Fibonacci Trading Strategy

Key Insights

- Fibo levels identify support and resistance levels in trends, with retracements to 0.618 and 0.786 signalling high probability of trend continuation.

- Buying incrementally on pullbacks to key Fibo levels allows for favorable average entry prices in an uptrend.

- Selling partially or completely in the 0.5 Golden Zone allows traders to take profits after significant extensions from major Fibo levels.

What Is Fibonacci for Trading

The Fibonacci trading strategy is a technical analysis method that relies on the numerical relationships between consecutive Fibonacci sequence numbers to pinpoint potential support and resistance levels within an asset's price movement.

This strategy operates on the premise that prices often retract a predictable portion of a trend before resuming their original trajectory. Traders employing this approach typically pinpoint critical Fibonacci levels, such as the 38.2%, 50%, and 61.8% retracement levels, to inform their trading decisions.

At the same time, Fibonacci lines should be seen as a confirmation aid. Therefore, it's advisable to complement this indicator with other technical analysis tools.

Fibo level, in turn, is a graphical analysis tool developed on the basis of Fibonacci numbers. The tool helps to identify the most important support and resistance levels within a trend.

Fibo Crypto Trading Strategy

This crypto strategy implementation period is at least 6 months.

The minimum investment per month is $30.

- Select a coin

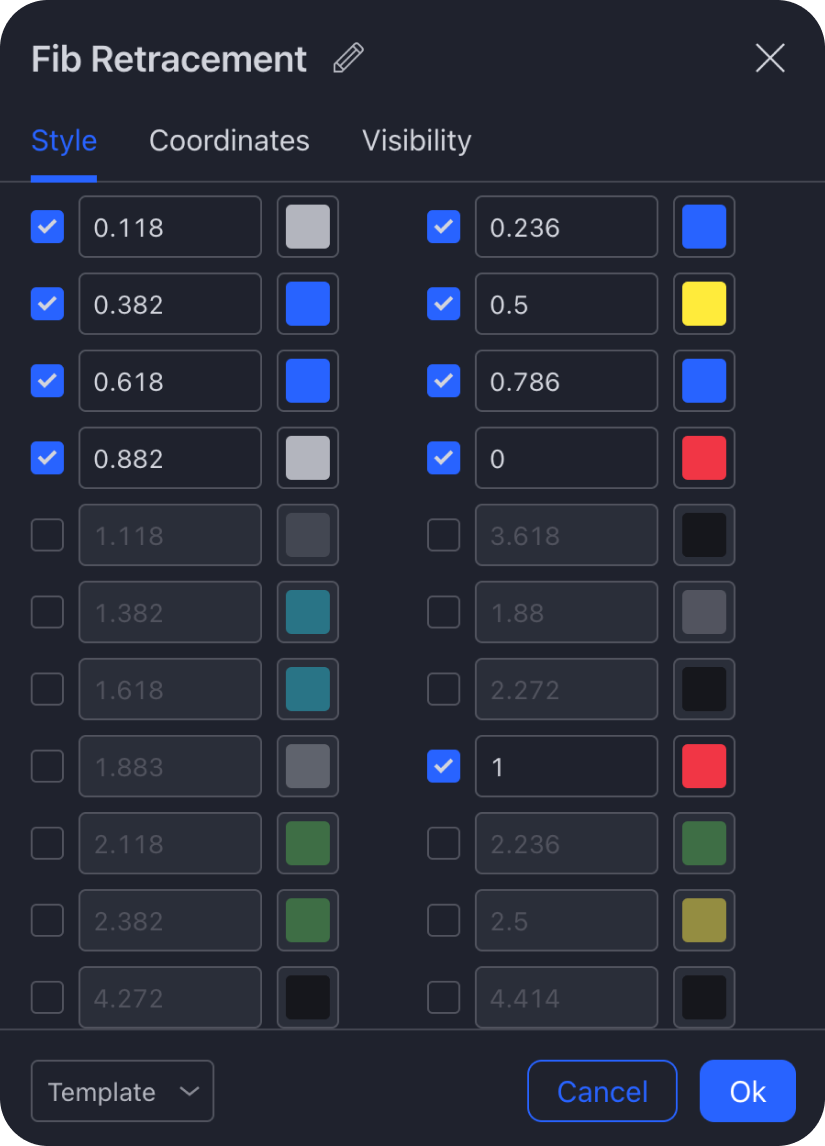

Open its daily chart, and customize the Fibonacci grid with settings adapted to trading crypto assets.

- Stretch the Fibonacci grid

You need it stretched on the selected chart from the start of the previous bullish trend. After building the Fibonacci levels, we can see how the price moves relative to them. An uptrend can be defined as a quote pattern that consists of constantly rising highs and lows.

- Split the deposit

To achieve the most favourable average price, split the deposit and increase it every time a lower Fibonacci level is reached. According to this strategy, we start buying when the price reaches the following levels:

- 0.618

- 0.786

- 1

Corrections to levels of 23.6 and 38.2 mean a high probability of trend continuation.

A pullback to the 50% level shows that the chances of a trend continuation and pullback are equal.

If the price rolled back to 61.8% or lower, then you should expect a trend reversal.

- Sell coins

We sell coins partially or completely when the price reaches the Golden Zone of 0.5.

Buying crypto at Fibonacci sequence levels is an effective and proven tool. With this strategy, we can identify important support and resistance levels, which allows us to make informed decisions when investing.

Users can get crypto assets to test this strategy on SimpleSwap.

Summary

The Fibonacci trading strategy serves as a valuable tool for traders seeking to enhance their analysis and execute more informed trading choices.

Traders often turn to Fibonacci retracements to gauge possible future price movements in financial markets. When applied effectively, these retracements and ratios can assist traders in spotting potential support and resistance levels by analyzing past price behavior.

Nevertheless, akin to any technical analysis technique, it is advisable to supplement it with other analytical methods and refrain from relying solely on it for trading decisions.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.