Manta Network Fundamental Analysis

Key Insights

- anta Network, consisting of Manta -Atlantic and Manta Pacific, is introducing to the market the first working Layer2 solution that utilizes Celestia technology to reduce fees for network data availability work.

- The network is growing at a very fast pac, as the Total Value Locked (TVL) at Manta Pacific peaked at $1bn in a short period of time, showing a 30-fold increase in user inflows since the beginning of the year.

- Manta Network created the New Paradigm campaign, which opened up the possibility of generating native yield without traditional asset lock-in, thereby strongly differentiating itself from competitors (Optimism, Base, etc)

What Is Manta Network

Manta Atlantic is an L1 solution in the Manta ecosystem on the Polkadot blockchain, creating identities and credentialswith zero disclosure. The Manta Pacific module plays a major role in the Manta ecosystem.

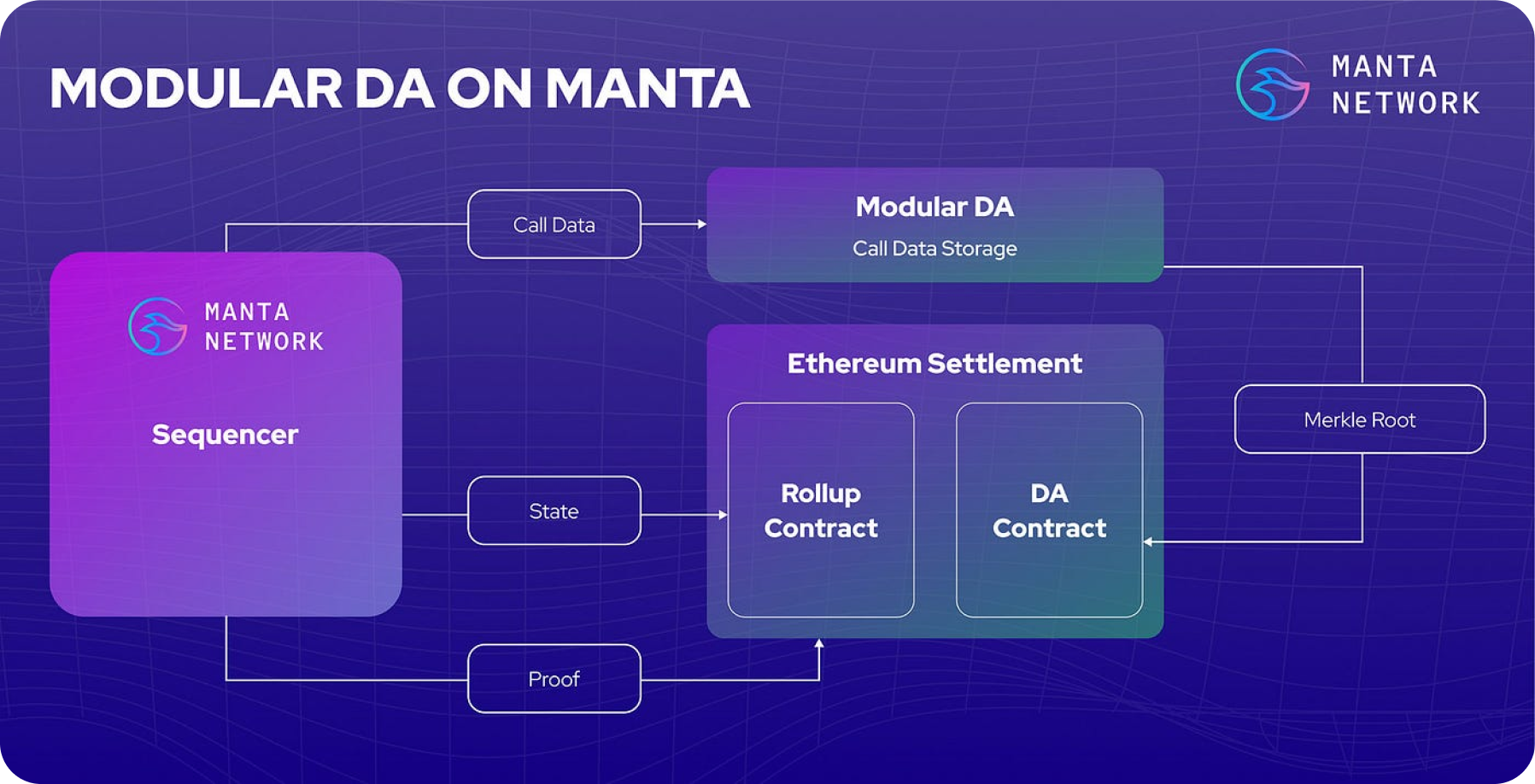

Manta Pacific is an L2 rollup on Ethereum, deployed using the OP Stack of the Optimism ecosystem and leveraging the Celestia modular network to make any data available.

On the Manta Network users can build and deploy any decentralized application on Solidity, and its high-end stack provides faster transaction speeds than L1 solutions and lower cost of gas on the Manta Network than L2 solutions.

Manta protocols are based on Substrate frameworks, which ensures high network security. The project also uses ZKP(including Universal Circuits, zkSBT and Manta NPO), a zero-knowledge proof-of-concept to ensure complete anonymity of network participants, interoperability between parachains in the Kusama ecosystem, and high transaction processing speed.

As a result, Manta Pacific is building a scalable zk infrastructure for web3 applications, utilizing all the current technologies available to provide a unique experience for the developers (about 100 technologies at the moment) of the applications and to successfully grow its network.

Indicative of this approach is willingness of Manta Network to switch to Polygon zkEVM and utilize Celestia for data availability. In doing so, the network's commissions are reduced by a factor of 6, with a possible subsequent reduction of 20 times. So far this solution has already saved more than about $1.5mln in gas commissions.

Manta Network Development

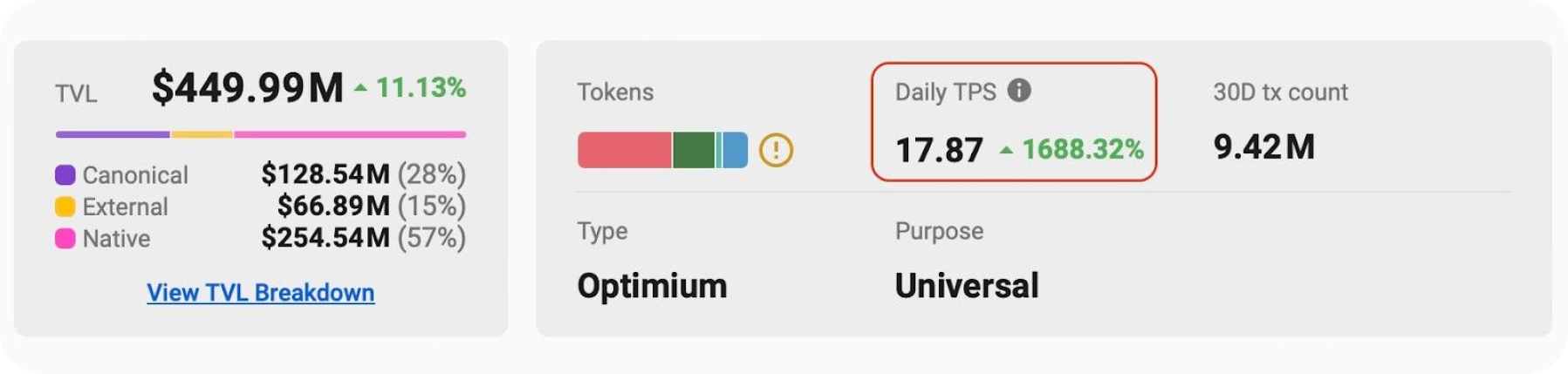

Based on data from the L2BEAT portal, the total value locked (TVL) in Manta Pacific peaked at $1bn in a short period of time and currently stands at $431.5 mln (also includes assets from external blockchains transferred to Manta Pacific via non-canonical bridges that block tokens in their native registries and issue IOU tokens on L2), maintaining a stable pattern over the last month. Orbiter Bridge shows the most user activity.

Such numbers speak to the high interest and trust in the Manta Pacific ecosystem at the project's release. The increase in locked value on the platform in such a short period of time shows its growing popularity and acceptance among users.

Since the launch of Manta Mainnet, there has been a multiple of development growth (more than 30x TVL growth in six months). However, since March the hype subsides a bit and TVL starts to decrease.

With growing TVL the activity of Manta Pacific network increases. At the moment TPS (transaction per second) is 17.87, which is 1688% higher than a week before (growth in 7 days).

Manta token ranks 9th among L2 solutions by capitalization according to CoinMarketCap. The network's earnings on commissions for the whole period of the project's existence have already amounted to more than $5mln.

The Manta project created interesting crypto solutions to the market and brought gamification elements for users to transfer their assets. And after that they turned on aggressive marketing and launched massive collaborations with leading market players in Web3, GameFi, and DeFi.

What attracted users to Manta:

- Manta solved a real capital freeze problem in the market. Any user who connects assets to the L2 network locks their ETH. However, the ETH remains on the L1 network and users get a wrapped token that can be used on the new L2 network. This means that their ETH stays there as unused capital. Manta is the first working protocol that solves this problem.

- Instead of users paying additional fees when transferring assets from the L2 network and back to the L1 network, Manta allows ETH or USDC to be staked and rewards users. By doing so, users earn additional revenue in Manta DeFi ecosystem.

By offering internal returns on its network and additional financial incentives for asset transfers, Manta has created additional value for users with assets on other Layer 2 networks.

Manta Network: Competitive Analysis

Manta Network has created the so-called New Paradigm, which opens up the possibility of native yield without traditional asset lock-in. Deposits in over 100 different tokens can be provided. At the same time, the Manta Pacific ecosystem is constantly adding new projects.

Manta Network’s New Paradigm offers five revenue streams including fixed yield, NFT incentives, and a unique DeFi compartmentalization in the L2 ecosystem, different from the Blast network.

Partnerships of Manta with StakeStone and Mountain Protocol provide immediate access to liquidity upon completion of the New Paradigm campaign and additional rewards.

Comparing Manta Pacific with Blast, Arbitrum and other L2 solutions, the technical capabilities of Manta project are seen as being ahead of those of the competition.

The main differences from competitive solutions (as mentioned above) are immediate access to tokens, 5 levels of incentives instead of 1-2 in competitors, revenues from network commissions (Gas Revenue) between Manta Network members, and the most favorable commissions in the network (up to 100 times more profitable).

It is worth noting that zkSync had about 4 times more users than Manta Network 3 months after launch. Base had 7 timesmore users 3 months after the start of the project.

At this point, activity on the Base network has leveled off. L2 networks that launched in 2021 had much less interest at launch. Arbitrum had only 5k active users 3 months after launch and Optimism had only 2.5k active users in the first few months.

Manta Network Ecosystem Advantages

The main advantage of the Manta product is its modularity and its ability to build a standardized infrastructure. The Manta project builds and deploys tools in a modular format, which provides plug and play mechanics for web3 application developers.

From a product standpoint, several key points can be highlighted:

- Manta team prioritizes zero-knowledge technologies, delivering an optimal user experience for both developers and end-users, with a strong focus on privacy and scalability.

- Manta Network is the first Layer 2 blockchain to launch on Celestia, greatly lowering gas fees for developers.

- Manta Network offers universal modules for developers, allowing them to leverage an existing SDK that simplifies the deployment of zero-knowledge solutions with minimal coding. Developers aren't required to maintain code or have in-depth blockchain knowledge.

- The Manta team is highly optimistic about utilizing Polygon's zkEVM and has therefore chosen to retain the OP stack.

Manta Network Ecosystem Products

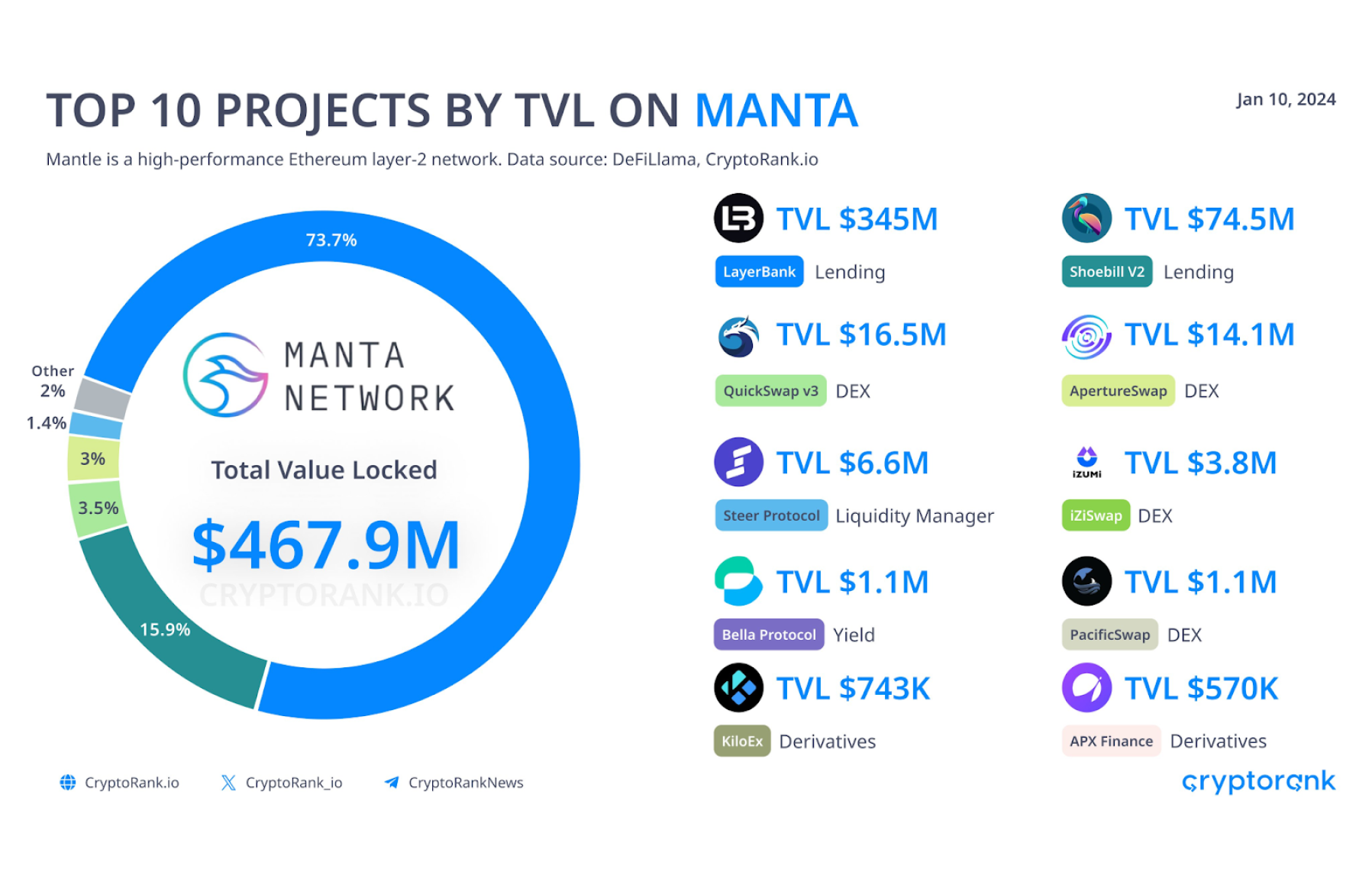

According to DefiLlama and Cryptorank Explorer, at the beginning of the year the top Manta Network projects by TVL were LayerBank, Shoebill, and QuickSwap. At the moment, six months later, the leading native projects are Manta CeDeFi with TVL of $94.83mln, LayerBank with TVL of $6.95mln and GullNetwork with TVL of $6.27mln.

Let's take a look at some of them:

- Manta CeDeFi

It is an innovative product that combines the features of decentralized exchanges and centralized trading solutions. It utilizes Celestia for increased scalability, combines high data privacy, low fees and provides interoperability between different blockchains for exchanges.

- LayerBank

This product offers a wide range of lending and borrowing options in the Manta Network ecosystem. LayerBank facilitates cross-network lending by enabling interoperability between multiple blockchains. It has about 700k users and a total transaction volume of $35mln.

- GullNetwork

Is an innovator in the Manta Network ecosystem that aims to create a revolutionary ecosystem based on Gull artificial intelligence. Launched as DEX protocol it leads development of its own Launchpad, NFT Launcher, CrossChain protocol. It wants to capture the meme coin launch market on its platform.

- QuickSwap

It is a decentralized exchange (swapper) that provides users with a convenient platform to exchange digital assets with the ability to provide liquidity to pools and buy crypto assets with fiat currency. Its TVL is at $5.73mln.

- Shoebill Finance

Once ranked number one in TVL, the once popular project on Manta has carved out a niche for itself with its collateralized LST lending on Manta Pacific, Wemix, and Klaytn. Its TVL is currently at $2.42mln.

Projects built on the Manta Network today include both decentralized exchanges and lending protocols, innovative products and games.

Manta Network Tokenomics

Ticker - MANTA

Total supply - 1,000,000,000,000

Annual inflation rate - 2%

The MANTA token serves multiple purposes, including governance voting, staking on Manta Atlantic L1, and paying gas fees on Manta Atlantic, where 72% of these fees support ecosystem projects to incentivize application development.

The Manta coin may also be used for potential future sequencer revenues on Manta Pacific L2 and for transaction fees on Manta Atlantic.

Manta Atlantic and Manta Pacific networks will collectively have a total supply of 1 billion tokens. As liquidity moves between these networks, tokens will be locked and unlocked within the Celer bridge liquidity pool.

The current circulating supply of Manta coin is determined by the total number of unlocked Manta Atlantic and Manta Pacific tokens.

As it can be seen from the tokenomics, the main distribution goes to the ecosystem and community of Manta Network (21.19%), to the treasury fund go 13.50%, to the team and adviser go 18.1%, and 11.1% go to the airdrop. Investorsreceived a total of 32.11% with a token lock of 30 to 48 months.

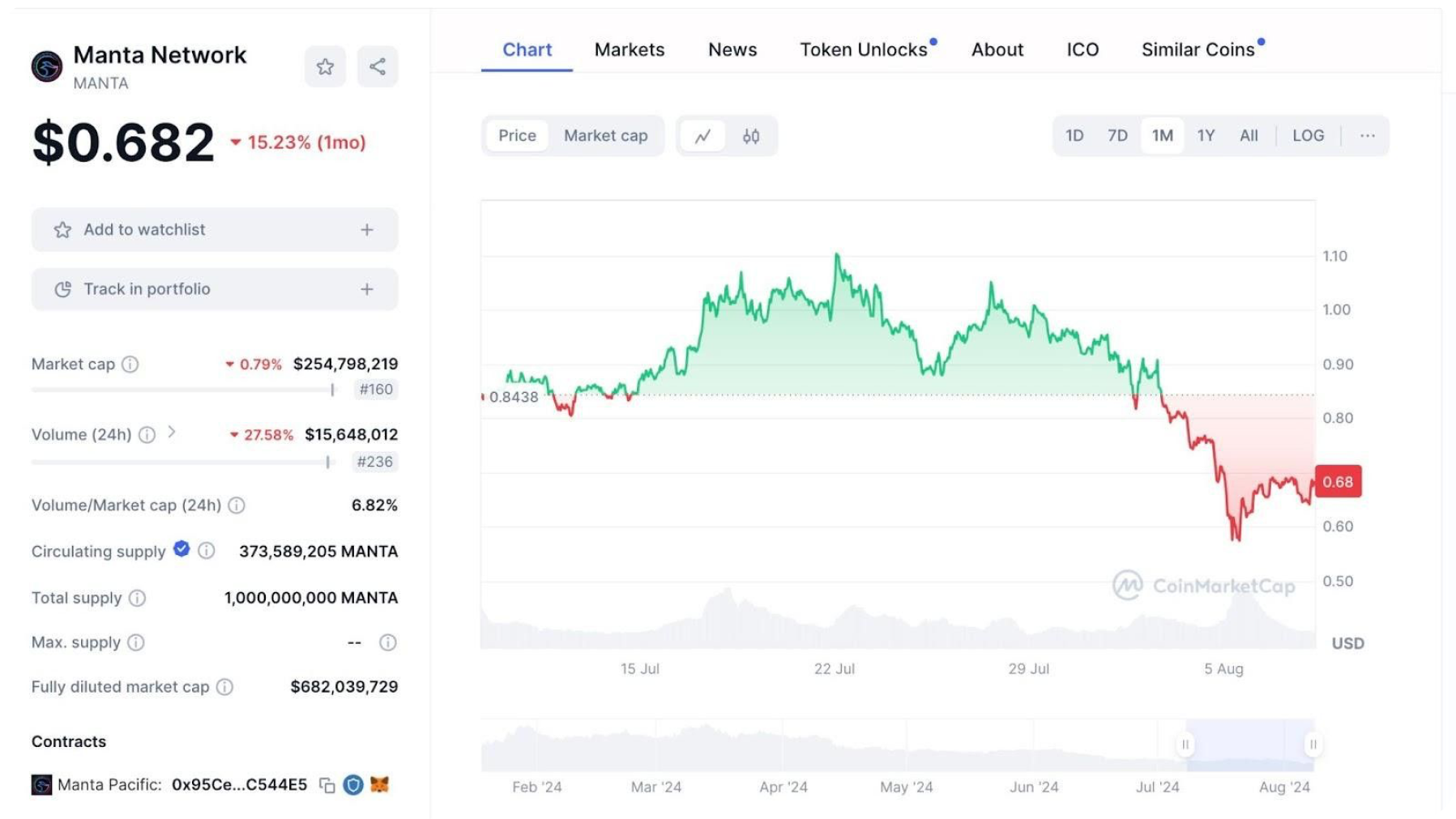

The MANTA token, ranked 160th by capitalization on CoinMarketCap with a daily trading volume of $15.6mln, is currently trading around $0.7 on most popular exchanges (Binance, Bybit). The 15% decline in the last month is due to the general decline in the market over the last week.

You can also buy Manta or exchange from any currency on SimpleSwap in a convenient format at a favorable rate.

Manta Network Business Model

Manta Pacific generates revenue by charging fees to users who engage with applications built on its Layer 2 infrastructure.

A portion of these fees is directed to the Ethereum network to cover settlement and data availability costs. By leveraging Celestia for data availability, Manta can drastically reduce its Ethereum-related expenses by up to 95%. Some of these savings are passed on to users within the Manta ecosystem as cashback.

It's important to note that, while Manta initially won't pay fees to Polygon zkEVM for using their Chain Development Kit (CDK), they anticipate a future economic agreement, similar to how Optimism charges Base 15% for utilizing the OP Stack.

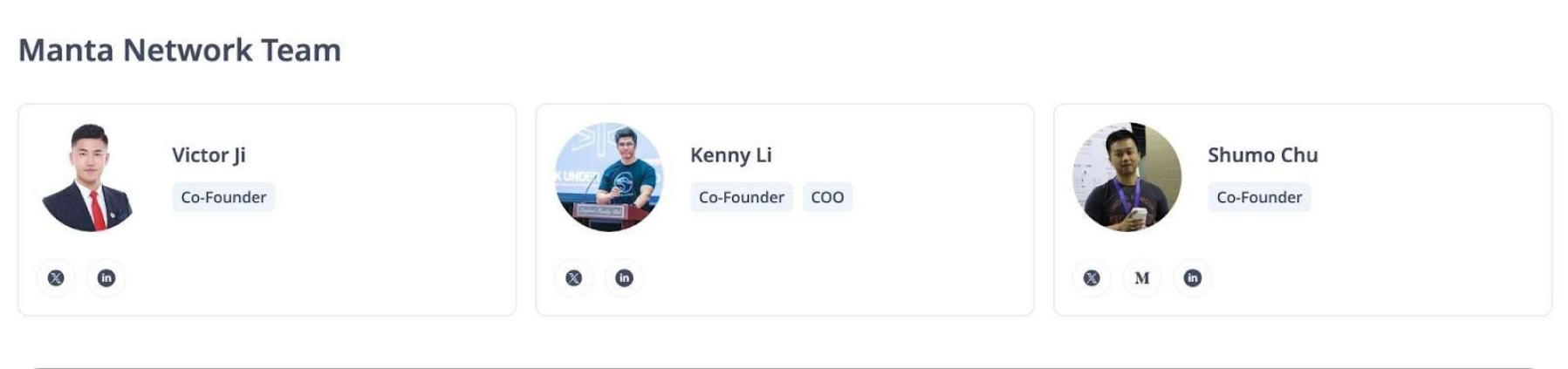

Manta Network Team

The core team of the Manta Network project consists of the three founders. Kenny Li graduated from MIT Sloan School of Management in May 2020, was also a teaching assistant in Gary Gensler's blockchain course at MIT, and has a background in cloud computing.

Shumo Chu is an assistant professor at UC Santa Barbara and a systems researcher at Algorand. Victor Ji is a former research fellow at Harvard.

According to LinkedIn, Manta Network (p0x Labs) has 17 employees. But in a recent interview with Kenny Li, Mantaallegedly has 60 employees worldwide, mostly in Turkey, China and India.

Manta Network Investors & Community

Manta Network has raised over $60mln in aggregate. The first round was led by well-known crypto venture capital firms such as Multicoin Capital and Polychain Capital. In the second round, Manta added funds such as ParaFi, Coinfund, CMS Holdings to its investor circle for $5.5mln.

On the Tokensoft platform, 80 mln Manta tokens were sold through a public sale at $0.36 per token. The amount of funds raised was $28.8 mln. The main investors of the final round were Polychain Capital and Qiming Venture Partners. They closed the round for $25 mln.

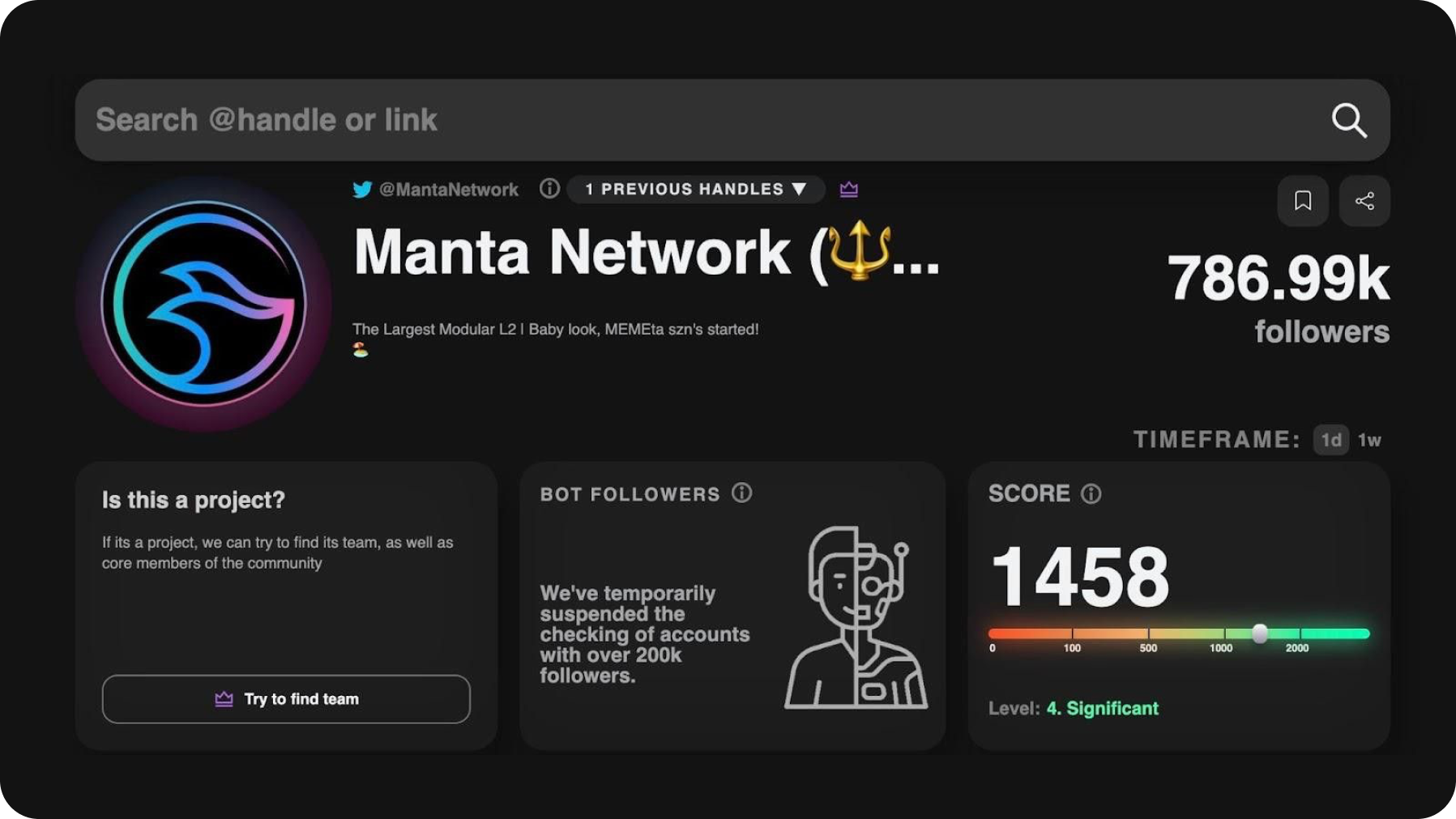

The community of the Manta Network project has about 1mln followers from all social networks. The bulk of users are on Twitter, about 800k followers, and Discord with more than 200k followers.

Twitter Score from the analytical service Twitter Scout shows an impressive 1458. That speaks about the dynamic development and activity of the Manta community.

The Manta project also has a YouTube channel, articles on Medium and a Telegram channel with about 50k followers.

Summary

Manta Network stands out as the first Ethereum-based rollup to utilize Celestia for data availability, significantly reducing costs by adopting this technology.

Despite raising considerably less funding than competitors—$60 million compared to ZKSync's $450 million—Manta Network successfully captured the crypto community's attention through aggressive marketing and innovative ideas.

The team’s willingness to adapt is evident in their bold decision to shift to Polygon zkEVM with the OP stack. Kenny Li, the project's founder, has a clear vision for scaling the tech stack in Web3, positioning Manta Network as a leader in this evolution.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.