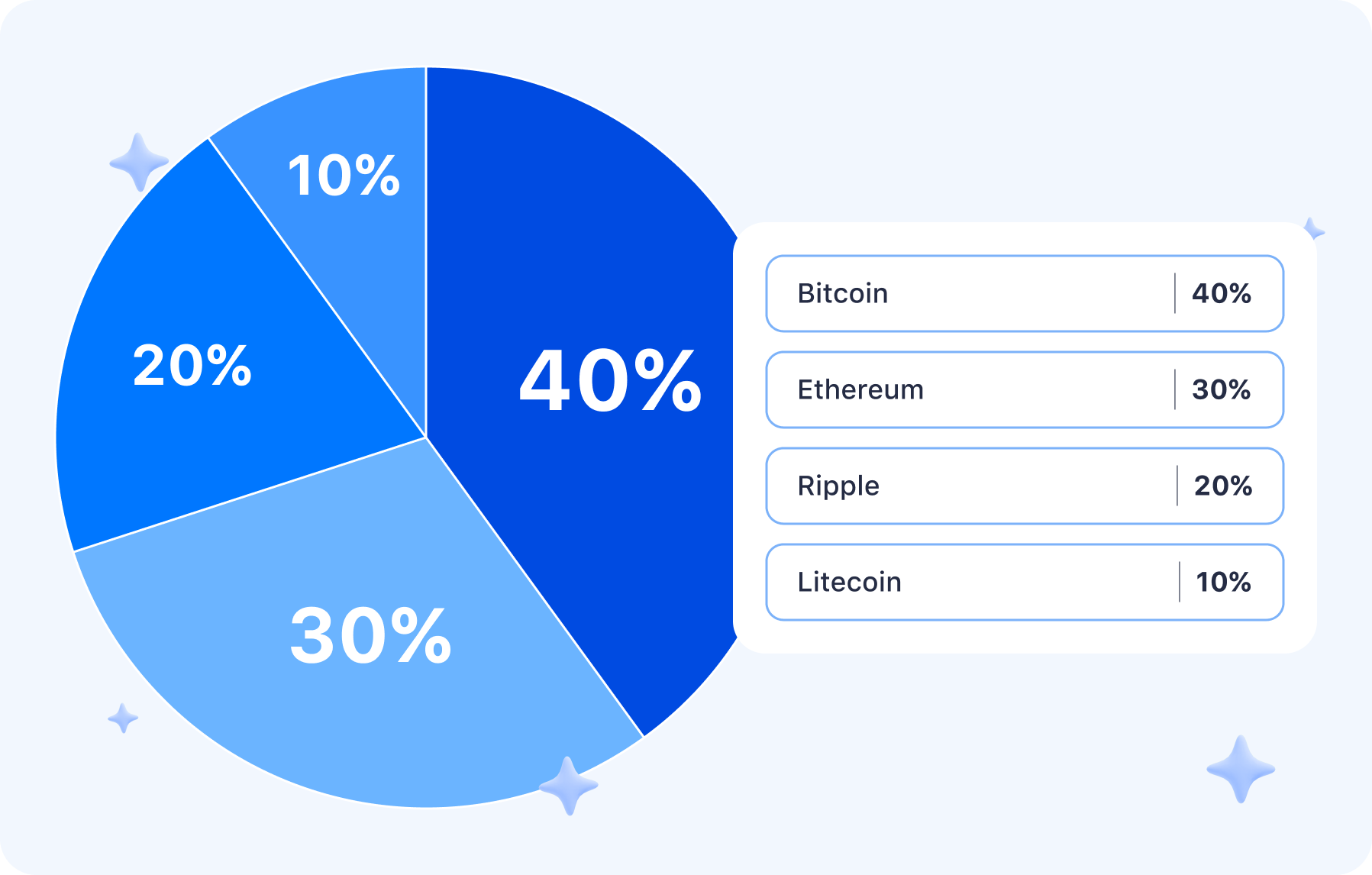

Instead of investing all of their funds in a single cryptocurrency such as Bitcoin, an investor can consider a wide range of crypto assets. For example, they can spread their investment between Bitcoin, Ethereum, Ripple and Litecoin. Both popular and lesser-known projects can be considered. For example, an investor can allocate their portfolio as follows: 40% Bitcoin, 30% Ethereum, 20% Ripple and 10% Litecoin. This will allow them to reduce dependence on the success or failure of one project and get the opportunity to earn money on various cryptocurrency assets.

Long-term Perspective Crypto Investment Strategy

What Is Long-term Perspective Investing

A long-term perspective in cryptocurrency investing involves selecting assets with potential for future growth. This focuses on the fundamental aspects of the crypto project, such as the potential for mass adoption, the quality of the development team, and the technological advantages. Crypto investment with a long-term perspective helps to capitalize on the rise in cryptocurrency prices over time

Action Example

While selecting cryptocurrencies for long-term crypto investment, an investor can evaluate the fundamental aspects of the project. For example, they may examine the white paper of the project, analyze the development team and their experience, and assess the technological advantages and prospects for market acceptance.

If an investor is convinced of Ethereum growth potential, they may decide to invest in this cryptocurrency for several years, expecting its value to increase in the future.

Dollar Cost Averaging Crypto Investing Strategy

What Is Dollar Cost Averaging

The Dollar Cost Averaging (DCA) strategy in cryptocurrency investing involves regularly investing equal amounts of money in a crypto asset regardless of its current cryptocurrency price. Following the DCA strategy allows for reducing the impact of short-term volatility on investments and creating a more stable and predictable investment portfolio.

Action Example

Suppose an investor decides to invest $1,000 in Bitcoin using a gradual purchase strategy. Instead of investing the entire $1000 all at once, they decide to break this amount into 5 parts of $200 and invest each part over 5 consecutive months. This allows them to average out the purchase cryptocurrency price over time and reduce the impact of short-term volatility on their investment.

Buying Cryptocurrency on Dips Investment Strategy

What Is Buying on Dips

Buying cryptocurrencies on dips means choosing when to buy during periods of declining prices. To do this, crypto investor can use technical analysis, trends, and crypto trading volume analysis to identify periods of declining prices that can provide them with opportunities to purchase crypto assets at more favourable prices.

Action Example

An investor can use technical analysis to determine when to buy Bitcoin on dips. For example, if the price of Bitcoin drops to a support level and technical analysis indicators show a possible reversal of the cryptocurrency price upwards, this could be a buy signal for the investor. For example, if the price of Bitcoin falls from $70,000 to $56,000, an investor may decide to buy Bitcoin at that level, expecting a subsequent price rise.

Summary

Cryptocurrency investment is a high-risk activity where the possibility of high returns comes with the possibility of significant losses. In this article we have looked at a comprehensive investment strategy that helps to reduce risk and increase the probability of successful investments in the growing cryptocurrency market.

Portfolio diversification allows you to spread your investments across different crypto assets to benefit from different growth areas in the market. A long-term perspective involves selecting assets with potential for future growth based on the fundamental aspects of the crypto project.

A gradual buying strategy helps smooth out cryptocurrency price volatility and create a stable investment portfolio, while buying cryptocurrencies on dips allows you to use technical analysis to identify periods of declining prices and opportunities to purchase assets at more favourable prices.

Combining these crypto investing strategies into one comprehensive approach allows investors to minimise risk and increase the likelihood of successful investments in the dynamic and volatile world of cryptocurrencies.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.