BTC On-Chain Analysis December 2023

Key Insights

- There is an increase in the number of transactions on the Bitcoin network, accompanied by a rise in the asset's value

- Suggested confidence in Bitcoin as a means for large transactions, potentially contributing to its long-term viability.

- The growth in online BTC activity and the increasing number of participants create a favourable picture for long-term investment in Bitcoin.

On-chain analysis is the process of examining blockchain data, including transactions, trades, and wallet address holdings. On-chain data is defined as that which has been validated and recorded on a blockchain ledger.

For investors and traders, on-chain data provides valuable insights into key aspects of the crypto market, including the holders and traders of specific currencies, the sophistication of investment strategies, and the reactions of token holders to market events.

BTC analysis allows for the extrapolation of trends and the assessment of sentiment in the crypto market.

On-chain analysis employs a variety of metrics. In this article we look into the Bitcoin network analysis exploring BTC transaction volume, BTC total addresses, and BTC balance by holdings and for the first time using Bitcoin Cycle Master as metrics.

BTC Transaction Volume in USD by Size

The rise in Bitcoin network transactions correlates with the appreciation of BTC, increasing from 372.05 thousand in December to 731.35 thousand.

This trend suggests heightened activity among Bitcoin network participants. This may be attributed to the rising interest in Bitcoin, which is a result of the increasing BTC price and the growing attention towards the crypto market.

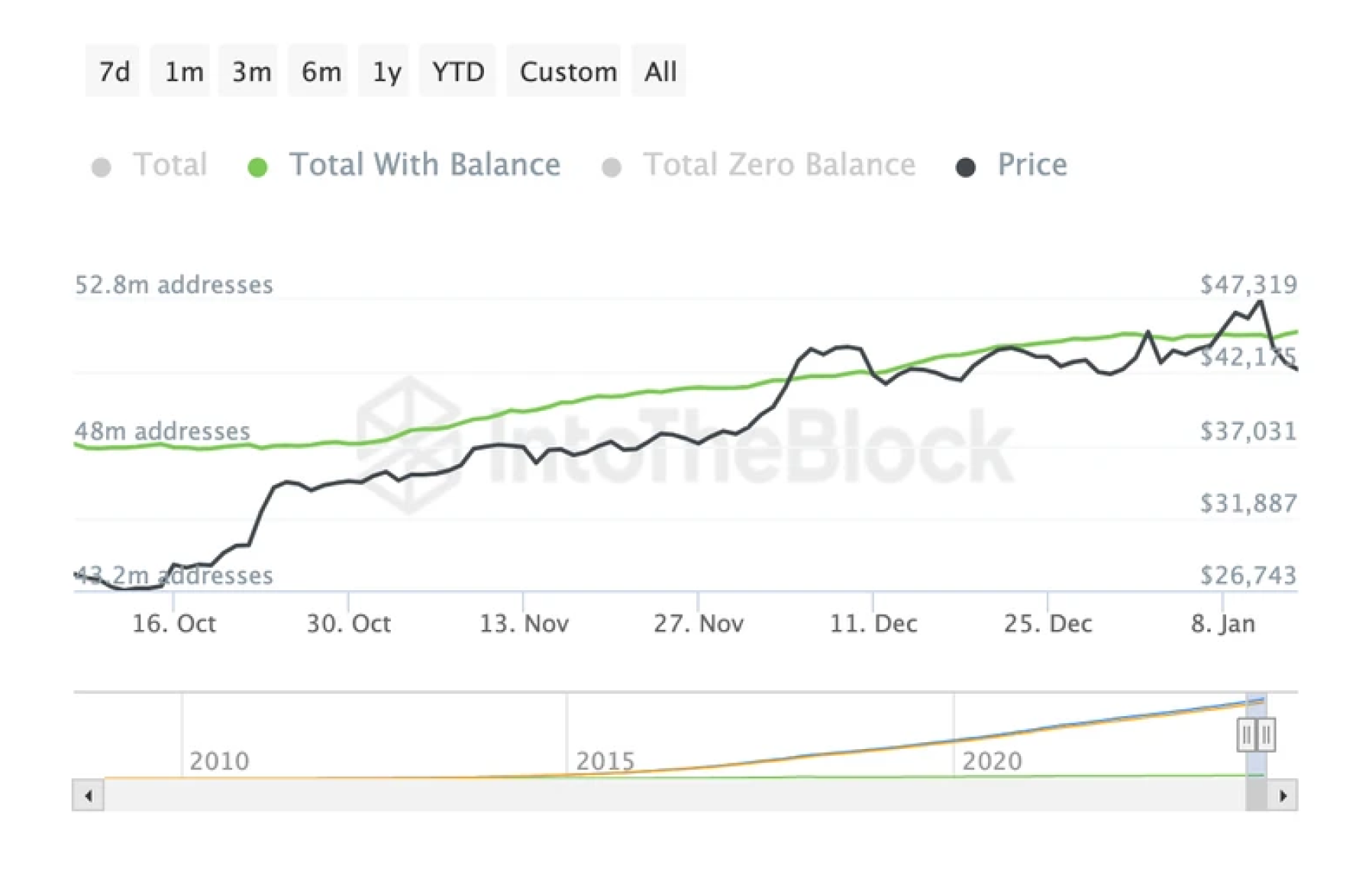

BTC Total Addresses

There has been a surge in transaction volume on the Bitcoin network, with users carrying out transactions exceeding $10 million.

Since early December, the number of Bitcoin addresses has steadily increased from 50.04 million to the current 51.74 million.

This growth may indicate a steady increase in the number of participants in the Bitcoin network, which can be attributed to the growing interest in the cryptocurrency and the expansion of its user base amid the pending adoption of BTC: ETP.

Bitcoin Balance by Holdings

The BTC analysis shows that there is an increase in the balance of BTC holders.

The changes are manifested in the following way:

Increase in the interest of small holders (0 - 0.001 BTC): +2.49%

Increase in the share of large holders (10k - 100k BTC): +2.33%

Increase in the share of the largest holders (> 100k BTC): +0.41%

These data indicate a variety of changes in the structure of BTC holders, with both small and large holders showing increased interest in the asset.

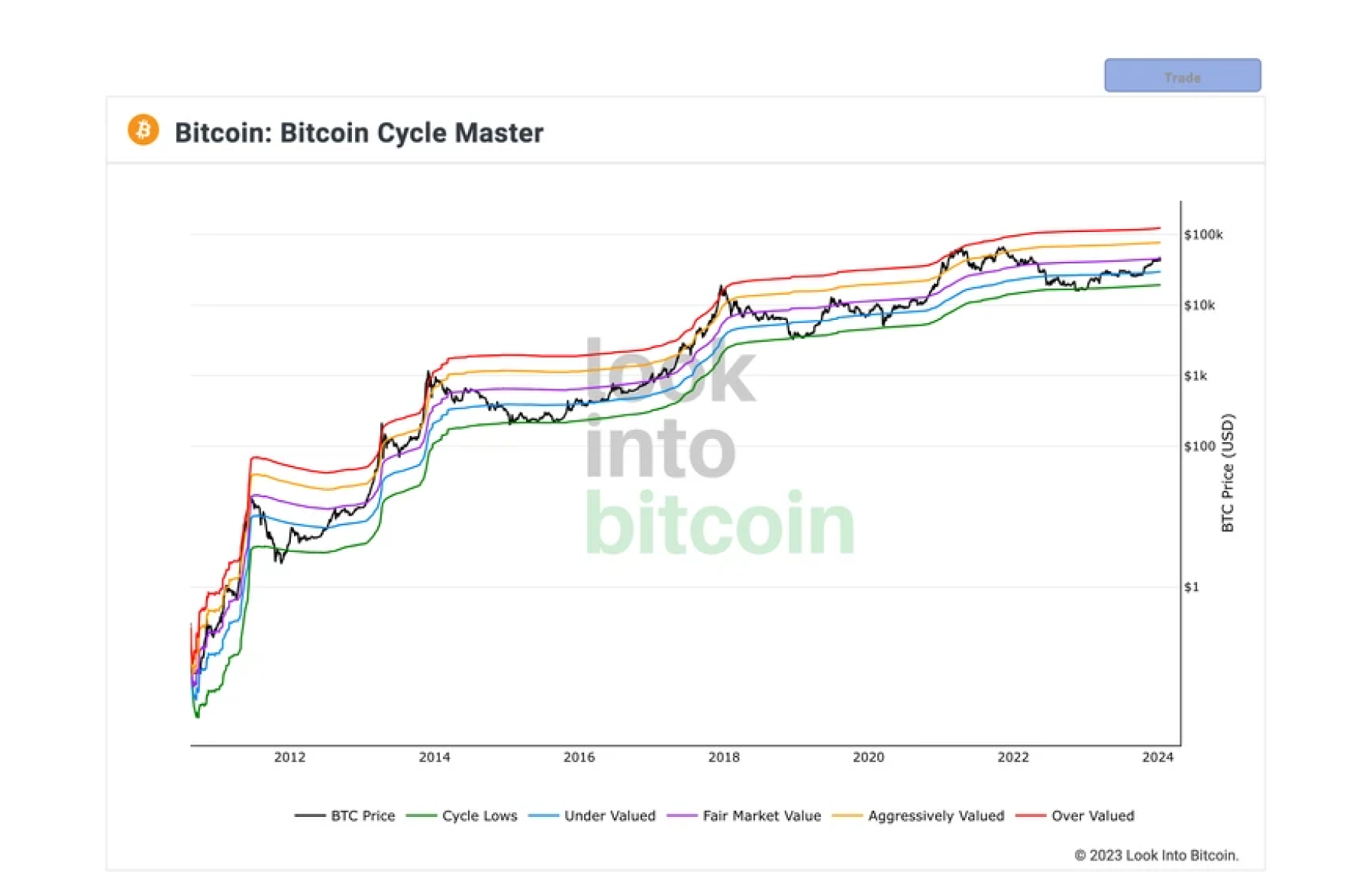

On-Chain Analysis: Bitcoin Cycle Master

Bitcoin Cycle Master is a on-chain data tool that combines various on-chain metrics, such as Coin Value Days Destroyedand Terminal Price, to assess Bitcoin valuation within its cyclical patterns. Historically, these cycles have occurred roughly every four years and align with Bitcoin Halving events.

However, it's important to note that past patterns do not guarantee future behavior, as the on-chain data metrics used in Bitcoin Cycle Master reflect real economic activities in the Bitcoin network.

The tool is designed to pinpoint periods of heightened risk, where on-chain data reflecting transaction behavior suggests potential cycle peaks, as well as periods of value opportunity, where similar behavior indicates potential cycle troughs.

Based on the Bitcoin Cycle Master metric, the current BTC price appears to be at fair crypto market value.

This suggests that the market is valuing Bitcoin according to its fundamental characteristics, without any clear overvaluation or undervaluation of the asset. The market price of Bitcoin reflects its current value, taking into account the factors identified by the Bitcoin Cycle Master.

Users can get BTC for fiat or crypto on SimpleSwap.

Summary

The on-chain data indicates heightened activity among crypto market participants. This trend can be linked to the growing interest in cryptocurrencies, highlighting the potential resilience of BTC price growth.

An increase in transaction volume on the Bitcoin network, particularly for amounts exceeding $10 million, indicates heightened activity by major market participants.

The growth in the number of Bitcoin addresses reflects an increase in the number of participants on the Bitcoin network. This can be attributed to the increasing interest in Bitcoin and highlights its perception as a valuable asset in the digital economy.

The increasing balance among Bitcoin holders, regardless of their size, demonstrates the diversity of interest in cryptocurrency. The growing interest from both small and large holders may emphasize the long-term sustainability and commitment of crypto market participants.

Based on the Bitcoin Cycle Master metric, the Bitcoin price is in line with the fair market value. This provides investors with a signal that the market is valuing Bitcoin according to its fundamental characteristics. This is an important factor for those considering a long-term investment.

Current Bitcoin analysis supports the idea that Bitcoin represents a promising asset for long-term investment. The balanced interest of cryptocurrency holders further supports this view.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.