Influence of Macroeconomic Factors on Crypto Market

Key Insights

- Favorable macroeconomic environment promotes growth and greater investor interest in high-risk assets such as cryptocurrencies, whereas during periods of economic downturn, protective assets such as gold are more popular (although BTC can also be seen as an inflation-protective asset).

- FED policy, in particular the rate hike/lower cycles, may influence the BTC price and the cryptocurrency market, but historical data does not show a strong correlation between the key interest rate and BTC rise/fall cycles.

- A surge in money supply could be a powerful trigger for the growth of high-risk assets such as BTC and other cryptocurrencies, while a decline in money supply could act as a negative factor on the crypto market.

Macroeconomic factors affect all asset types, stimulating growth and bull market or conversely triggering asset declines and periods of bear market. The cyclical nature of the economy with periods of growth and decline is reflected in commodity markets, financial markets and cryptocurrencies.

The cryptocurrency market is different from other markets and has its own growth drivers. These are factors such as crypto market sentiment (periods of euphoria or extreme fear), technology development, adoption levels, and liquidity.

Traditional financial assets tend to be more dependent on macroeconomic factors such as key interest rate and inflation because this directly affects their operating performance (the interest rate at which they can borrow).

Apart from inflation and key interest rate, in this research we consider money supply (monetary mass) and FED policyas other crucial macroeconomic factors affecting the cryptocurrency market.

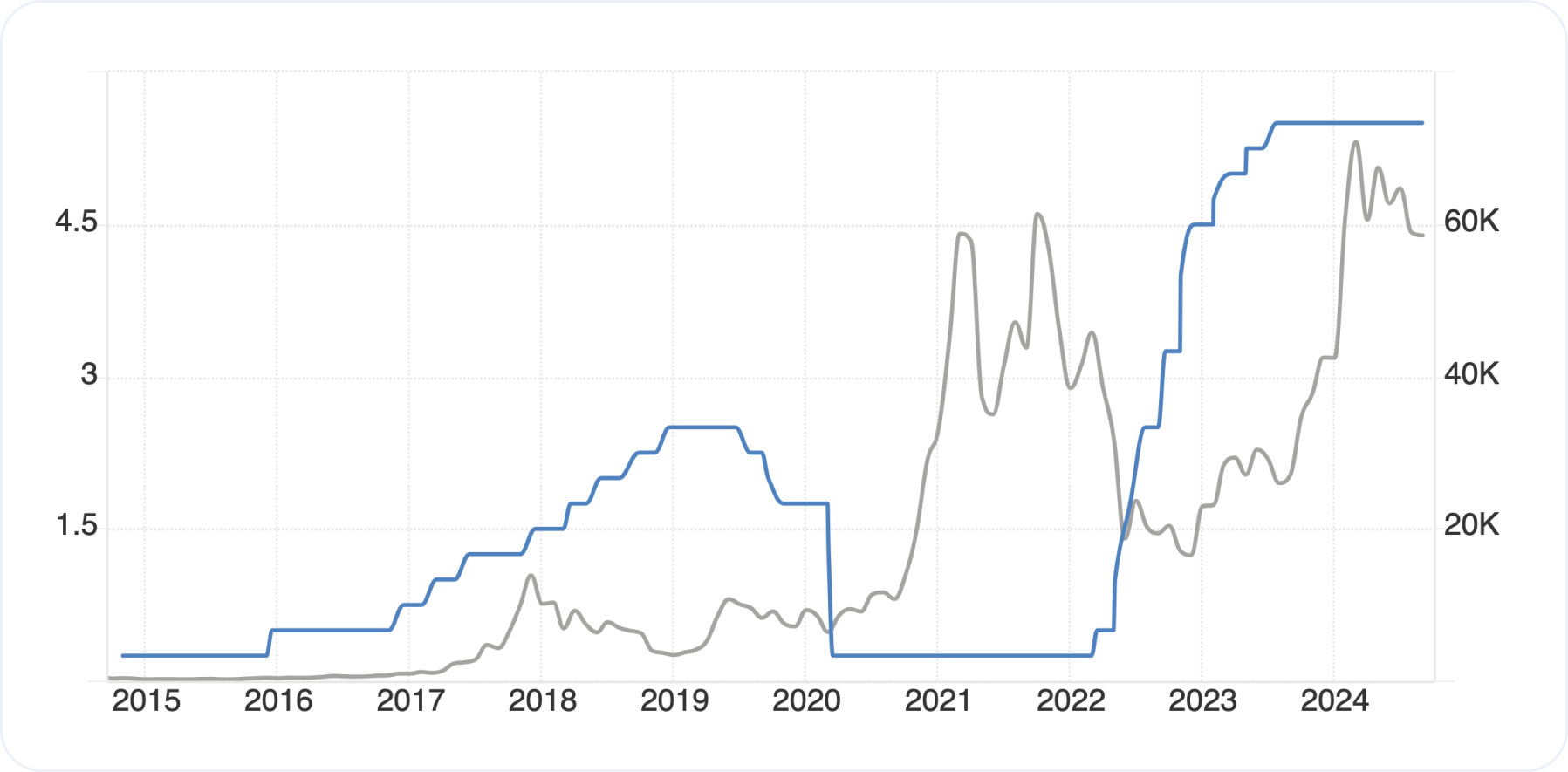

BTC Dynamics: Impact of Federal Reserve Policy and Key Interest Rate

Federal Reserve policy has an overall impact on the cryptocurrency market and the BTC price as a market benchmark.

Periods of loose monetary policy and Quantitative Easing stimulate investor interest in risky assets such as BTC and other cryptocurrencies. A period of tight monetary policy and Quantitative Tightening reduces demand for such risky assets.

A prime example of the impact of FED policy on BTC and the cryptocurrency market is the 2020-2021 bullrun period.

In 2020, against the backdrop of COVID19, the FED started a new cycle of monetary policy easing and lowering the key interest rate, which remained at 0.25 throughout 2021. BTC showed significant growth during this period, renewing its ATH.

2021 was a bullrun period in the crypto market with the entire segment rising. The ensuing bear market of 2022-2023 coincided with the period of FED interest rate hike and monetary policy tightening.

However, it should be noted that the decline in the price of BTC and consequently the decline of the entire crypto market started earlier than the key interest rate cut cycle.

BTC started declining after the ATH update in October 2021, while the first interest rate hike occurred in March 2022. This suggests that the bear market of 2022-2023 was not a result of the FED's tight policy and interest rate hikes, but generally coincided with this cycle.

The BTC bull market in 2024 is also not driven by the FED's soft policy. The interest rate remains high throughout the year, but BTC has already updated its ATH in March 2024.

If we look at a historical chart of the correlation between BTC price and Fed Funds Key Rate, we see only one period of clear correlation between BTC price and the interest rate - 2020-2021. In other cases, the size of the interest rate did not have a direct impact on the dynamics of BTC, for example, the bull market of 2017-2018coincided with the period of the rate increase.

Correlation of BTC and Fed Funds Key Rate. Source: https://tradingeconomics.com/

Nevertheless, as institutional investors and traditional financial market participants enter the crypto market, the impact of the FED rate and policy on the crypto market is likely to increase.

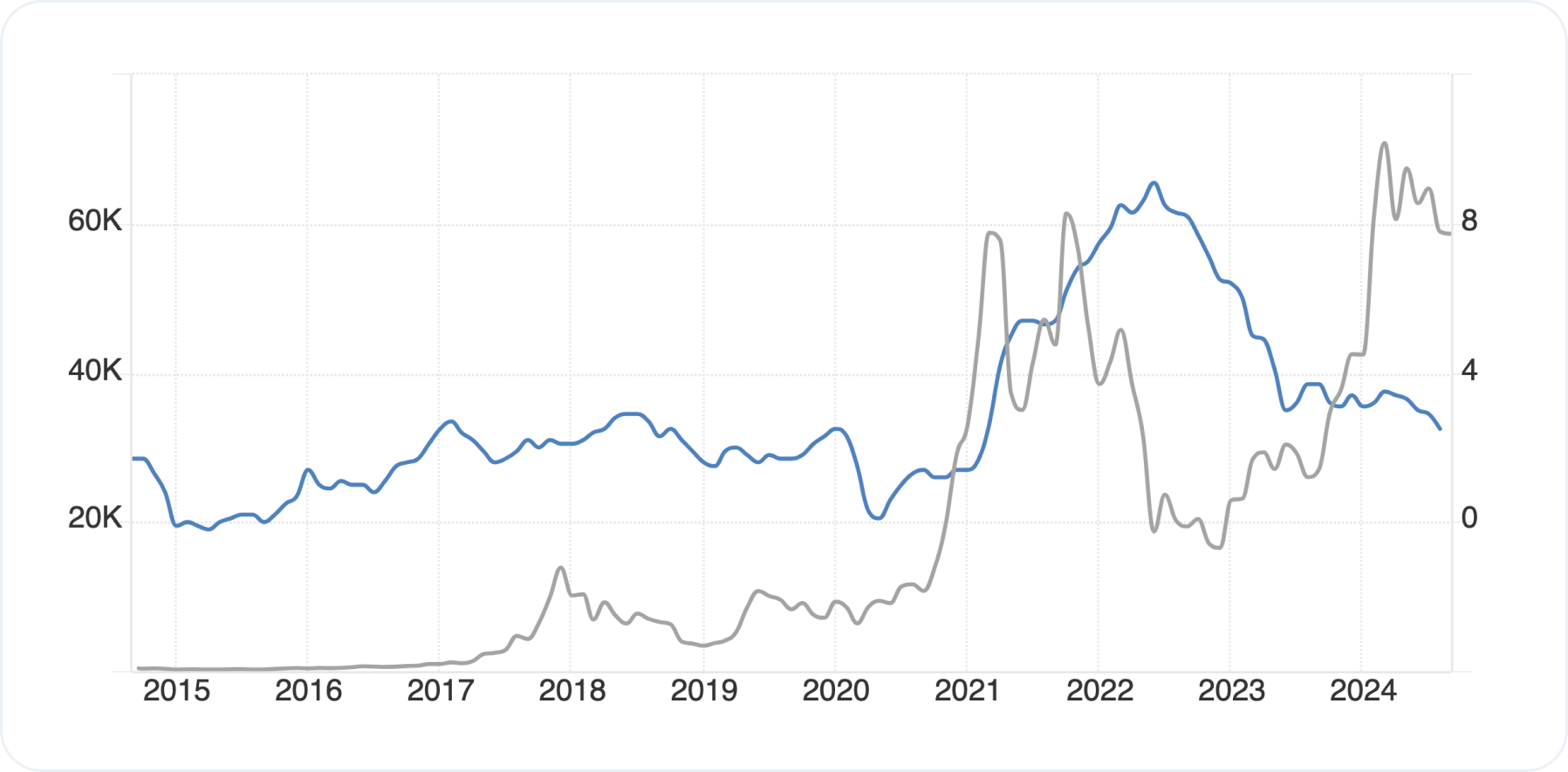

Inflation’s Impact on Cryptocurrency Market

Inflation is one of the FED's key tools used to monitor macroeconomic trends and the success of monetary policy.

High inflation after the COVID19 crisis and the large-scale quantitative easing program was the reason for the FED to raise the key interest rate and tighten policy. Significant decline in inflation and achievement of the Federal Reserve target in 2024 allows us to expect the regulator to start a cycle of rate cuts.

Inflation and dynamics of the cryptocurrency market historically have a positive correlation. As you can see from the chart below, BTC growth cycles generally coincide with periods of rising inflation (soft monetary policy) and down cycles with periods of low inflation (tight monetary policy). A prime example is 2020-2021, when a sharp rise in inflation coincided with a bull rally in BTC.

However, as in the case of the key interest rate, the BTC price decline after the bull market in late 2021 occurred beforethe inflation curve reversed downward.

Therefore, it cannot be argued that inflation has a direct impact on BTC's performance and the entire cryptocurrency market. In 2024, an atypical picture is observed: the BTC price rose and updated ATH against the backdrop of lower inflation. This suggests that the correlation between these indicators can change under the influence of other factors.

US Inflation Rate and BTC Price Correlation. Source: https://tradingeconomics.com/

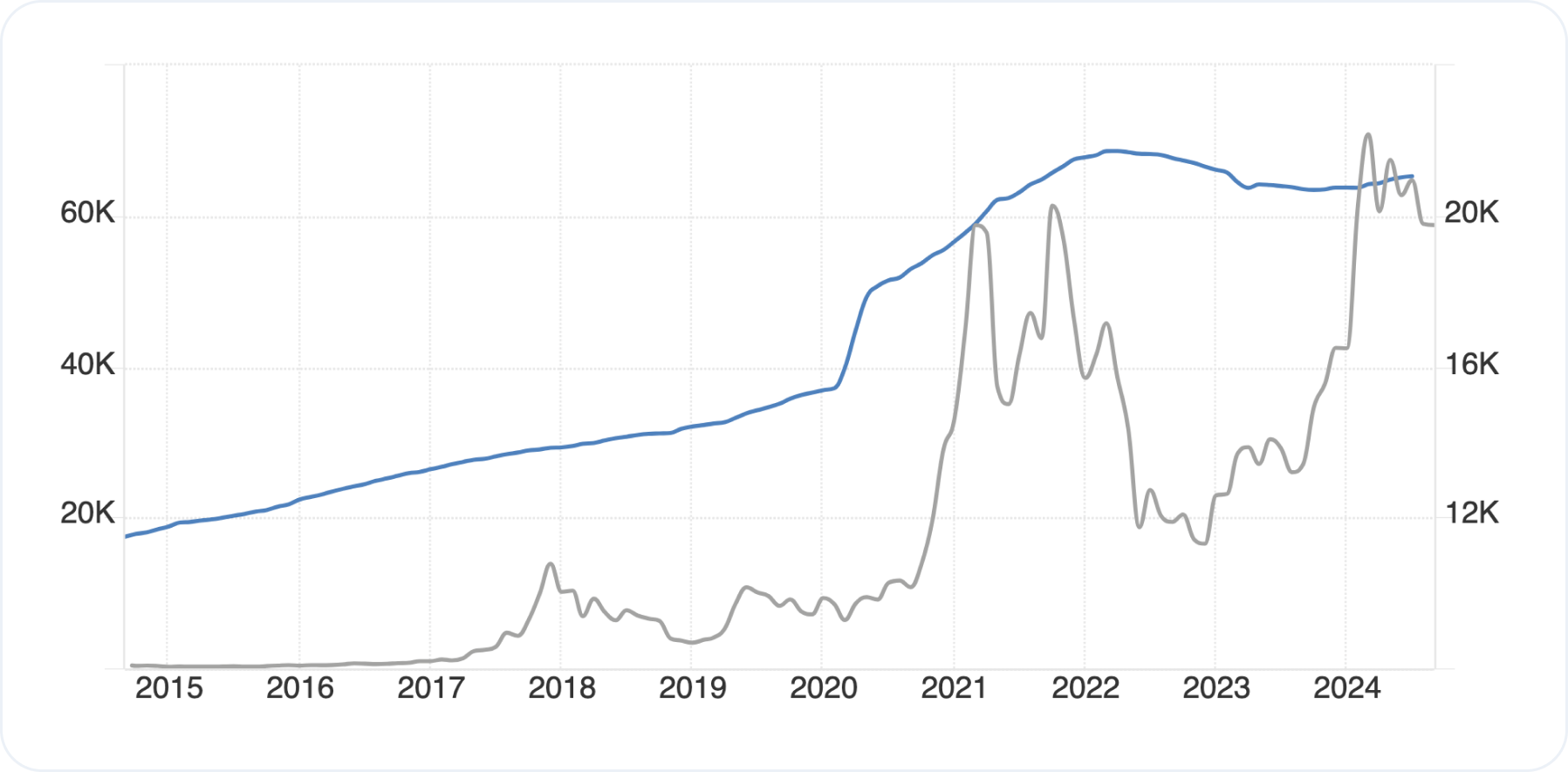

Money Supply M2: Influence on Crypto Market

Monetary aggregates (M) are an indicator of the amount of money supply in the economy. M2 includes the most liquid assets: cash, account balances, checks, as well as time deposits and other highly liquid assets. In the U.S. economy, money supply M2 serves as the primary indicator of the supply of money in the markets.

The money supply tends to grow gradually. In 2015-2019 there was a moderate growth of this indicator without sharp ups and downs. However, the COVID19 crisis led to a sharp jump in the money supply available on the financial market due to the FED stimulus measures.

The surge in money supply led to an increase in investor demand for risky assets such as cryptocurrencies. This was reflected in the BTC price, which showed a significant increase.

It can be assumed that the sharp increase in money supply in the US financial markets was one of the triggers for the rapid growth of cryptocurrencies in 2020-2021. At the same time, the decline in M2 coincided with the bear market of 2022-2023.

2024 Key Interest Rate Cut: What To Expect

The key interest rate cut in Q3-Q4 2024 is one of the most anticipated macroeconomic events that will affect all markets.

The transition to a looser monetary policy and the rate cut cycle in general should have a favorable impact on financial and other sectors.

However, do not overestimate the impact of this factor on the cryptocurrency market. While the rate undoubtedly has an impact on the price of BTC and altcoins, the crypto market has its own set of triggers for ups and downs, which distinguishes it from traditional financial markets.

It is also worth considering that the key interest rate cut will not have an immediate impact on the crypto market, but will have a long-term effect that may only manifest itself in a few months. In the moment, we can expect increased volatility and sharp price movements in both directions.

Please note that users can get any cryptocurrency of their choosing for fiat or crypto on SimpleSwap.

Summary

Macroeconomic factors such as inflation, interest rate, and monetary policy influence traditional financial markets and cryptocurrencies, though the crypto market has unique drivers like market sentiment and technology adoption.

The relationship between BTC price and Federal Reserve policy, inflation, and money supply has shown correlations at certain points, notably during the 2020-2021 bull market.

However, Bitcoin's recent price movements suggest that external factors beyond macroeconomic conditions also play a significant role in its fluctuations.

As the anticipated interest rate cuts in late 2024 approach, the impact on the cryptocurrency market may be delayed and contribute to increased volatility.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.